Money Repayment Contract Template

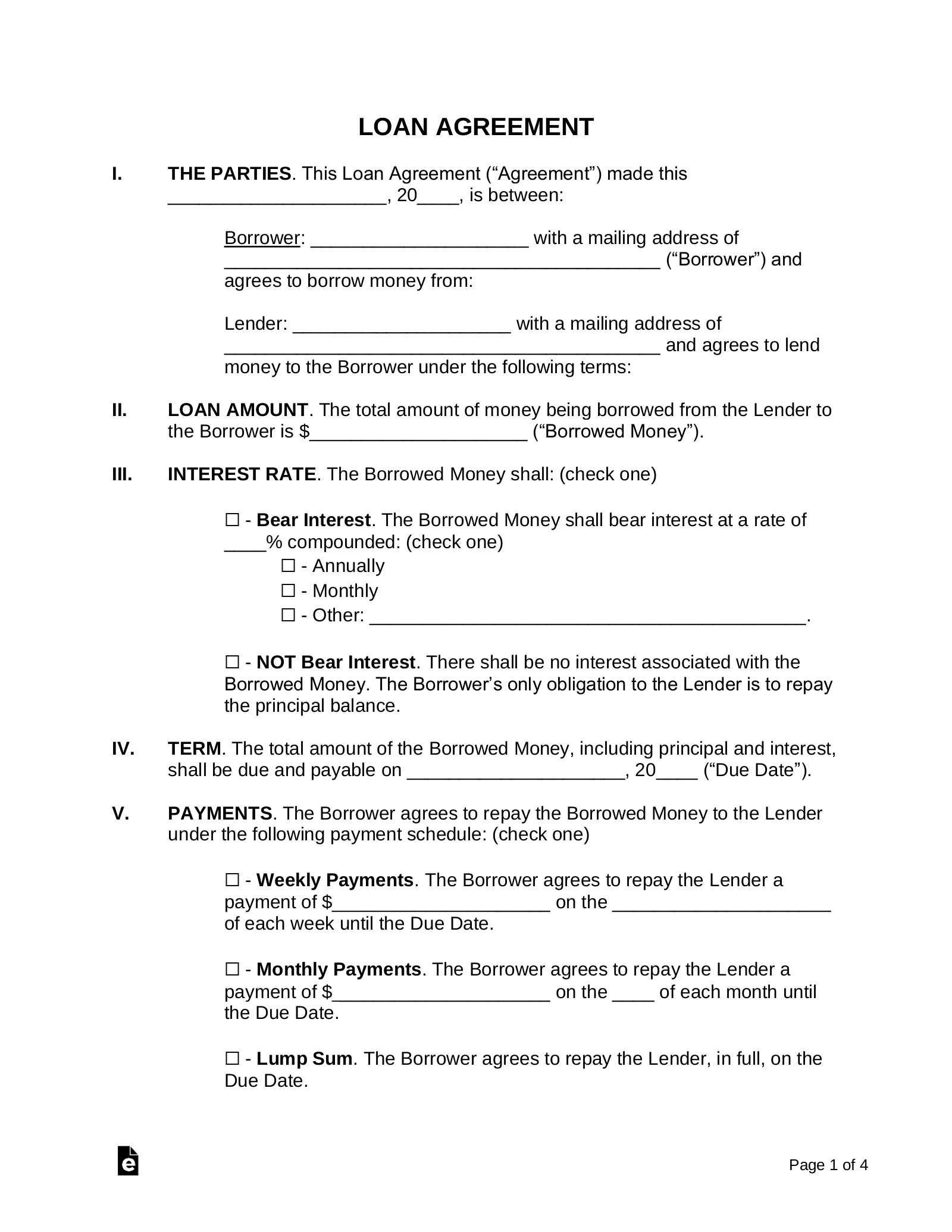

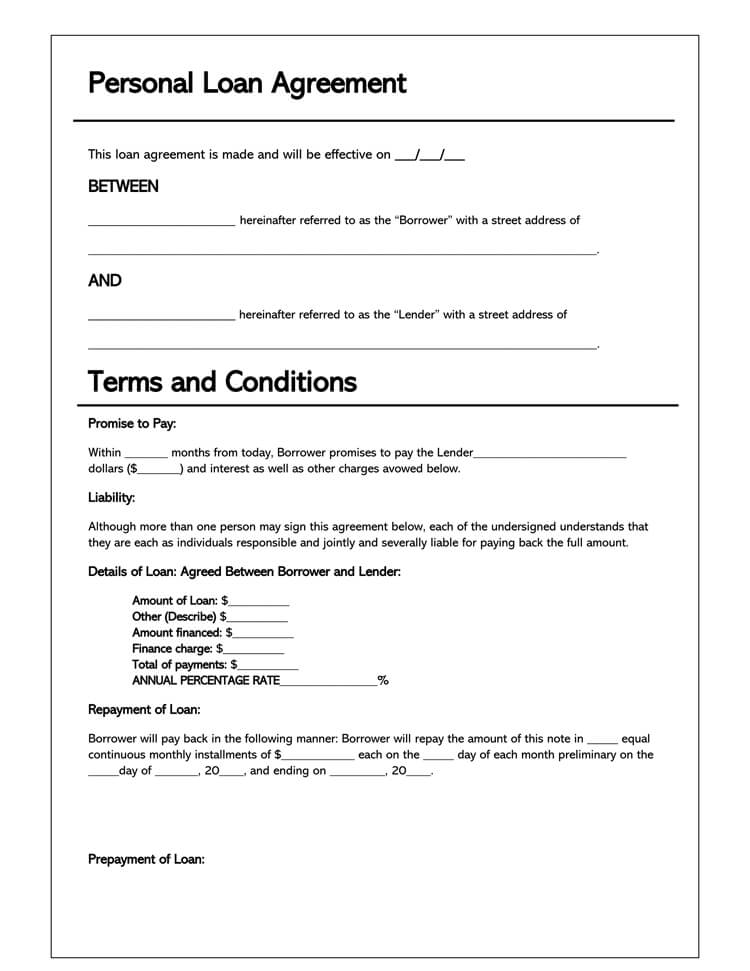

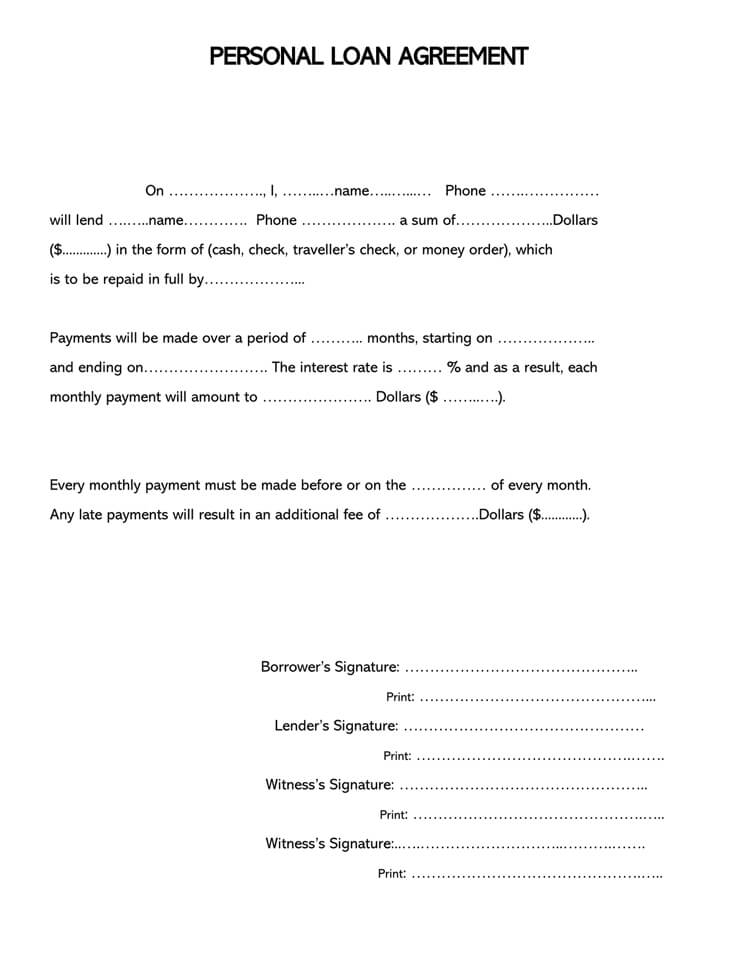

If you are loaning money as a personal favor you may decide not to charge interest.

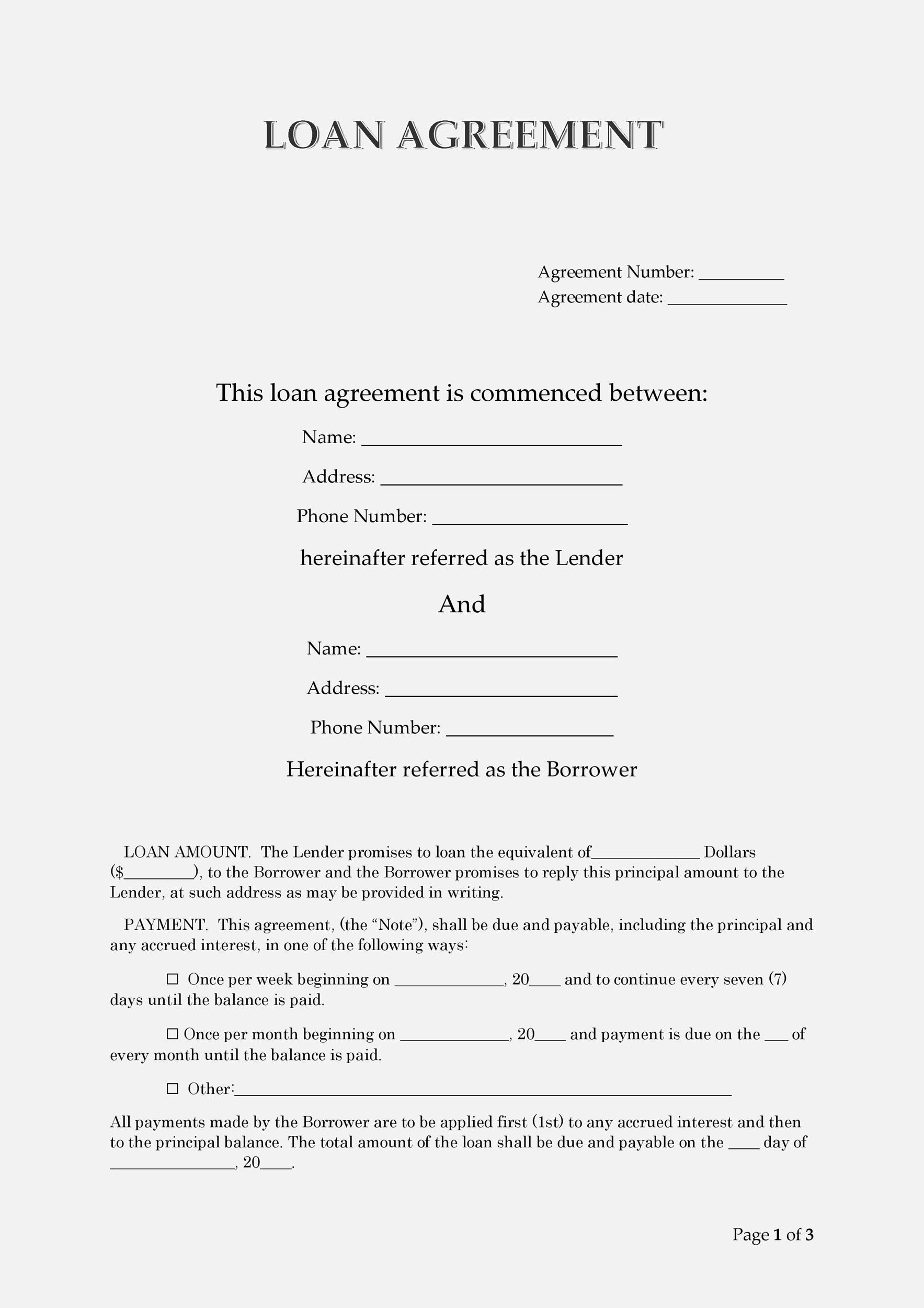

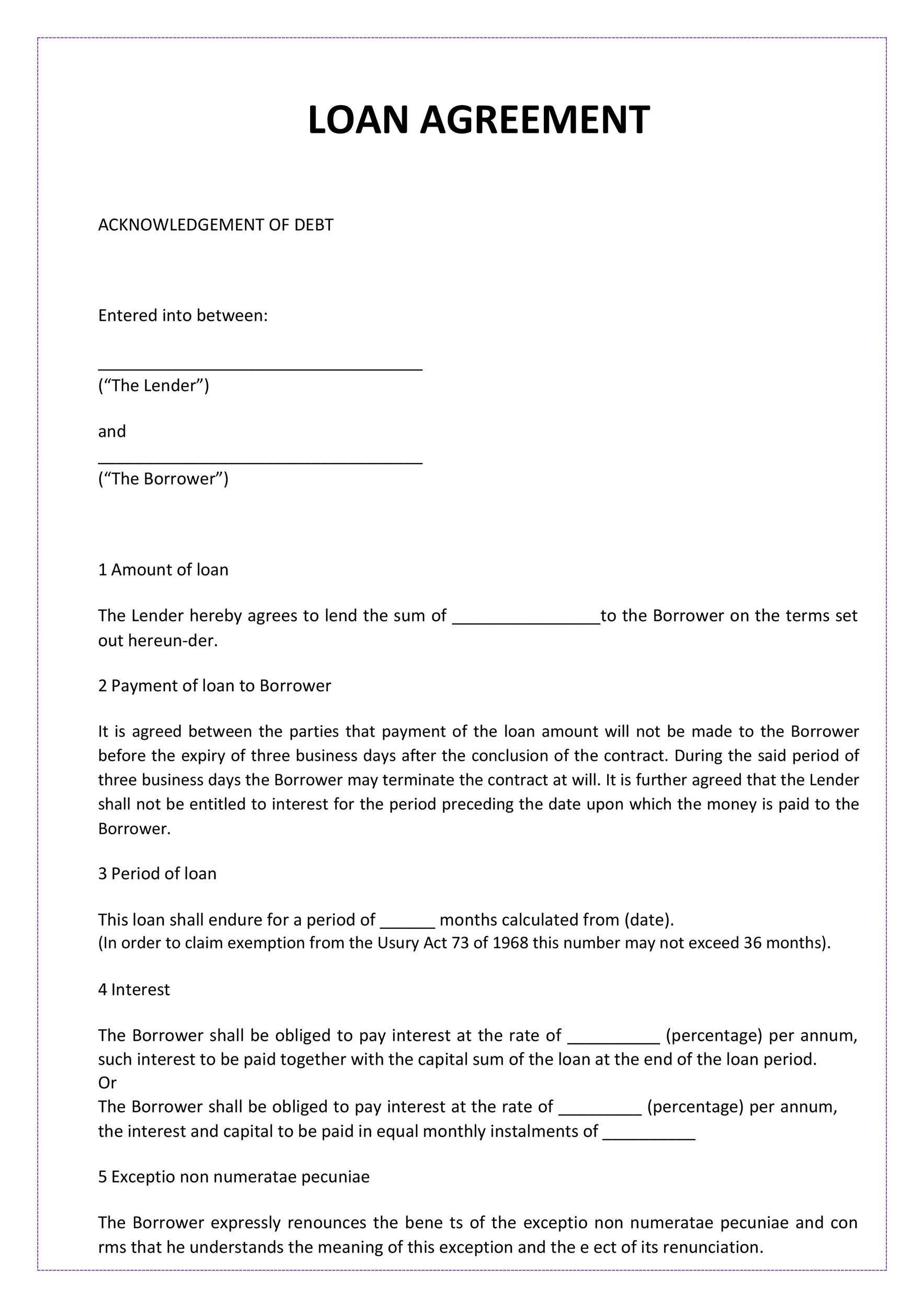

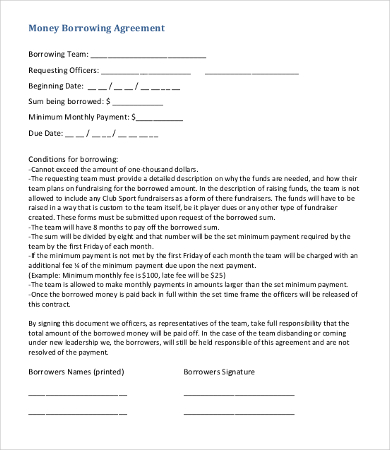

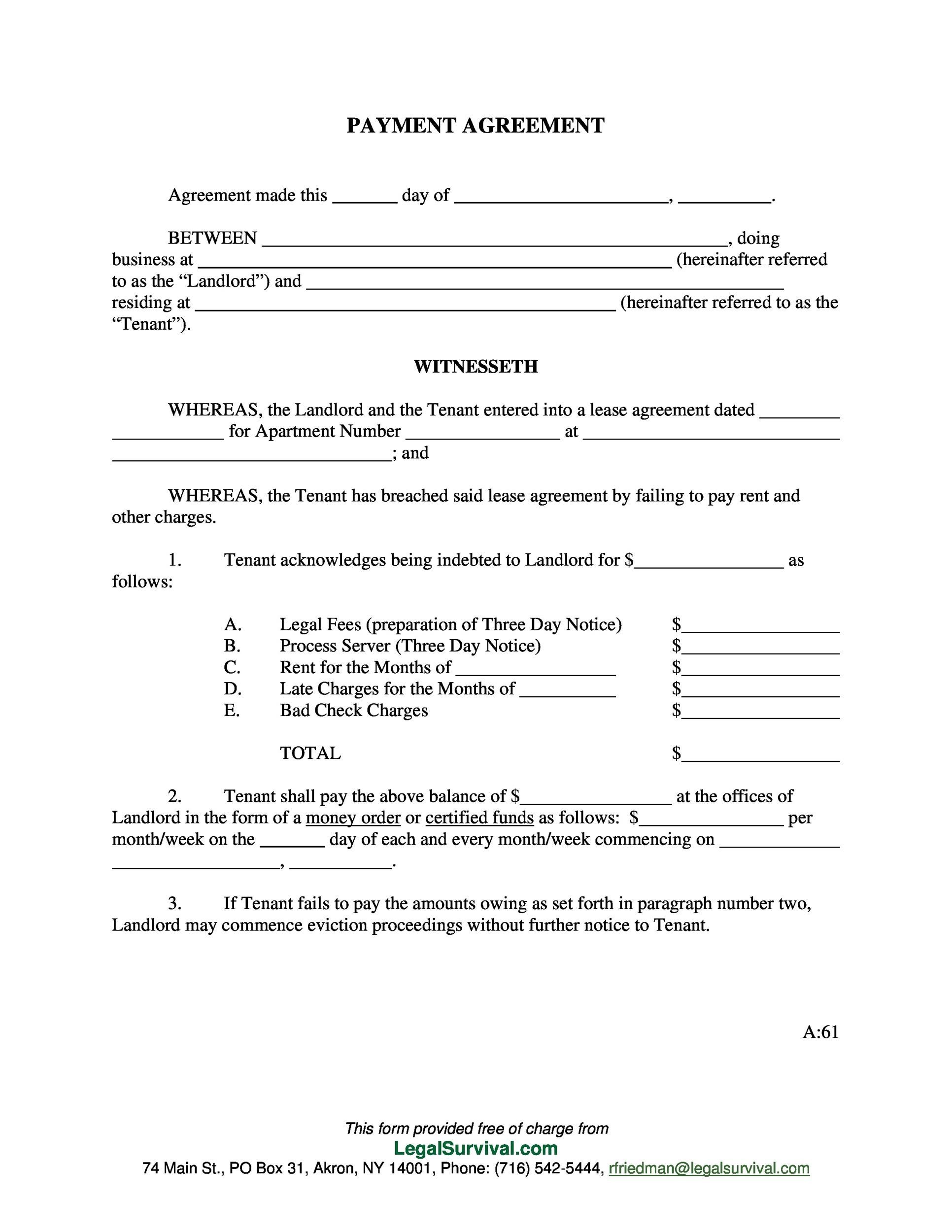

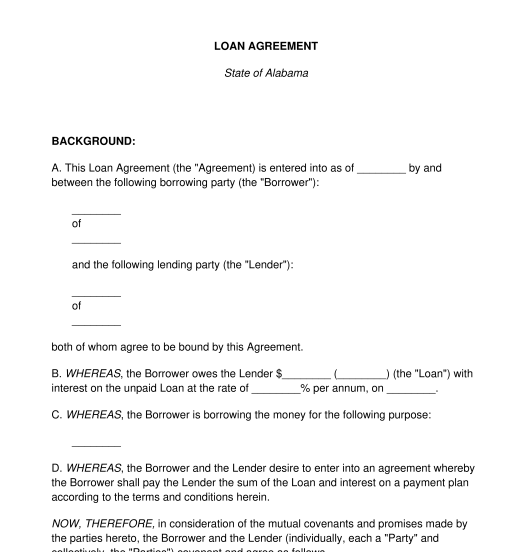

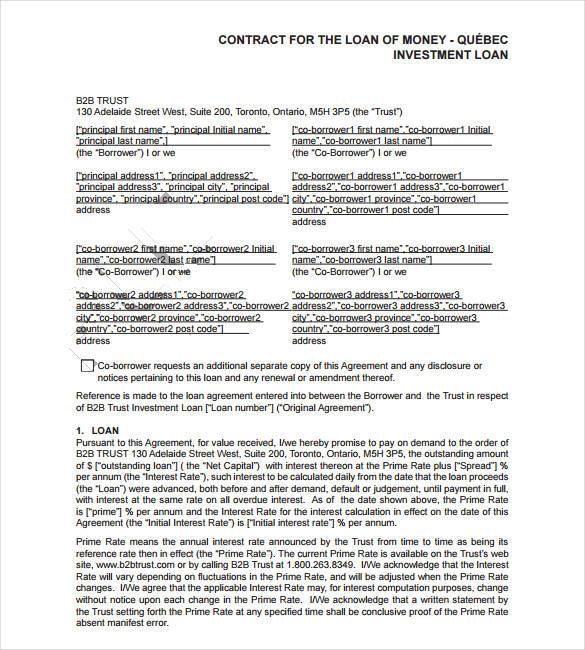

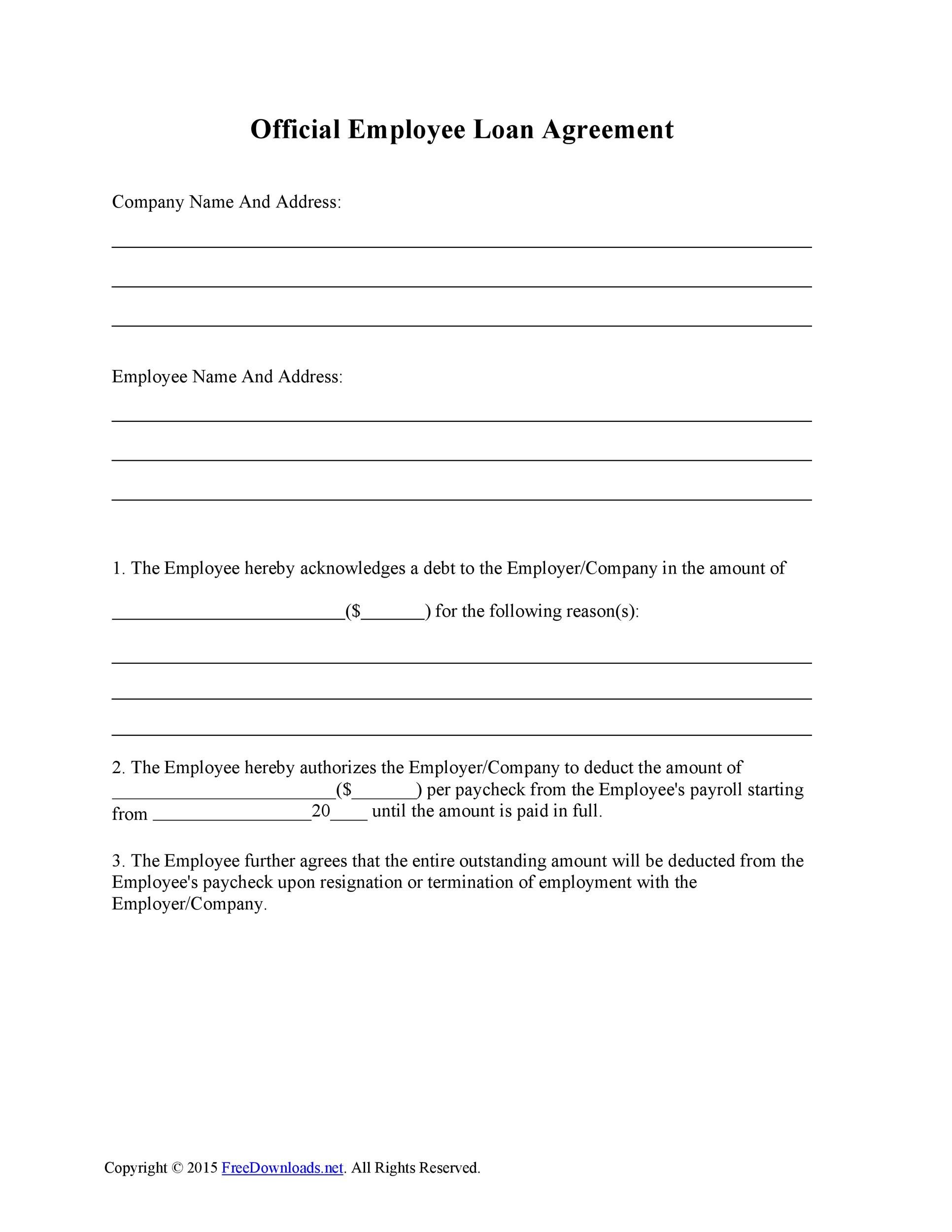

Money repayment contract template. This will minimize resentment and tension regarding the borrowed money. The owing party agrees and acknowledges that it owes the owed party an amount of money equal to the deficiency as defined above. As a lender this document is very useful as it legally enforces the borrower to repay the loan. A free loan agreement template is a money lending agreement.

Nothing in this payment agreement is a waiver of any amounts owed and in the event of any breach of this agreement by the owing party the owed partys rights to the deficiency shall not be limited. Sometimes it is a business loan agreement personal loan agreement or loan contract. In other words it must be clearly represented as a legal loan agreement letter. If you must borrow money from a friend its best to put your friendship aside and simply think of it as a business deal among friends and draft an official money loaning agreement with all the details that surround the transaction.

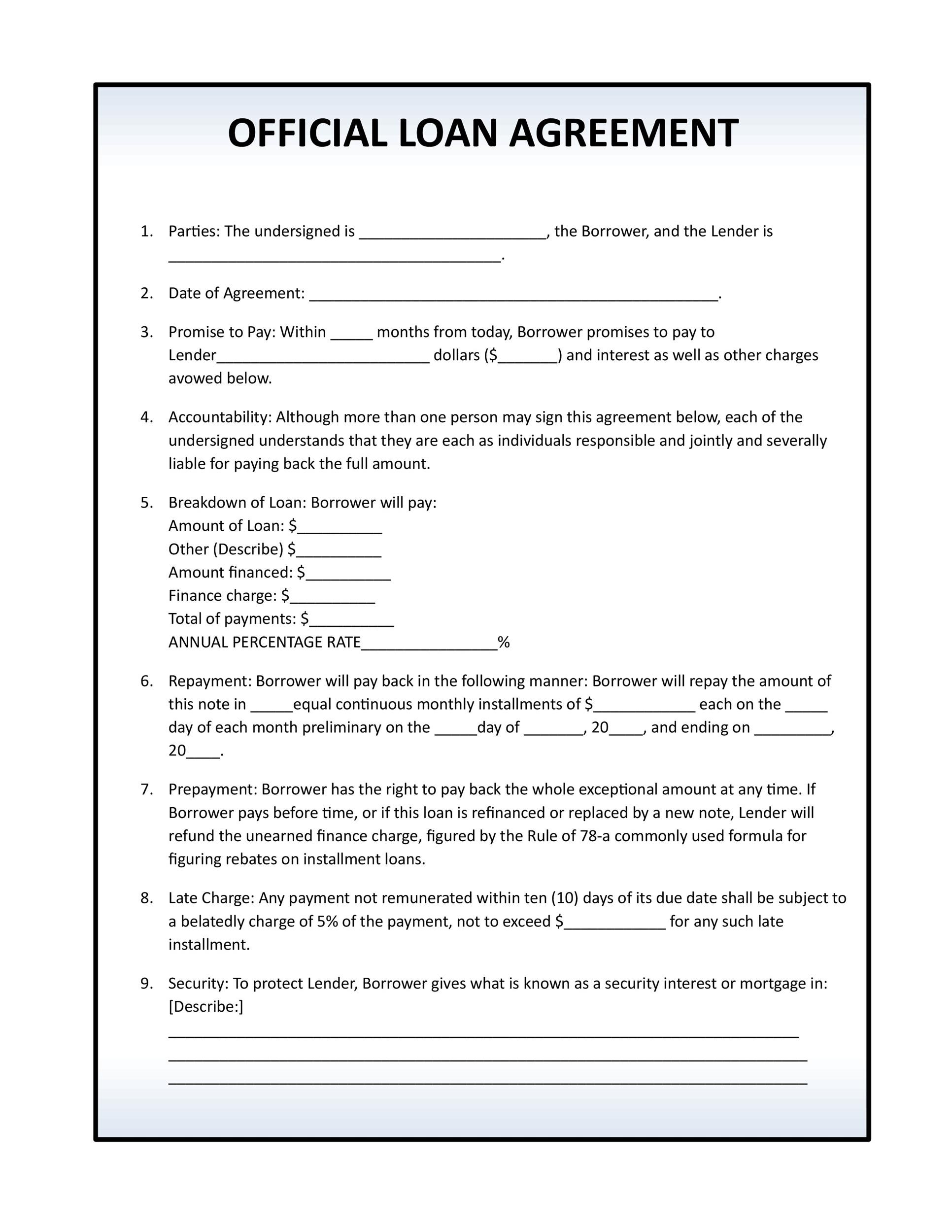

If you want to use the loan as a money making opportunity you should charge interest. A loan agreement is a written agreement between a lender and borrower. When you loan money to someone it is important to create a legal document that lays out how the loaned money will be repaid. Establish a repayment schedule.

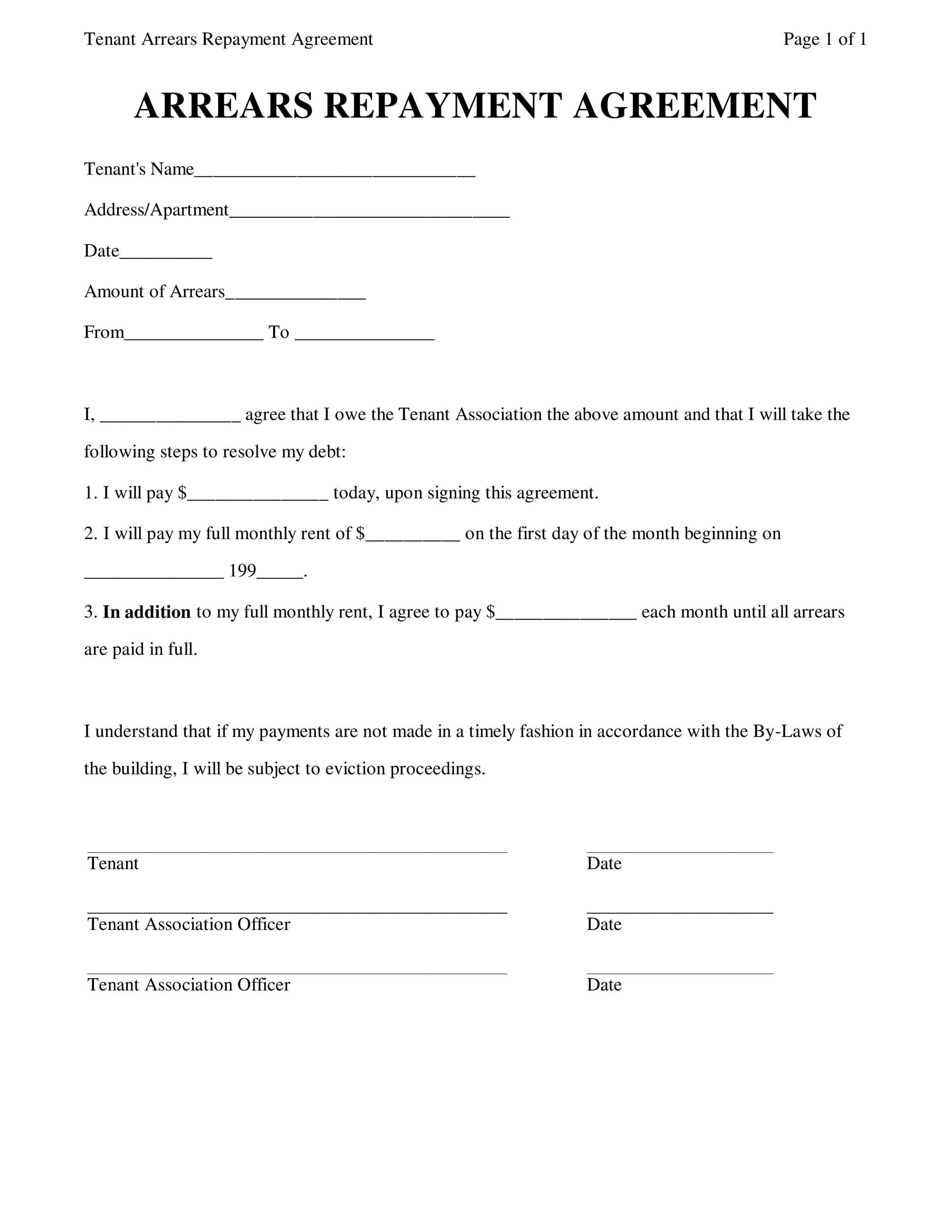

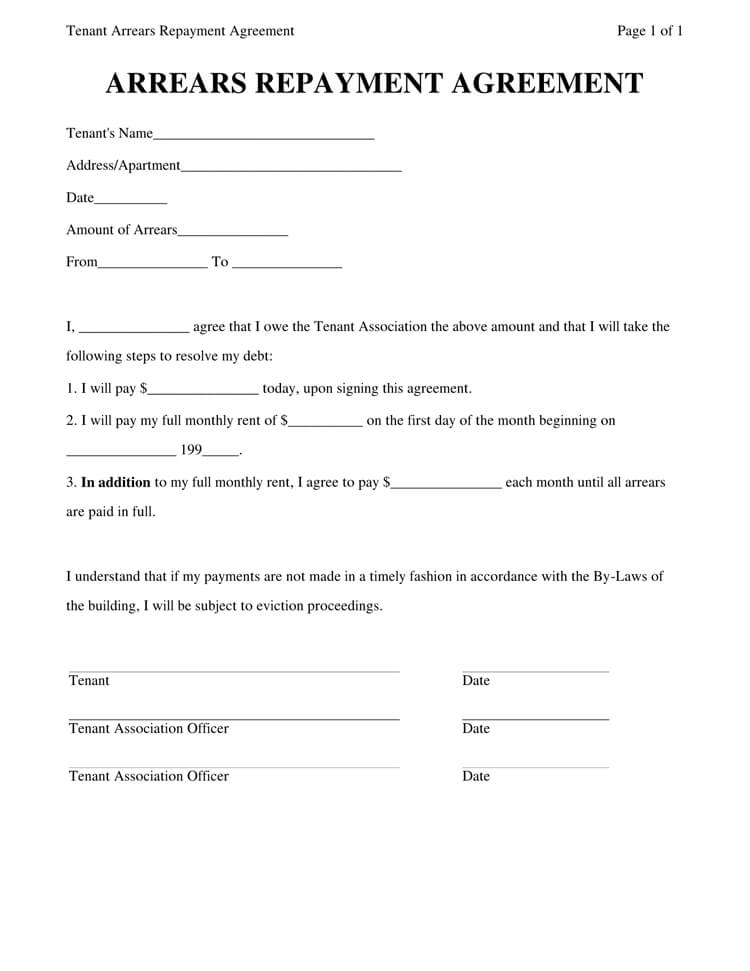

Consider taking this pro active step to avoid someone to whom you owe money taking action against you. Offering to enter into a repayment agreement can be a useful way of avoiding legal action. These documents dont have to be long or complicated. Sometimes called a promissory note or an installment agreement a payment agreement letter defines a transaction between at least two parties.

This is the case even if you are loaning money to a friend. By coming to an agreement on repayment both the lender and the borrower should feel comfortable that the loan will be repaid. The loan agreement form can help you configure what the total payment amount will be based on interest how the interest is charged and how many payments will be made. The borrower promises to pay back the loan in line with a repayment schedule regular payments or a lump sum.

How to write a legal document for money owed. It is very important to agree to a repayment schedule that works for both parties.