1040 Tax Form 2018 Printable

Individual income tax return.

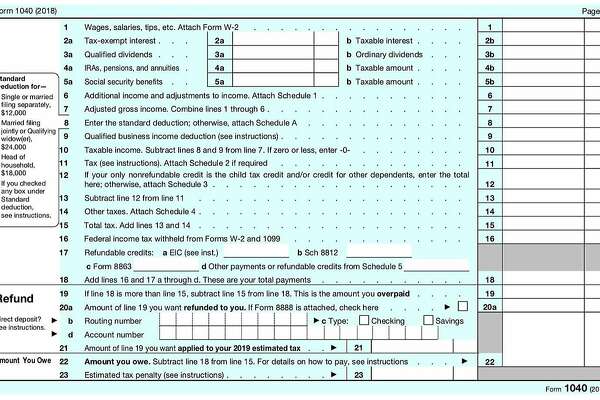

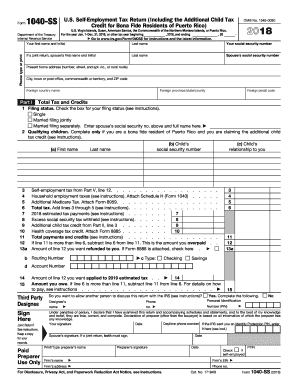

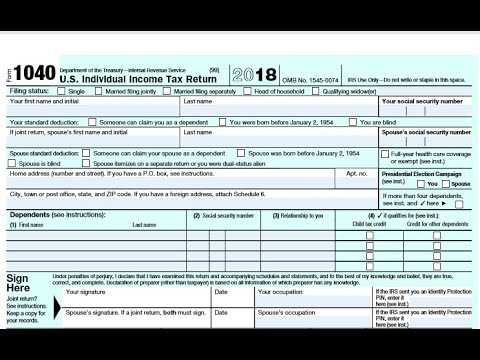

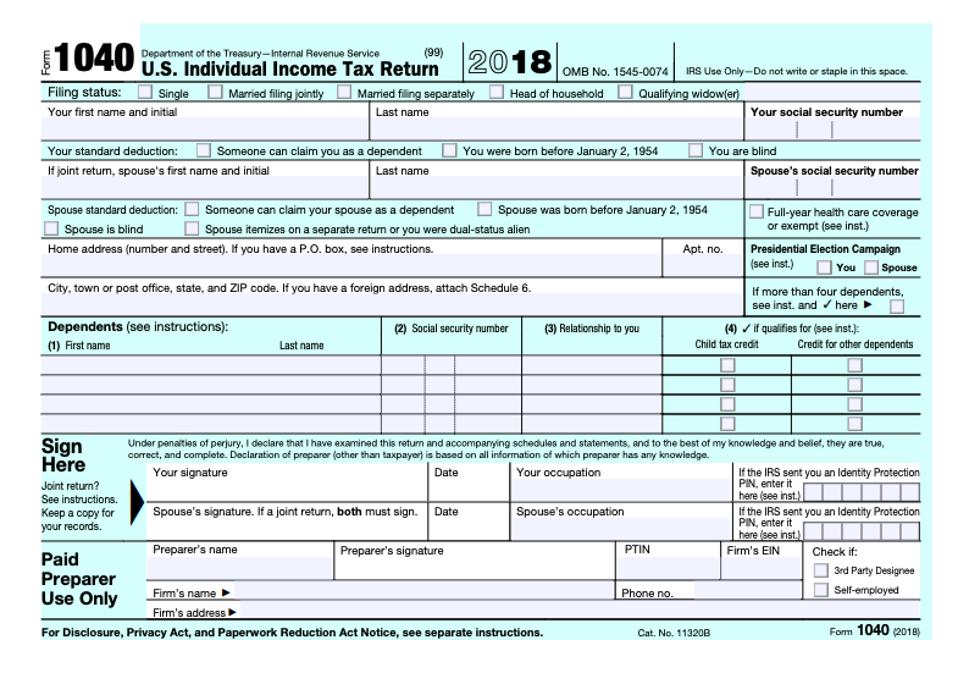

1040 tax form 2018 printable. Form 1040 department of the treasuryinternal revenue service 99 us. Many people will only need to file form 1040 and no schedules. However theres a better way to get your tax forms. For the 2018 tax year federal irs income tax form 1040 us individual income tax return must be postmarked by april 15 2019.

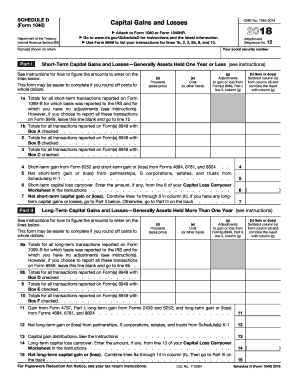

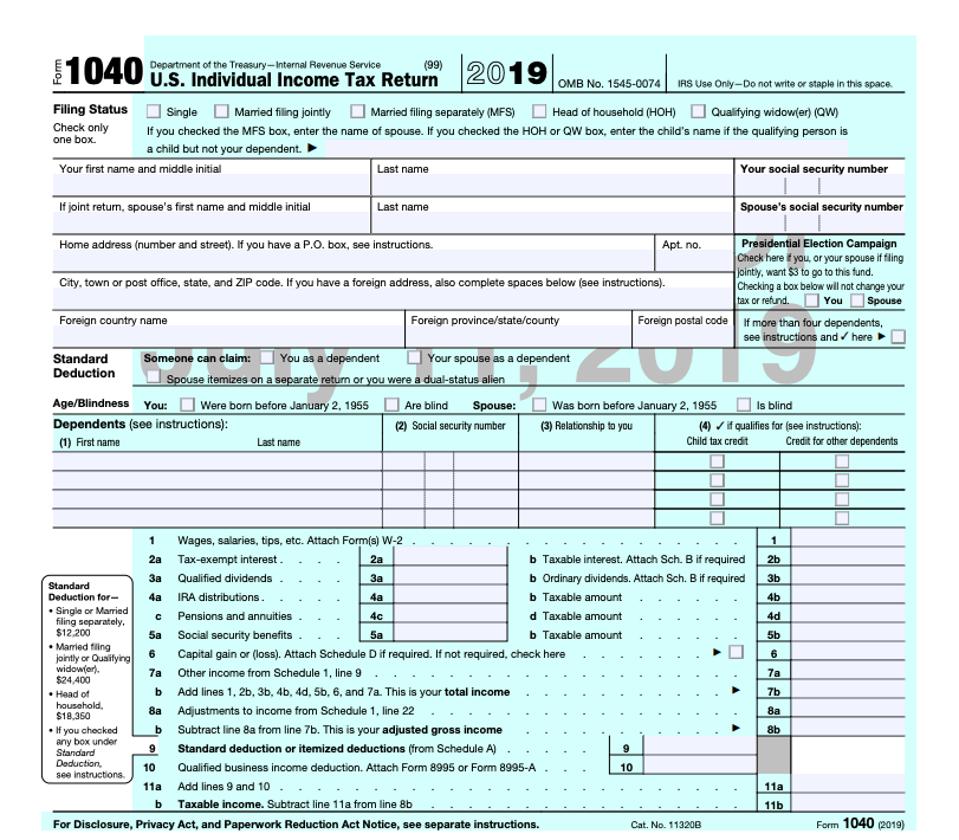

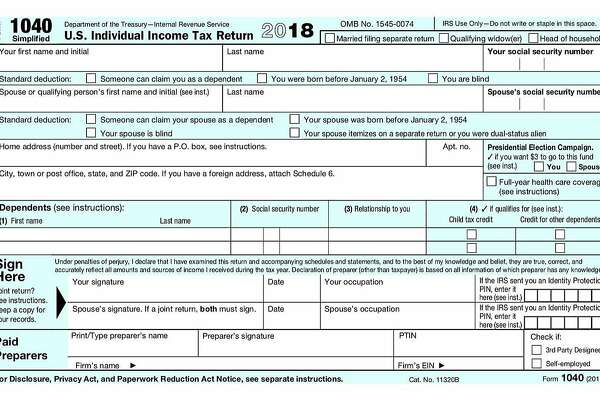

For tax year 2018 you will no longer use form 1040 a or form 1040 ez but instead will use the redesigned form 1040. Printable 2018 federal tax forms 1040ez 1040a and 1040 are grouped below along with their most commonly filed supporting irs schedules worksheets 2018 tax tables and instructions for easy one page access. Individual income tax return 2019 11272019 inst 1040. For tax year 2018 you will no longer use form 1040 ez but instead use the redesigned form 1040.

About form 1040 ez income tax return for single and joint filers with no dependents. Instructions for form 1040 us. For tax year 2018 you will no longer use form 1040a or form 1040ez but instead will use the redesigned form 1040. We last updated federal form 1040 in december 2018 from the federal internal revenue service.

Single married filing jointly. 2018 2019 2020 forms instructions irs printable tax printable irs tax forms can be downloaded using the links found below. This form is for income earned in tax year 2018 with tax returns due in april 2019. Income tax return filed by certain citizens or residents of the united states.

Irs use onlydo not write or staple in this space. Check only one box. Taxpayers to file an annual income tax return. Federal irs income taxes due are based on the tax year january 1 2018 through december 31 2018.

Many people will only need to file form 1040 and no schedules. This would include a change in the number of exemptions of dependents if amending your 2018 return. More about the federal form 1040 tax return. Forms and publications pdf instructions.

Married filing separately mfs head of household hoh qualifying widower qw. If any information relating to exemptions to dependents if amending your 2018 return has changed from what you reported on the return you are amending.

:max_bytes(150000):strip_icc()/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)

/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)