Form 8962 Printable

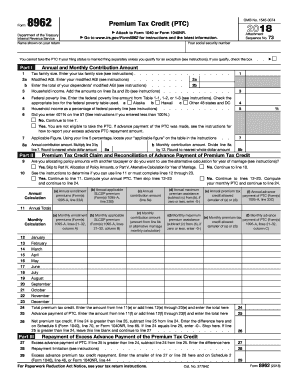

Allocation of policy amounts.

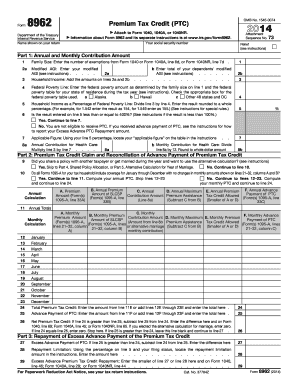

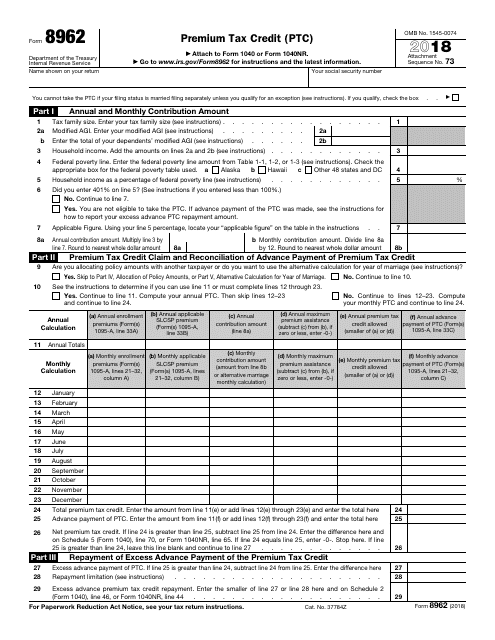

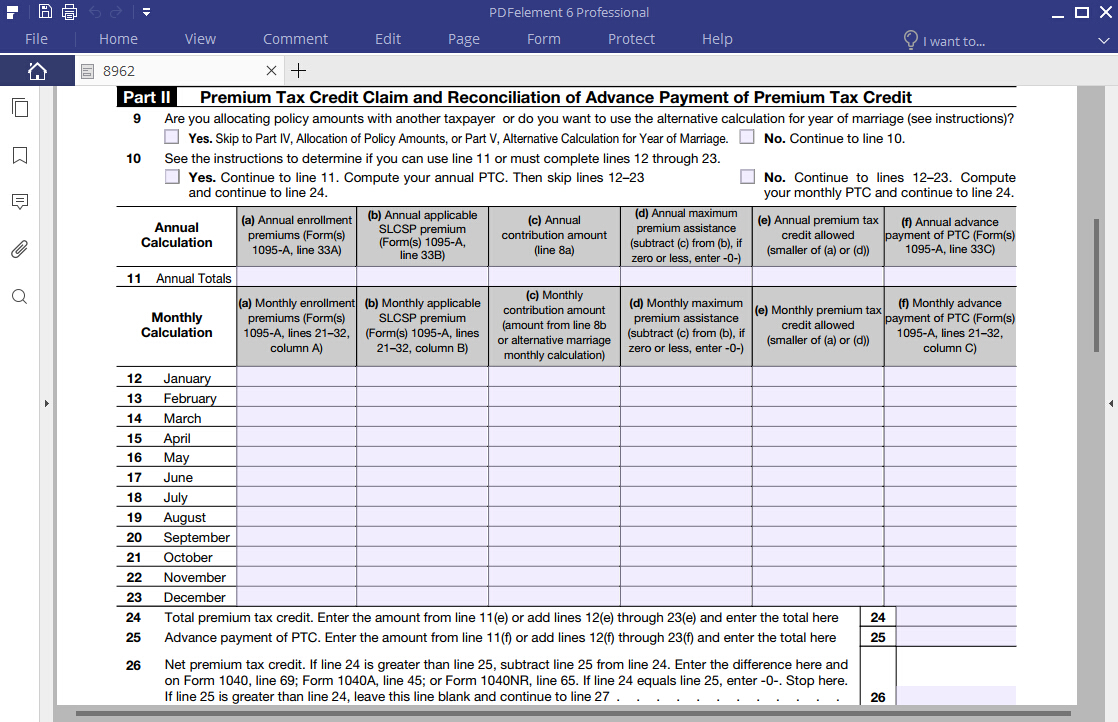

Form 8962 printable. Request for transcript of tax return. Use form 8962 to figure the amount of your premium tax credit ptc and reconcile it with advance payment of the premium tax credit aptc. Product number title revision date posted date. To speed the process try out online blanks in pdf.

If theres a change to your refund amount or the amount you owe youll need to print and send page 2 of your 1040. Premium tax credit ptc 2019 12032019 inst 8962. Complete the following information for up to four policy amount allocations. Add all allocated policy amounts and non allocated policy amounts from forms 1095 a if any to compute a combined total for each month.

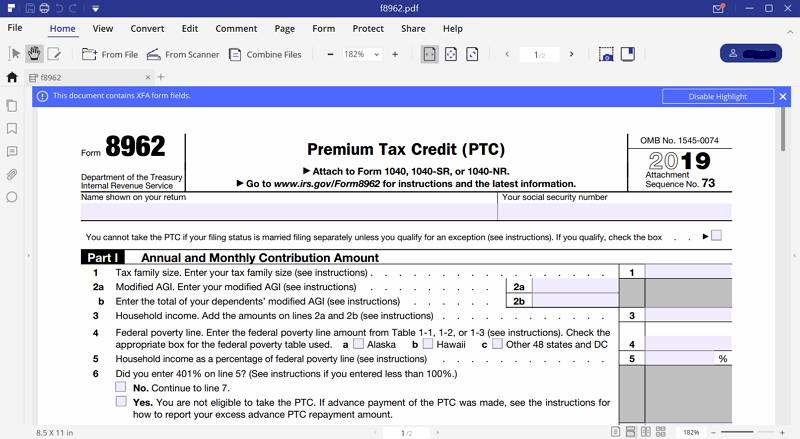

You may take ptc and aptc may be paid only for health insurance coverage in a qualified health plan defined later purchased through a health insurance marketplace marketplace also known as an exchange. Employers engaged in a trade or business who pay compensation. When youre done in turbotax youll need to print out form 8962 and mail or fax it to the irs along with any other items requested in their letter irs letter 0012c. Download fillable irs form 8962 in pdf the latest version applicable for 2020.

Multiply the amounts on form 1095 a by the allocation percentages entered by policy. 30 a policy number form 1095 a line 2 b ssn of other taxpayer c allocation start month d. Instructions for form 8962 premium tax credit ptc. Enter the combined total for each month on.

Employers quarterly federal tax return. Premium tax credit 2019 form 8962 form 8962 omb no. 1545 0074 premium tax credit ptc department of the treasury internal revenue service name shown on your return 2019 attach to form 1040 1040 sr or 1040 nr. See instructions for allocation details.

Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. Form 8962 department of the treasury. Fill out the premium tax credit ptc online and print it out for free. Form 8962 2017 page.

Information about form 8962 premium tax credit including recent updates related forms and instructions on how to file. An individual needs 8962 form to claim the premium tax credit. Department of the treasury internal revenue service united states federal legal forms and united states legal forms. Instructions for form 1040.

It is used to report your credit amount on your tax return and reconcile the advance credit payments made on your behalf.