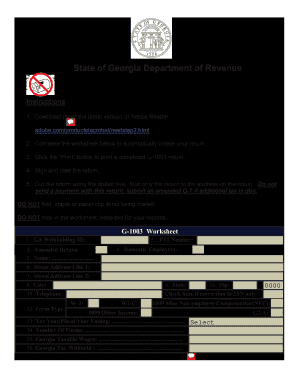

Georgia Retirement Income Exclusion 2018 Worksheet

/taxes-in-retirement-how-much-will-you-pay-2388083v-6-5b4cba9fc9e77c0037315bd8.png)

Retirement income includes income from pensions and annuities interest income dividend income net income from rental property capital gains income and income from royalties.

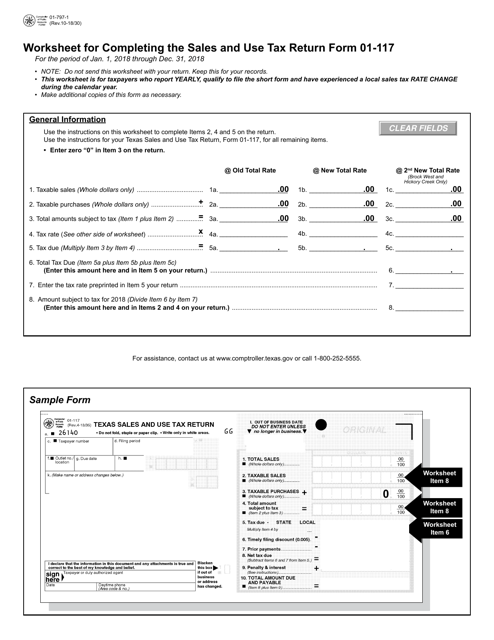

Georgia retirement income exclusion 2018 worksheet. The georgia retirement income exclusion is calculated from the date of birth entries on the general basic data worksheet section 1 general line 8 date of birth for taxpayer and spouse. This other income includes virtually any other income received with the 2 exceptions above. Georgia tax center gtc is the department of revenues secure self service customer facing portal for making online individual or business tax payments and for corresponding with the department of revenue. How do i enter georgia retirement exclusion in an individual return using worksheet view.

A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently disabled. Retirement income includes items such as. Processing center po box 740319 where do you file. The site is secure.

The https ensures that any information you provide is encrypted and transmitted securely. Retirement income includes items such as. Interest dividends net rentals capital gains royalties pensions annuities and the first 400000 of earned income. Call 1 800 georgia to verify that a website is an official website of the state of georgia.

Georgia retirement income exclusion rie on georgia form 500 schedule 1 you are allowed to subtract a retirement income exclusion. See page 12 of form it 511 to obtain the worksheet for calculating the maximum allowable adjustment. The list shown on the georgia department of revenue website for retirement income is in a sense incomplete in that it does not include other income which is on the retirement income exclusion worksheet. The retirement income exclusion is limited by 35000 for taxable years beginning on or after january 1 2008.

Retirement income exclusion see form it 511 for the retirement income exclusion worksheet to calculate the maximum allowable adjustment for this year. Individual income tax online services what is georgia tax center. A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently disabled. Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their georgia tax return.

If you are 62 64 years of age or less than 62 and permanently disabled the maximum retirement income exclusion is 35000.

/w42018.cropped-5bfc2e8e46e0fb00265c78e6.jpg)