Secured Certificate Loan

The funds are frozen when the loan is taken out.

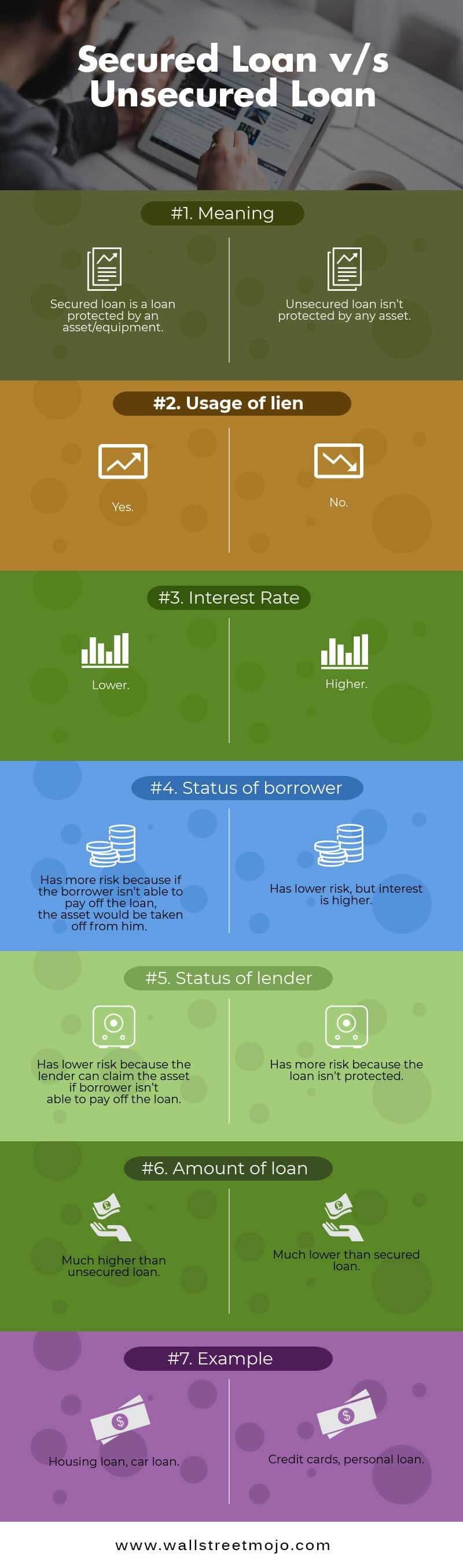

Secured certificate loan. Certificate secured loans generally are issued by credit unions. America first offers low interest rates as low as 30 above your certificate dividend and flexible repayment terms that match your accounts maturity. You borrow money based on the amount you deposit into a dedicated share certificate or savings account. A certificate secured loan is a loan provided through a credit union that is secured by the amount available on deposit in the borrowers share account.

Depending on the credit union and their specific policies. As your loan is paid down your money in savings will be released for your use. The funds are kept in the share for a specific period of time based on the terms of the loan. Certificate secured loans secure an affordable loan by borrowing against your america first certificate account.

You can use this money to make a major purchase consolidate bills pay personal expenses or finance higher education. Loans savings secured certificate secured loans. You will provide the certificate as collateral and then you will be able to borrow a certain amount of money. A certificate secured loan is a personal loan that allows you to borrow against your savings account certificate with a credit union.

A certificate secured loan is a type of agreement in which you pledge a type of deposit account to a financial institution in exchange for access to a sum of money. Use your savings as collateral for a great low interest loan while you are earning dividends on your savings.

/GettyImages-955530262-5bd87bb1c9e77c00518d6332.jpeg)