Irs Tax Return Receipt

6 weeks or more since you mailed your return or when.

Irs tax return receipt. This will provide you with evidence of the date of delivery as well as the signature of the recipient. Every taxpayer misplaces receipts. You can also send your tax return with a domestic return receipt usps form 3811 for an additional charge of 235. It is important to keep these documents because they support the entries in your books and on your tax return.

The short tax period begins on the first day after the close of your old tax year and ends on the day before the first day of your new tax year. The charity turned out to be fake courtesy of kramer. If the irs approves a change in your tax year or if you are required to change your tax year you must figure the tax and file your return for the short tax period. 21 days or more since you e filed.

Or you could send it priority mail which will provide you with a tracking number you can use to verify the returns receipt. You may mail your tax return certified mail return receipt requested. If you need a photocopy of your return you must use form 4506. You should keep them in an orderly fashion and in a safe place.

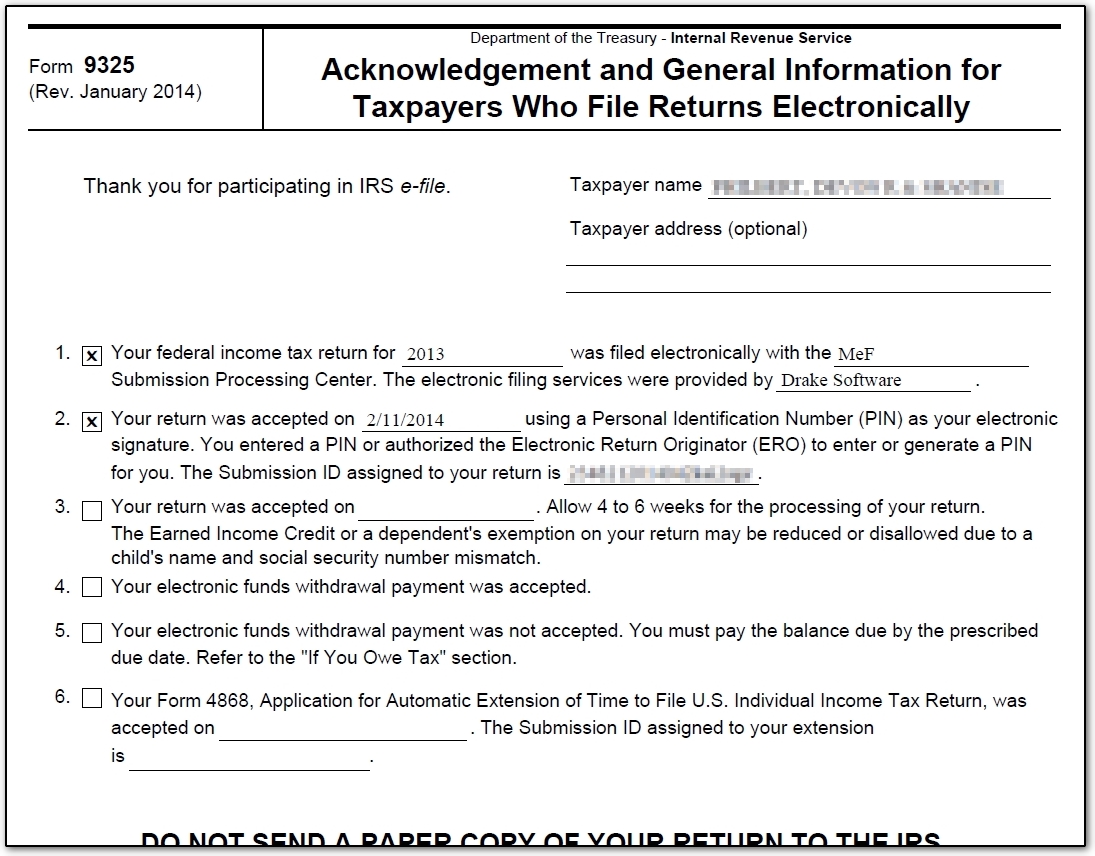

Additionally you can submit your paper return to a representative at a local irs field office and get an accepted time stamp or ask the rep to look up the status of your previously filed return. In a seinfeld episode called the the truth even jerry was undergoing a tax audit. If you contact the irs about a return filing attach a copy of the acknowledgement to all correspondence with the irs and have it available if you call customer accounts services 877 829 5500 the official acknowledgement contains information that will help the irs representative identify the proper return and provide better service. You should only call if it has been.

For instance organize them by year and type of income or expense. The irs questioned a 50 charitable contribution to the people of krakatoa for volcano relief. Complete and mail form 4506 to request a copy of a tax return. Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years.

The fee per copy is 50.

/financial-irs-tax-return-forms-183876977-5b58ef2646e0fb0024c7a42d.jpg)

/cdn.vox-cdn.com/uploads/chorus_image/image/58409839/897291366.jpg.0.jpg)

/GettyImages-73855278-56a939415f9b58b7d0f9628e.jpg)