How Much Can You Give To Charity Without Receipts

If you are within that 3 percent range you most likely can go ahead and claim charitable deductions without a receipt.

How much can you give to charity without receipts. With no written record you can not deduct a donation. Having the proper receipts and acknowledgments affects whether you can take the deduction or not whereas the agi reported on your return can limit the amount thats deductible. Donations involving a motor vehicle boat or airplane that has a value that exceeds 500 are handled differently. Donations of more than 250 require a written acknowledgement from the charity.

The total amount of your charitable deduction reported as an itemized deduction on schedule a generally cannot exceed 50 percent of your agi. The amount you can deduct for charitable contributions generally is limited to no more than 60 of your adjusted gross income. According to irs publication 526 the gospel for qualified charitable contributions. Cash donations of 250 or more.

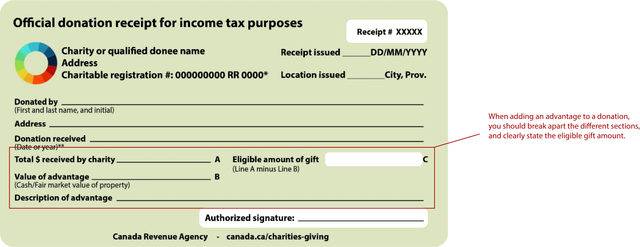

You need a receipt and other proof for both of these. For a cash donation of 250 or more you must have an acknowledgment from the charity stating the date and amount of the donation and whether you received any goods or services in exchange for the donation. There is no specific charitable donations limit without a receipt you always need some sort of proof of your donation or charitable contribution. A charitable organization is required to provide a written disclosure to a donor who receives good or services in exchange for a single payment in excess of 75.

Nulls answer is the best if you dont make over 250 in noncash contributions to a single charity and no more than 500 total. The average donation for that income level is about 3620 or around 3 percent. For amounts up to 250 you can keep a receipt cancelled check or statement.

:max_bytes(150000):strip_icc()/NoTaxesonDividendsandCapitalGainsforMillionsofAmericanHouseholds-56a5dcdd5f9b58b7d0dec9d5.jpg)

/donation-686720693-5a91b3061d64040037b855bd.jpg)