Printable 1099 Form Independent Contractor

Also refer to publication 1779 independent contractor or employee.

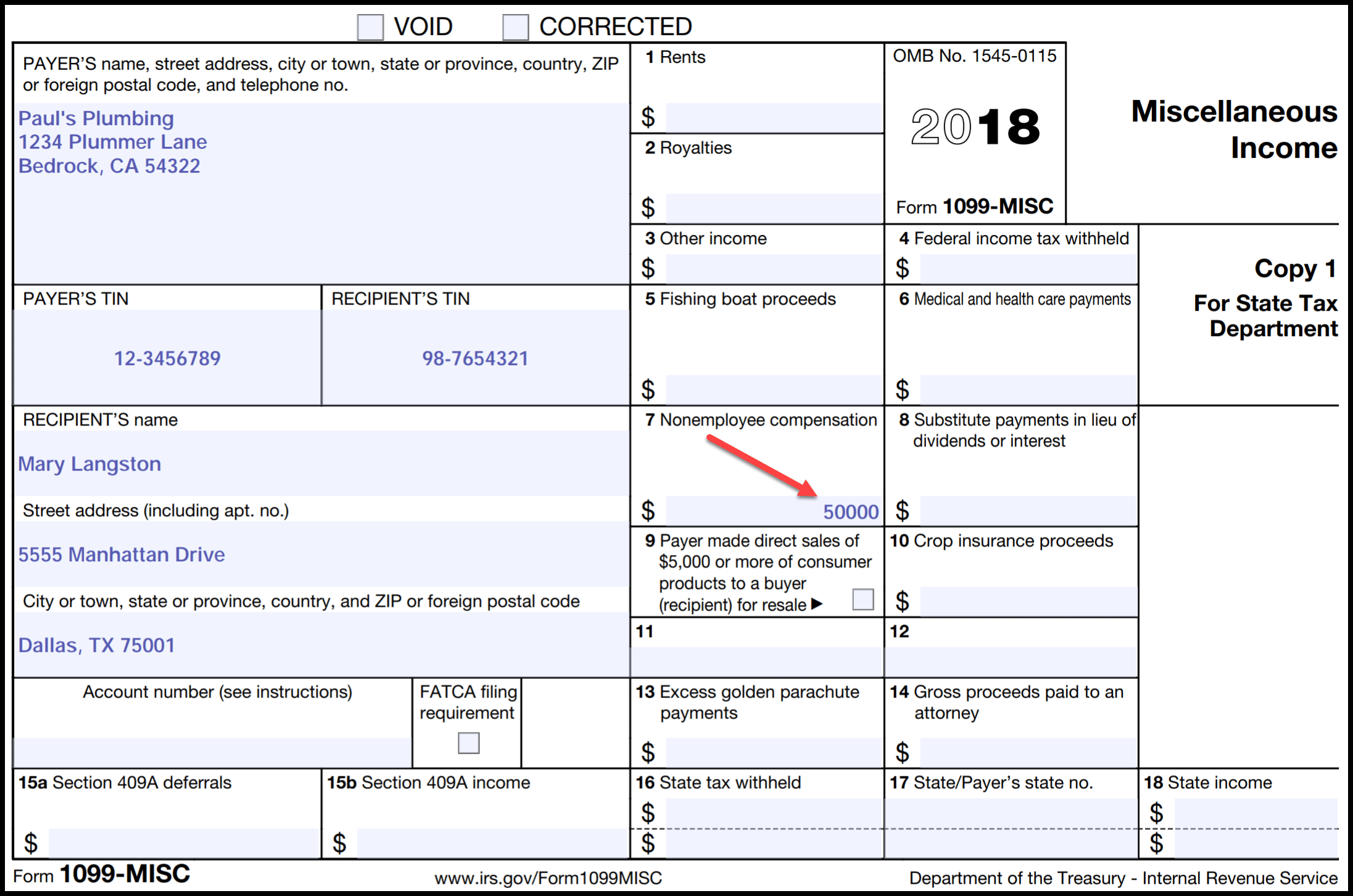

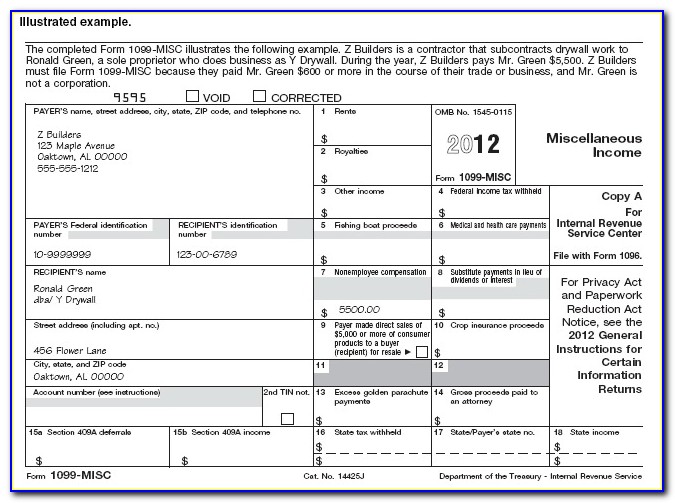

Printable 1099 form independent contractor. Form 1099 misc is used to report rents royalties prizes and awards and other fixed determinable income. Form 1099 nec as nonemployee compensation. Printable independent contractor 1099 form. Printable 1099 form independent contractor.

1099 independent contractor form pdf. Form 1099 misc is a tax form used by irs to track all the miscellaneous income paid. Posts related to 1099 form independent contractor printable. Information about form 1099 misc miscellaneous income including recent updates related forms and instructions on how to file.

Payers use form 1099 misc miscellaneous income to. If you would like the irs to determine whether services are performed as an employee or independent contractor you may submit form ss 8 determination of worker status for purposes of federal employment taxes and income tax withholding. See the instructions for forms 1040 and 1040 sr or the instructions for form 1040 nr. 1099 form for contractors 2018.

1099 form for contractors to fill out. Form w 9 if youve made the determination that the person youre paying is an independent contractor the first step is to have the contractor complete form w 9 pdf request for taxpayer identification number and certification. Free blank estimate forms for contractors. When setting up my company there is supposed to be a contractors shortcut however it does not show up on the bar to the left.

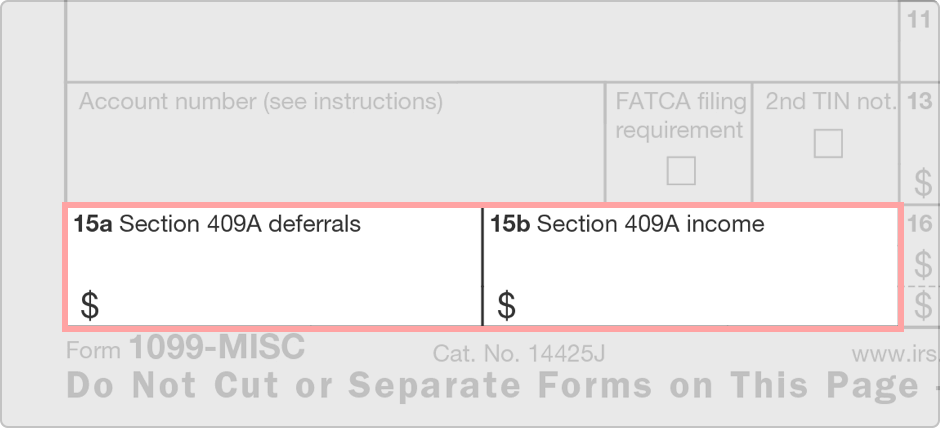

Find form w 9 form 1099 and instructions on filing electronically for independent contractors. Any amount included in box 12 that is currently taxable is also included in this box. This income is also subject to a substantial additional tax to be reported on form 1040 1040 sr or 1040 nr. The 1099 misc form is a specific version of this that is used for anyone working for you that is not a true employee.

1099 form independent contractor printable. In a simple context you must file 1099 misc if you have paid any independent contractor a sum of 600 or more in a year for their services for your business or trade. Form for 1099 contractors. Irs form 1099 independent contractor.

Report payments made in the course of a trade or business to a person whos not an employee. Dear real tax tools. A 1099 form is a tax form used for independent contractors or freelancers. Best estimating software for small contractors.

Report payments of 10 or more in gross royalties or 600 or more in rents or for other specfied purposes. May 13 2019 by role. To the non employees independent contractor in the course of the trade or business.