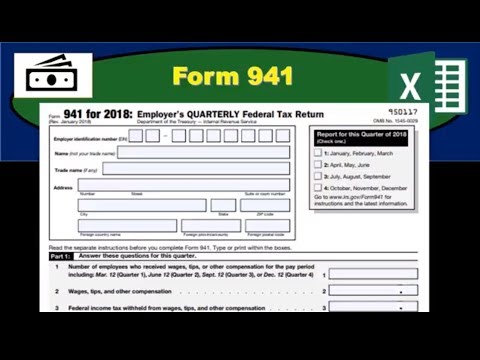

941 Form 2018 Printable

2018 blank 941 form.

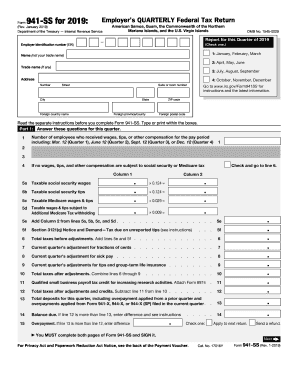

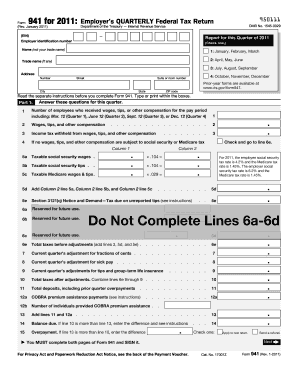

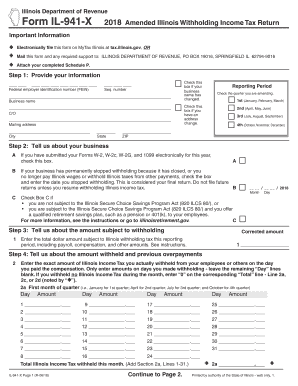

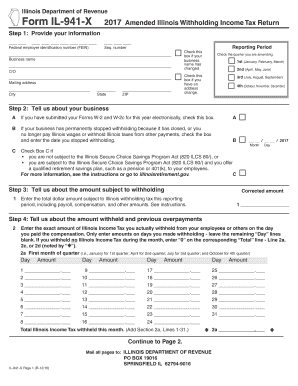

941 form 2018 printable. The irs will use the completed voucher to credit your payment more promptly and accurately. The form was last revised in january 1 2018 and is available for digital filing. You must complete all three pages. Information about form 941 employers quarterly federal tax return including recent updates related forms and instructions on how to file.

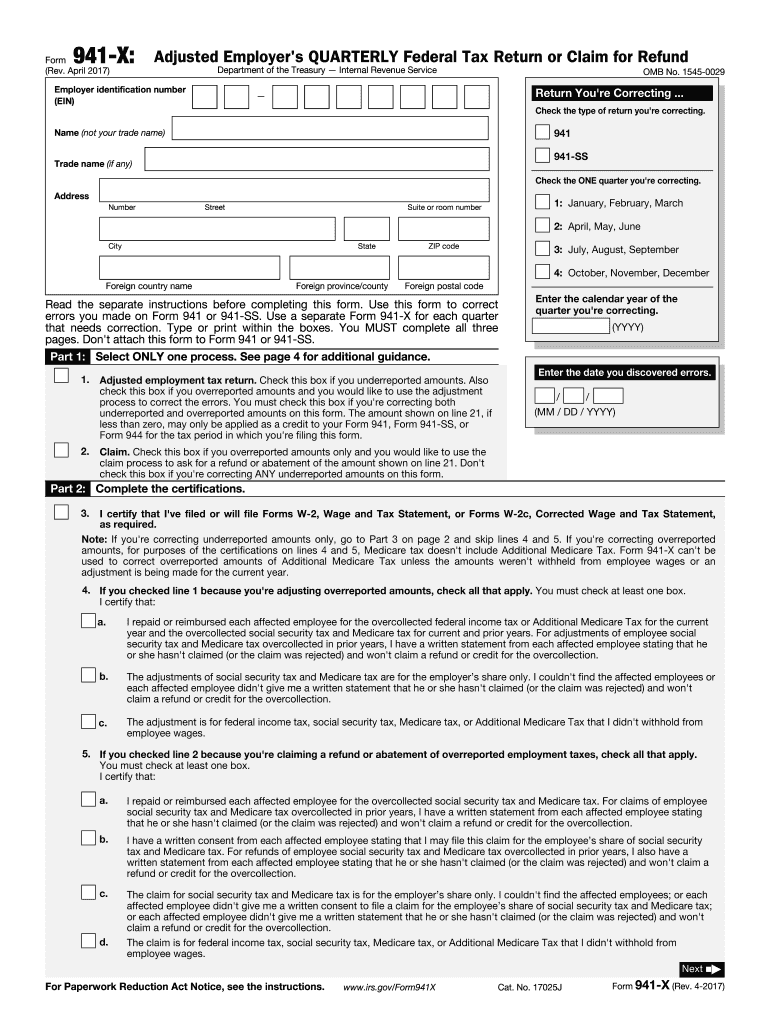

Available for pc ios and android. When you file this form with form 941 or form 941 ss dont change your tax liability by adjustments reported on any forms 941 x or 944 x. Read the separate instructions before you complete form 941. Department of the treasury internal revenue service forms website.

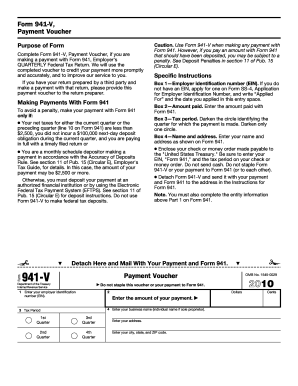

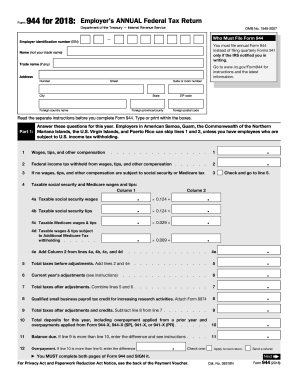

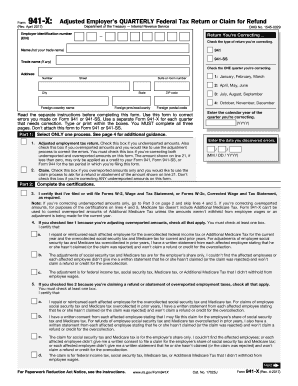

Dont attach this form to form 941 or 941 ss. Irs form 941 or the employers quarterly federal tax return is a form issued by the us. April 2017 adjusted employers quarterly federal tax return or claim for refund department of the treasury internal revenue service omb no. The most secure digital platform to get legally binding electronically signed documents in just a few seconds.

Instructions for form 9465 pdf. You must fill out this form and attach it to form 941 or form 941 ss if youre a semiweekly schedule depositor or became one because your accumulated tax liability on any day was 100000 or more. Department of the treasury internal revenue service. We last updated federal form 941 in december 2018 from the federal internal revenue service.

Download an up to date irs form 941 in pdf format down below or look it up on the us. Answer these questions for this quarter. Fill out securely sign print or email your irs 941 online 2018 form instantly with signnow. Complete form 941 v if youre making a payment with form 941.

Type or print within the boxes. Type or print within the boxes. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. 1 number of employees who received wages tips or other.

Form 941 for 2019. This form is for income earned in tax year 2019 with tax returns due in april 2020we will update this page with a new version of the form for 2021 as soon as it is made available by the federal government. January 2019 employers quarterly federal tax return department of the treasury internal revenue service. We last updated the employers quarterly federal tax return in december 2018 and the latest form we have available is for tax year 2018.

Instructions for schedule d form 941 report of discrepancies caused by acquisitions statutory mergers or consolidations 0611 07172012 form 941 schedule r allocation schedule for aggregate form 941 filers 0118 02272018 form 941 ss.