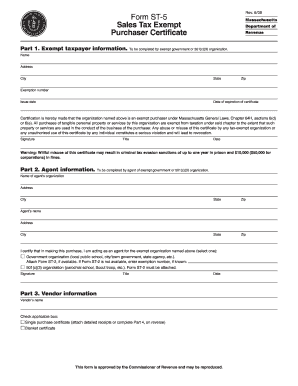

Georgia Resale Certificate

Georgia sales tax resale certificate example.

Georgia resale certificate. Heres a quick guide on what you need to know to buy products for resale and to sell products for resale in georgia. Georgia does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re used for all exempt purchases made from that vendor. Will arrive via mail unless you opt in for electronic correspondence. If you go to a wholesaler and buy a computer you plan to sell like ebay you may purchase the item without paying state sales tax.

If you wish to use georgia resale certificate. St 5 sales tax certificate of exemption 18086 kb department of. Georgia tax exemption georgia resale certificate georgia sale and use tax georgia wholesale certificate etc. A new certificate does not need to be made for each transaction.

Purchases or leases of tangible personal property or services for resale only. Will no longer use color bonded certificate paper with a watermark will now use plain white stock paper are available for viewing and printing through the georgia tax center after login. Virtually all legitimate wholesale companies will ask for a copy of your resale certificate. Personal property obtained under this certificate is subject to sales and use tax if the purchaser uses or consumes the property in any.

Georgia sales tax resale certificate number. The https ensures that any information you provide is encrypted and. A sales and use tax number is. Most businesses operating in or selling in the state of georgia are required to purchase a resale certificate annually.

State of georgia department of revenue sales tax certificate of exemption. Call 1 800 georgia to verify that a website is an official website of the state of georgia. St 5 certificate of exemption st 5 certificate of exemption. Even online based businesses shipping products to georgia residents must collect sales tax.

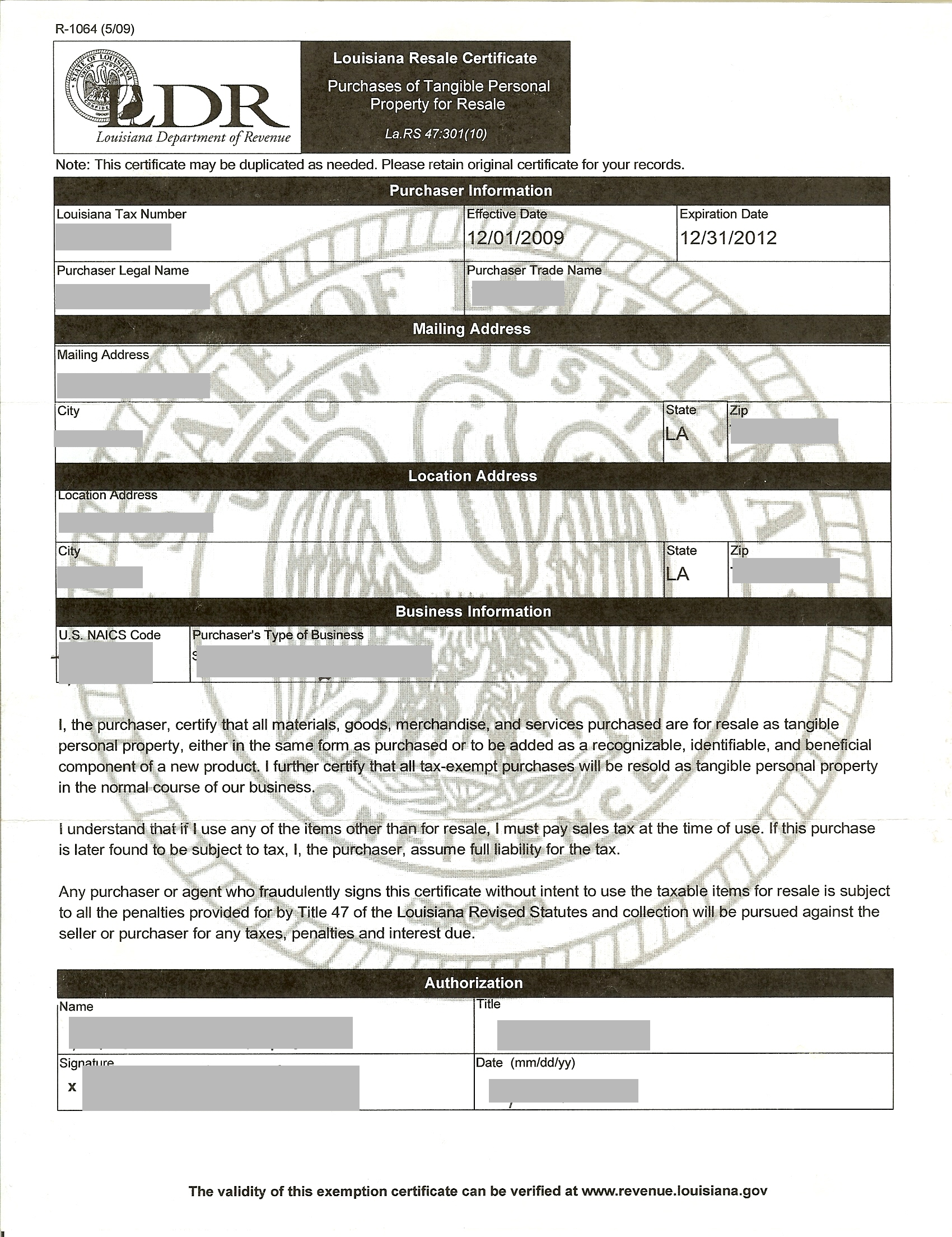

In general the uniform sales and use tax multi jurisdictional certificate of exemption or the certificate of exemption from the purchasers home state bearing the purchasers resale registration number will serve as sufficient proof that the transaction is not a taxable retail sale. A georgia state resale certificate can be used to purchase items at wholesale costs and will allow you to resell those items. 48 8 38 third party drop shipment policy. After your online submission you should receive.

Online registration is available through georgia tax center gtc a secure electronic customer self service portal. This certificate is used to collect sales tax from your clients and to avoid paying sales tax to your supplier. Also known as. Any entity that conducts business within georgia may be required to register for one or more tax specific identification numbers permits andor licenses.

Acceptance of uniform sales tax certificates in georgia. Effective march 8th 2018 sales tax certificates. In georgia this process involves presenting a georgia sales tax certificate of exemption to the merchant from whom youre buying the merchandise to be resold.