Keeping Track Of Receipts For Taxes

Business owners and sole proprietors arent the only ones who should be keeping receipts for taxes.

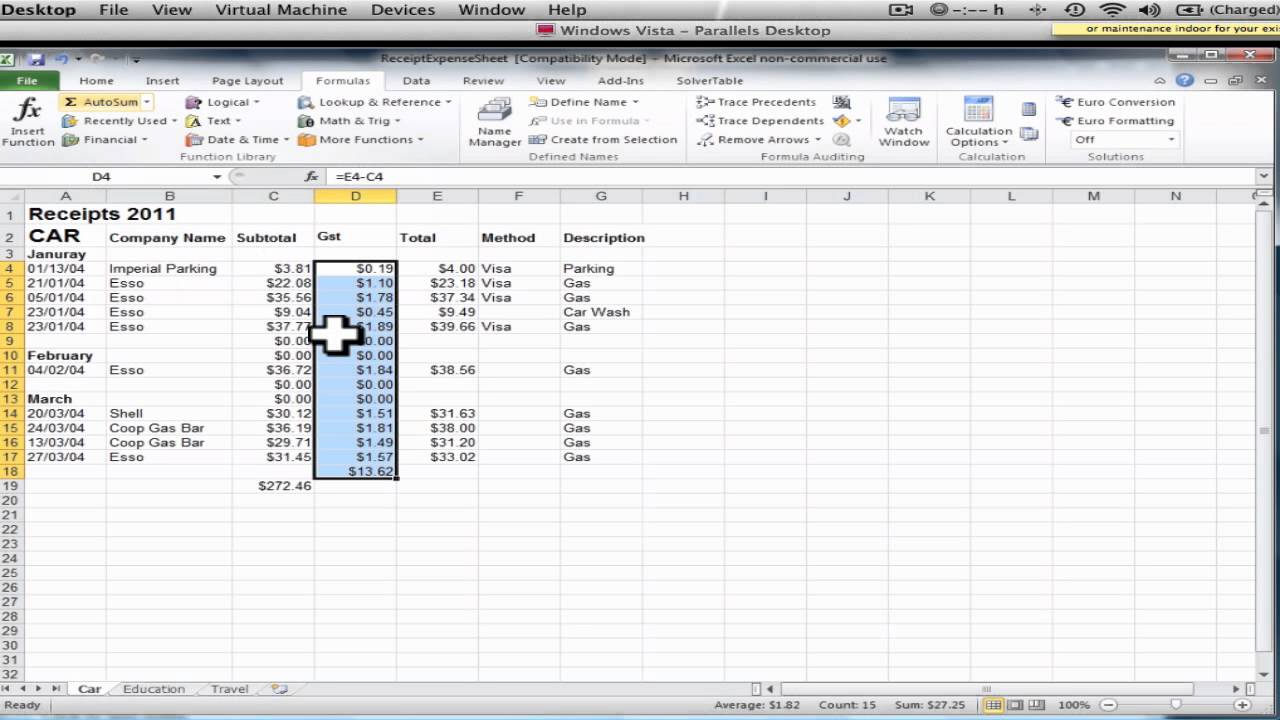

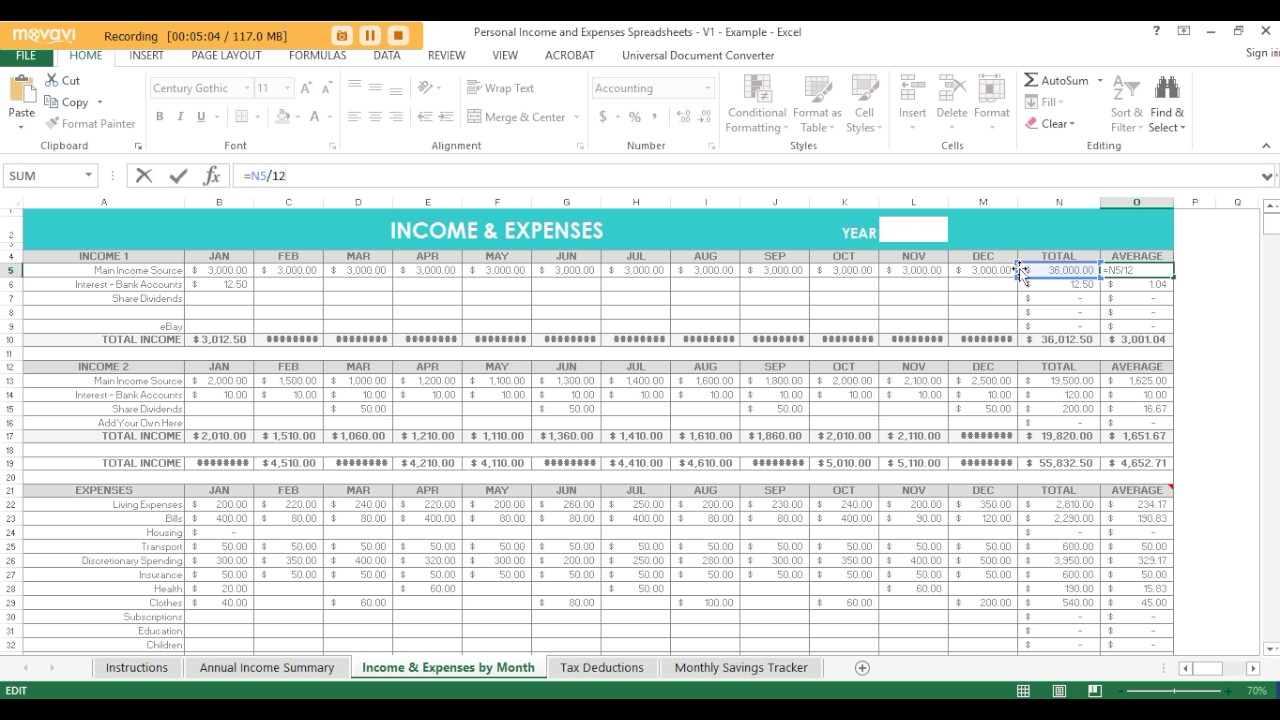

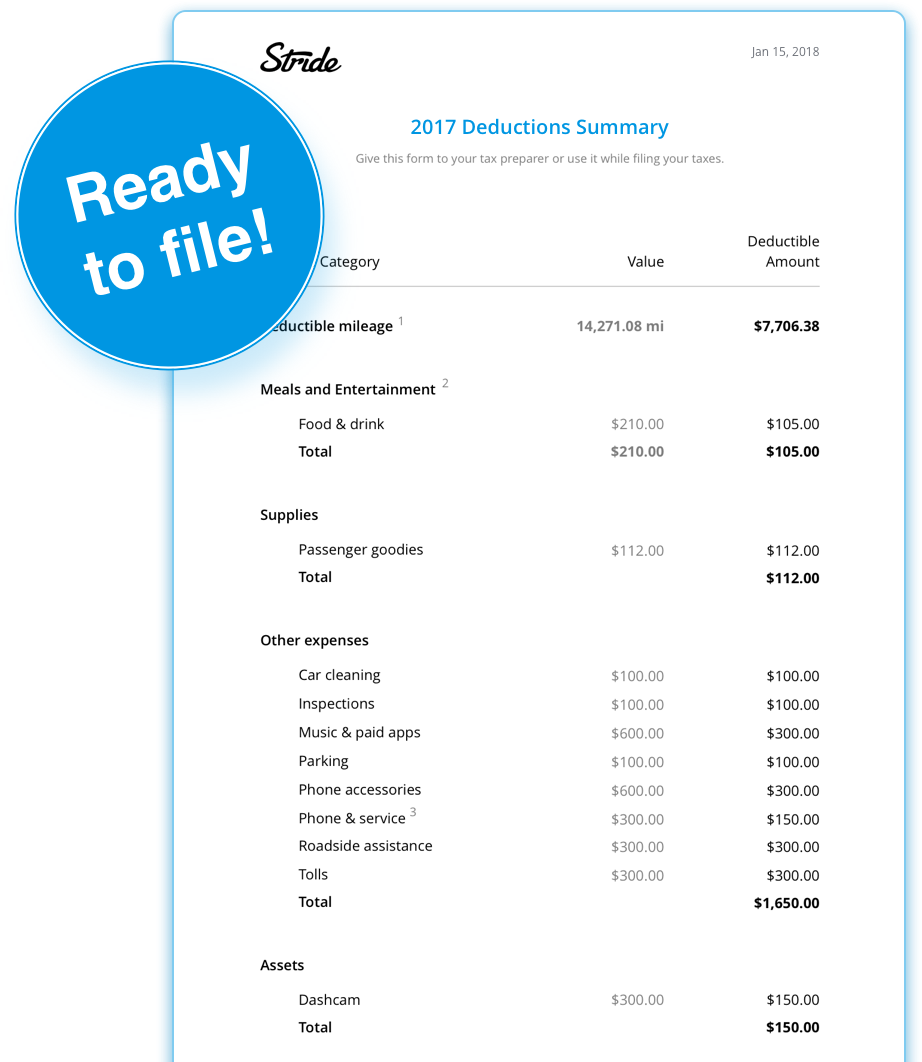

Keeping track of receipts for taxes. The irs is not a big fan of estimating your expenses. For additional information refer to recordkeeping for employers and publication 15 circular e employers tax guide. It keeps you organized keeps you on budget and can be a big money saver when you file deductions at tax time. Keep all records of employment for at least four years.

Keeping track of receipts for your small business is very important. The irs says you need to keep your records as long as needed to prove the income or deductions on a tax return in general this means you need to keep your tax records for three years from the date the return was filed or from the due date of the tax return whichever is later. Having organized records of purchases is essential to operating a successful business. For self employed individuals it is often helpful to save receipts from every purchase you make that is related to your business and to keep track of all of your utility bills rent and mortgage information for consideration at tax time.

However hoping that the ink on your home depot receipt hasnt faded away is a whole other issue. Keep these documents as well. The irs allows taxpayers to scan receipts and store them electronically. When preparing their annual income tax returns filers may take a standard deduction or itemize their expenses.

So before you pull out your hair this tax season take some time to organize your expenses and follow these quick steps to better track your business receipts. If you opt for the standard deduction retention of your receipts is not important for tax purposes. For the 2019 tax year the standard deduction is 12200 for single taxpayers and 24400 for those who are married and filing jointly. There are specific employment tax records you must keep.

Certain utilities and expenses for operating a business from your home may also qualify. Scan receipts and keep them at least six years.