Aml Risk Assessment Template 2017

Risk assessment is at the heart of it all.

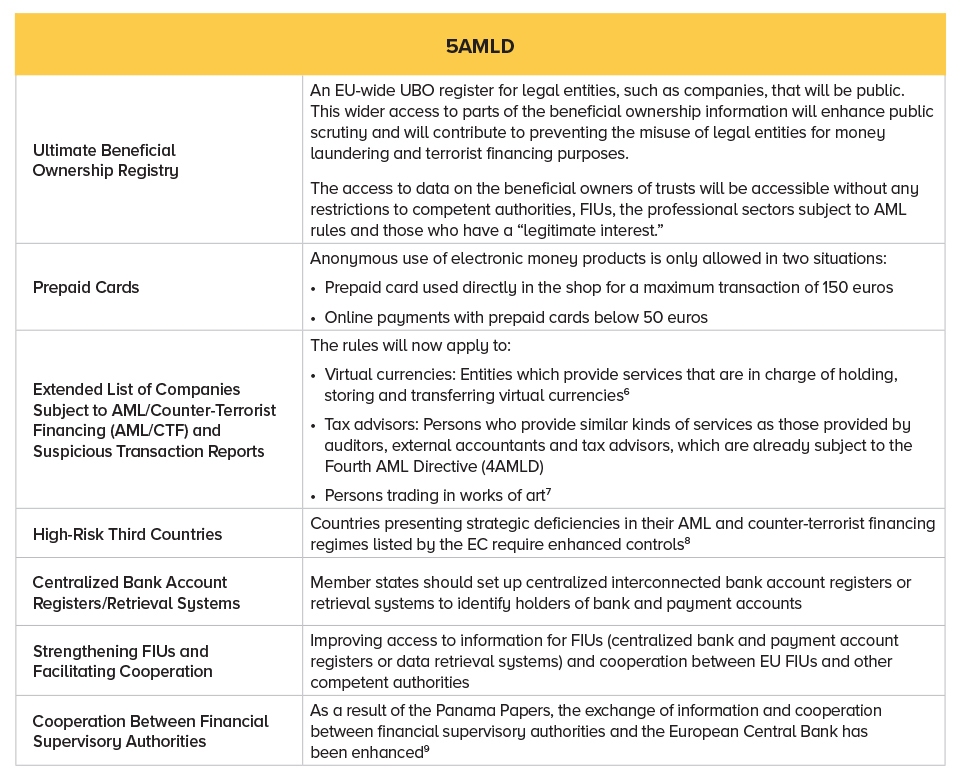

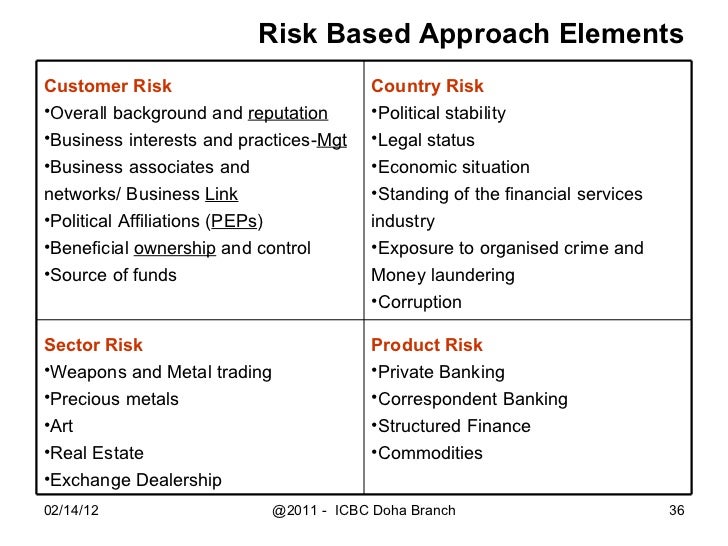

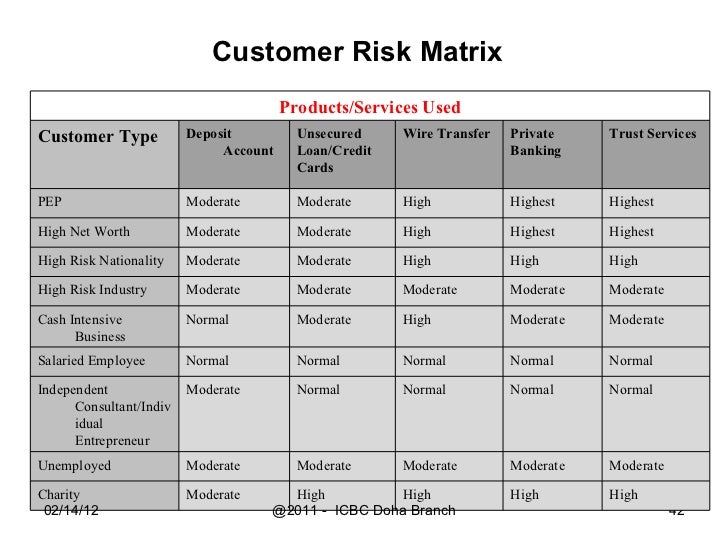

Aml risk assessment template 2017. Risk assessment is at the heart of it all. Centre of the european unions anti money laundering aml and countering financing of terrorism cft regime. Egulator on demand a copy of your risk assessment and all steps taken to carry it out regulation 186r 2eep your records of such meetings or consultations. The form is designed to help firms in assessing aml risks posed at both client and transactional level.

In the aml regime. The underpinning of this risk based approach is a risk assessment flowing from a. Practice risk assessment template uk. Aml risk assessment template 2017.

A key feature of the mlr 2017 is the risk based approach to preventing and detecting money laundering and the specific requirement to undertake and maintain a documented practice wide aml risk assessment. What do solicitors and law firms need to do to be compliant with the 2017 money laundering regulations. Note that you must also have your firms aml policy approved by senior management regulation 19. What do solicitors and law firms need to do to be compliant with the 2017 money laundering regulations.

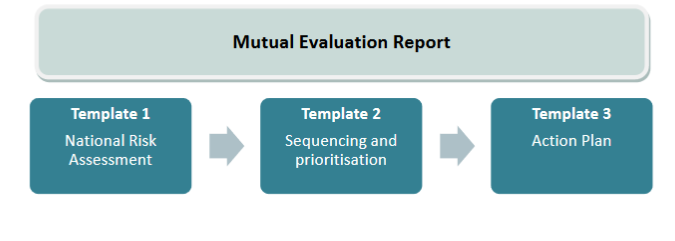

For these purposes risk. The amlctf regimes in the uk requires a risk assessment of your practice to be conducted and documented in order to identify what money laundering and terrorist financing risks your practice may face and how you will control them. Doing an aml risk assessment. Icas will be asking all supervised firms to submit their first risk assessment soon as part of the next phase in the aml approval process.

Ii to quickly fill in the templates formatting select pre populated cells and drag the fill handle down the new cells 2 see bsaaml risk assessmentoverview the first step of the risk assessment process is to identify the specific products services customers entities and geographic locations unique to the bank. Aml and ctf banking sector compliance consultancy services compliance training compliant business management training sar workshop and adverse media risk assessments. Your aml risk assessment should list the steps you take to mitigate the money laundering risk in. The new money laundering regulations 2017 require all firms to conduct a firm wide aml risk assessment.

As part of our ongoing work to refresh the anti money laundering aml resources we make available to the profession we have recently added an example aml risk assessment form which can be downloaded and used by member firms. The templates below can be amended to suit your own practice. With the reference jcgl201734. Posted on july 24 2019 july 25 2019 by informer.

However that should k ome after the risk assessmentc.