Contract To Pay Back Money Template

This gives the payment agreement some teeth.

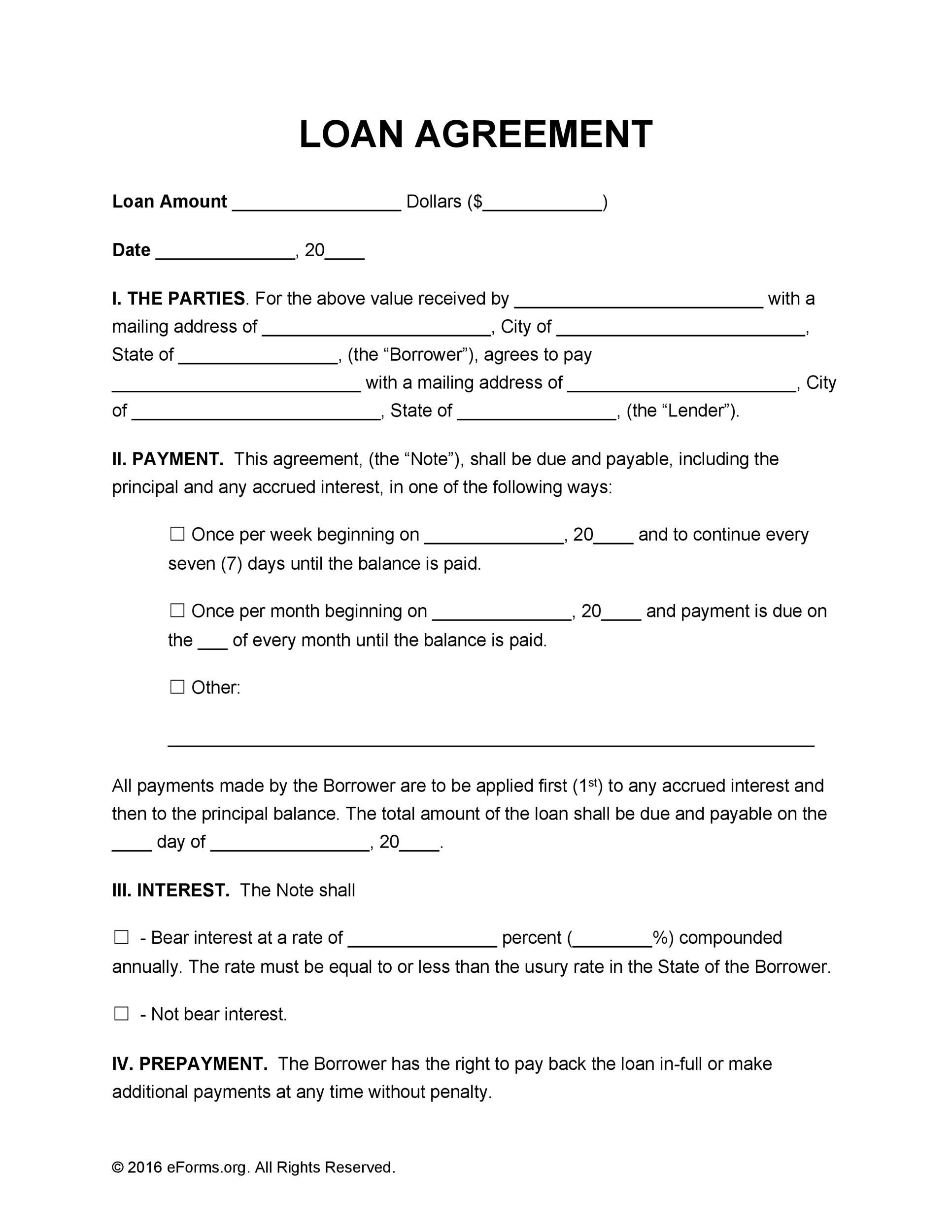

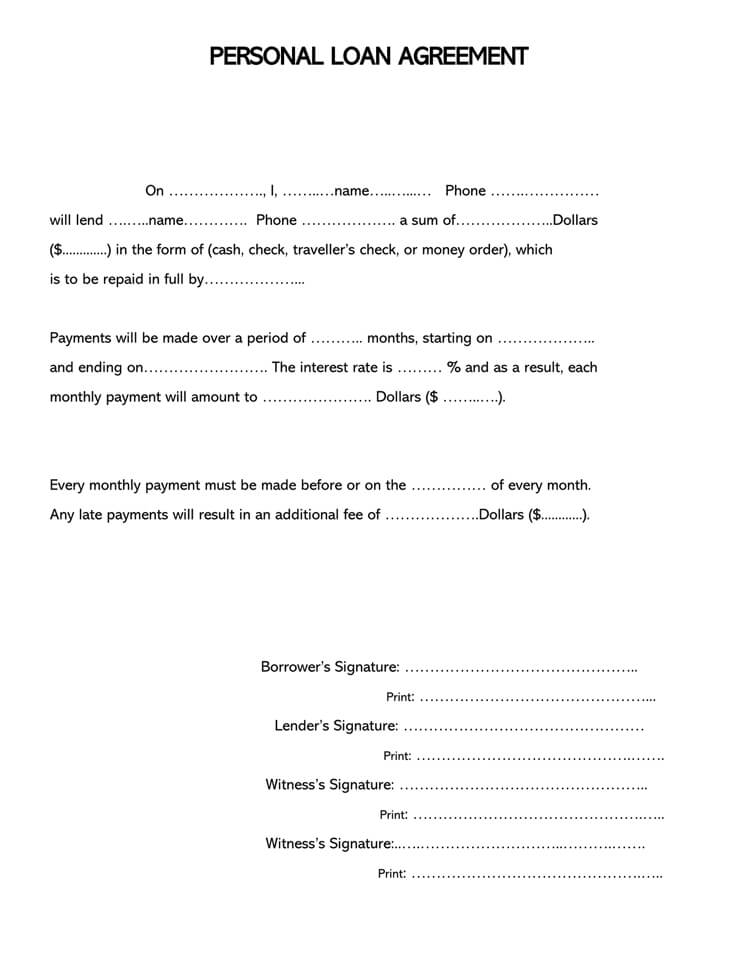

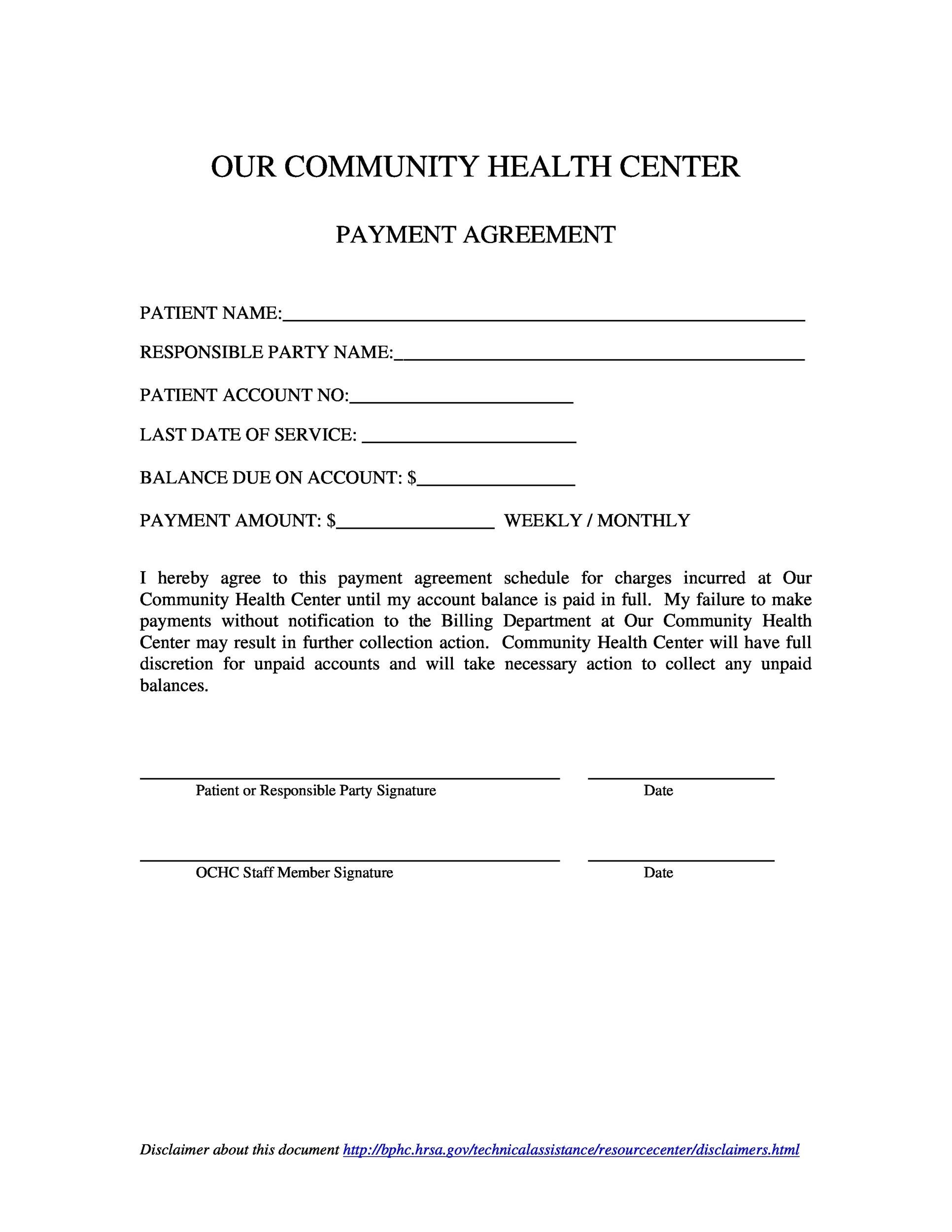

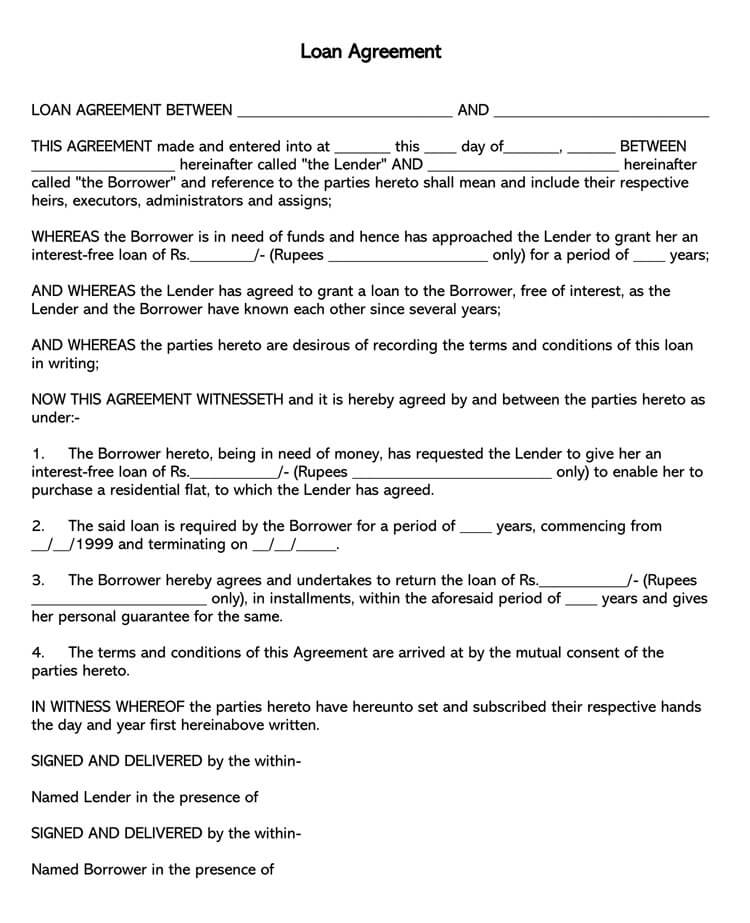

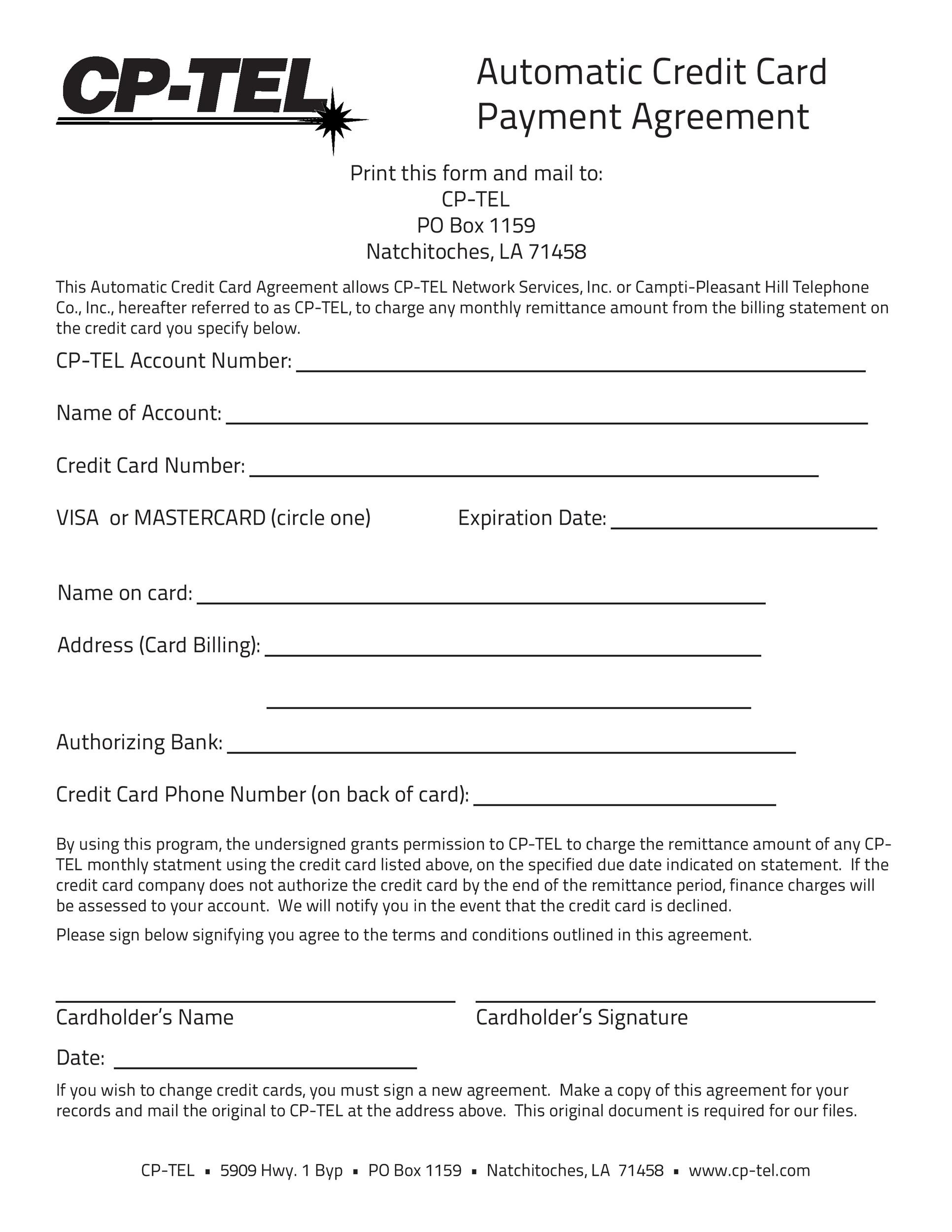

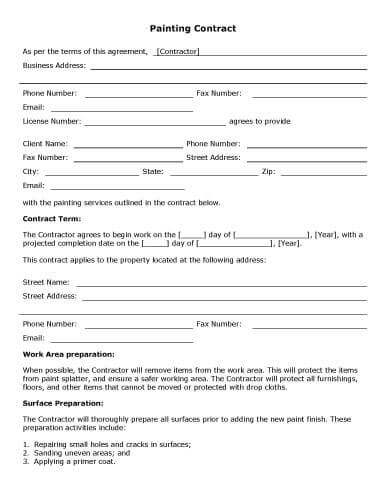

Contract to pay back money template. If you are thinking about lending out some money or borrowing money from someone you should create such a document. Borrowers signature date lenders signature date. Moreover the agreement may define what sort of penalty is involved if the money is not paid back as agreed upon. The letter should include how and when the repayments will be made as well as any penalties if the promisor defaults on payments.

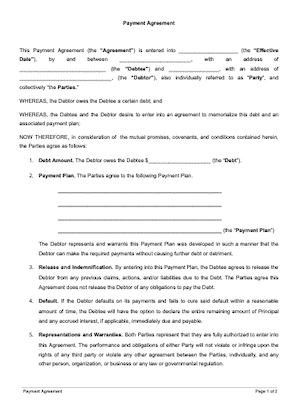

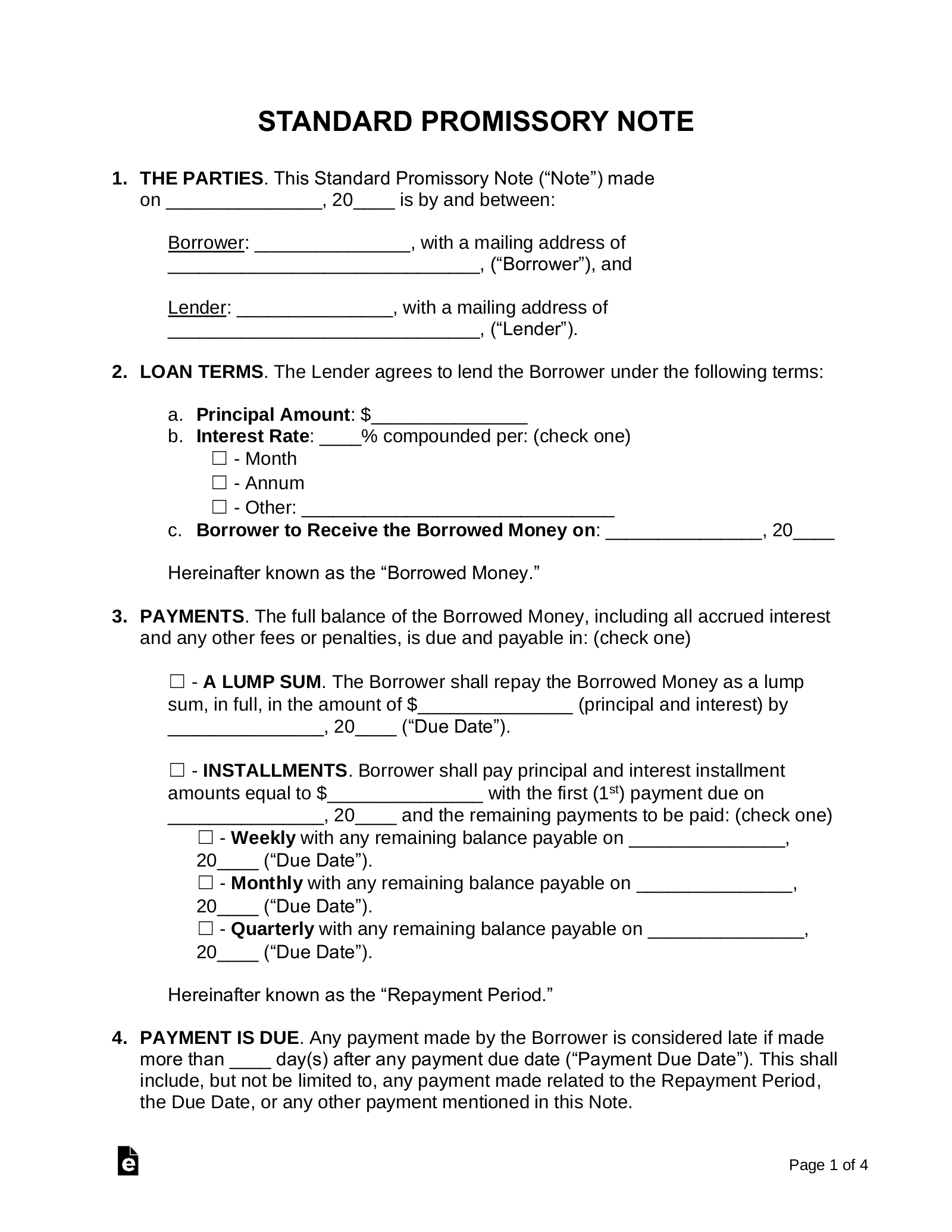

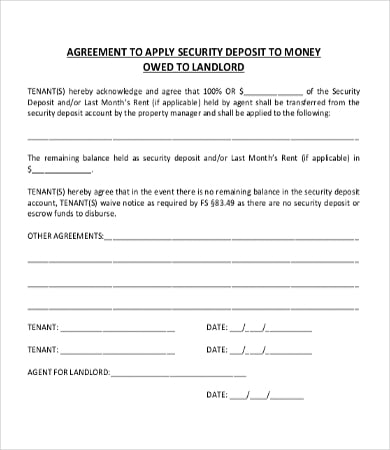

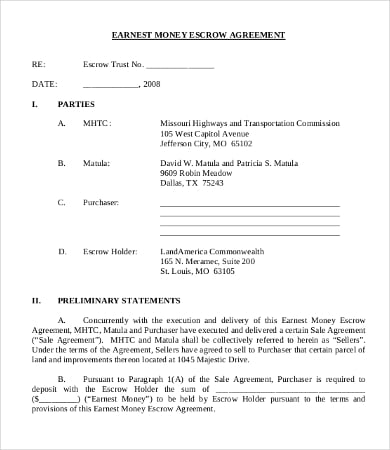

The landlord agrees not to take any eviction action including the serving of termination notice or filing of eviction action in court as long as the tenant complies with this payment plan. Payment schedule for the tenant to pay in full a delinquent rent balance. Before you create a promissory note you should try and understand these subtle differences. A payment agreement is an outline of the important terms and conditions of a loan.

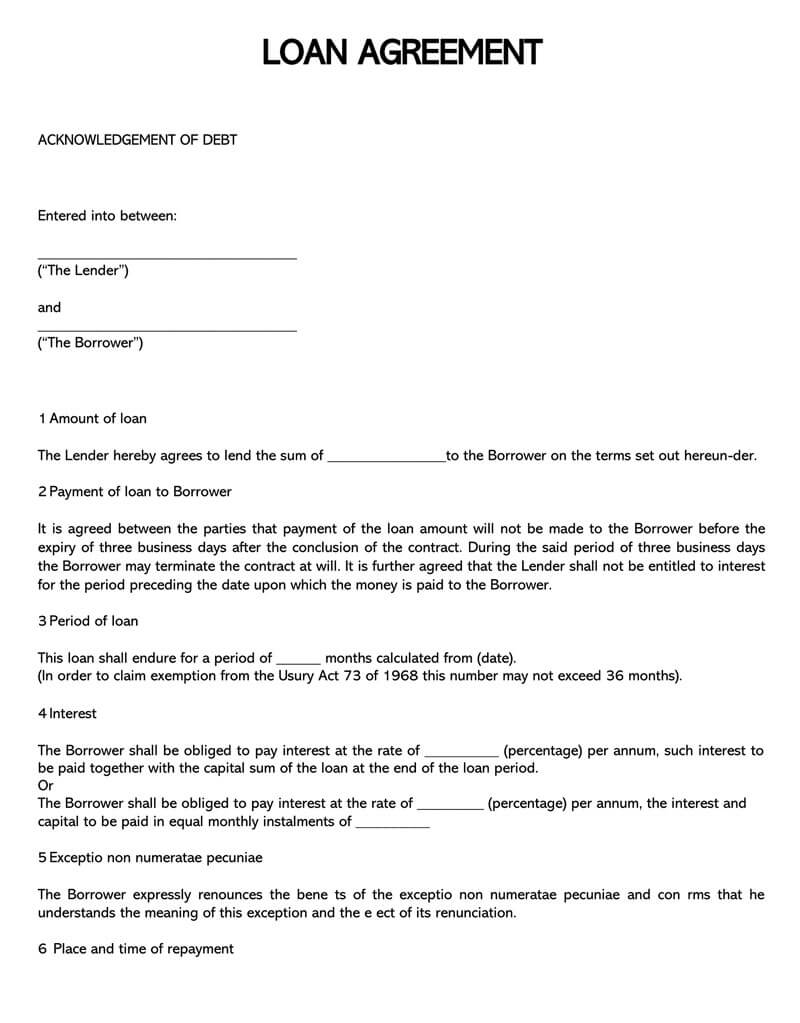

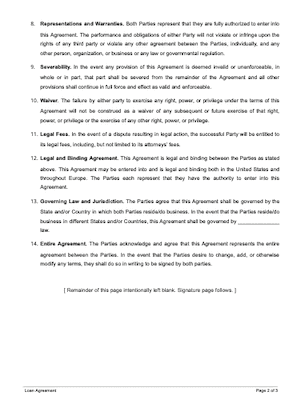

A payment agreement also referred to as a promissory note is an agreement that sets forth the terms of a loan and its repayment. A payment agreement template also known as a payment agreement contract is a document which contains relevant information about a loan. The owed party may assign this agreement with written notice to the owing party. Moreover the agreement may define what sort of penalty is involved if the money is not paid back as agreed upon.

A payment agreement letter is a legally binding contract between someone who borrows money the promisor and the person who lends the money the payee. If youre borrowing or lending money a payment agreement serves as your detailed receipt of the loan. For instance the party loaning the money may require that the borrower pay them back with a cashiers check while prohibiting the use of a personal check. Failure to make any.

Last updated on february 12th 2019. If you are considering lending to or borrowing from someone you know you should draft a payment. For instance the party loaning the money may require that the borrower pay them back with a cashiers check while prohibiting the use of a personal check. When you create your promissory note be sure you word the note in such a way as to make it a promise and not a demand.

If the owing party fails to make a payment for ten days then the total amount accelerates leaving the owing party with a much bigger bill to pay. In witness to their acceptance and agreement to all of the terms of this debt agreement the lender and borrower affix their signatures below. A note is a promise to pay money while a draft is an order to pay money.