Equity Compensation Agreement Template

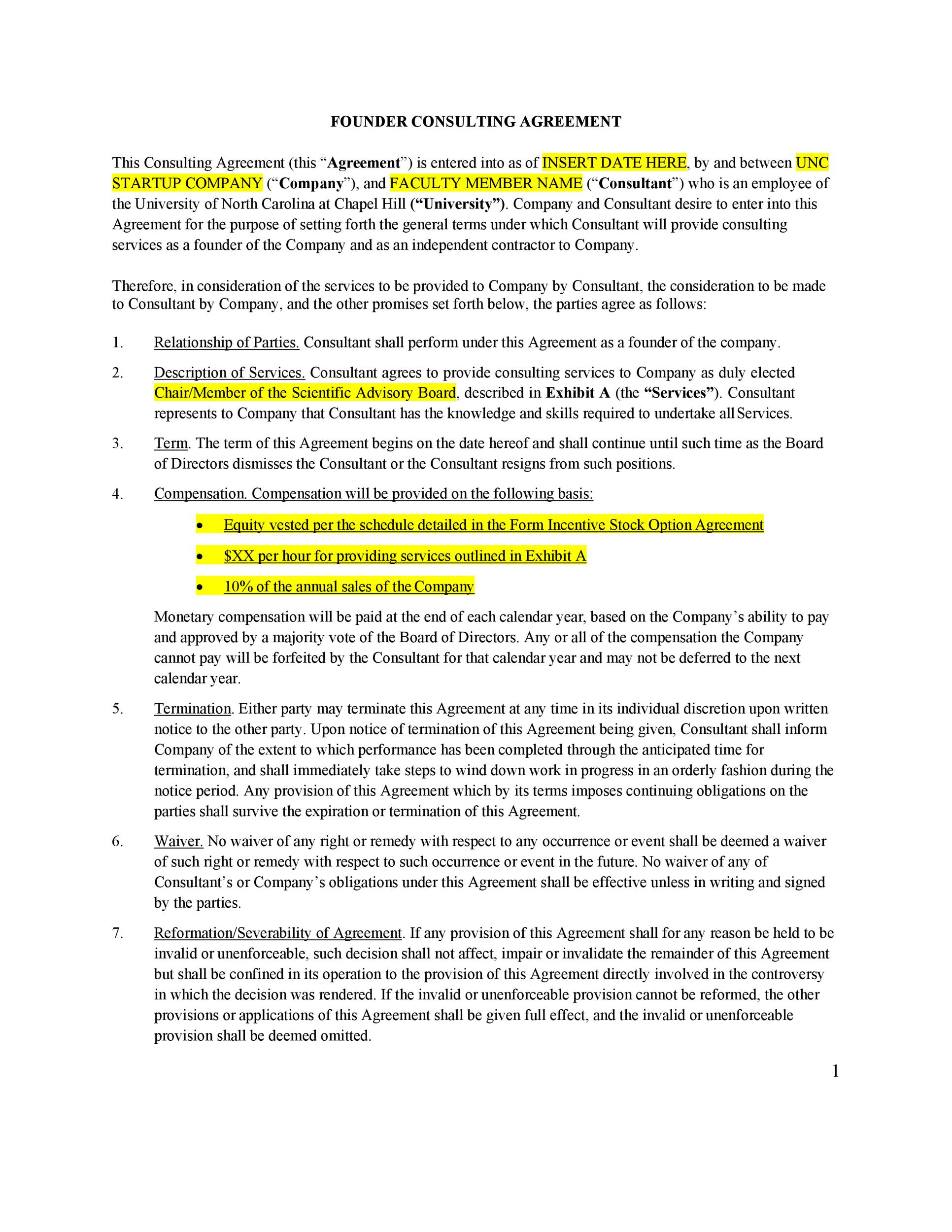

To be used when equity grants under the stock plan are made as restricted stock awards rather than options.

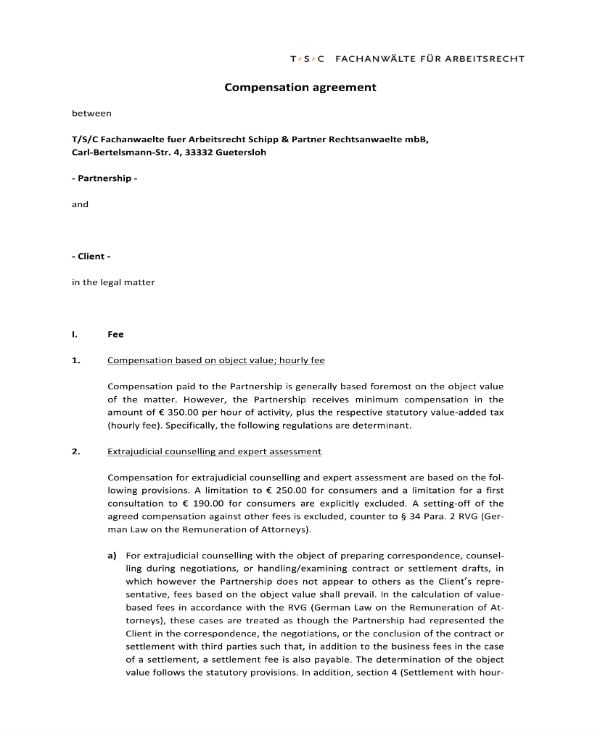

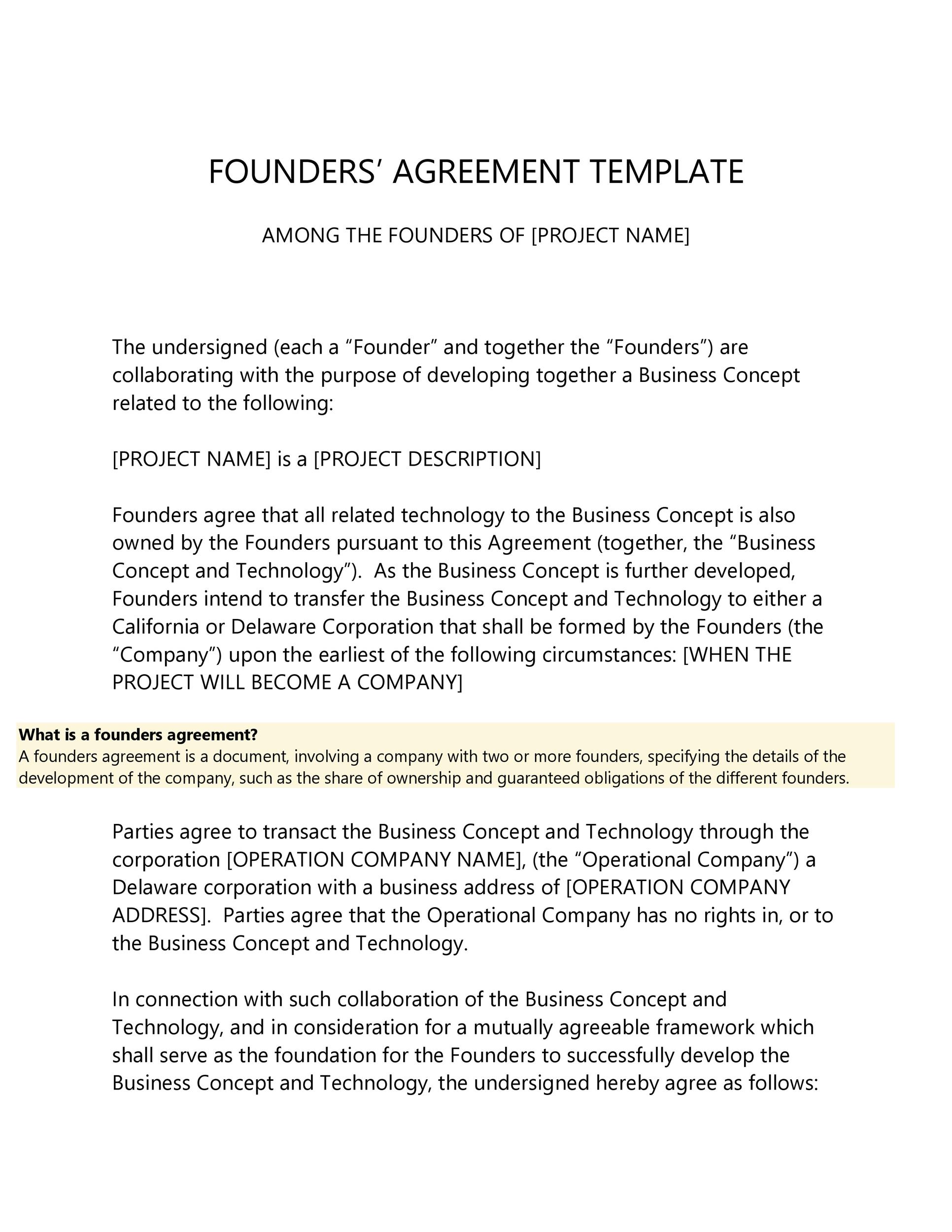

Equity compensation agreement template. Should be required to sign the llc agreement and a buy sell agreement if the llc agreement does not. From chapter 3 equity interests in limited liability companies footnotes omitted one of the potential complexities of granting equity compensation to employees of an llc classified as a partnership for tax purposes is that the irs takes the position that a member cannot also be an employee of the llc. Smrcnders feereement template 12 2012. Operating agreement provisions llc equity options phantom equity equity appreciation rights.

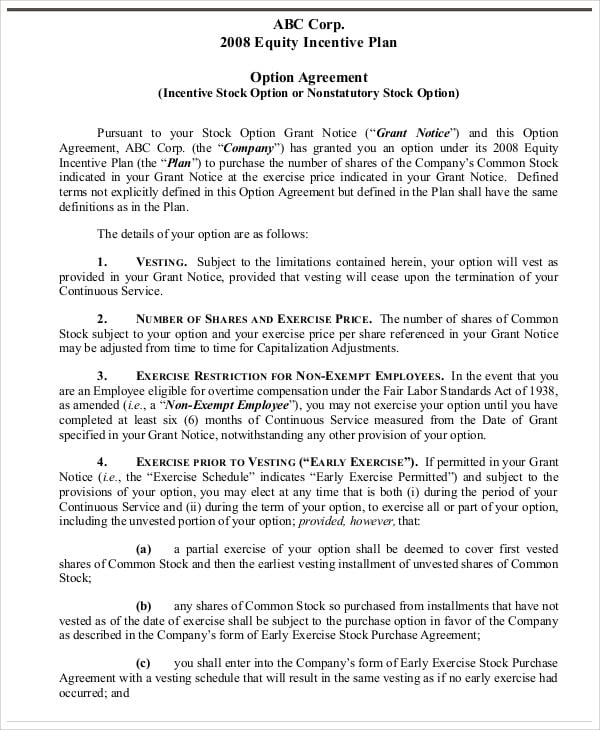

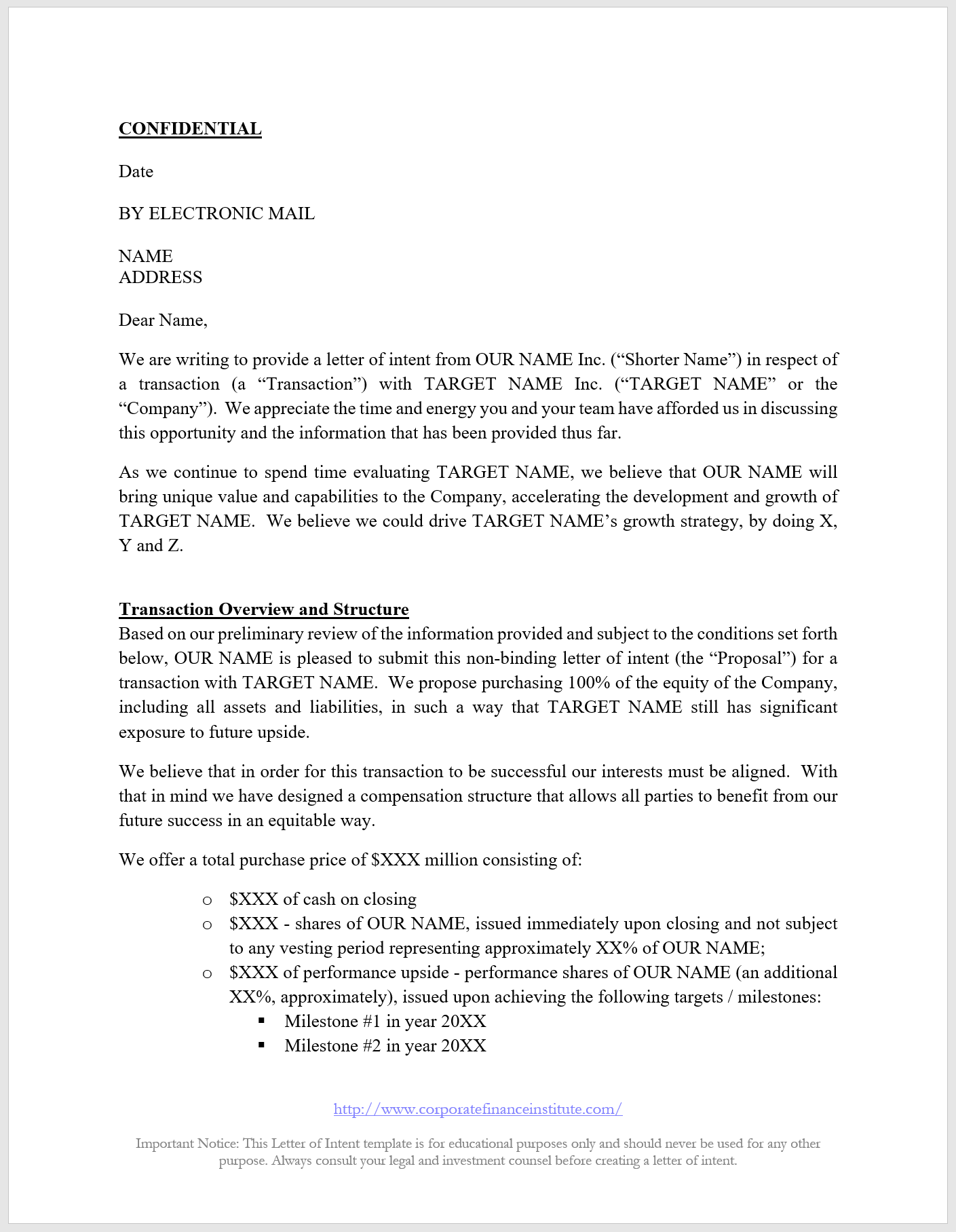

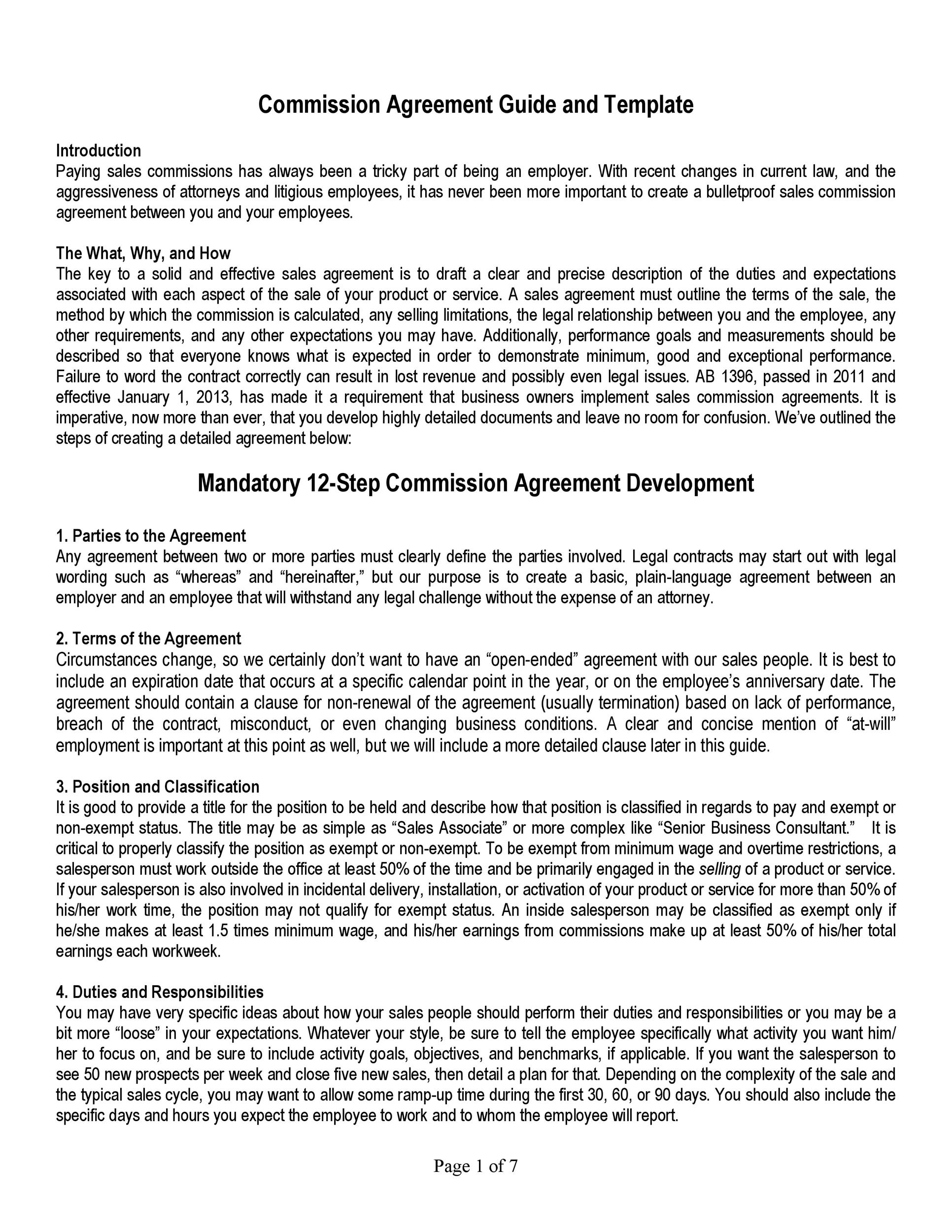

The fast agreement is free and can be modified as you need. Stock option agreements specify the individual options grants vesting schedules and other employee specific information. An equity appreciation right is a contractual right to receive upon the. Why compensate advisors with equity only.

Designing equity compensation and employment agreements for startup. Can i modify the fast agreement. Attract motivate and retain key employees advantages of llcs. Each grant of options will be documented by a separate option agreement.

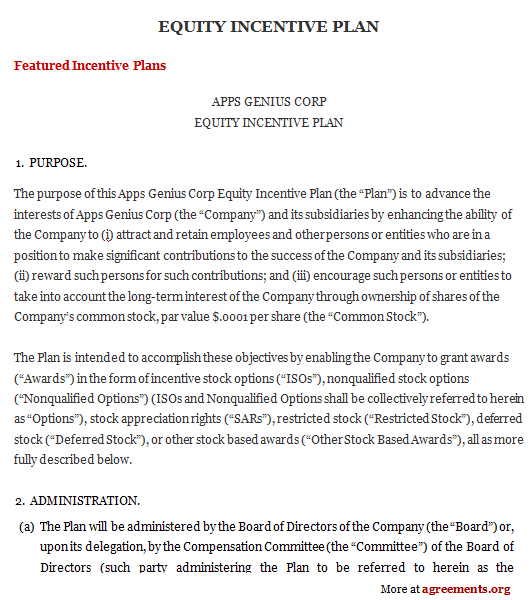

Please check any modified fast agreement against the original template to ensure that you are not signing any unexpected terms. An equity incentive plan provides incentives to eligible recipients in the form of incentive stock options nonstatutory stock options stock appreciation rights restricted stock awards restricted stock unit awards performance stock awards and performance cash awards. Business contracts real estate contract template paralegal. Methods for awarding equity compensation or sweat equity in order to avoid very unpleasant surprises.

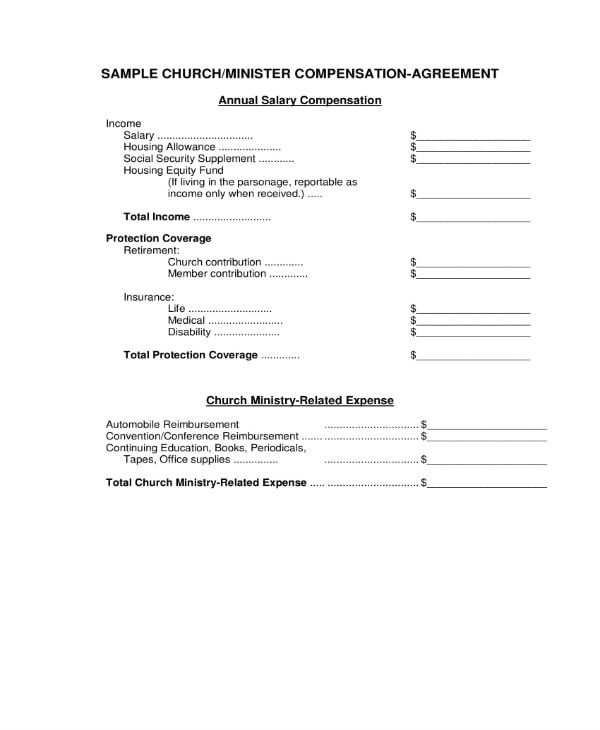

Should address what happens if a founder doesnt stick around or otherwise contribute what is expected vesting provisions buyback. The plan specifies who is eligible for such awards as well as how the award vests whether the award is transferable and. Unrepresented seller pensation agreement hashdoc. 3 incentive compensation arrangements.

Options are a fantastic means to control the recognition of taxable income and market risk since you do not have the stock until you exercise the alternative. Types of llc equity incentive compensation. Others will be asked to exercise options on a normal schedule. Allocation of stock among founders should generally be allocated based on relative value of contributions.