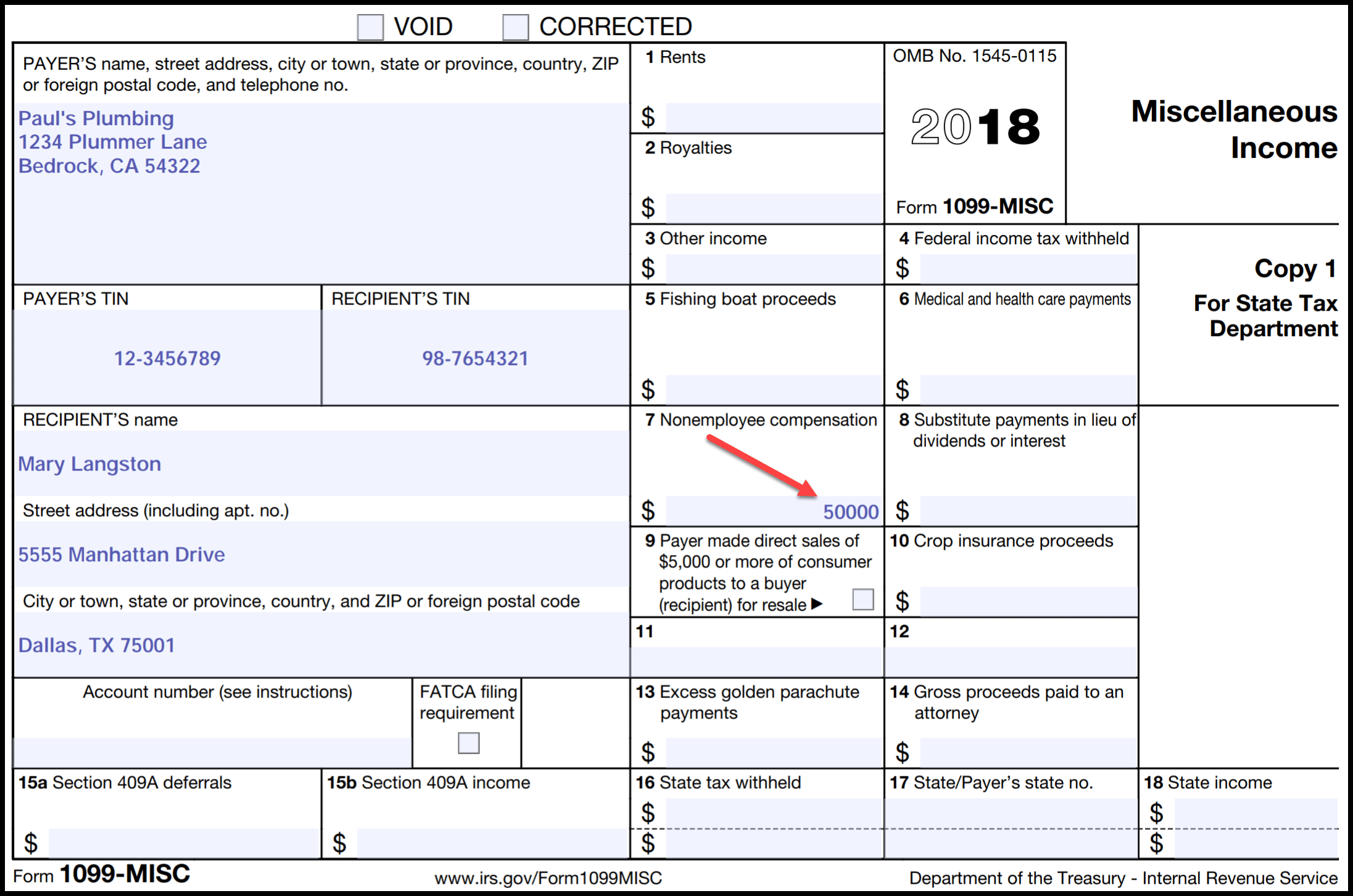

Printable 1099 Form Sample

Confirm your printer settings then select print.

Printable 1099 form sample. Form 1099 misc is used to report rents royalties prizes and awards and other fixed determinable income. Print and file copy a downloaded from this website. Select all vendors you wish to print 1099s for and choose the print 1099s button. Looking for a printable form 1099 misc and independent contractors.

Report payments made in the course of a trade or business to a person whos not an employee. The 1099 misc form is a specific version of this that is used for anyone working for you that is not a true employee. Information about form 1099 misc miscellaneous income including recent updates related forms and instructions on how to file. A penalty may be imposed for filing with the irs.

See the instructions for forms 1040 and 1040 sr or the instructions for form 1040 nr. Here you will find the fillable and editable blank in pdf. Purchase your 1099 kit by mid january so you can print. E file with irs for 149 per form.

Download and print a 1099 misc form. Choose the fillable and printable pdf template. Verify all 1099 information by viewing the 1099 reports. Create your sample print save or send in a few clicks.

Create complete and share securely. Print a test form before printing final forms. Create free fillable printable form 1099 misc for 2019. This income is also subject to a substantial additional tax to be reported on form 1040 1040 sr or 1040 nr.

Employers furnish the form w 2 to the employee and the social security administration. How to print your 10991096 forms in quickbooks desktop for mac. Instantly send or print your documents. The social security administration shares the information with the internal revenue service.

Fill generate download or print copies for free. Make sure you have blank 1099 misc forms designed for printers. Select print 1096s instead if printing form 1096. Qualified plans and section 403b plans.

Online service compatible with any pc or mobile os. Report income from self employment earnings in 2019 with a 1099 misc form. If your annuity starting date is after 1997 you must use the simplified method to figure your. If the figures appear incorrect double click the amount in the total column to view the individual transactions.

Insurance contracts etc are reported to recipients on form 1099 r. Payers use form 1099 misc miscellaneous income to. From the reports menu select vendors payables then choose 1099 summary. Any amount included in box 12 that is currently taxable is also included in this box.