100 Day Post Acquisition Plan Template

Below is a discussion of the objectives.

100 day post acquisition plan template. 100 day post acquisition plan template a business plan may be described as the formal announcement of a collective set of company goals or planning. The first 100 days. Well before closing on the acquisition of a company the sponsor should develop a 100 day plan for the acquired company that will put it on the path to. Business plan is required to conduct a company because it is a vital part of initial strategic planning of any company.

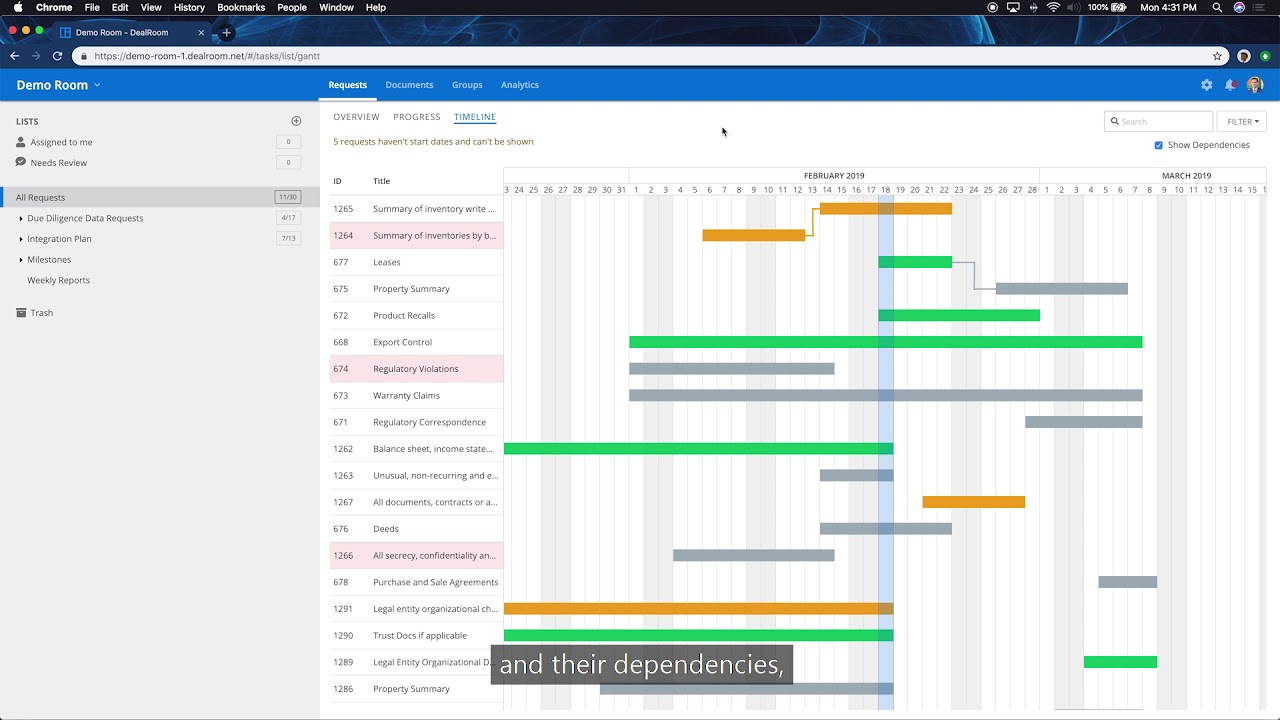

This is why the foundation of a successful integration is built on the 100 day plan. Well before closing on the acquisition of a company the sponsor should develop a 100 day plan for the acquired company that will put it on the path to achieving the sponsors investment goals. By randall eisenberg. During those early months private equity firms can follow several practical suggestions to kick start growth.

The companys own staff need to focus on day to day business operations. A longer term transition plan day 2 is essential for moving toward the end state. Over the years weve developed and field tested. Barn images with modifications by capstone.

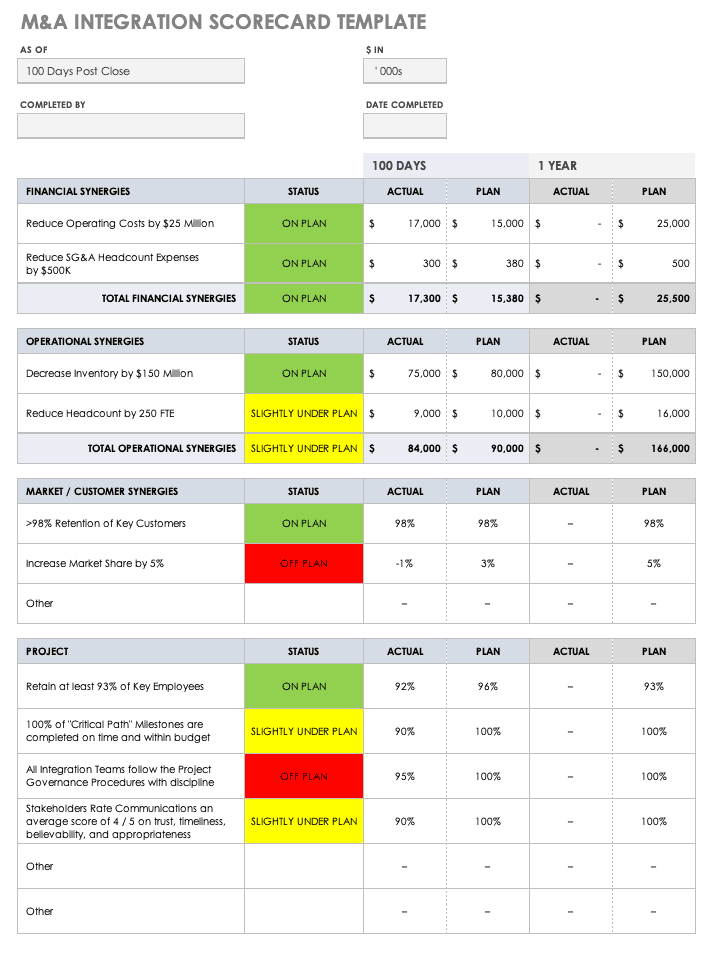

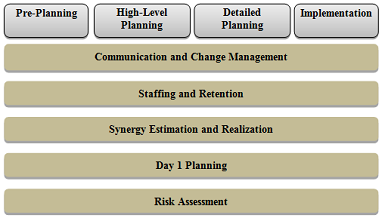

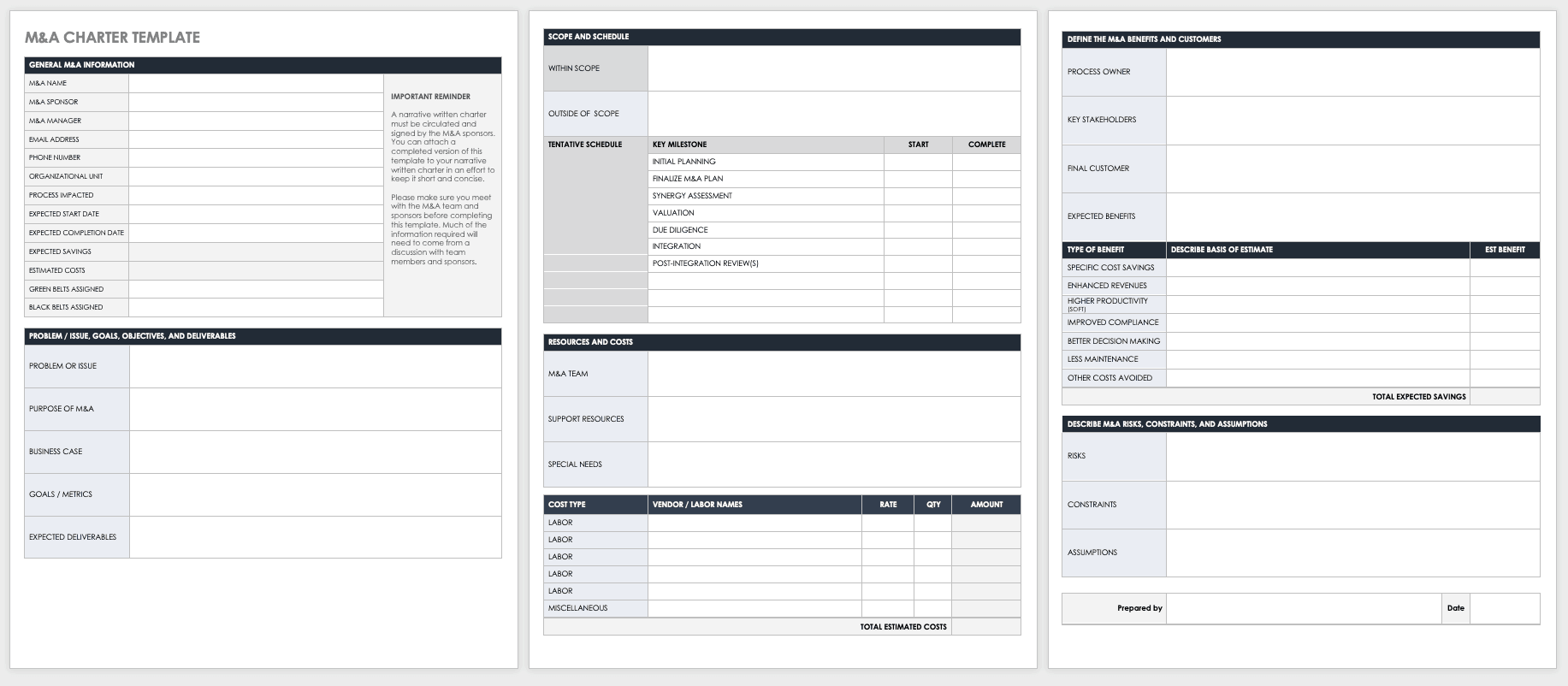

A more detailed and refined plan. Integration refers to the merging of cultures and processes that occurs between companies post acquisition. When it comes to ensuring the long term viability of your acquisition no process is as important as integration. Prepare external communication plan and template materials for works councils and other employee bodies.

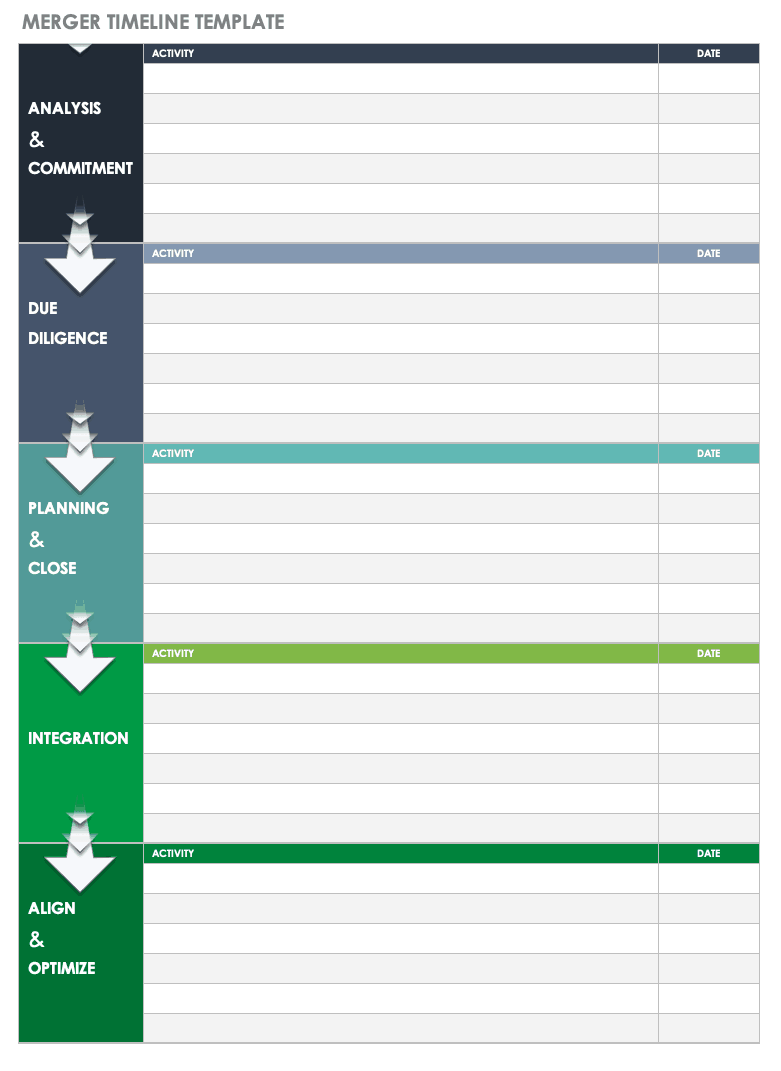

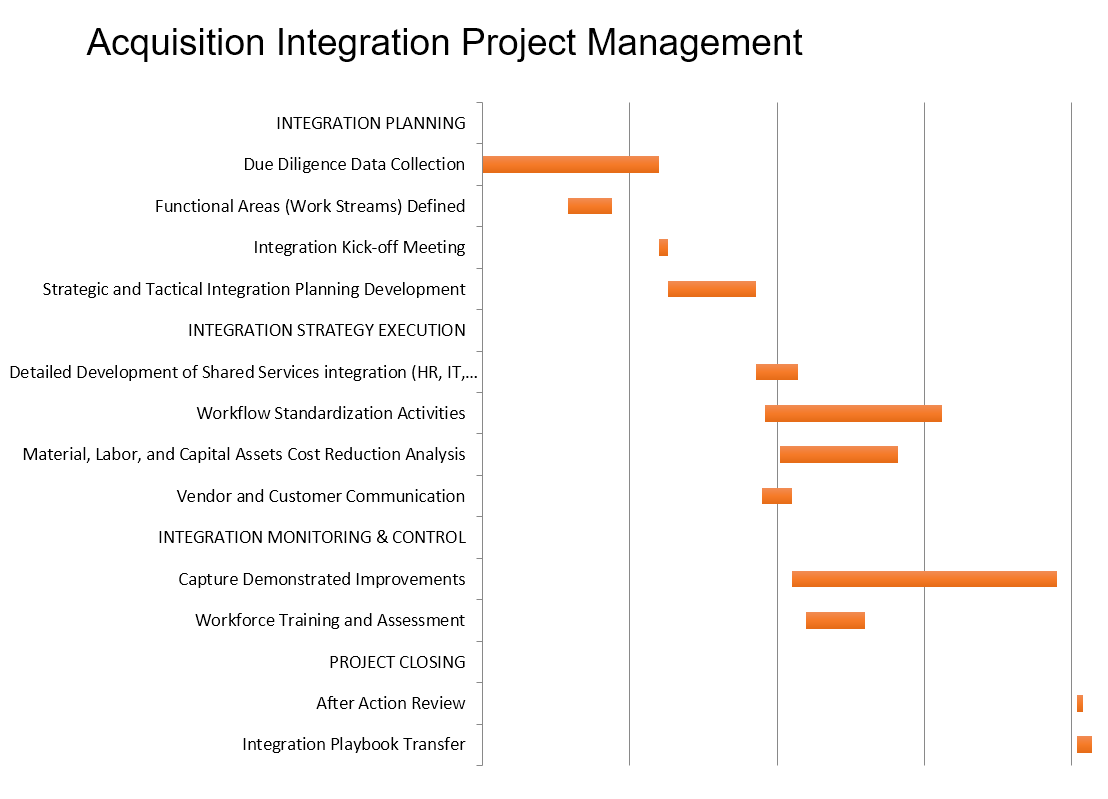

Identifying owners and timelines for future efforts such as fully integrated hr services will continue the integration process over the longer term and create a new combined organization that realizes the vision and goals announced on day 1. We focus attention on all key stages of the ma lifecycle including conception planning the first 100 days post mergeracquisition and ongoing evaluation and improvement. For this critical phase capgemini consulting has proven methodolo gies and capabilities to develop and execute the plan. Achieving the sponsors investment goals.

Additionally it may contain the background information about the organization. Post acquisition integration handbook. The goal is to equip executives with management techniques tools templates and metrics to improve merger activity performance. In our experience the first 100 days after a private equity firm takes ownership of an asset are critical to long term value creation.

Your first hundred days are critical in terms of getting people on board aligning them with what youre trying to do and showing them what your vision is for the integrated companies. Thus having a plan for the rst 100 days in place decides over the suc cess of a post merger integration. Section 2 post acquisition integration.