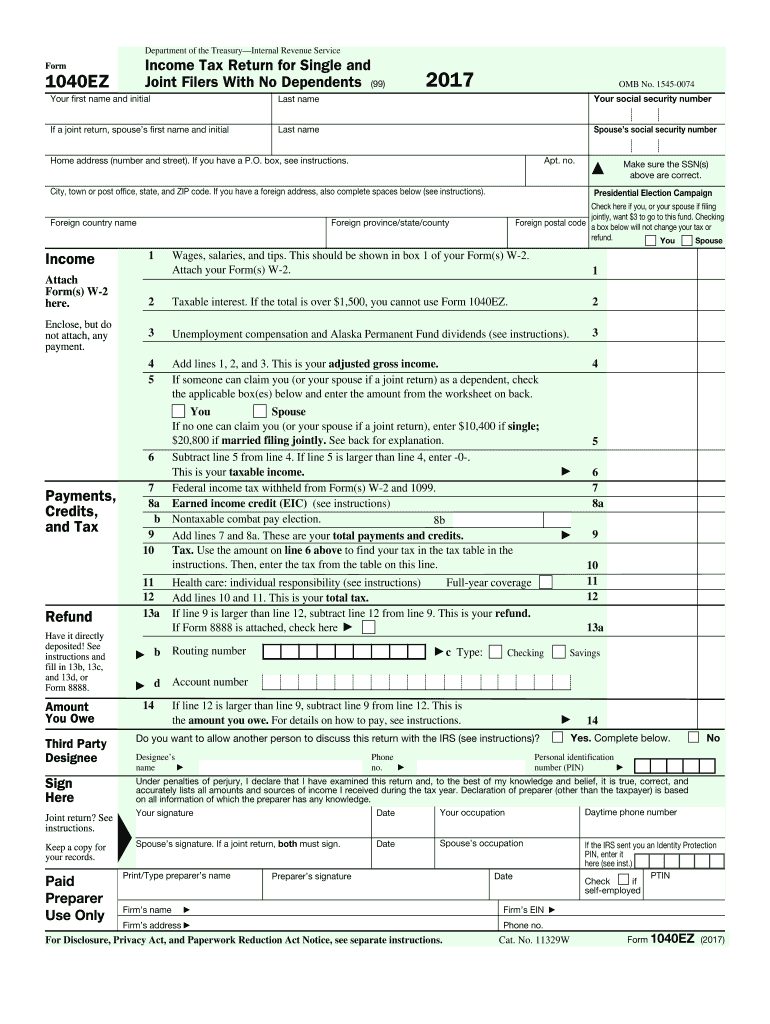

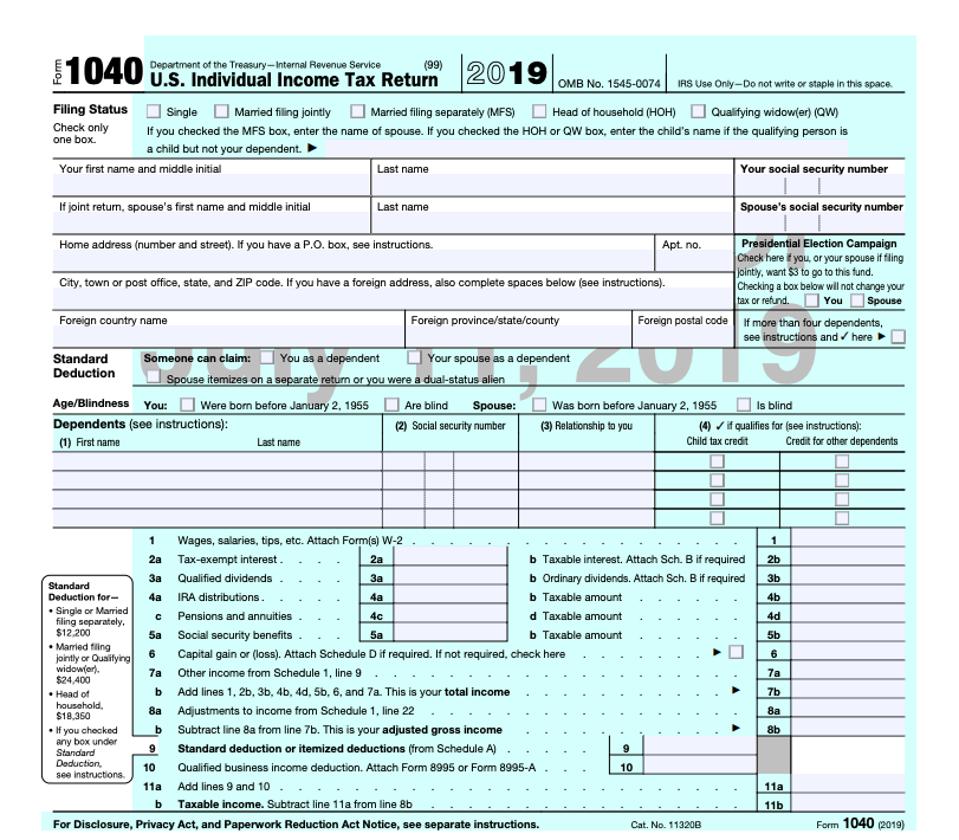

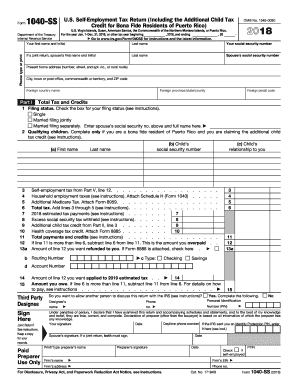

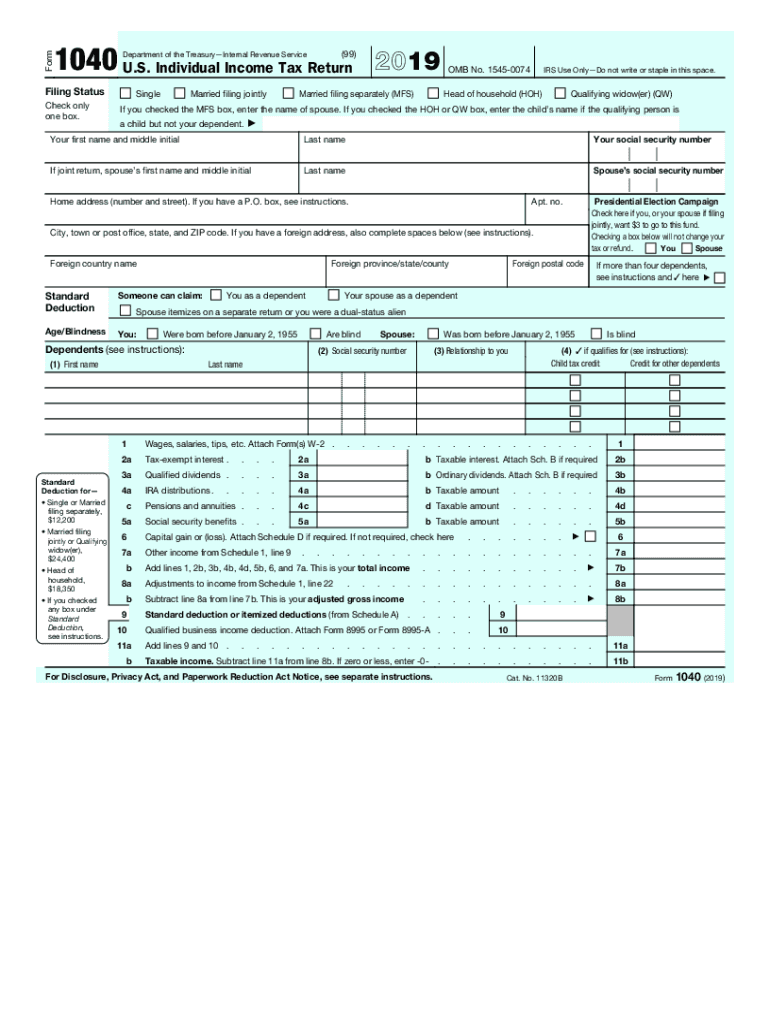

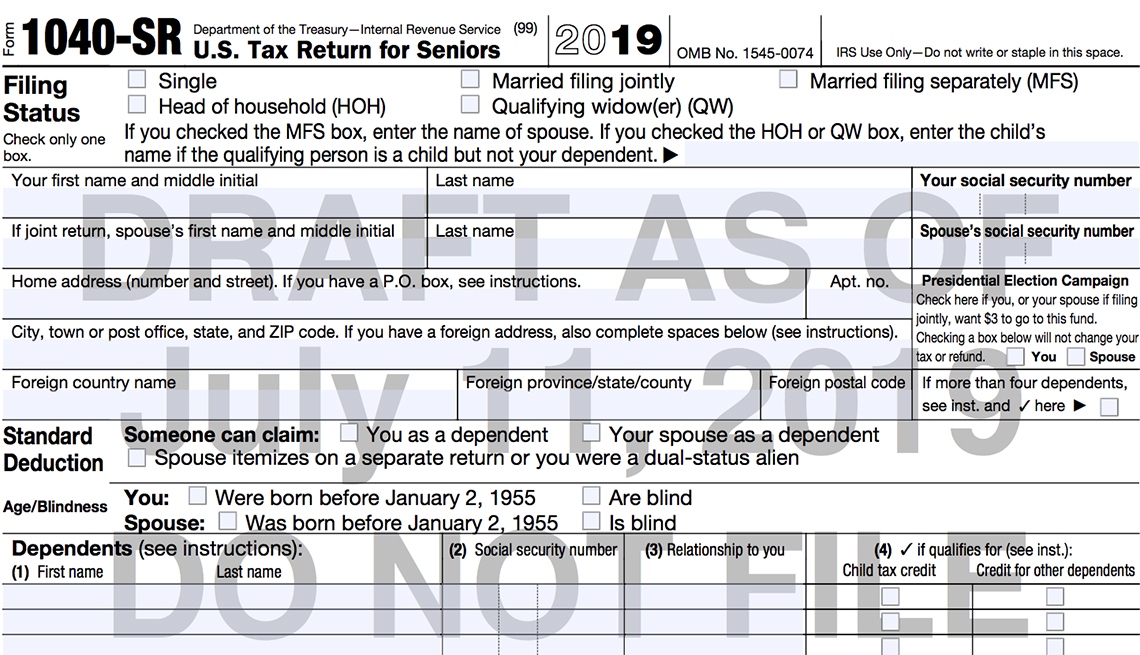

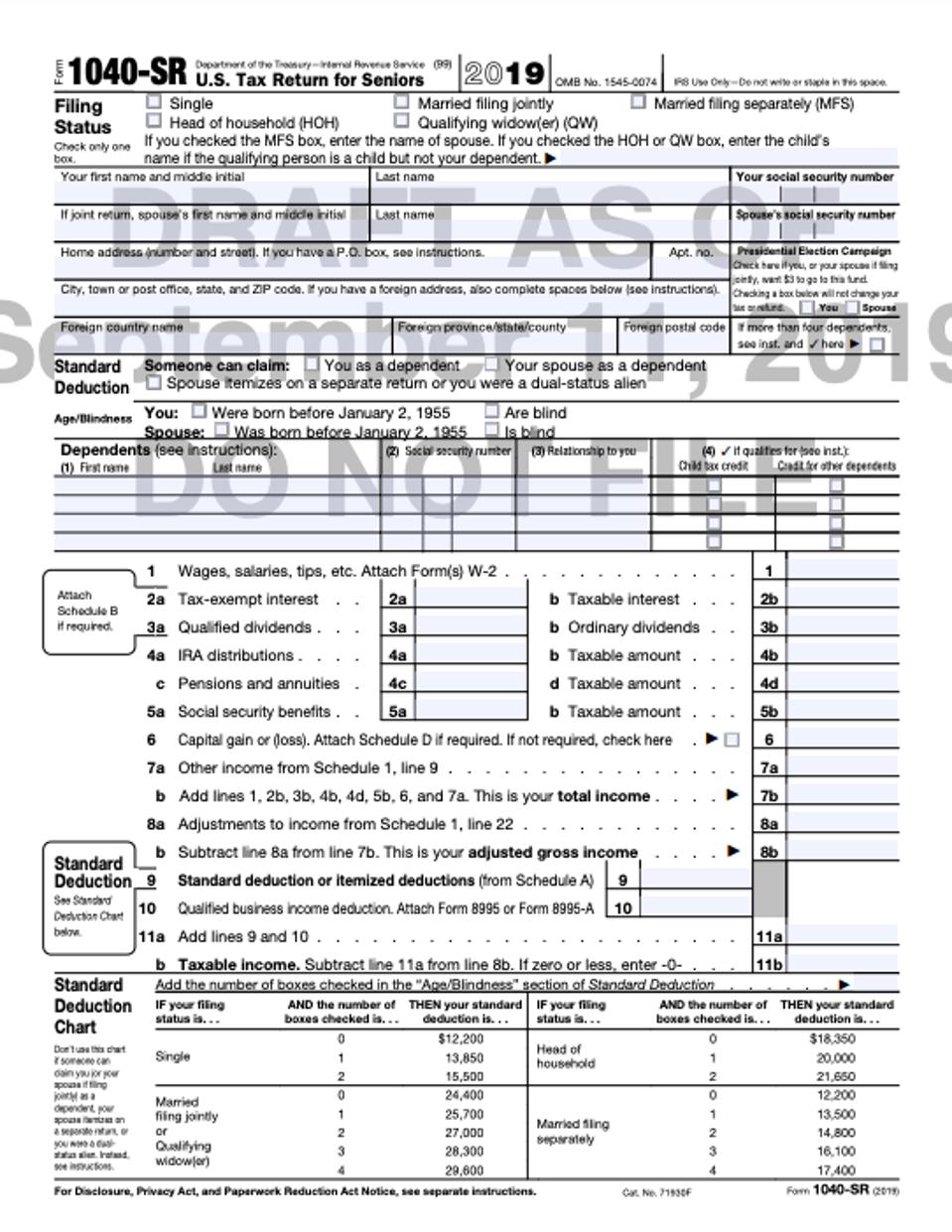

2019 Printable 1040 Tax Form 2019

However theres a better way to get your tax forms.

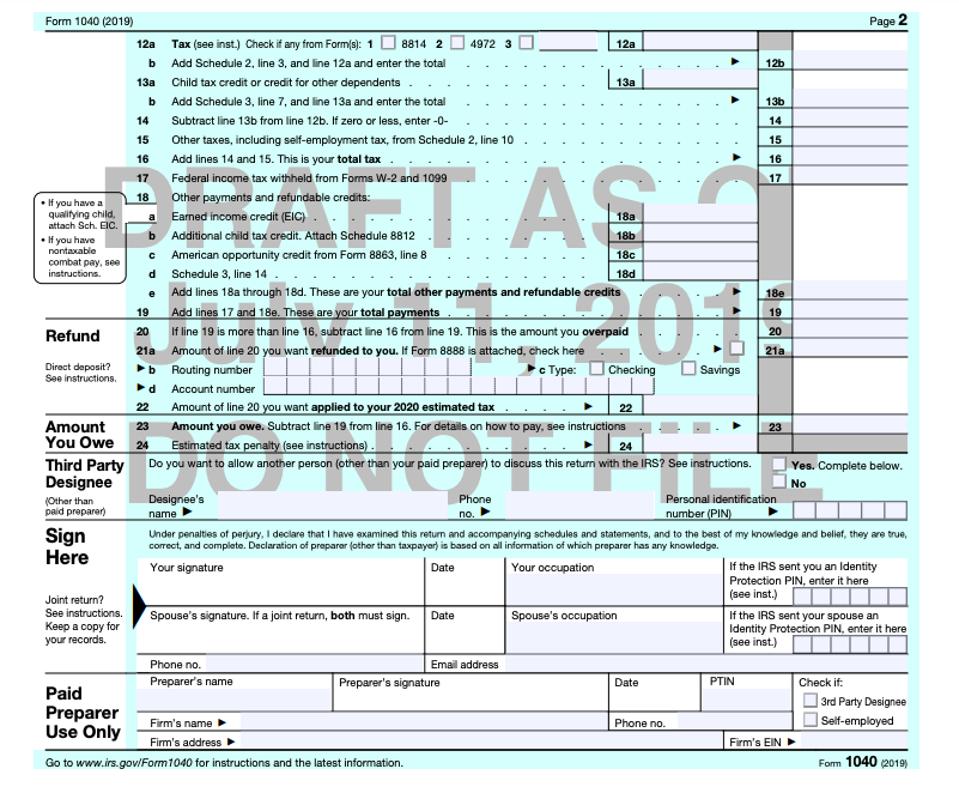

2019 printable 1040 tax form 2019. Form 1040 department of the treasuryinternal revenue service 99 us. These percentages may be different if you are a farmer fisherman or higher income taxpayer. Your 2019 tax return must cover all 12 months. Employers who withhold income taxes social security tax or medicare tax from employees paychecks or who must pay the employers portion of social security or medicare tax.

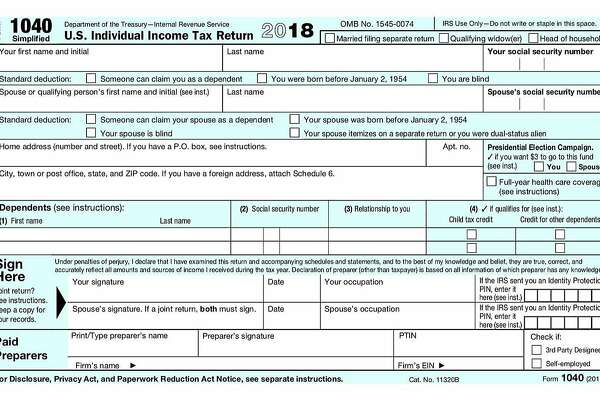

Irs use onlydo not write or staple in this space. Washington as part of a larger effort to help taxpayers the internal revenue service plans to streamline the form 1040 into a shorter simpler form for the 2019 tax season. This form is for income earned in tax year 2019 with tax returns due in april 2020we will update this page with a new version of the form for 2021 as soon as it is made available by the federal government. Get taxes form 1040 for 2019 instructions fillable worksheet print form and more for every 1040 form type.

The new 1040 pdf about half the size of the current version would replace the current form 1040 as well as the form 1040a and the form 1040 ez. Once irs e file closes after oct. 100 of the tax shown on your 2019 tax return. Instructions for schedule a form 1040 or form 1040 sr itemized deductions 2019 01172020 inst 1040 schedule a instructions for schedule a form 1040 itemized deductions 2018 02252020 form 1040 schedule b interest and ordinary dividends 2019 11152019.

We last updated federal form 1040 in january 2020 from the federal internal revenue service. You dont have to pay estimated tax for 2020. 2018 2019 2020 forms instructions irs printable tax printable irs tax forms can be downloaded using the links found below. Form 941 pdf related.

Individual income tax return. Instructions for form 941 pdf. Printable 2019 federal income tax forms 1040 1040sr 1040ss 1040pr 1040nr 1040x instructions schedules and more. Employers quarterly federal tax return.

Before you efileit use our 2019 tax calculator to estimate your 2019 tax refund or taxes owed. 90 of the tax to be shown on your 2020 tax return or b.

:max_bytes(150000):strip_icc()/Form1040_screen_shot_2019-10-14_at_4.05.40_pm-e3d41e44e75c4ea29d04e6e71d2b94ef.png)

:max_bytes(150000):strip_icc()/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)

/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)