Irs Rules On Receipts For Business Expenses

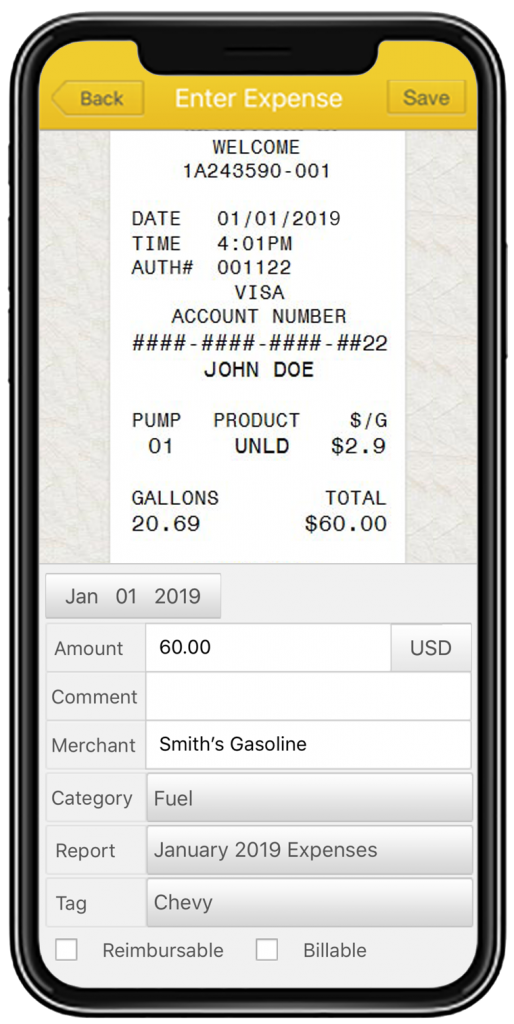

The irs does not require that you keep receipts canceled checks credit card slips or any other supporting documents for entertainment meal gift or travel expenses that cost less than 75.

Irs rules on receipts for business expenses. What does a business need to do to keep adequate records. Such as receipts of each individual expense for a business to keep adequate records. I am comparing the receipts that i saved and my creditdebit card statements and i realize that i didnt save receipts for many business expenses. If you use part of your home for business you may be able to deduct expenses for the business use of your home.

Many of the expenses are for 10 50. Business use of your home. It was my first time freelancing and i didnt exactly know the rules of the game. Credit card receipts and statements.

A business needs to keep a log of business expenses along with documentary evidence ie. I worked as a freelance contractor for 7 months in 2013. Your supporting documents should show the amount paid and a description that shows the amount was for a business expense. Irs requirements for receipts.

Refer to chapter 4 of publication 535 business expenses for information on deducting interest and the allocation rules. Detailed in this post are the irs rules for recording business expenses. The remaining 30 is personal interest and is not deductible. Claiming deductions for things like charitable donations business expenses childcare or tuition payments can lower your tax bill and potentially result in a larger.