California Itemized Deductions Worksheet

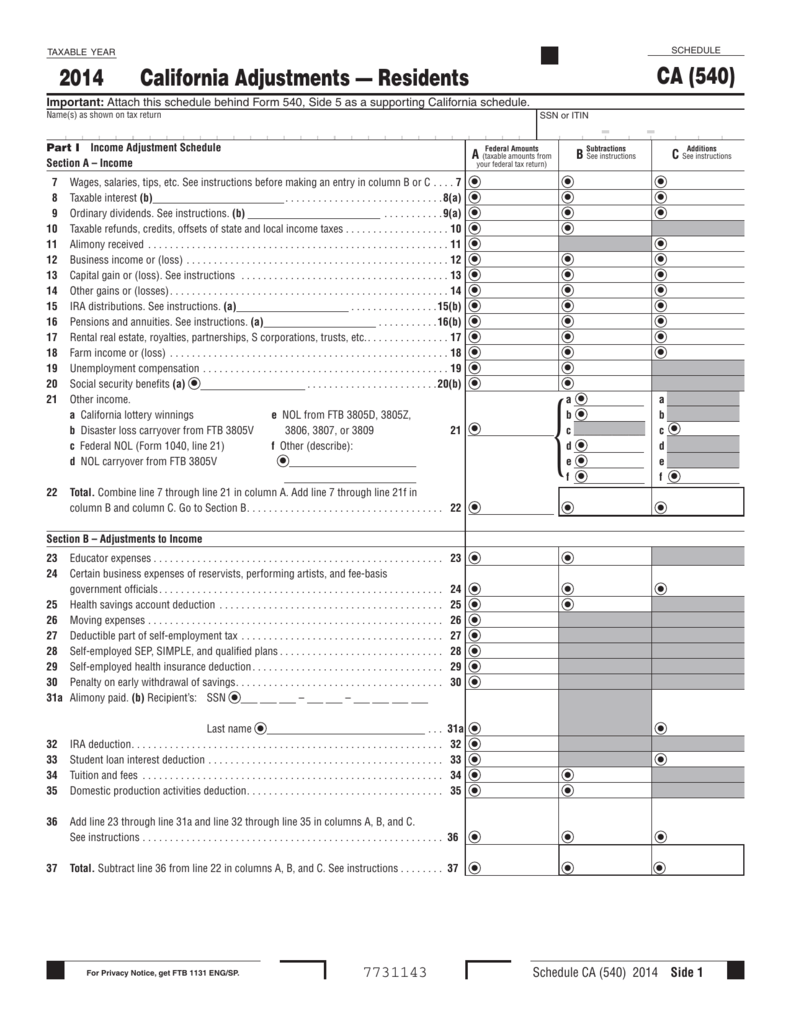

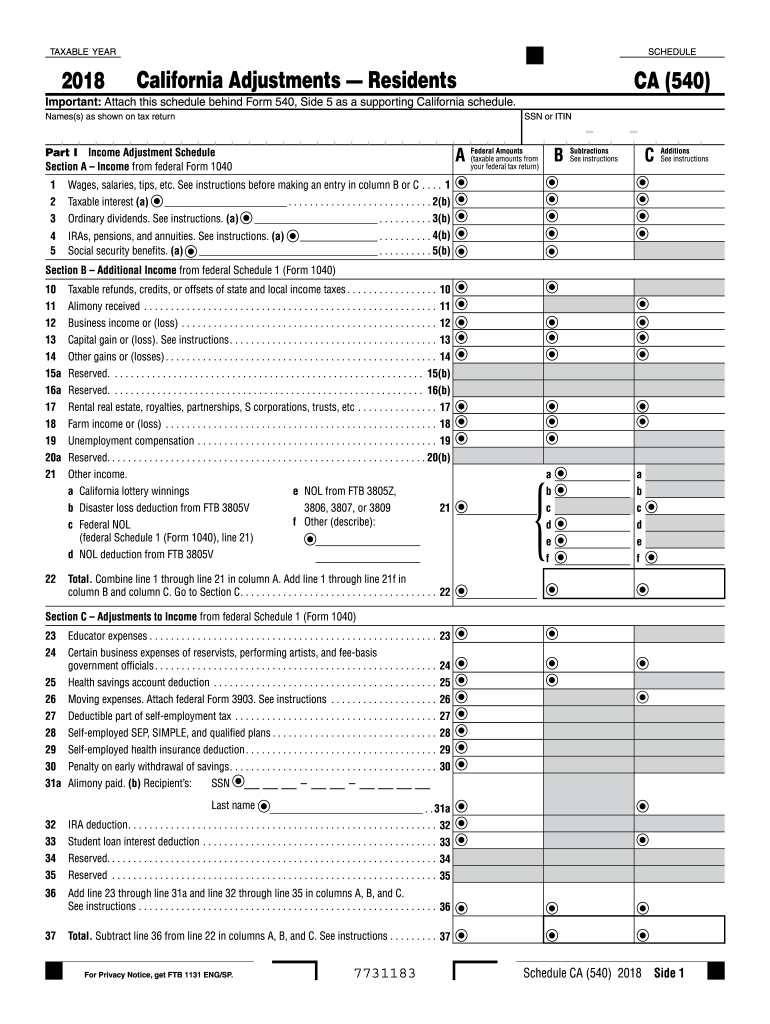

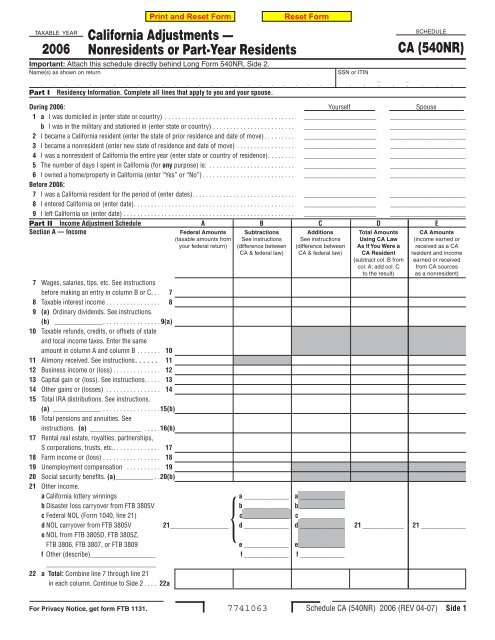

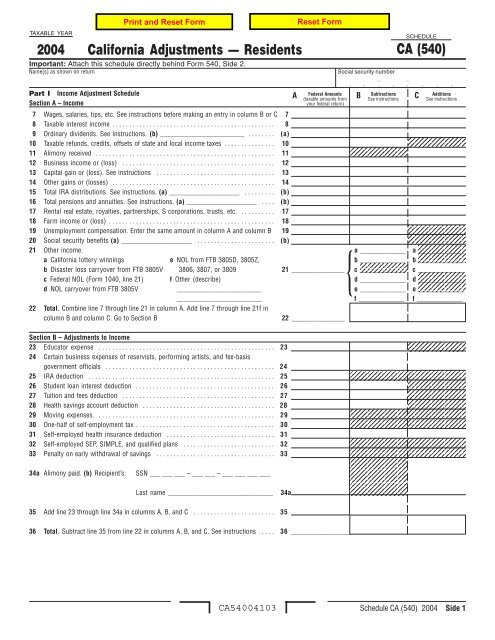

Combine line 7 through line 21 in column a.

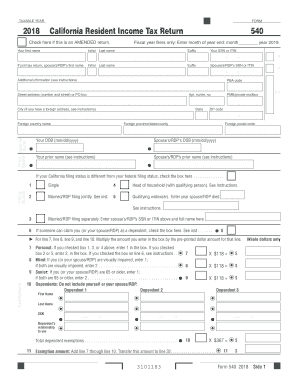

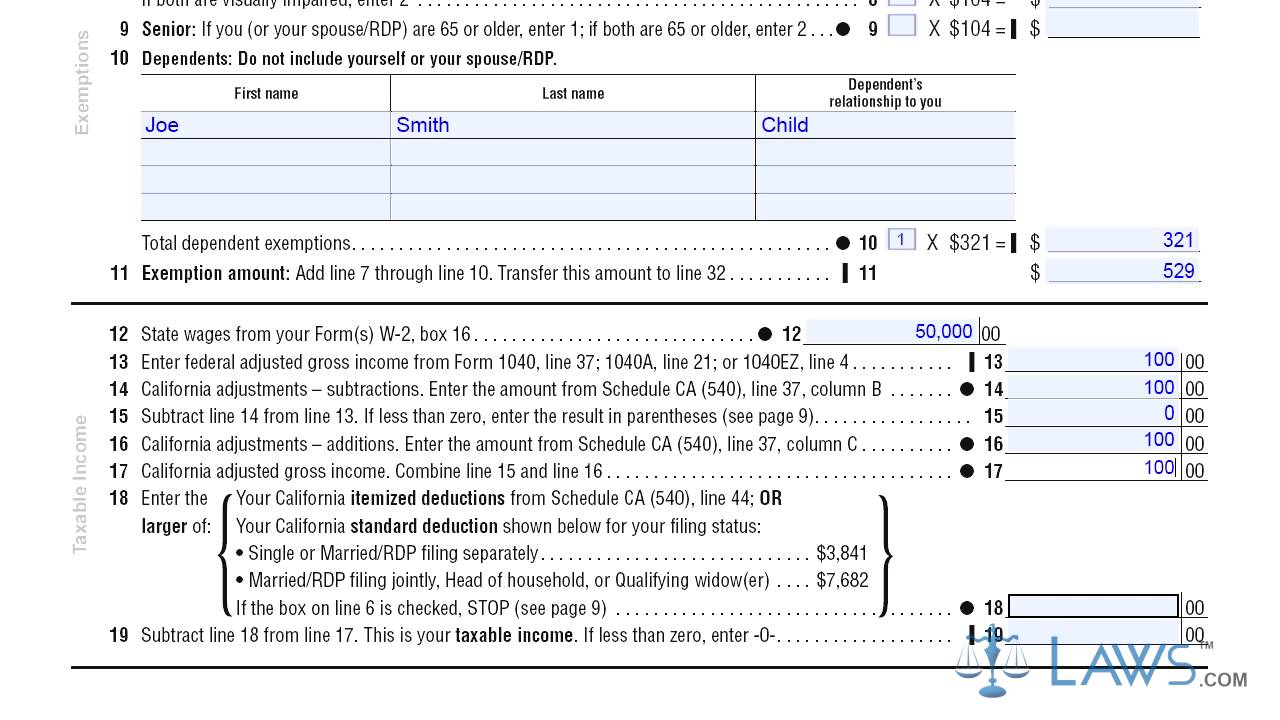

California itemized deductions worksheet. To figure your standard deduction use the form 540 california standard deduction worksheet for dependents on page 9. Figure your california itemized deductions by completing schedule ca 540 part ii line 38 through line 44. Column b and column c. Use form 540 to estimate your itemized deductions for the tax year in question and then compare it to the standard deductions which the worksheet will help you figure.

Expenses that exceed 75 of your federal agi. Nol deduction from ftb 3805v. On home purchases up to 1000000. Combine line 1 through line 21 in column a.

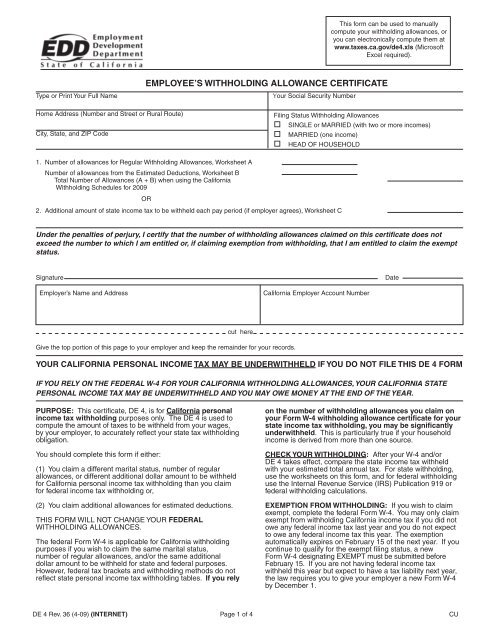

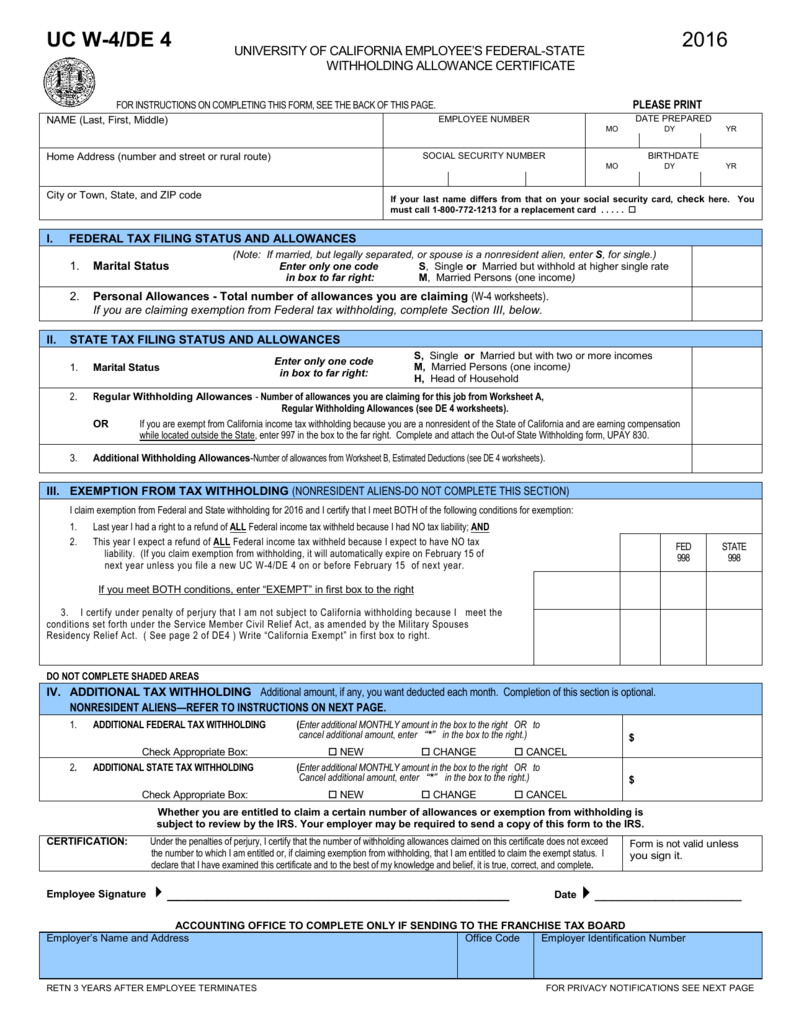

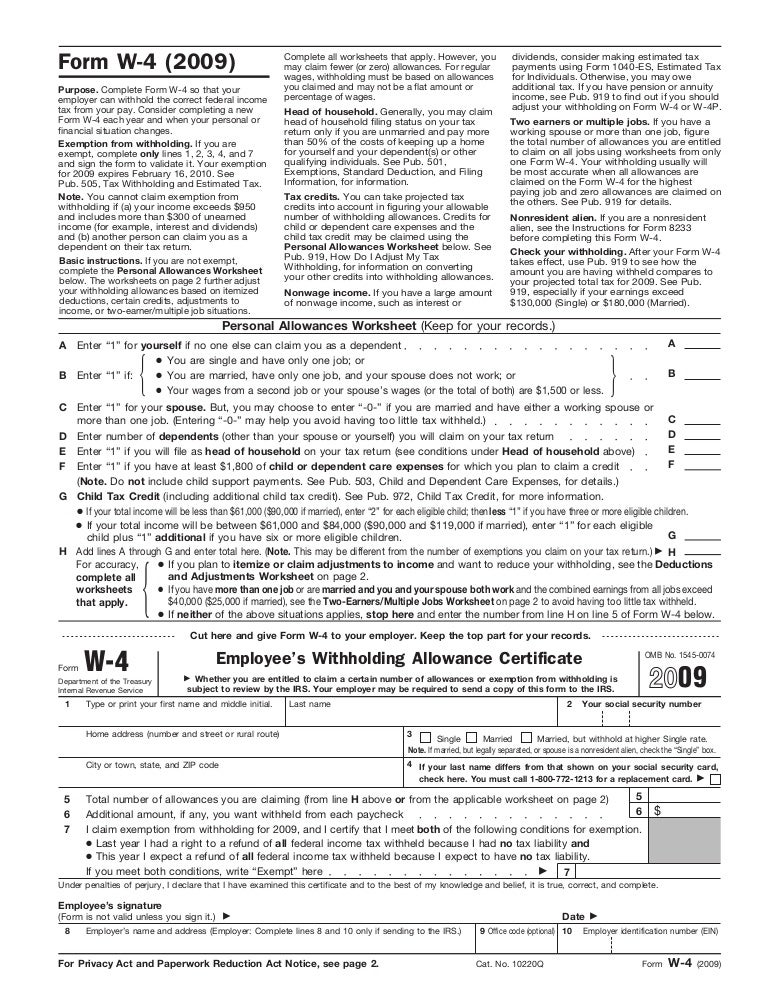

Home mortgage interest federal changes limited the mortgage interest deduction debt maximum from 1000000 500000 for married filing separately to 750000 375000 for married filing separately. Enter the result on form 540 line 18. On home purchases up to 750000. Worksheet b estimated deductions worksheet a regular withholding allowances.

Other taxes california doesnt permit a deduction for foreign income taxes. Add line 1 through line 21f in column b and column c. If someone else can claim you as a dependent you may claim the greater of the standard deduction or your itemized deductions. You can find important news immediately about federal tax form 1040 itemized deductions.

Federal nol federal schedule 1 form 1040 line 21 d. Medical and dental expenses. Disaster loss deduction from ftb 3805v. At that point youll progress to worksheet c.

Youll also enter income adjustments like paid alimony and ira deposits and complete the calculations to arrive at a total on line 10. If the amount on line 1 is zero stop. Student loan interest deduction worksheet enter the total amount from schedule ca 540 line 33 column a. Federal nol form 1040 line 21 d.

Disaster loss deduction from ftb 3805v. Add line 7 through line 21f in. Deduction ca allowable amount federal allowable amount. A few try to learn more together about itemized tax worksheet 2019 california itemized deductions spreadsheet intended for small business tax worksheet preparation deductions.

Your deductions cannot be more than 50 of your california ca adjusted gross income agi. Nol from ftb 3805z 3806 3807 or 3809. Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540. Nol from ftb 3805z 3806 3807 or 3809.

Deductions for the year to exceed your allowable standard deduction.