Printable Power Of Attorney Form Nj

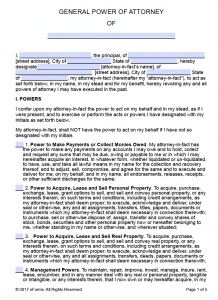

You are called the principal in this relationship.

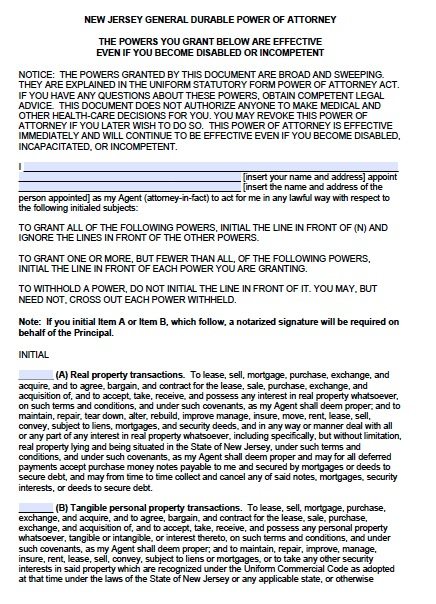

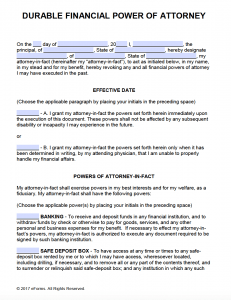

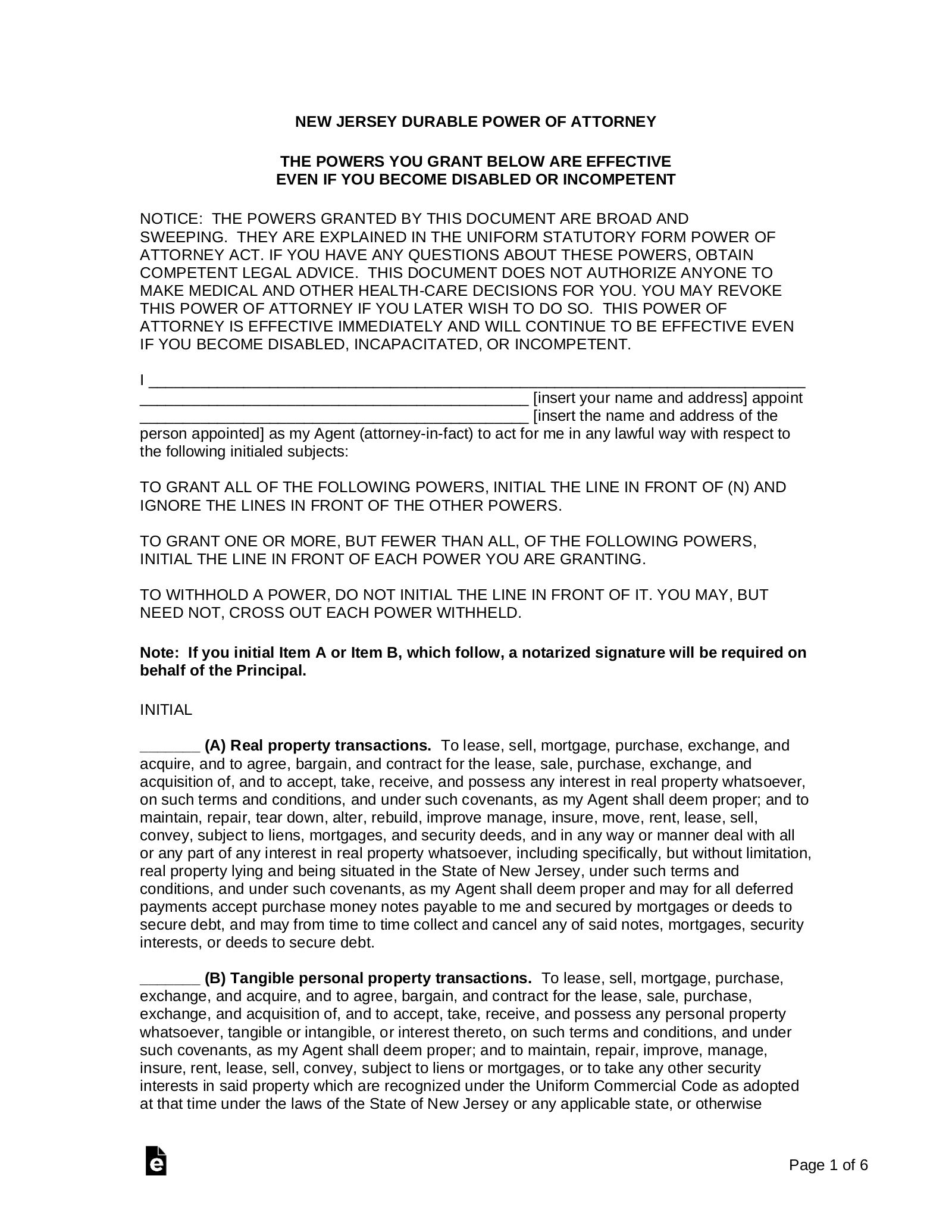

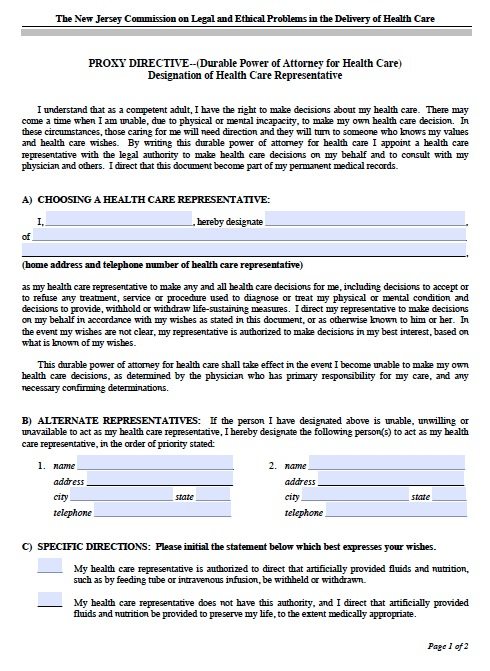

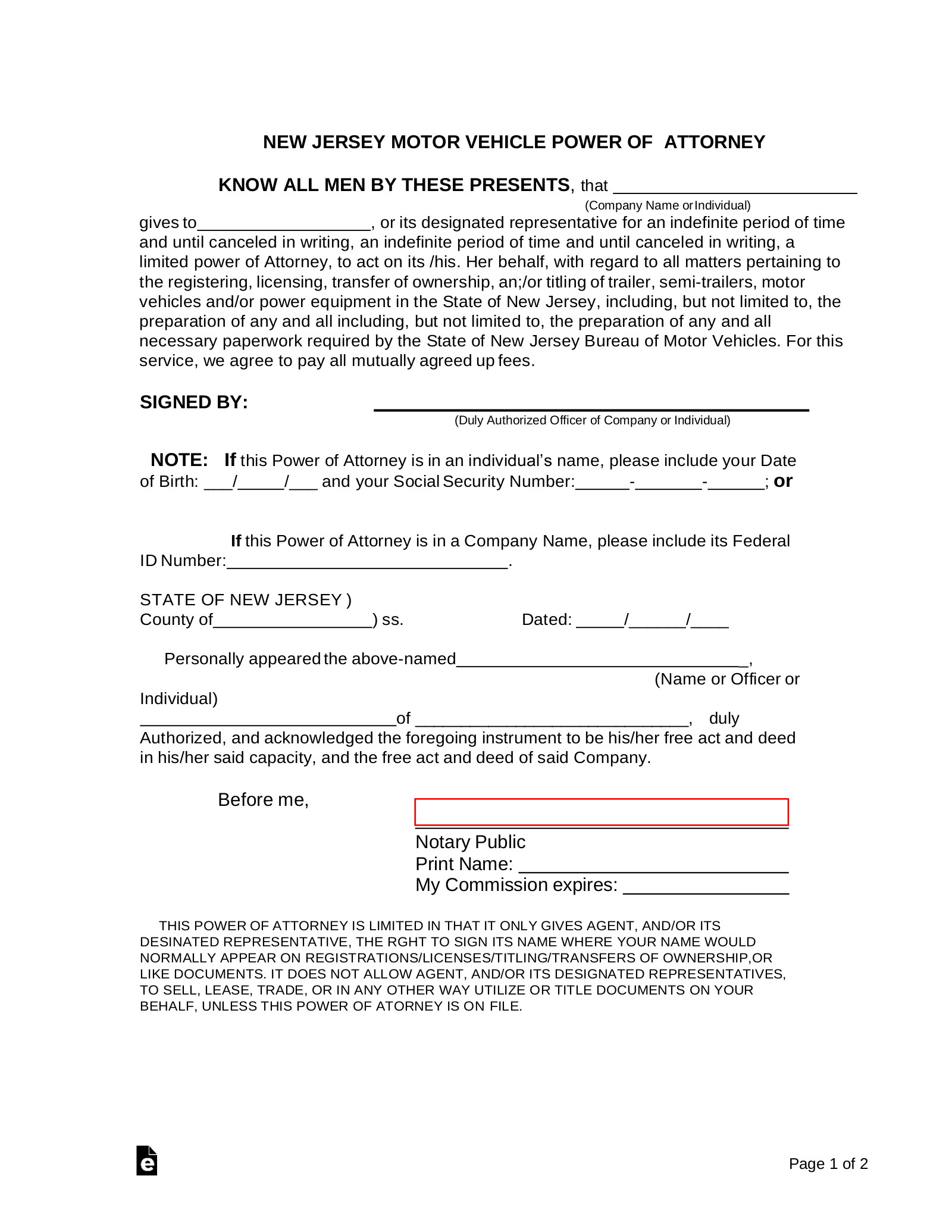

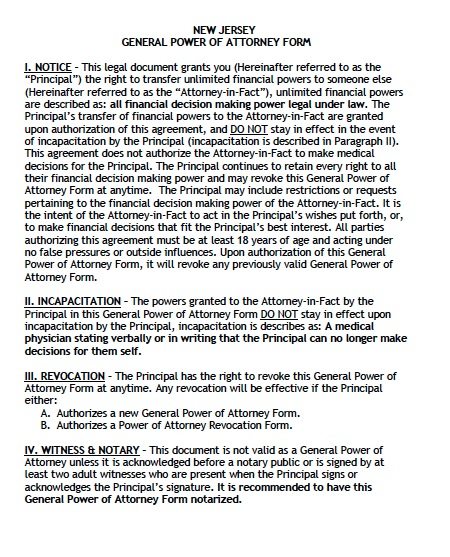

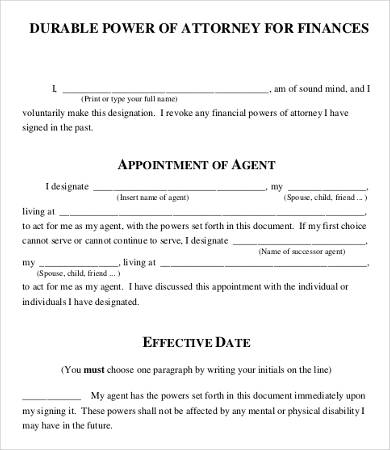

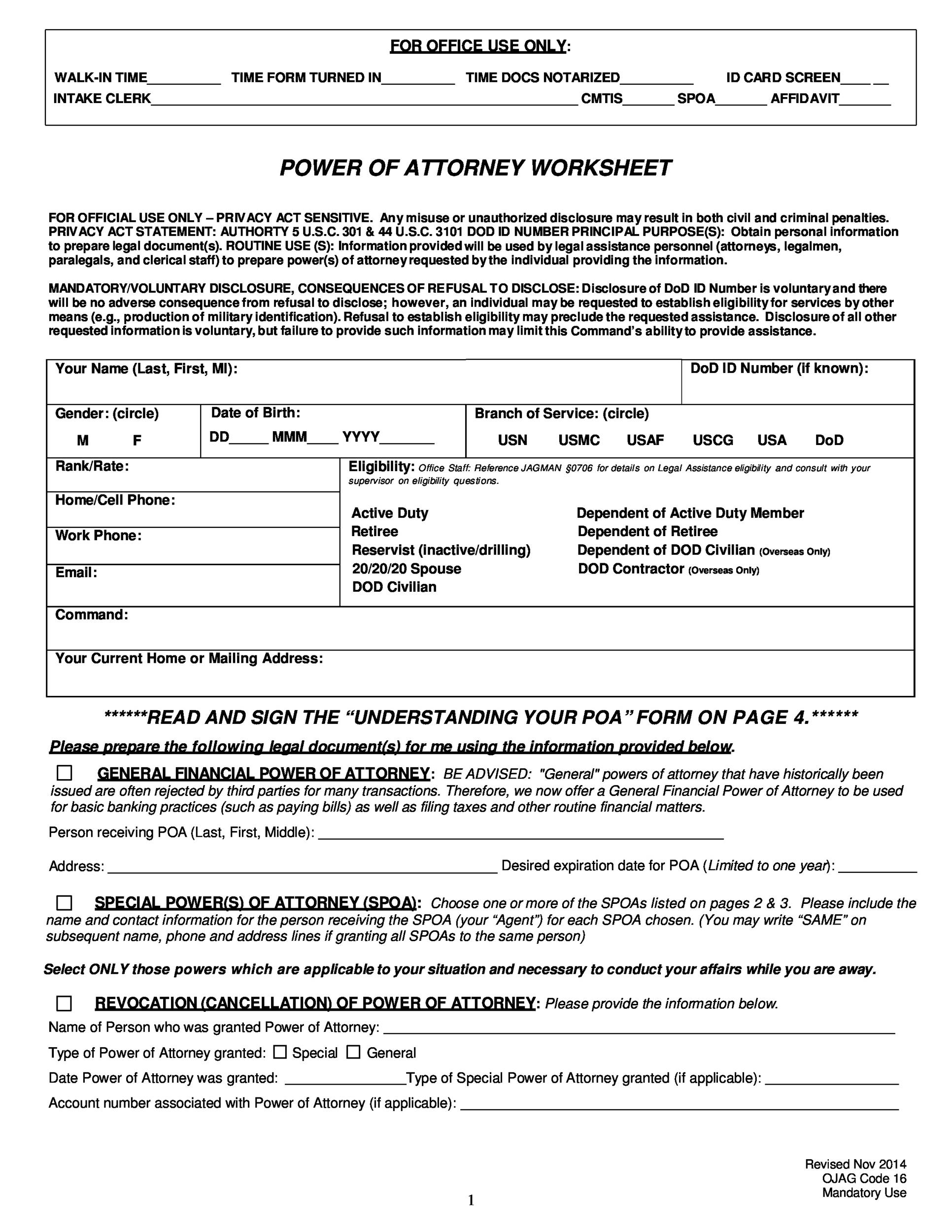

Printable power of attorney form nj. The new jersey tax power of attorney form form m 5008 r is used to appoint an agent or an entity to handle a persons taxes with the division of taxation. The power of attorney allows you to continue to have control over your life after an unfortunate incident like this. The new jersey general power of attorney form is designed to transfer control of financial affairs from the principal to an appointed agent. 462b8 1 et seq a new jersey power of attorney is an important document that is meant to empower a person or persons referred to as an agents or attorney in fact to act in the capacity of another person referred to as a grantor or principal.

In accordance with njsa. If a previously filed form m 5008 r or power of attorney has more than one representative and you do not want to retain all the representatives on the previously filed form you must execute a new form indicating the representatives retained. The power of attorney form serves as a document that authorizes a close friend or family member to make decisions on your behalf. The power of attorney form is a powerful document and it is imperative that whoever you grant power of attorney to is trustworthy.

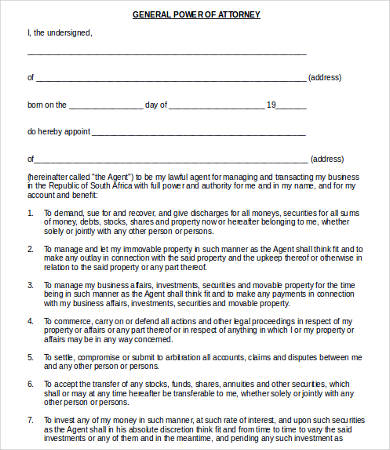

New jersey power of attorney requirements. New jersey power of attorney forms must be utilized to grant authority to another person to act on your behalf for financial matters and transactions. The agent will be authorized to act on the principals behalf in regard to property and asset management personal finances business matters and any other affairs the principal establishes in the agreement. Durable power of attorney in new jersey is a form whereby a principal the person granting authority can appoint an agent the representative who exercises the authority to generally manage and control their assets and propertythis type of form is often used for long term planning purposes for when a person wants to make sure his or her affairs continue to be managed in the unfortunate.

In most cases the principal will hire a tax accountant or other certified professional to represent them in these matters.