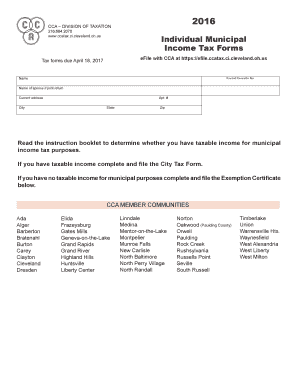

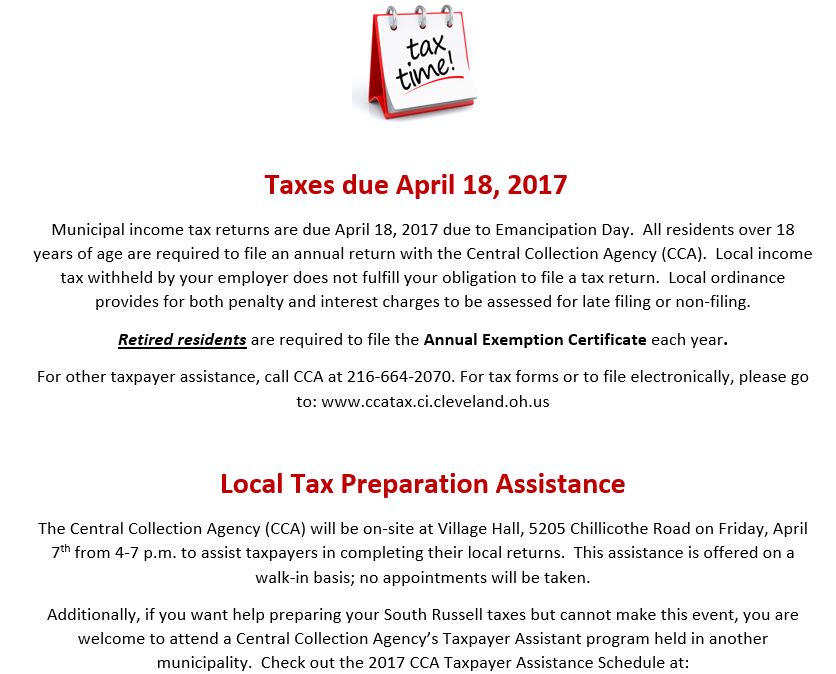

Cca Exemption Certificate

At an active member of the armed forces of the united states for the entire year 2016.

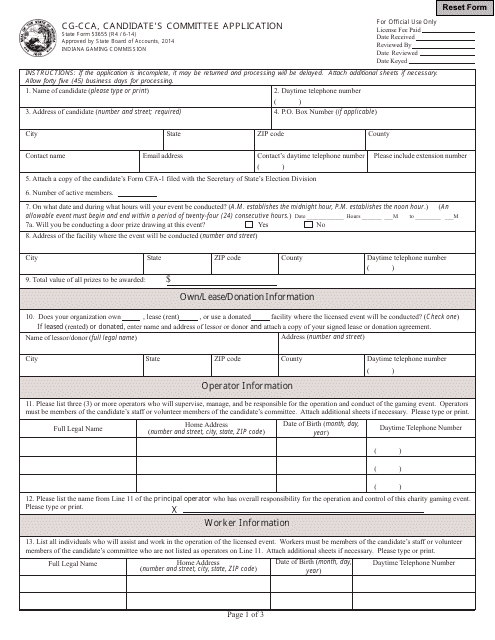

Cca exemption certificate. The withholding agent keeps this form with their records. Sales and use tax exemption for purchases by qualifying governmental agencies. Please fill out this form and indicate the reasons you would like to request an exemption from orientation at cca. Adobe acrobat reader starts and the exemption certificate appears.

2017 exemption certificate at show name or address changes on reverse. Exemption certificate i live in a mandatory filing city and i am not required to pay city income tax because. 2016 exemption certificate at show name or address changes on reverse. Exemption for orientation request.

This certificate is only for use by a purchaser who. The center for recruitment and orientation will review your exemption request and respond within 2 business days whether or not your exemption has been approved. You must keep the exemption certificate for at least three years from the due date of the sales tax return on which the last sale using the exemption certificate was reported. Sales and use tax exemption for purchases made under the buy connecticut provision.

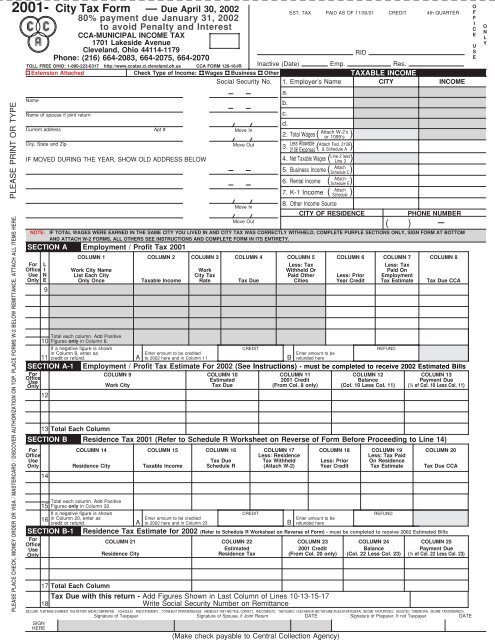

At retired received only pension social security interest or dividend income 2. For more information see tax bulletin record keeping requirements for sales tax vendors tb st 770. Exemption certificate i live in a mandatory filing community and i am not required to pay municipal income tax because. A is registered as a new york state sales tax vendor and has a valid certificate of authority issued by the tax department and is making purchases of tangible personal property other than motor fuel or.

At retired received only pension social security interest or dividend income member of the armed forces of the united states for the entire year 2017. Withholding agent information payee information exemption reason check only one box. Your name address and social security number appear automatically. I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that i know at the time of purchase will be used in a manner other than that expressed in this certificate and depending on the amount of tax evaded the offense may range from a class c misdemeanor to a felony of the second degree.

2018 withholding exemption certificate californiaform 590 the payee completes this form and submits it to the withholding agent.