Mn 1099 Form Printable

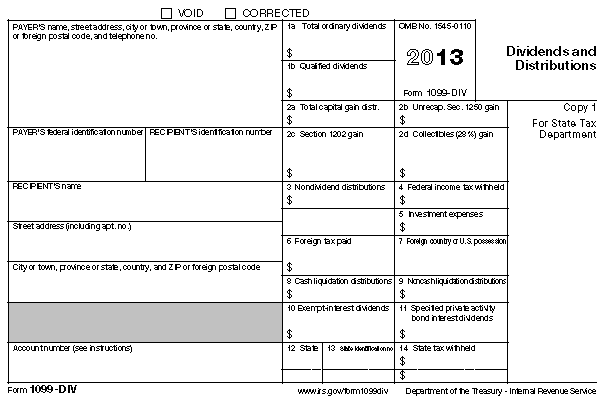

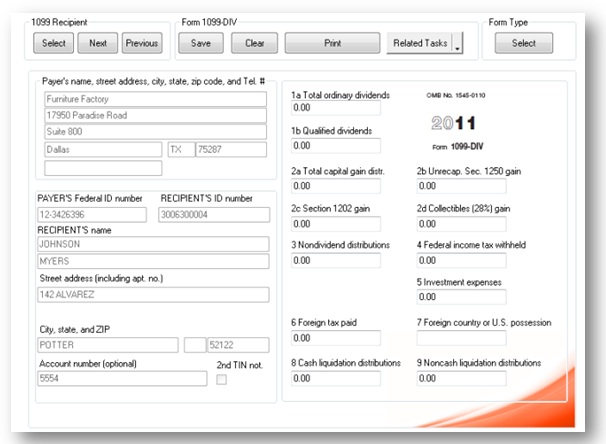

Payers use form 1099 misc miscellaneous income to.

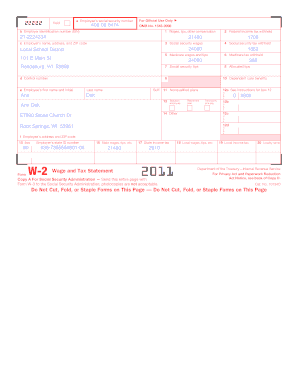

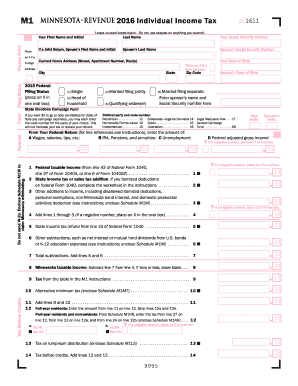

Mn 1099 form printable. About form 1099 misc miscellaneous income. Mn 1099 form printable. Irs form w 2 and form 1099. Federal form w 2 shows wages paid and tax withheld for your employees.

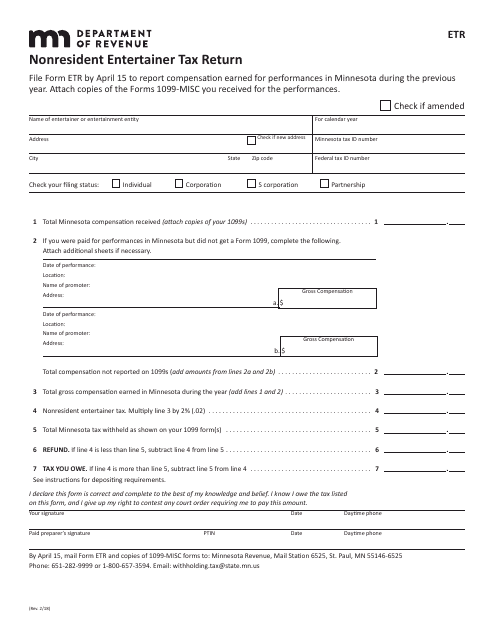

If your net income from self employment is 400 or more you must file a return and compute your se tax on schedule se form 1040. You also may have a filing requirement. Federal form 1099 shows payments and tax withheld for workers who are not your employees. Cookies are required to use this site.

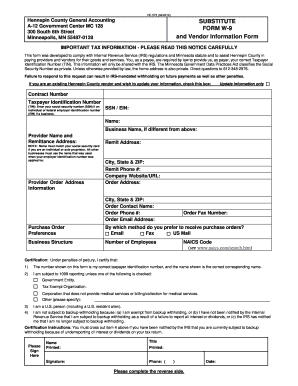

Your browser appears to have cookies disabled. Form 1099 nec as nonemployee compensation. At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest. The state of minnesota accepts the 1099 information on cd or in pdf format.

Form 1099 a acquisition or abandonment of secured property use form w 9 only if you are a us. Any amount included in box 12 that is currently taxable is also included in this box. Local governments are required to file internal revenue service irs form w 2 to report employee wages tips and other compensation. This income is also subject to a substantial additional tax to be reported on form 1040 1040 sr or 1040 nr.

Amounts shown may be subject to self employment se tax. Report payments of 10 or more in gross royalties or 600 or more in rents or compensation. Is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. File form 1099 misc for each person to whom you have paid during the year.

Report payments made in the course of a trade or business to a person whos not an employee or to an unincorporated business. However if you are submitting more than 10 or more 1099s you must e file them. In addition entities need to file form 1099 misc for non employees eg independent contractors who received 600 or more for their services. See the instructions for form 8938.

Posts related to mn 1099 form printable.