Printable Tax Form 8857

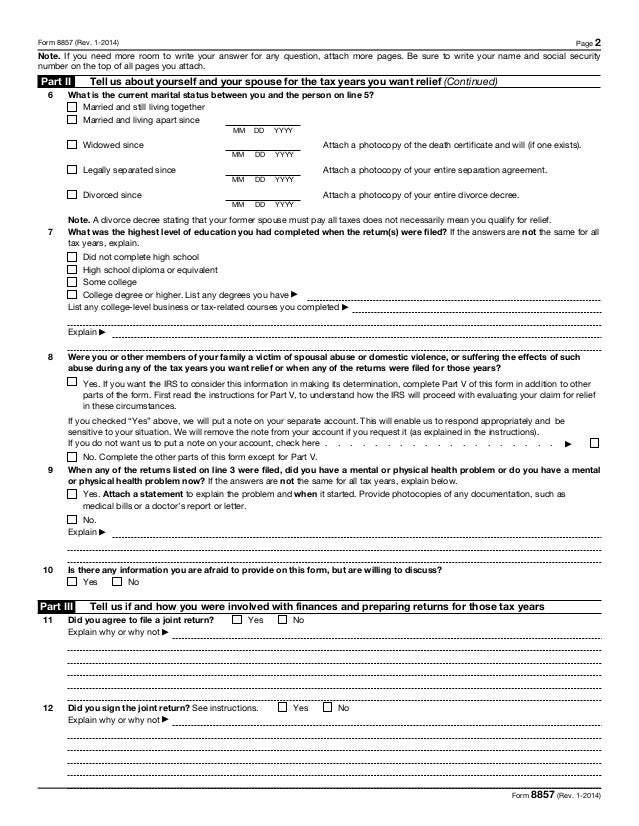

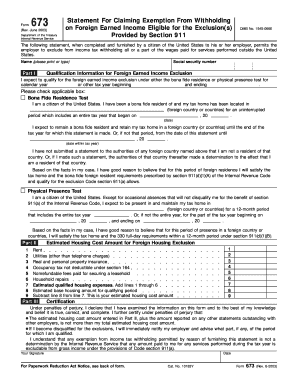

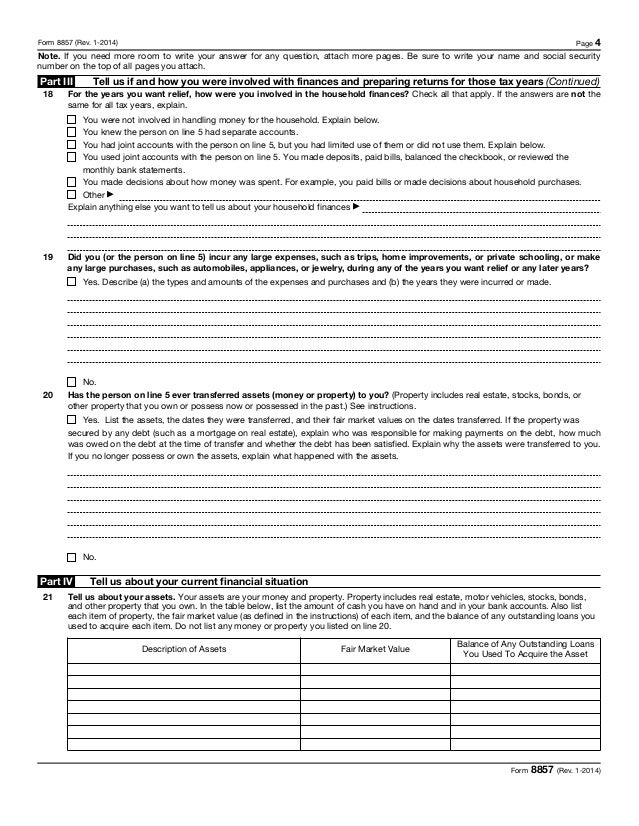

Please write your name and social security number on any attachments.

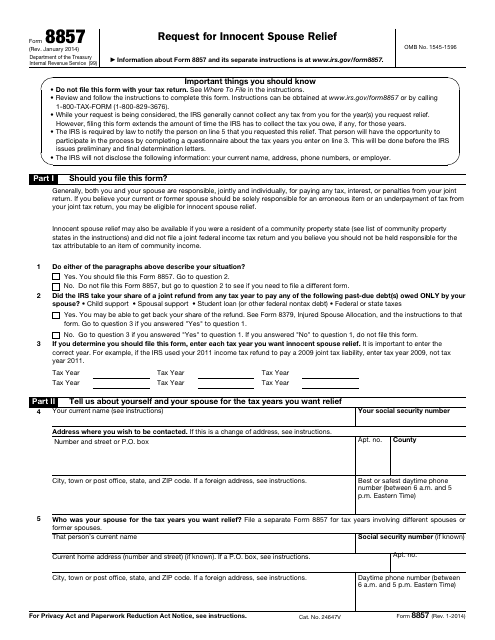

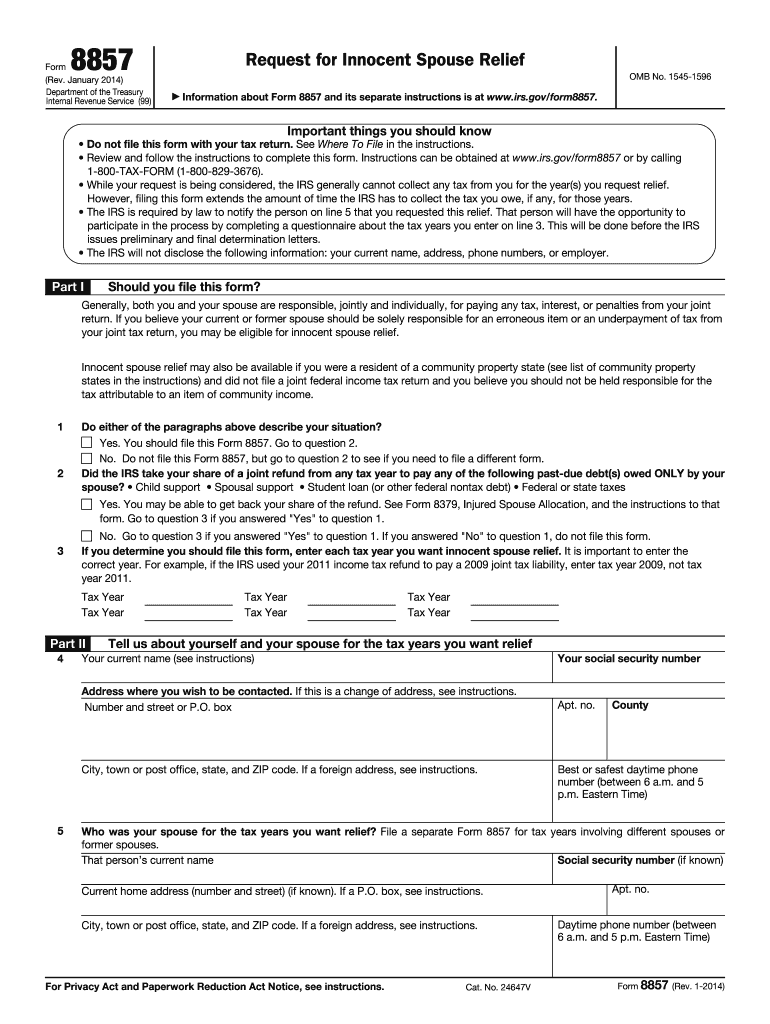

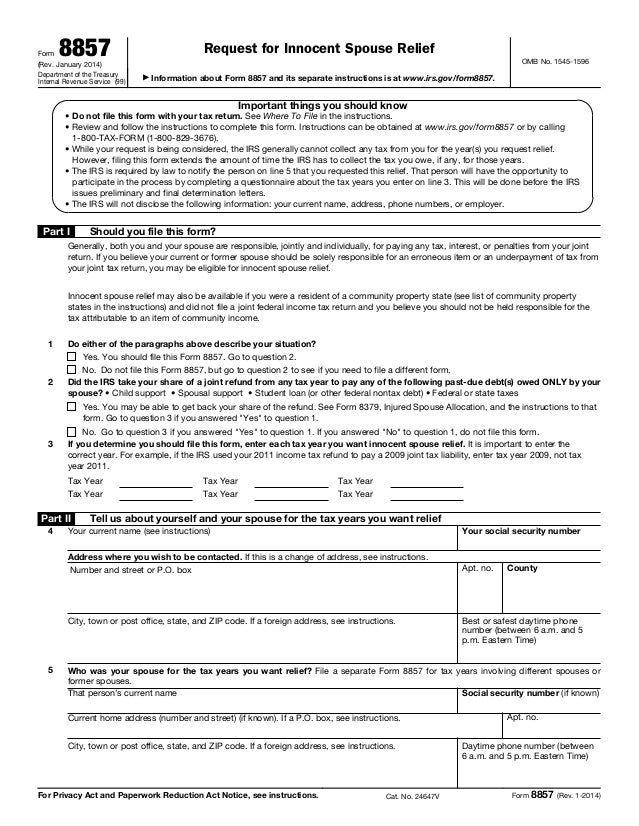

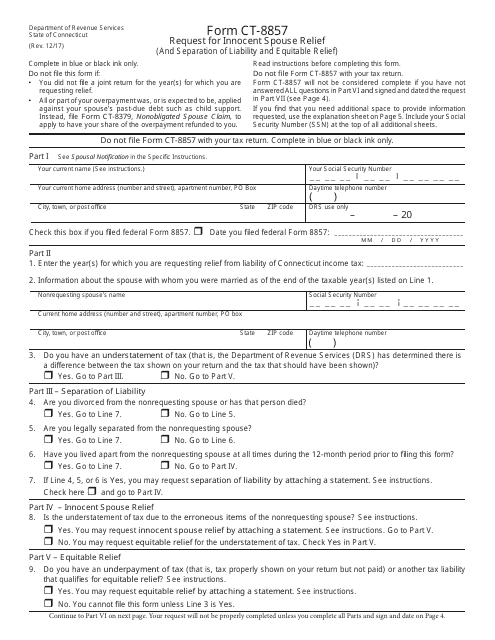

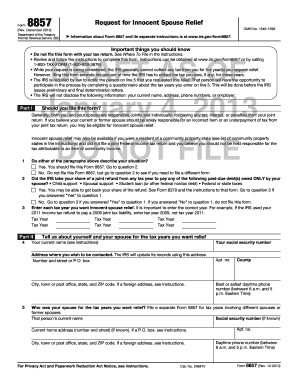

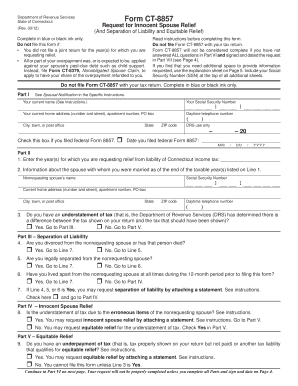

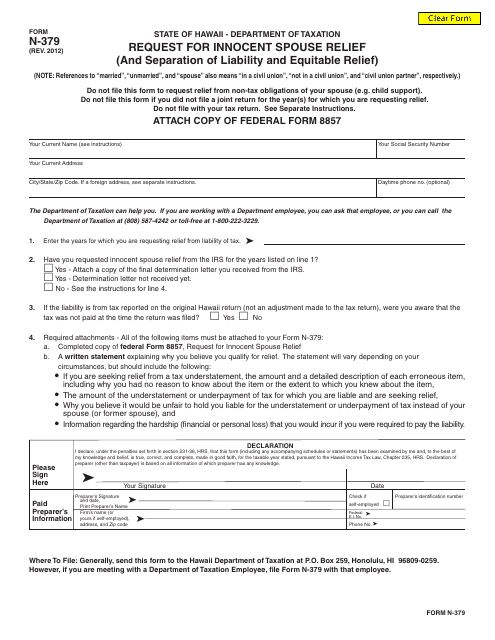

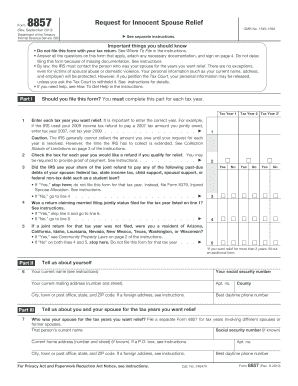

Printable tax form 8857. To apply for innocent spouse relief file form 8857 request for innocent spouse relief. The irs is examining your tax return and proposing to increase your tax liability. We last updated utah form tc 8857 in february 2019 from the utah state tax commission. Form 8857 is used to request relief from tax liability when a spouse or former spouse should be held responsible for all or part of the tax.

Attach a statement explaining why you qualify for relief. Create a blank editable 8857 form fill it out and send it instantly to the irs. Information about form 8857 request for innocent spouse relief including recent updates related forms and instructions on how to file. We last updated the request for innocent spouse relief in february 2019 and the latest form we have available is for tax year 2018.

2 did the irs take your share of a joint refund from any tax year to pay any of the following past due debts owed only by your spouse. Easily complete a printable irs 8857 form 2014 online. You should file this form 8857. Instructions for form 941 pdf.

Request for innocent spouse relief is an internal revenue service irs tax form used by taxpayers to request relief from a tax liability involving a spouse or former spouse. The following are some of the ways you may become aware of such a liability. Employers who withhold income taxes social security tax or medicare tax from employees paychecks or who must pay the employers portion of social security or medicare tax. The irs sends you a notice.

You should file form 8857 as soon as you become aware of a tax liability for which you believe only your spouse or former spouse should be held responsible. Form 941 pdf related. Where to file mail your completed form 8857 request for innocent spouse relief to one of the following addresses. Go to question 2.

This means that we dont yet have the updated form for the current tax yearplease check this page regularly as we will post the updated form as soon as it is released by the federal internal revenue service. For most us individual tax payers your 2019 federal income tax forms are due on april 15 2020 for income earned january 1 2019 through december 31 2019. This form is for income earned in tax year 2019 with tax returns due in april 2020we will update this page with a new version of the form for 2021 as soon as it is made available by the utah government. Get ready for this years tax season quickly and safely with pdffiller.

Do not file this form 8857 but go to question 2 to see if you need to file a different form. Employers quarterly federal tax return.