Printable Irs Form 990

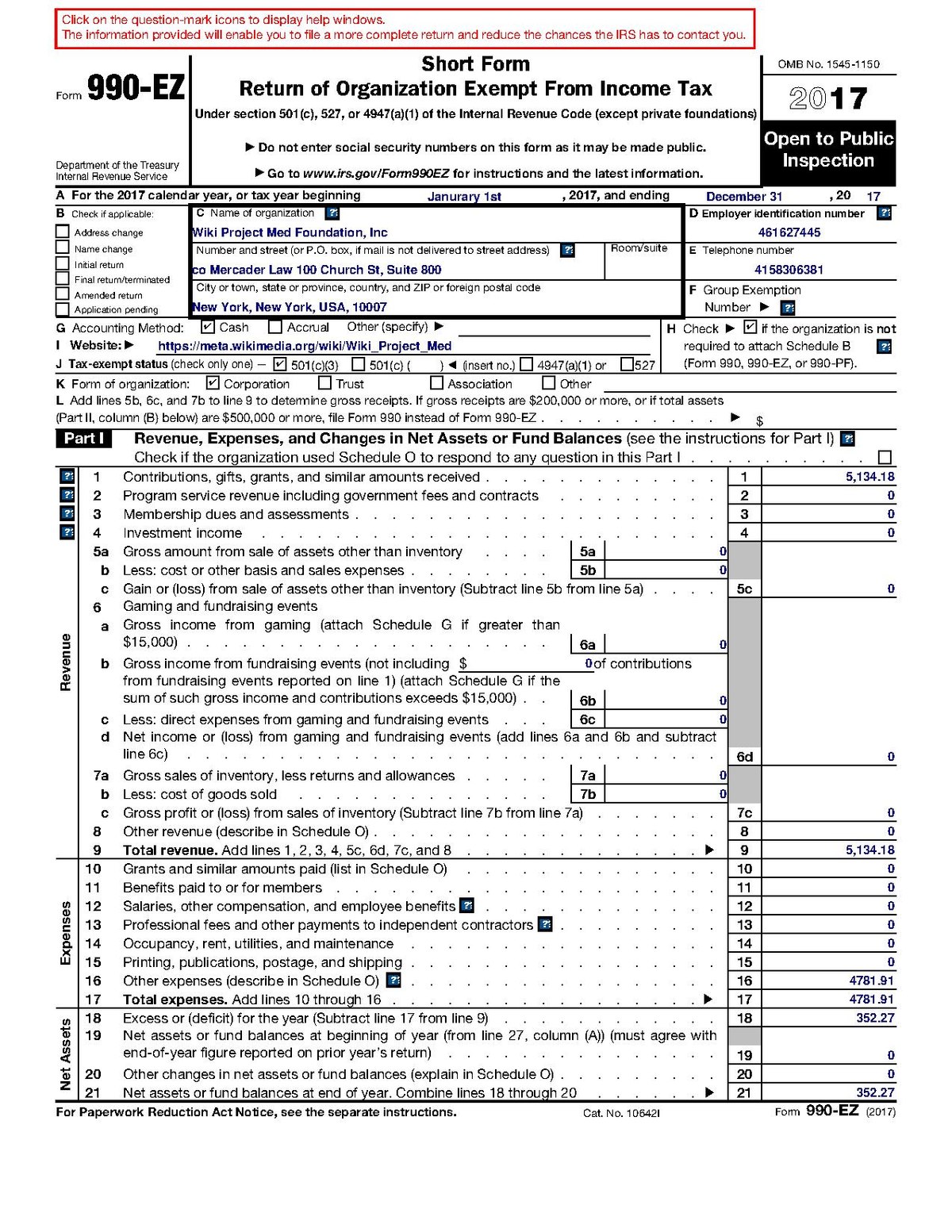

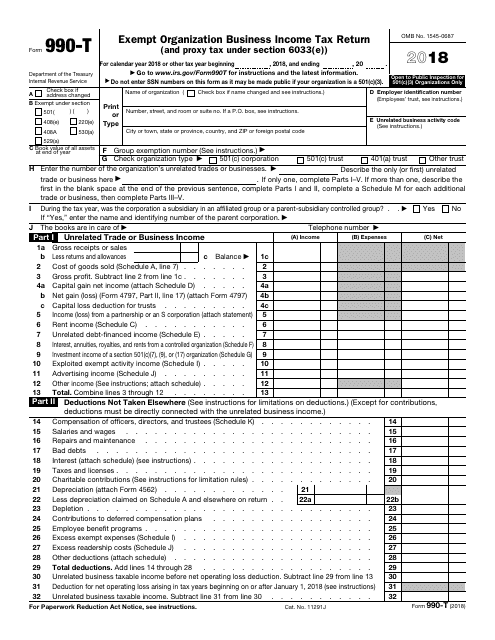

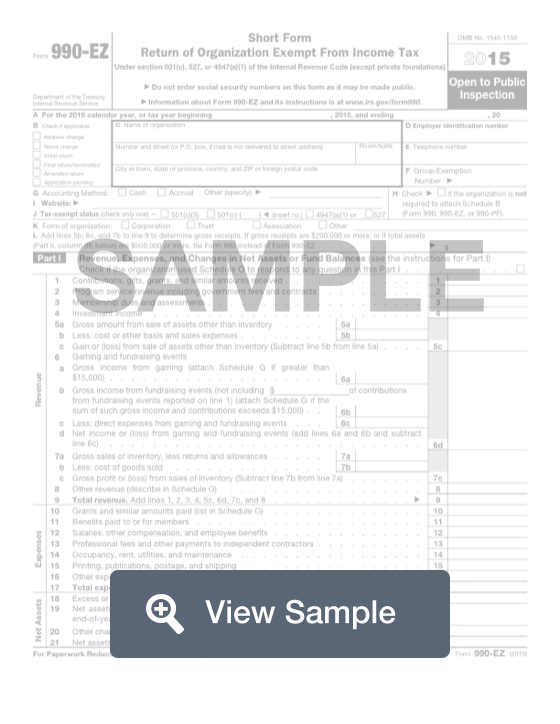

Instructions for form 990 ez short form return of organization exempt from income tax under section 501c 527 or 4947a1 of the internal revenue code 2019 01132020 form 990 pf.

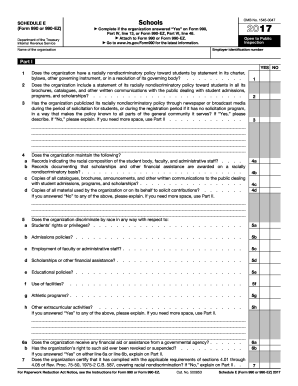

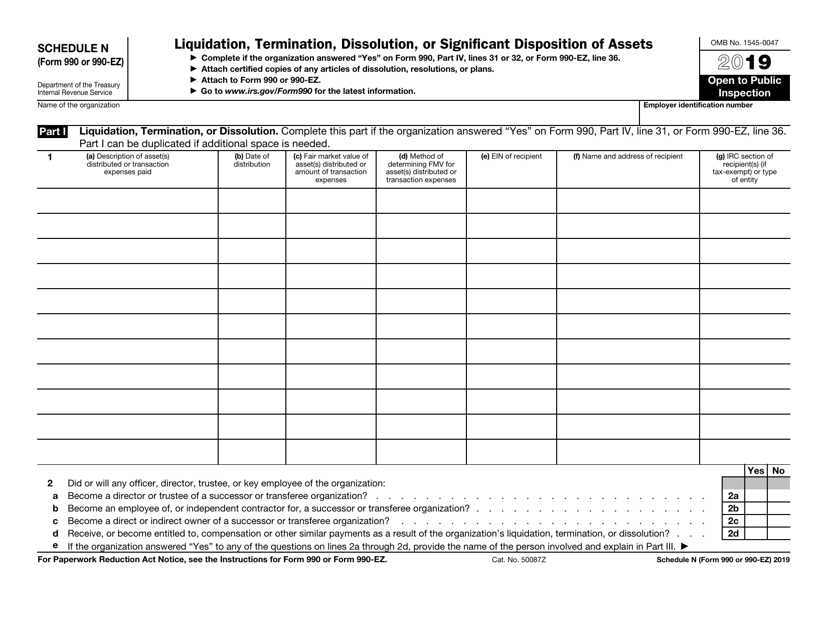

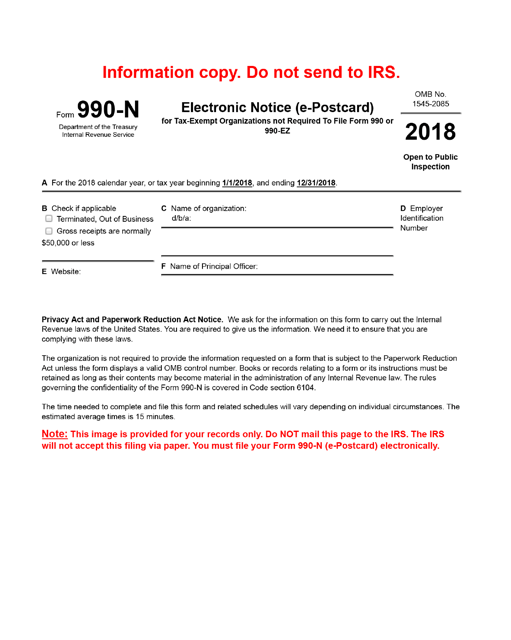

Printable irs form 990. If the due date falls on a saturday sunday or. Organizations that file form 990 or form 990 ez use this schedule to provide required information about public charity status and public support. Information about form 990 ez short form return of organization exempt from income tax including recent updates related forms and instructions on how to file. Form 990 n electronic notice e postcard for tax exempt organizations not required to file form 990 or form 990 ez must be submitted electronically.

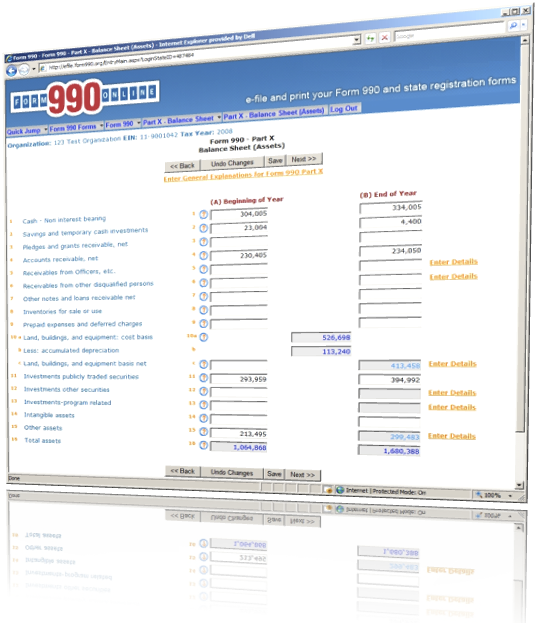

Most nonprofit enterprises are required to file an income tax returns to irs on annual basis. Short form return of organization exempt from income tax 2019 12102019 inst 990 ez. Short form return of organization exempt from income tax 2019 12102019 inst 990 ez. Review 990 series forms schedules and instructions.

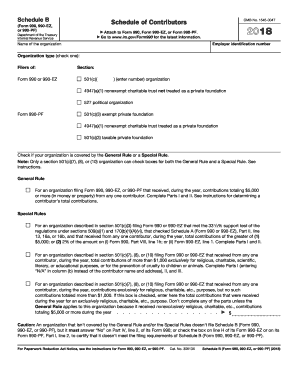

Information about schedule a form 990 or 990 ez public charity status and public support including recent updates related forms and instructions on how to file. Such form provides irs with details about organizations activities for previous fiscal year and always has to be submitted on time. Form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501c 527 or 4947a1 of the internal revenue code except private foundations. See the form 990 filing thresholds page to determine which forms an organization must file.

Certain exempt organizations file this form to provide the irs with the information required by section 6033. For prior year forms use the prior year search tool on the irs forms instructions publications page. Instructions for form 990 ez short form return of organization exempt from income tax under section 501c 527 or 4947a1 of the internal revenue code 2019 01132020 form 990 pf. If your tax year ended on december 31 the e postcard is due may 15 of the following year.

Information about form 990 return of organization exempt from income tax including recent updates related forms and instructions on how to file. Form 990 ez department of the treasury internal revenue service short form return of organization exempt from income tax under section 501c 527 or 4947a1 of the internal revenue code except private foundations.