How To Keep Track Of Receipts For Taxes

If you deducted the cost of bad debt or worthless securities keep records for seven years.

How to keep track of receipts for taxes. I bought this cute little jar at hobby lobby but you could also pick up any clear jar and add a chalkboard label yourself. Go paperless store everything electronically and always make backups. If you dont want to mail off your receipts they also have an app where you can simply snap photos of your receipts and then email or upload your images. If youre looking to lower your taxable income and increase your potential for a tax refund a great place to start may be by looking at the purchases you already make and the bills you already pay each year.

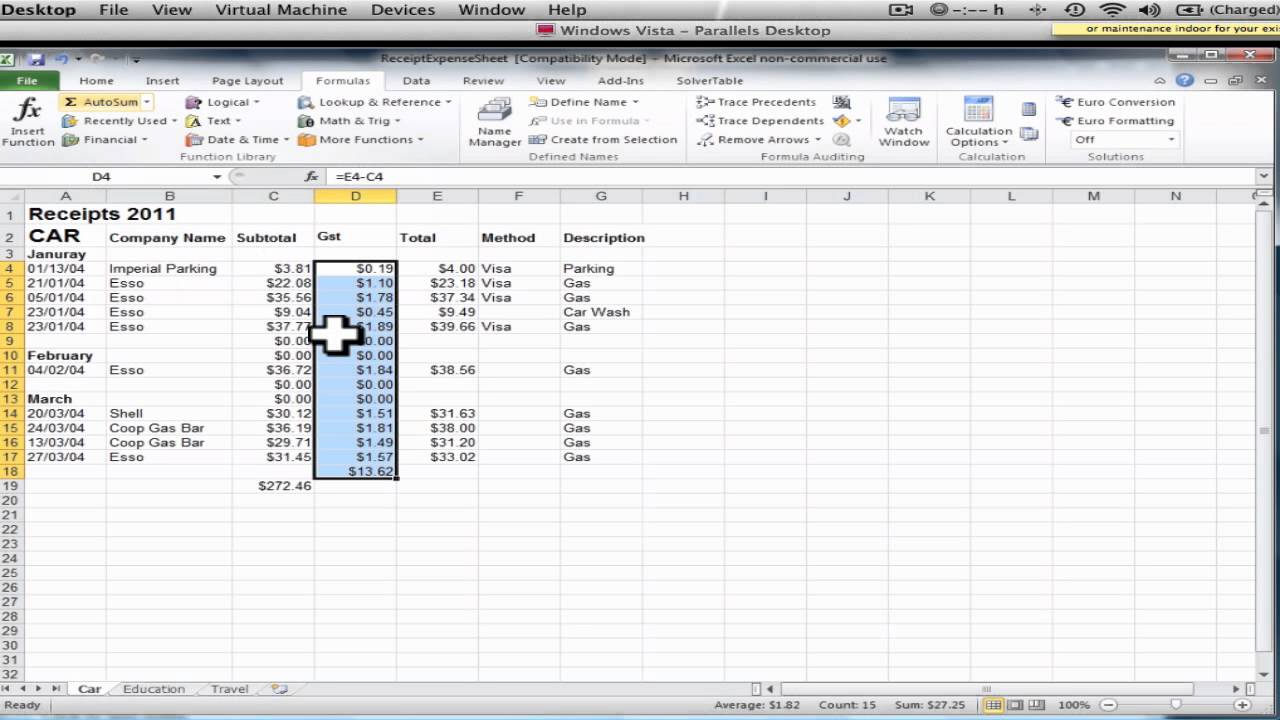

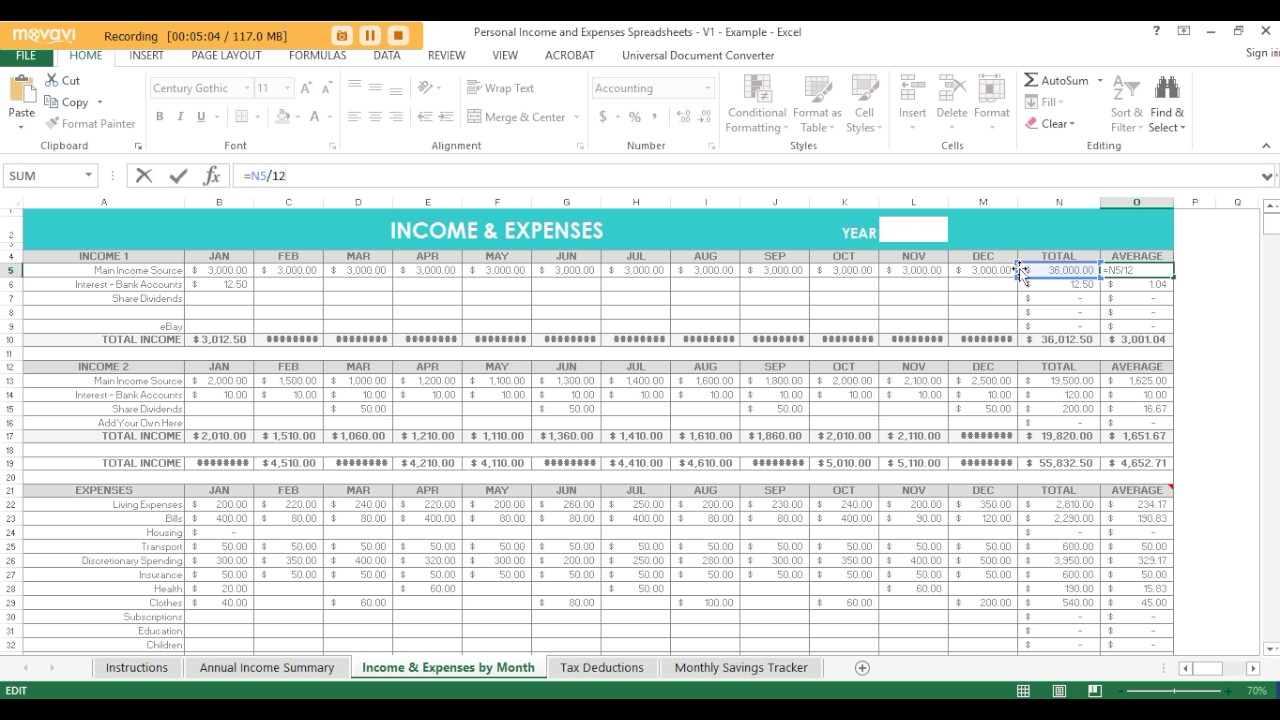

If you dont have many receipts just take a basket put it in your office and throw receipts into it. For instance organize them by year and type of income or expense. My declutteringorganizing motto is every item should have a place. How to keep track of tax write offs receipts.

While this is not a very elegant method having one easily accessible place where you put all your receipts can serve as a reminder to hang on to them in the first place. You should keep them in an orderly fashion and in a safe place. If you omitted income from your return keep records for six years. It is important to keep these documents because they support the entries in your books and on your tax return.

You will have to sort through them at the end of the year. To eliminate wads of receipts strewn everywhere designate a receipt jar where everyone can put receipts the minute they walk in the door. However by choosing the itemization route the onus is on you the taxpayer to keep good records in order to prove or substantiate your expense as valid and thats where being able to fan through your receipts to tally up all your deductible expenses at the end of the year comes in handy. Employment tax records must be kept for at least four years.