Quickbooks Cash Receipts

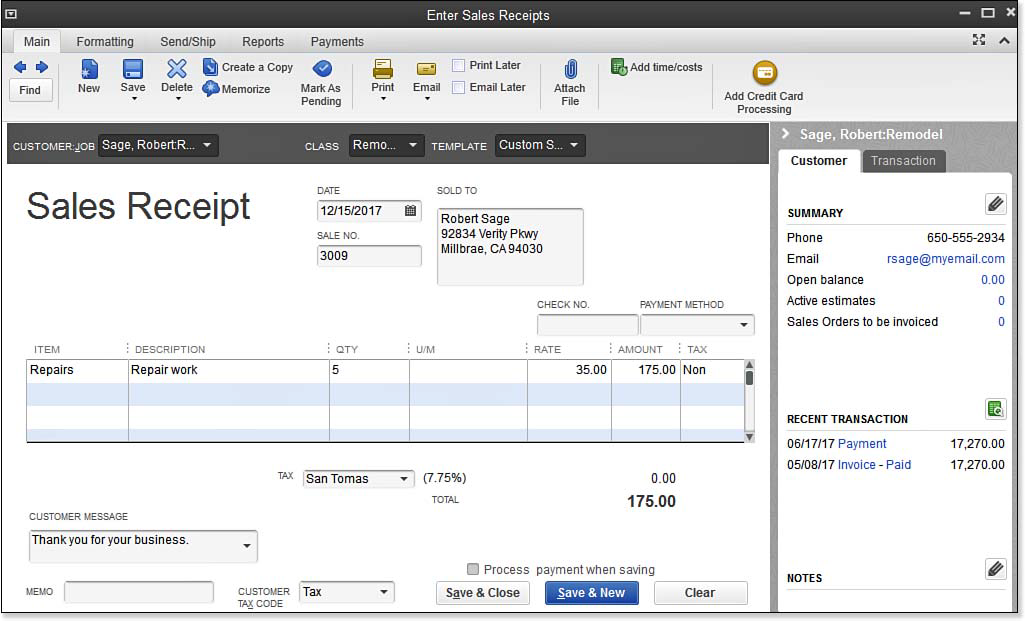

Print out a register tape of all the sales made for the day.

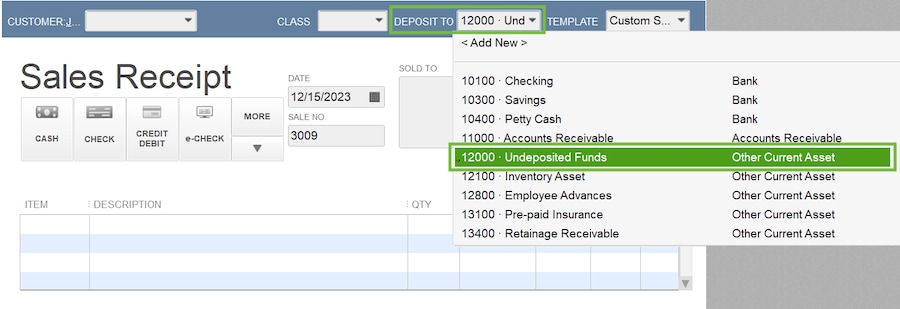

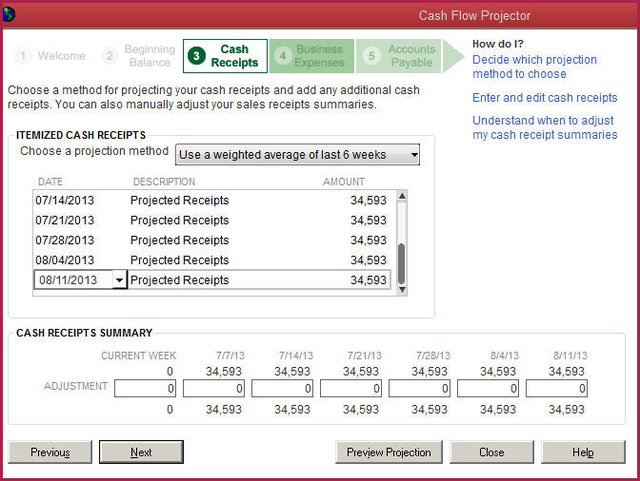

Quickbooks cash receipts. Quickbooks simple start suggests a cash sale number by adding 1 to the last cash sale number you used. Optional enter a sale number. Once you set up a petty cash account entering receipts is fast and straightforward. If you receive money from your supplier for undelivered goods or services you may enter this amount as a supplier credit available in quickbooks online.

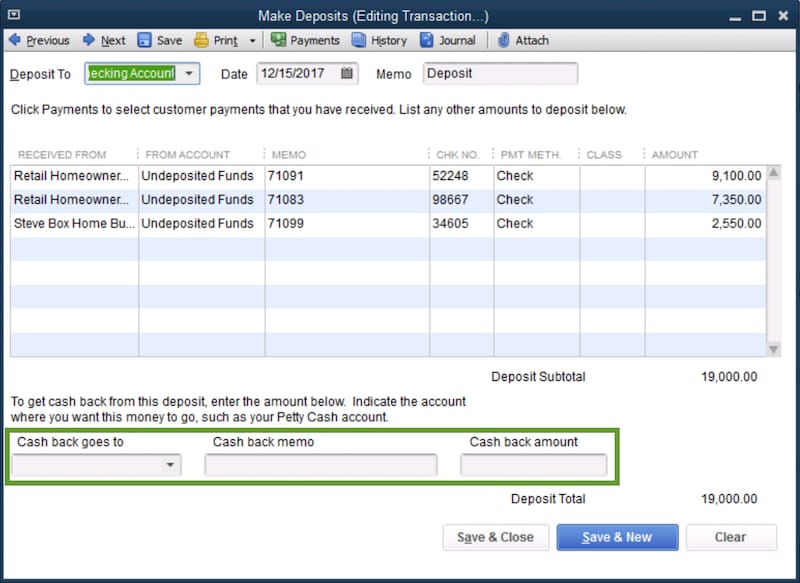

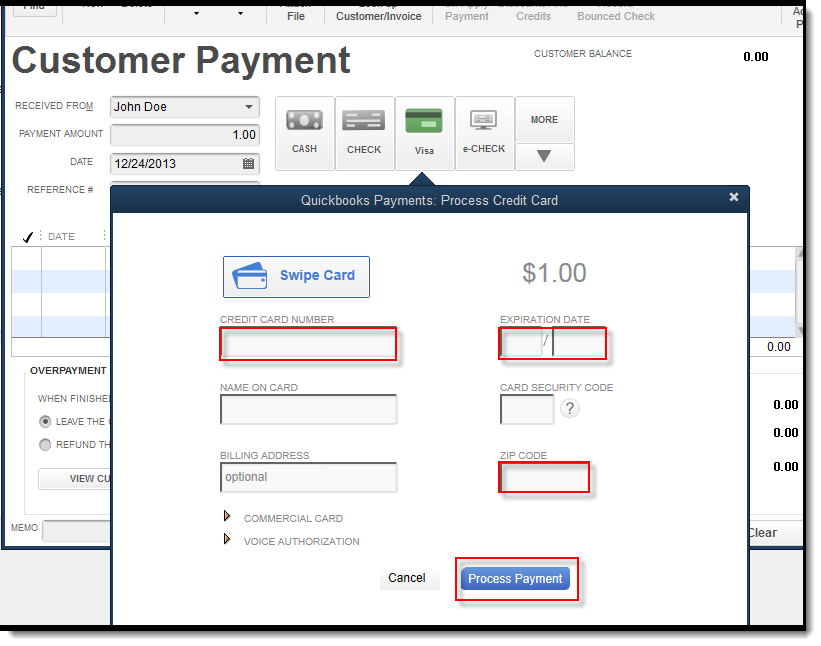

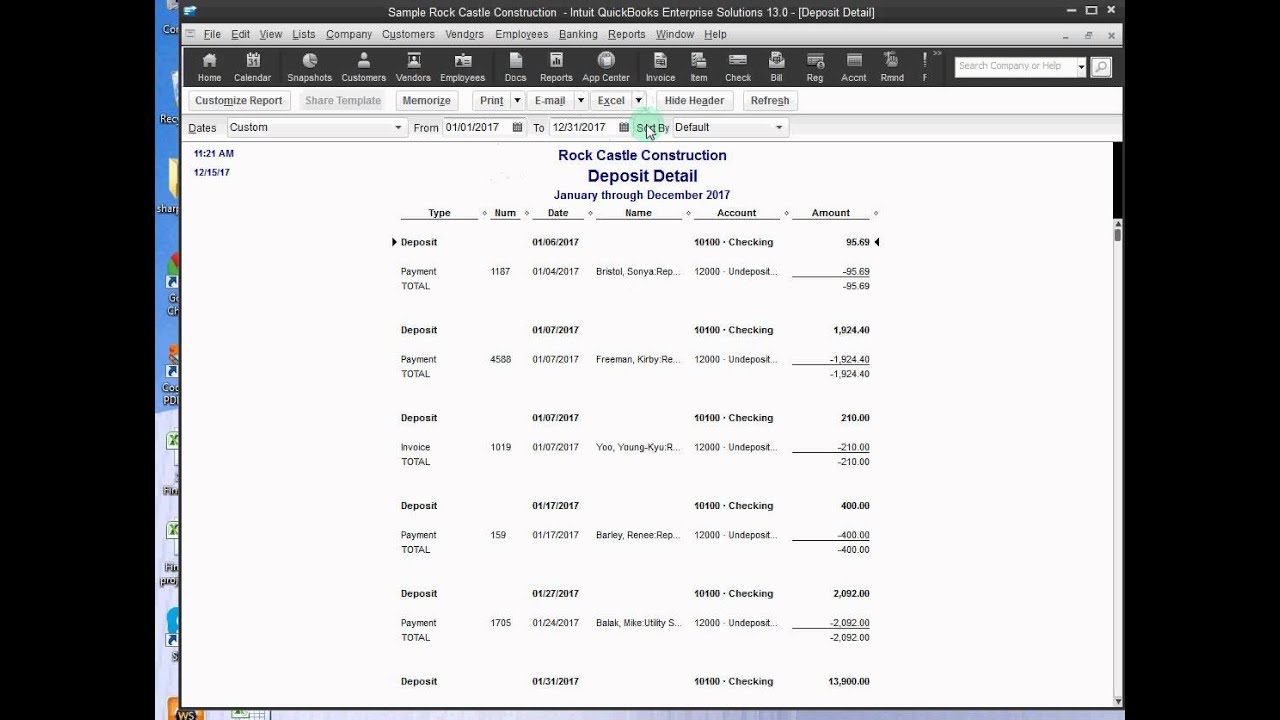

Enter the dollar amount for the first line item on your register tape. These transactions can be entered into quickbooks with a journal entry or you can setup a bank account called petty cash. From the quickbooks reports menu select custom reports then select transaction detail. Recording cash transactions in quickbooks.

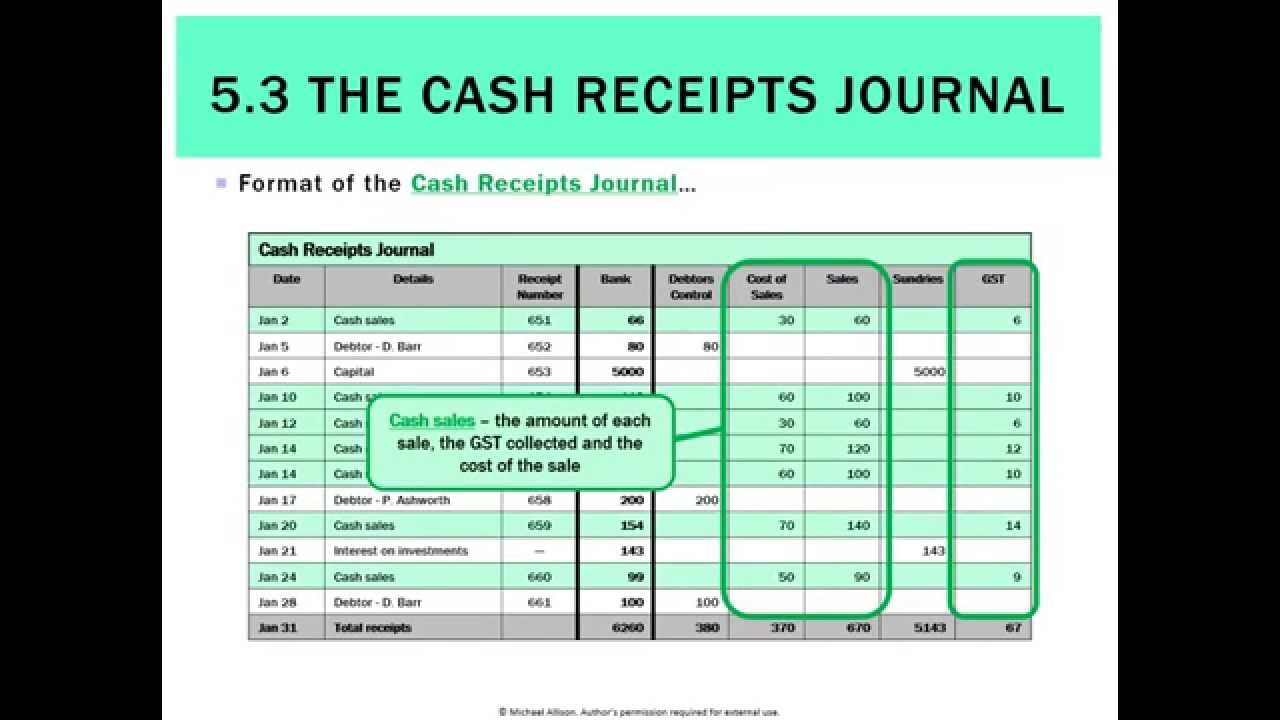

When you buy something using money from your petty cash or cash drawer you can still record these expenditures in quickbooks so you can track spending and connect purchases to the proper accounts. To create cash receipts journal in quickbooks software you need to follow these steps. When you choose the type of expense in quickbooks you need to fill in a form that adds business costs into your tax records. There are some occasions in which you purchase items with cash or on your personal account.

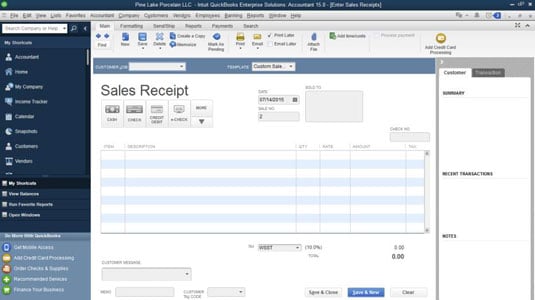

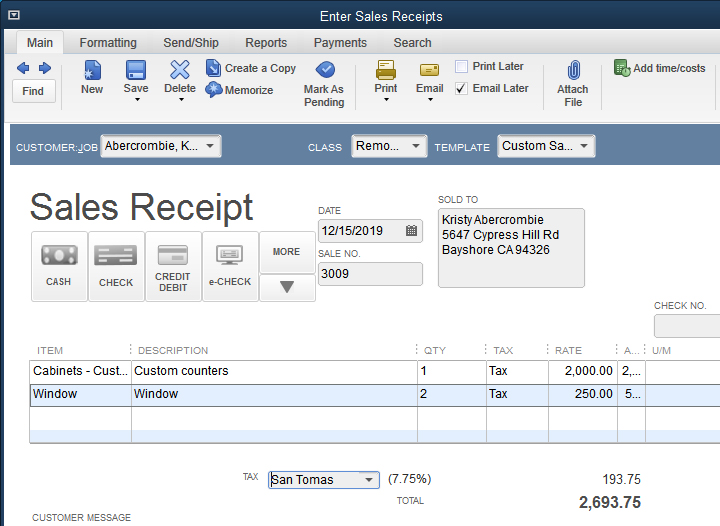

In quickbooks navigate to the customers menu and select enter sales receipts. Are you new to quickbooks or are you struggling to figure out the software. This report shows you all of the payments you received and deposits you made within the selected time period with a subtotal for each customer and a grand total at the bottom of the report. Use this number or tab to the sale no.

Learn how to create a sales receipt in quickbooks. Enter the appropriate date range. Text box and change the number to whatever you want. You will use a sales receipt when you receive a full payment from the customer at the time of sale.

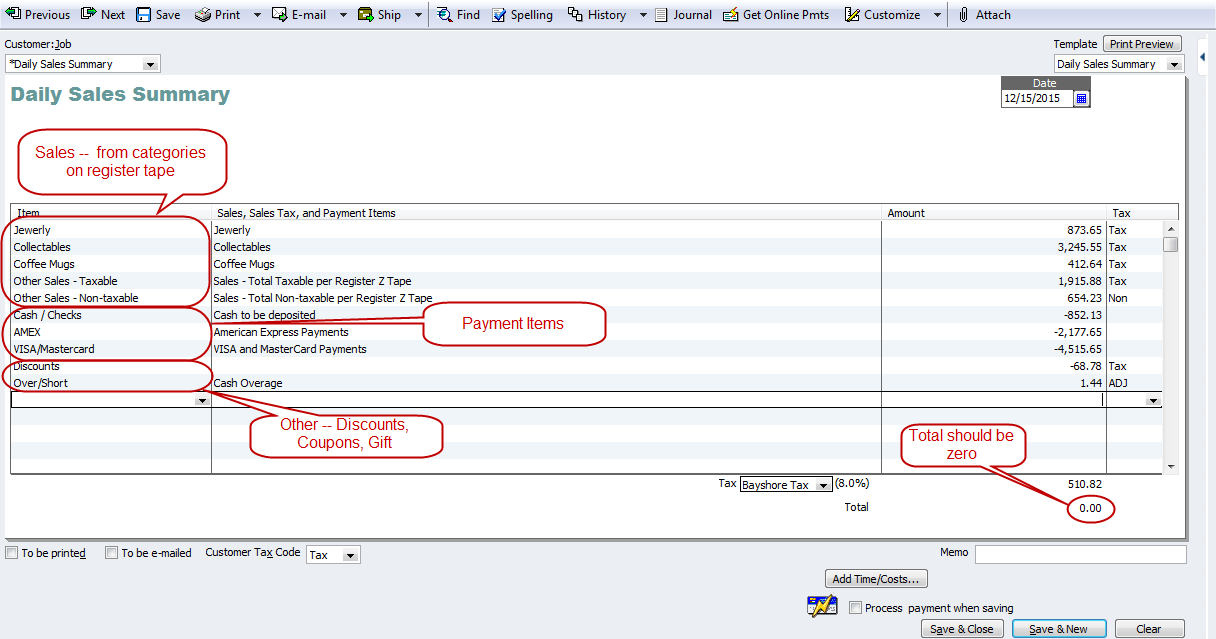

In the drop down menu choose daily sales summary. Enter the appropriate date range. In the menu bar select reports then custom reports then transaction detail. If you sold a product or a service and got paid immediately youll probably need to issue a sales receipt to your customer.

A sales receipt is essentially a transaction you enter in quickbooks online to reflect that you have received income from a customer. You want to record them so you can write off the expense. Complete the form to enter expense receipts and invoices. Why would you use a sales receipt instead of an invoice.

Fix the sold to address if necessary. Create a cash receipts journal report.