Qualified Dividends And Capital Gain Tax Worksheet

The tax calculation did not work correctly with the new tcja regular tax rates and brackets for certain taxpayers who had 28 rate gain taxed at a maximum rate of 28 or unrecaptured section 1250 gain taxed at a maximum rate of 25.

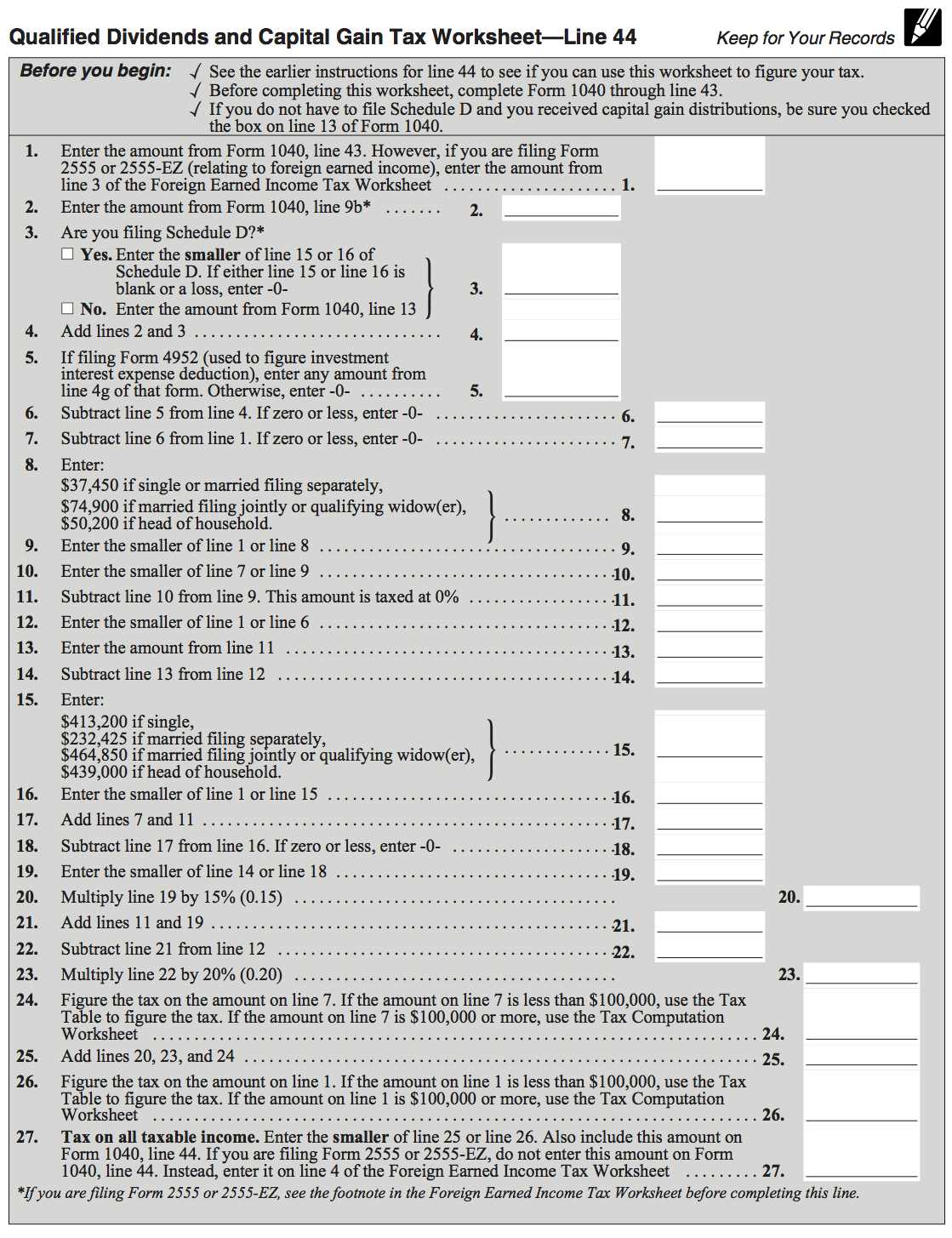

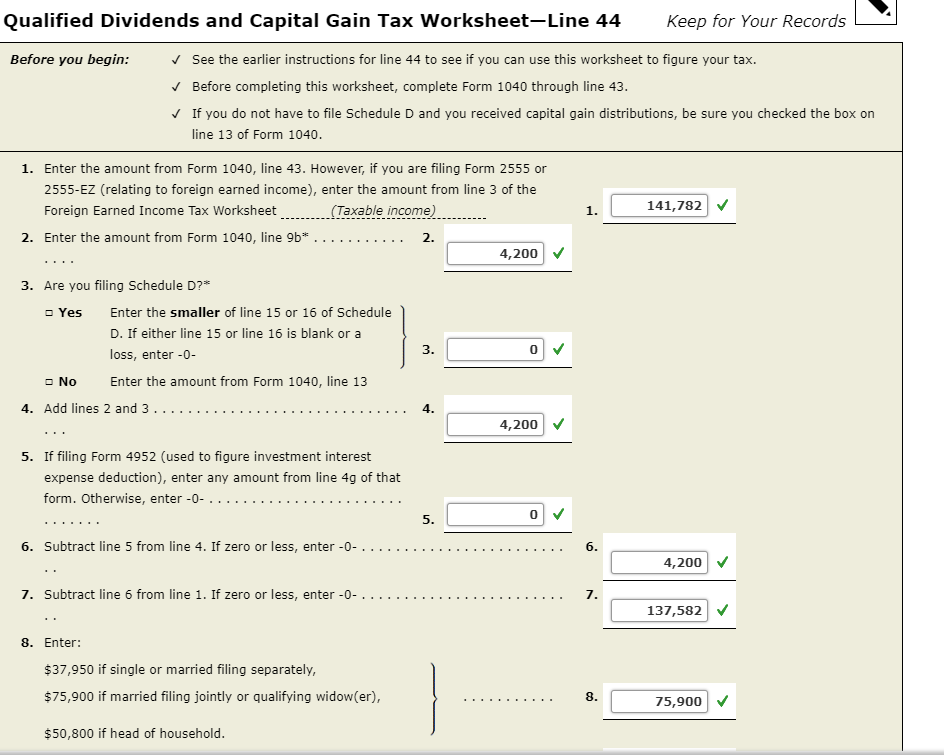

Qualified dividends and capital gain tax worksheet. For tax year 2019 the 20 rate applies to amounts above 12950. Some of the worksheets displayed are 2019 form 1041 es 44 of 107 qualified dividends and capital gain tax work 2018 2018 form 1041 es 2018 estimated tax work keep for your records 1 2a 2018 form 1040 es 2017 qualified dividends and capital gain tax work. 2018 qualified dividends and capital gain tax worksheet. The maximum tax rate for long term capital gains and qualified dividends is 20.

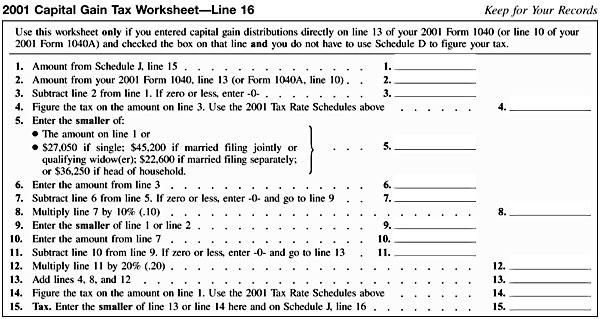

Showing top 8 worksheets in the category 2019 qualified dividends and capital gain tax. Qualified dividends and capital gain tax worksheet form 1040 instructions html. Instead 1040 line 44 tax asks you to see instructions in those instructions there is a 27 line worksheet called the qualified dividends and capital gain tax worksheet which is how you actually calculate your line 44 tax. Qualified dividends and capital gain tax worksheetline 11a.

2019 qualified dividends and capital gain tax. The 0 and 15 rates continue to apply to amounts below certain threshold amounts. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains. All forms are printable and downloadable.

Keep for your records. Capital gains and qualified dividends. Qualified dividends and capital gain tax worksheet form 1040 instructions page 40. Fill online printable fillable blank qualified dividends and capital gains tax worksheet 1040 line 11a form.

Once completed you can sign your fillable form or send for signing. Enter the tax amount on line 7. If the qualified dividends and capital gain tax worksheet in the form 1040 or form 1040 nr instructions the schedule d tax worksheet in the schedule d instructions or your actual schedule j form 1040 or 1040 sr income averaging for farmers and fishermen is used to figure your tax check the box on line 7. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.

Tools or tax ros e a qualified dividends and capital gain tax worksheet 2018 form 1040 instructions for line 11a to see if you can use this worksheet to figure your tax. The 0 rate applies to amounts up to 2650. Use fill to complete blank online irs pdf forms for free. The 27 lines because they are so simplified end up being difficult to follow what exactly they do.