Expense Report Receipt Requirements

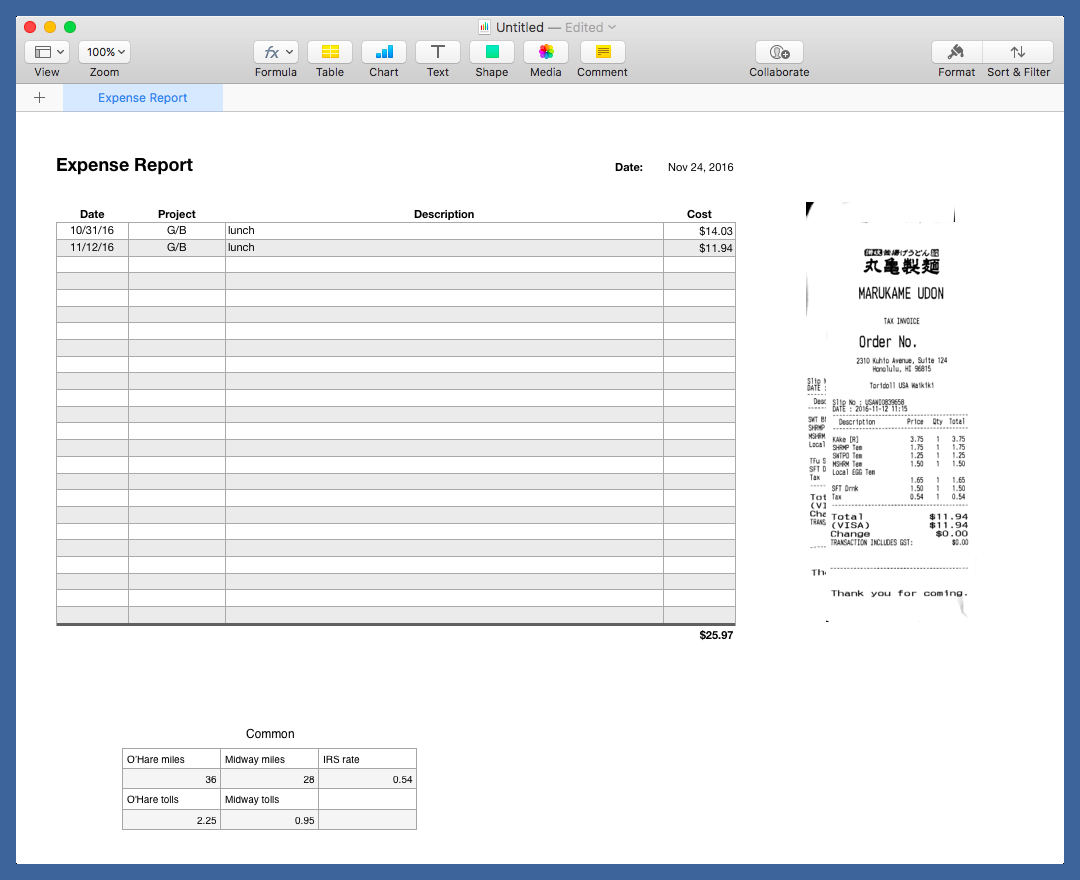

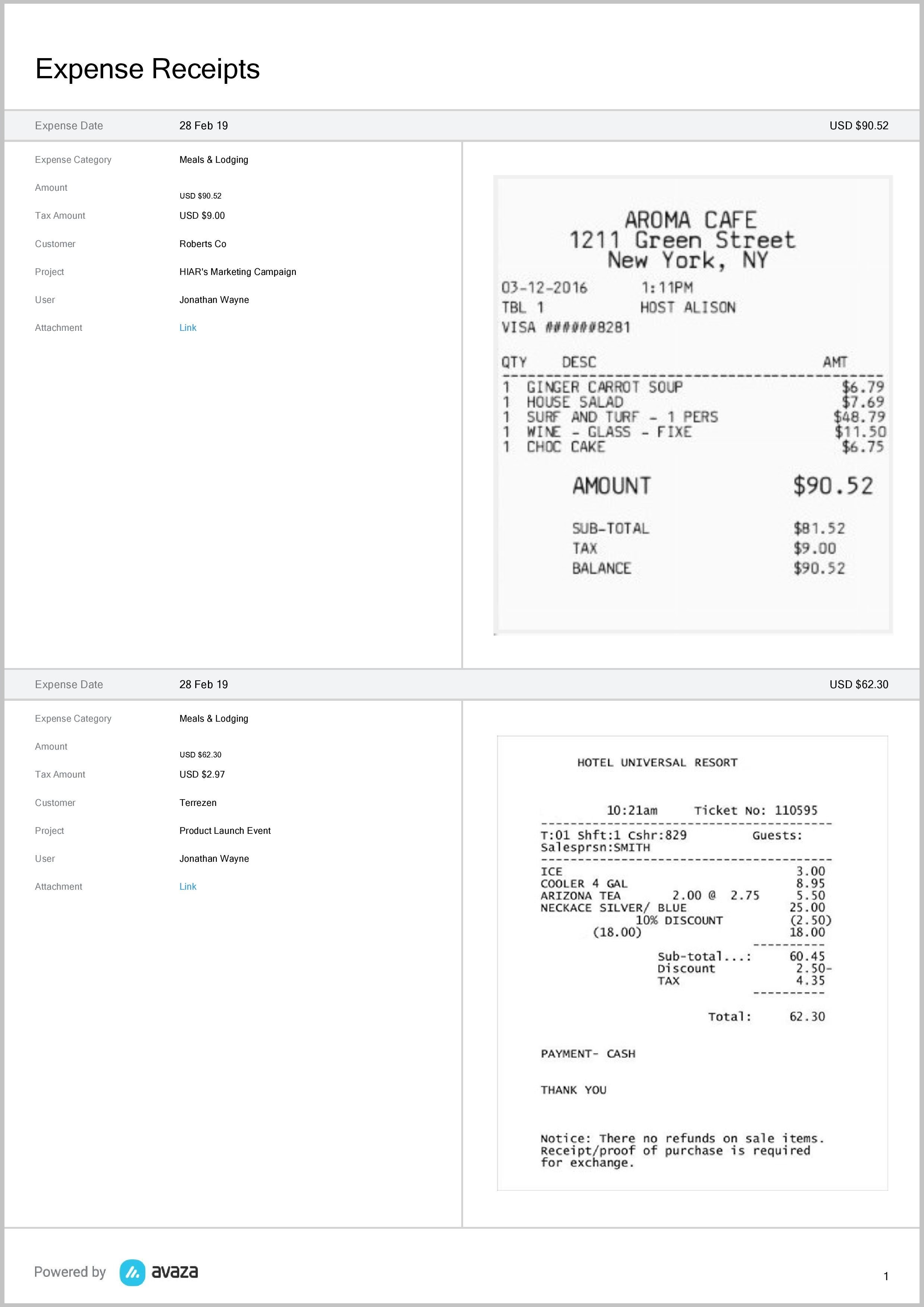

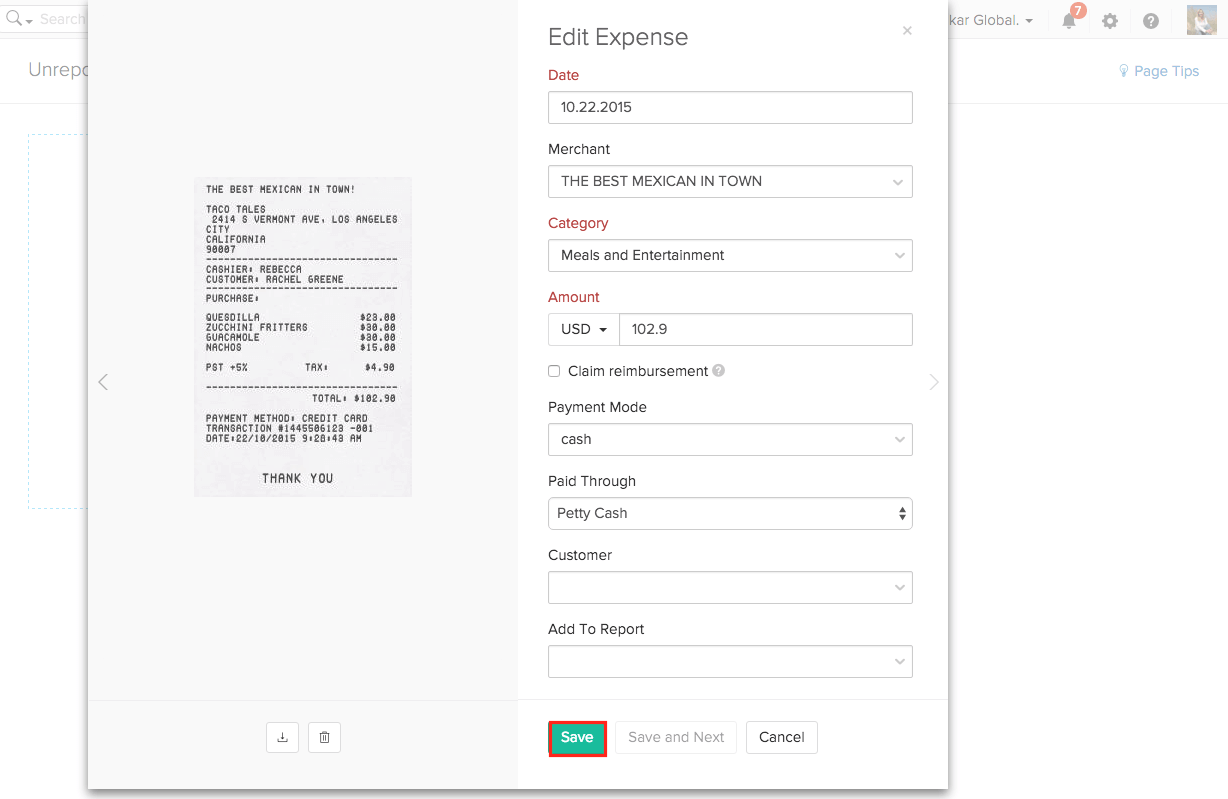

Expense reimbursement policy is compliant and adhered to is very important to ensure reimbursements are not considered taxable.

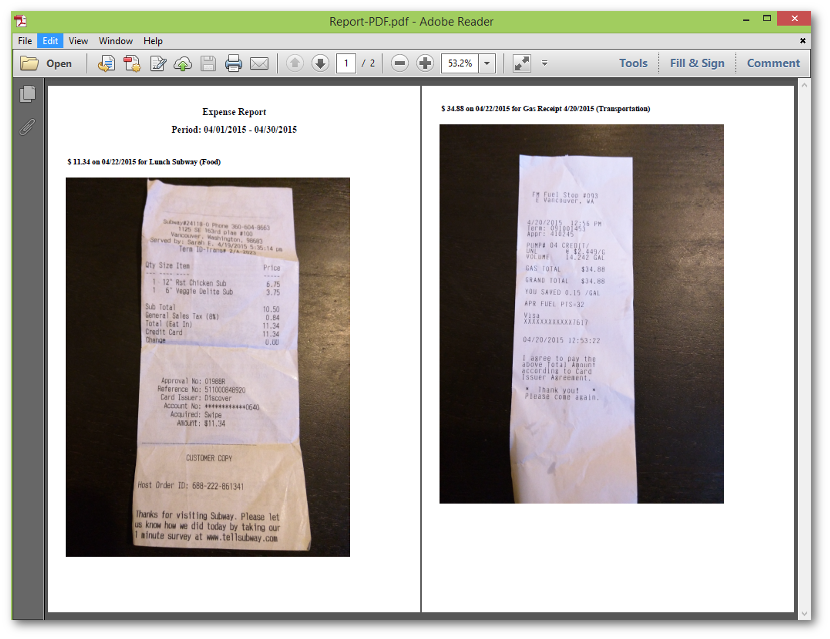

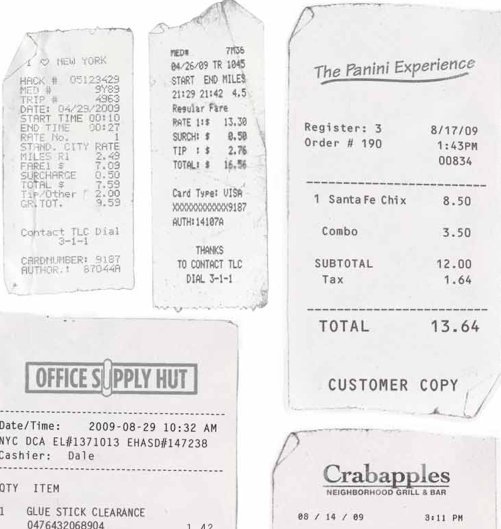

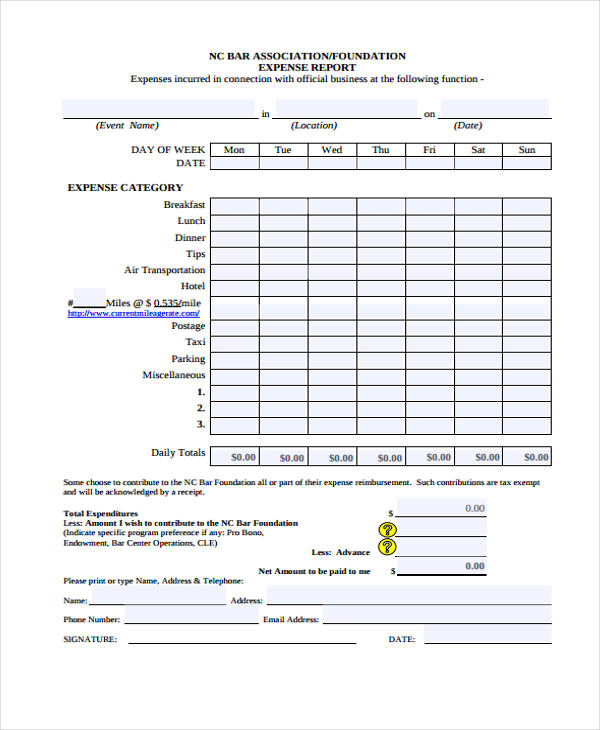

Expense report receipt requirements. The following are some of the types of records you should keep. Your policy may include the use of per diem allowances for. You should keep supporting documents that show the amounts and sources of your gross receipts. The irs does provide an exception to keeping records actual receipts for any expense other than lodging that is less than 75.

And 3 any expenses. An exception to the receipt rule also applies if you have a transportation expense such. Many of the expenses are for 10 50. 1 any expense over 75 where the nature of the expense is not clear on the face of the electronic receipt.

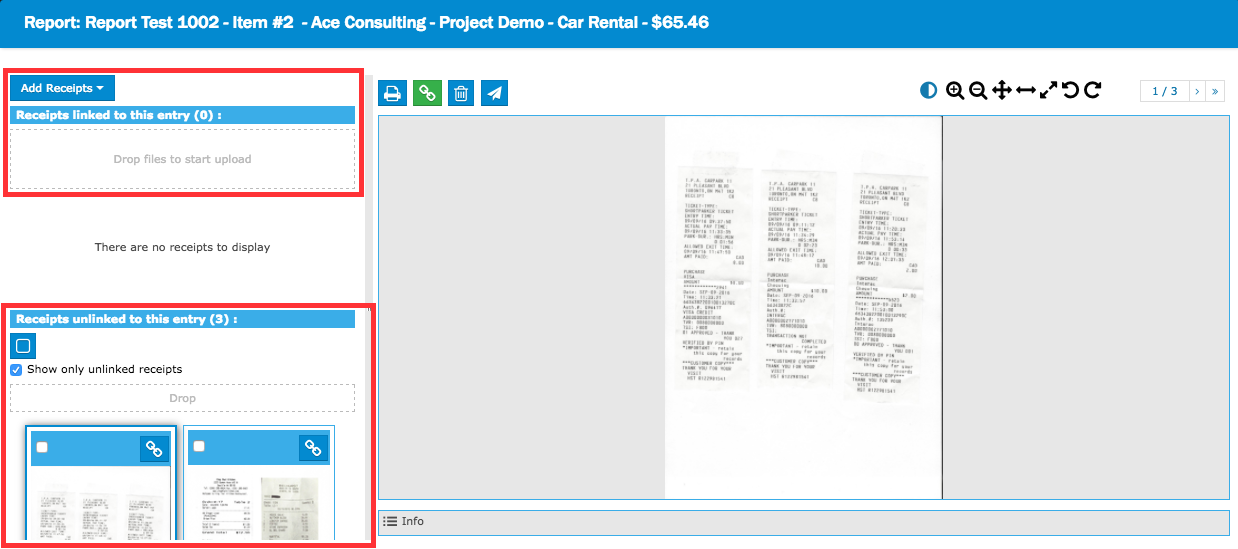

2 all lodging invoices for which the credit card company does not provide the merchants electronic itemization of each expense. Gross receipts are the income you receive from your business. Ive read on the irs website that if you have adequate evidence you dont necessarily need a receipt for expenses that are less than 75 entertainment office supplies etc. If a personal card is used to book airfare the receipt with all the information required in item a above must be attached to the concur expense report.

Generally you dont need a receipt if you have an expense that was less than 75 unless it was for lodging. The employer requires employees to submit paper expense reports and receipts for.