Manufacturing Exemption Certificate

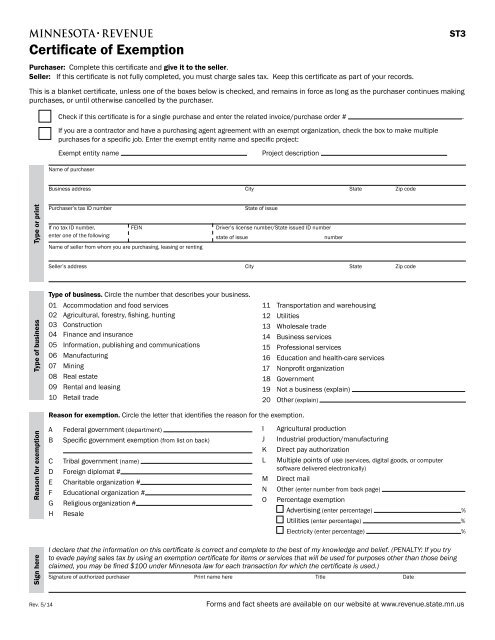

1115 this booklet is designed to help businesses properly use kansas sales and use tax exemption certificates as buyers and as sellers.

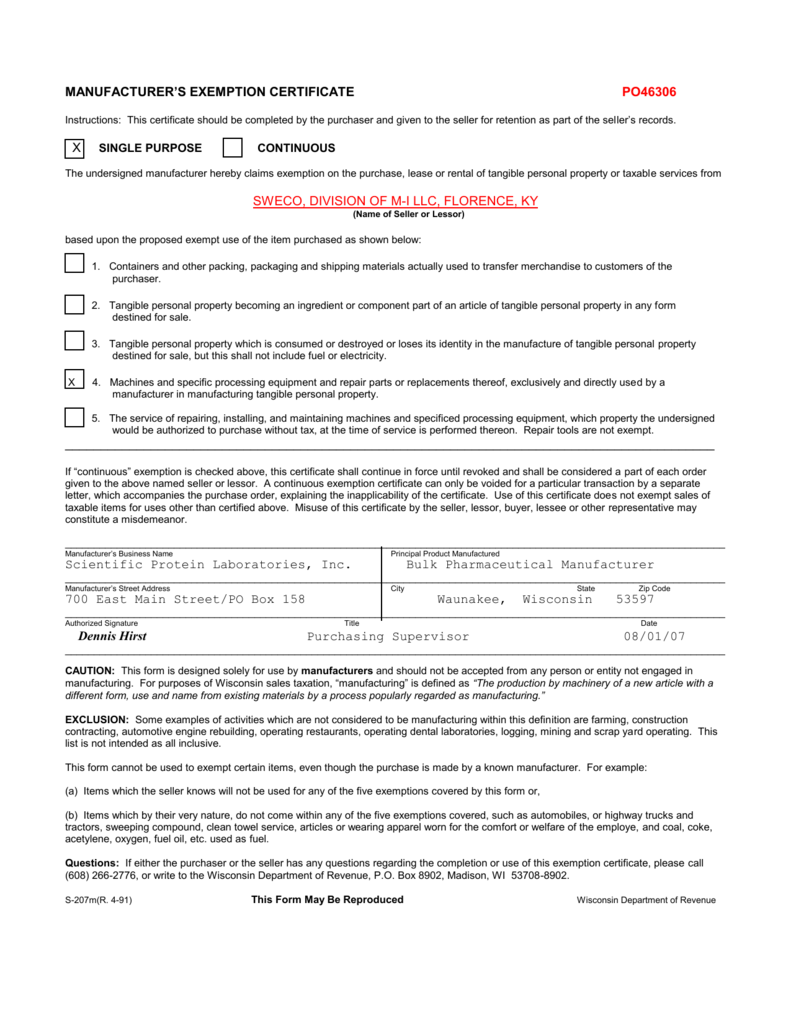

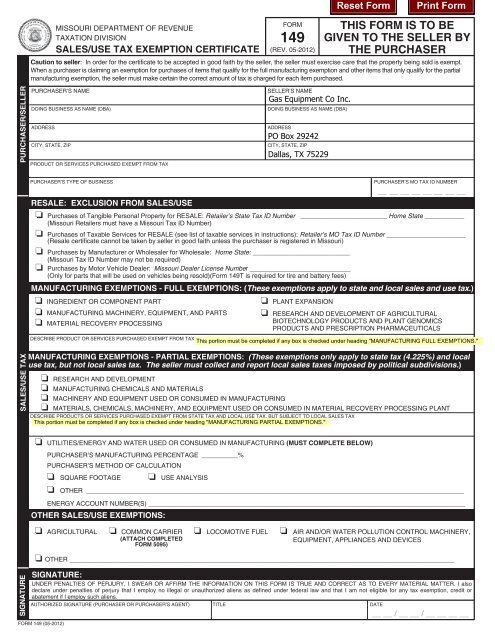

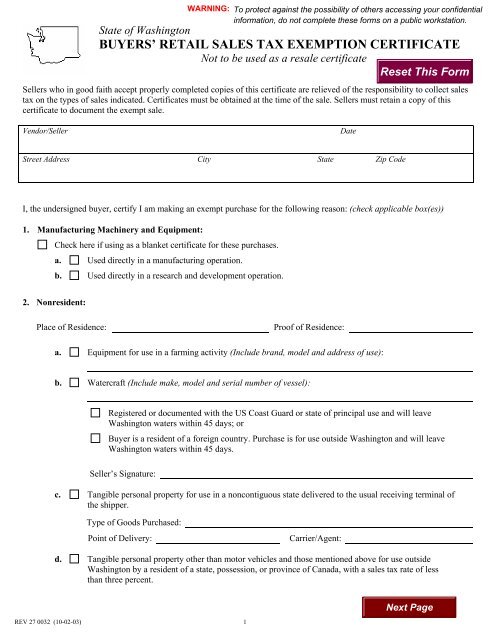

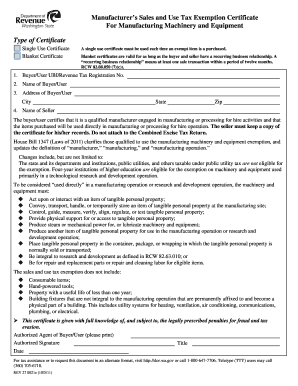

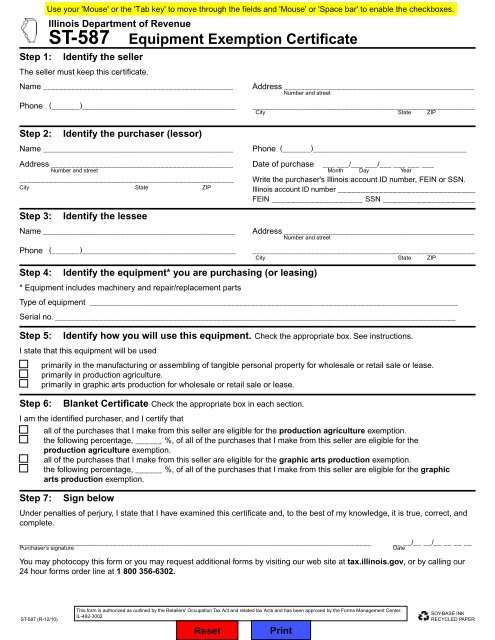

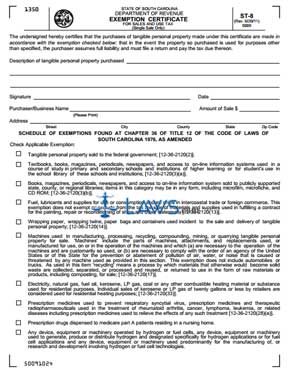

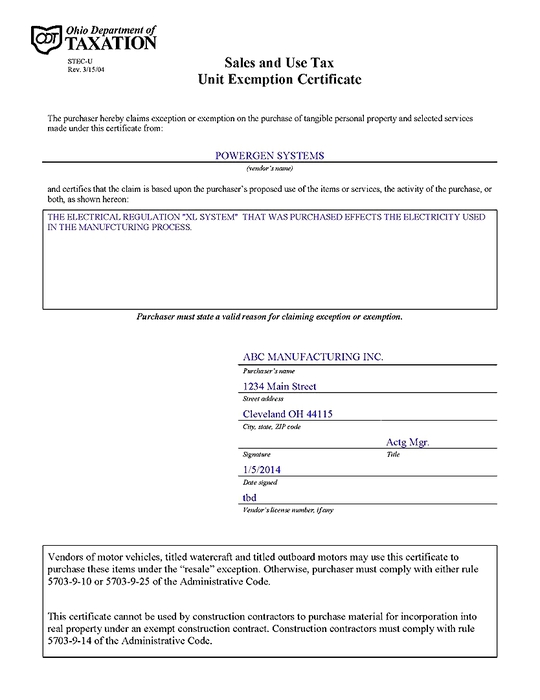

Manufacturing exemption certificate. It explains the exemptions currently authorized by kansas law and includes the exemption certificates to use. Generally an exemption certificate is required for proof that no tax is due on any sale that is made tax free as a sale of machinery or equipment used in graphic arts production manufacturing machinery equipment and tangible personal property to be used primarily in manufacturing or assembling. Certificate for machinery equipment materials tools and fuel used by an aircraft manufacturer operating an aircraft manufacturing facility. You must attach the exemption certificate to the record of the purchase or have some other method of associating the exemption certificate with a particular sale.

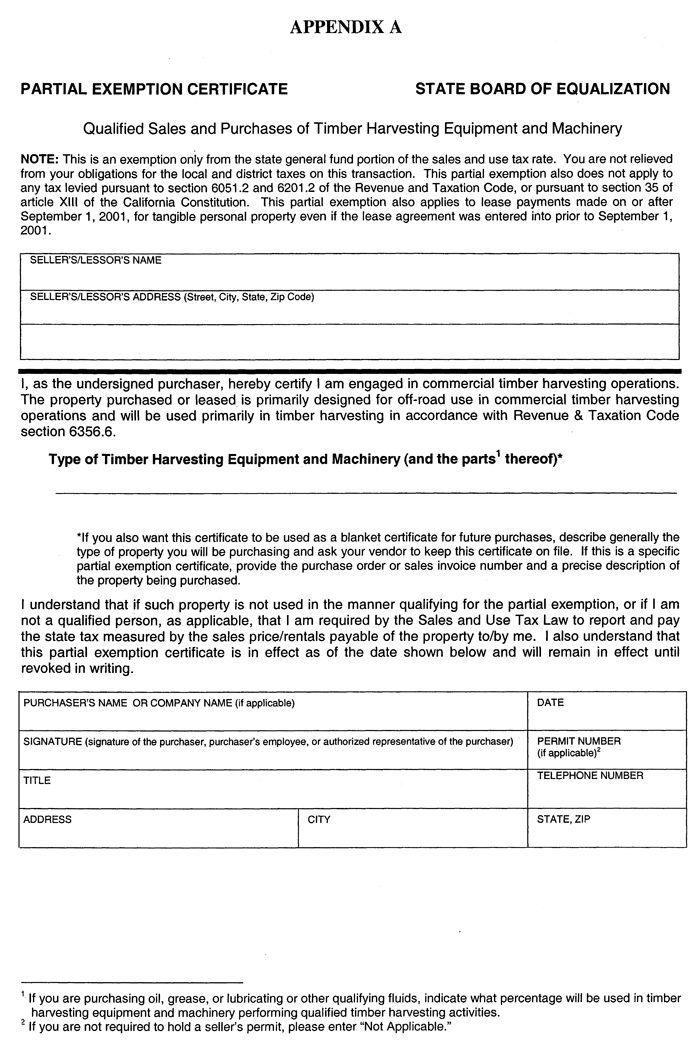

You must keep the exemption certificate for at least three years from the due date of the sales tax return on which the last sale using the exemption certificate was reported. Exemption certificates pub ks 1520 rev. Farmers retail sales tax exemption certificate fill in leasehold excise tax exemption to operate an anaerobic digester fill in manufacturers sales and use tax exemption certificate fill in motion picture and video production business exemption certificate. Manufacturers in new york city are eligible for exemptions from state and local sales taxes.

Generally a business must report under one or more of the manufacturing bo tax classifications to be eligible for the manufacturers sales and use tax exemption. Businesses must apply for the exemption with the new york state department of taxation and. When is an exemption certificate required. The exemptions apply to purchases and installation of machinery and equipment supplies or fuel and utilities.

Exemption certificate for logs delivered to an export facility. In order to document that the partial exemption applies to the contract to construct the special purpose building the subcontractor must obtain from the prime contractor and retain in its records a copy of the cdtfa 230 m partial exemption certificate for manufacturing research and development equipment or similar form that the qualified. Certificate for exempt purchases of meals or lodging by exempt entities fillable 0105. The manufacturing exemption applies to machinery or equipment that causes a physical or chemical change in a product in order to make it saleable.