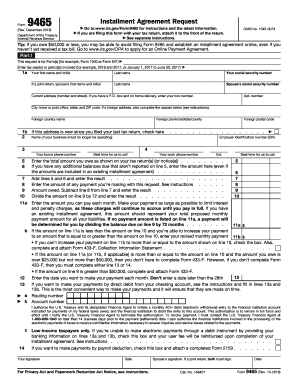

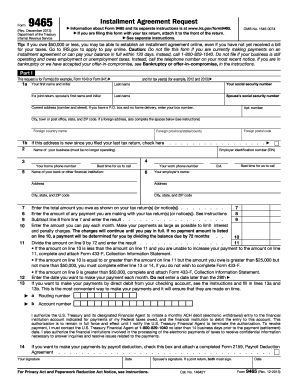

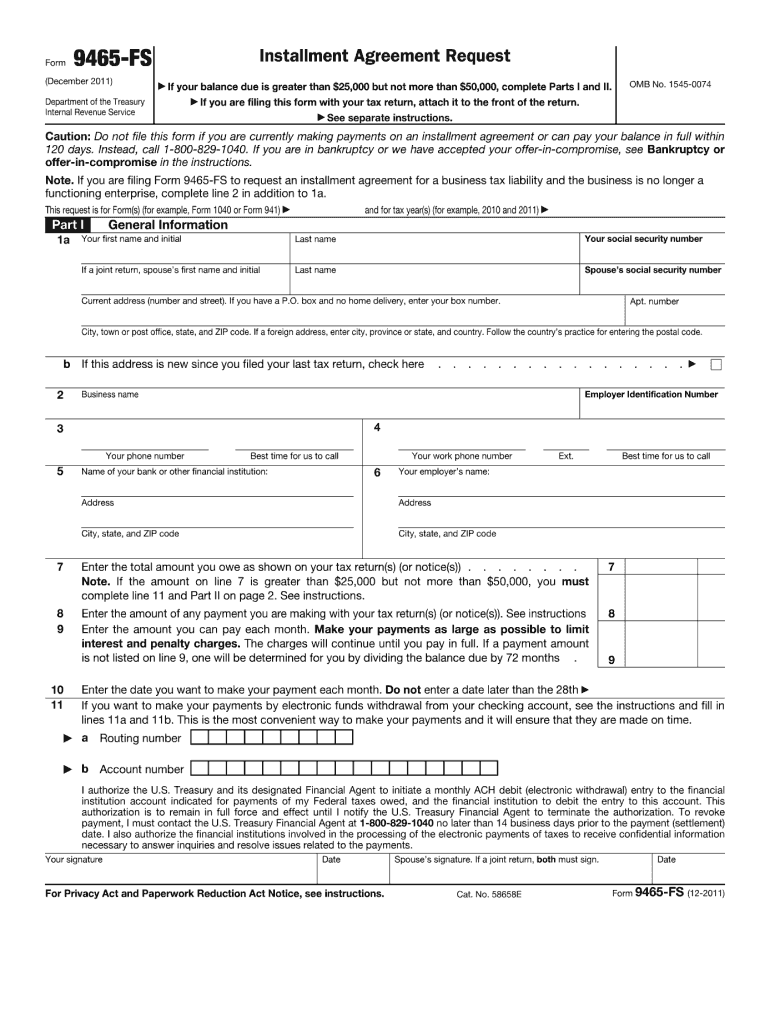

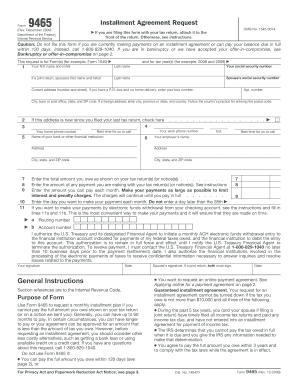

Form 9465 Printable

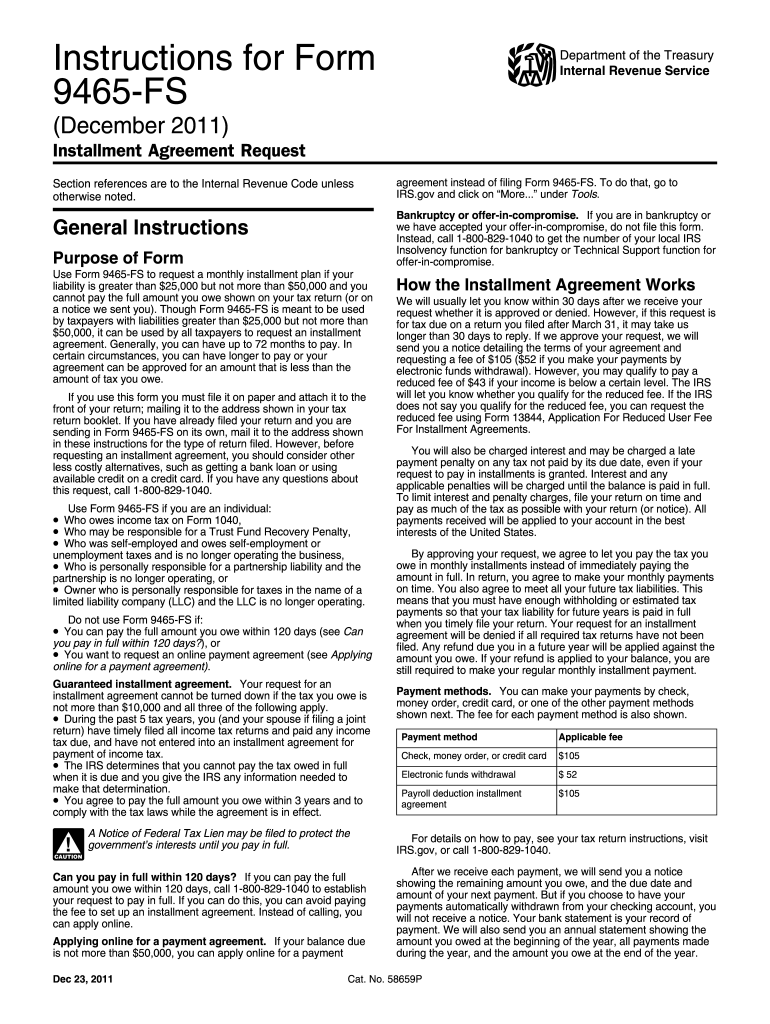

Installment agreement request 1218 12282018 inst 9465.

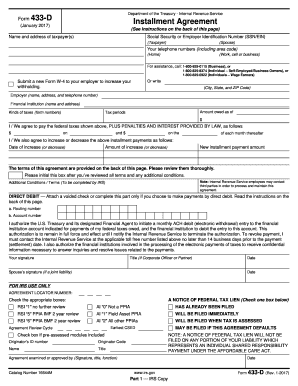

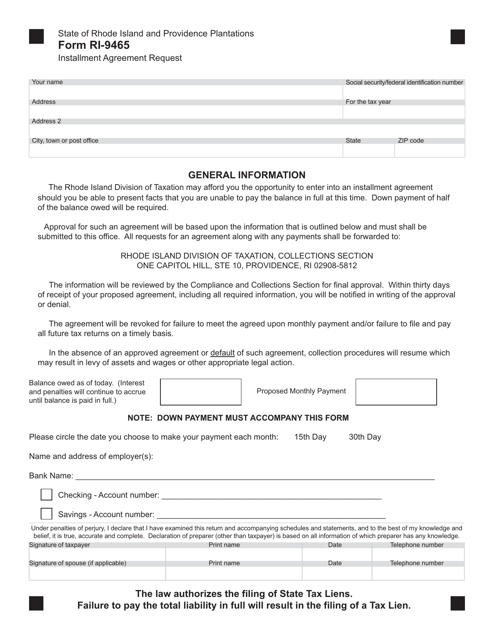

Form 9465 printable. 2 part ii additional information. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Complete this part only if all three conditions apply. You owe more than 25000 but not more than 50000 and 3.

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Fill printable form 9465 online. Fillable printable form 9465 what is a form 9465. 2 part ii additional information.

If you have already filed your return or youre filing this form in response to a notice file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. The form 9465 is used to prepare a request for a monthly installment plan in case a taxpayer cant pay the full amount shown on their tax return or on a notice that the internal revenue service has sent. This form is for income earned in tax year 2019 with tax returns due in april 2020we will update this page with a new version of the form for 2021 as soon as it is made available by the federal government. Download or print the 2019 federal form 9465 installment agreement request for free from the federal internal revenue service.

Form 9465 installment agreement request is used to ask an installment plan every month for one who owes 50000 or less. Instructions for form 9465 installment agreement request 1219 01092020 form 9465 sp installment agreement request spanish version 1218 01112019 inst 9465 sp. 12 2018 form 9465 rev. You defaulted on an installment agreement in the past 12 months 2.

We last updated federal form 9465 in december 2018 from the federal internal revenue service. If one cant pay the full amount he or she owes shown on your tax return he or she can use this form. Fill out securely sign print or email your tax form 9465 instantly with signnow. Complete this part only if you have defaulted on an installment agreement within the past 12 months and the amount you owe is greater than 25000 but not more 50000 and the amount on.