Tax Certificate Auction

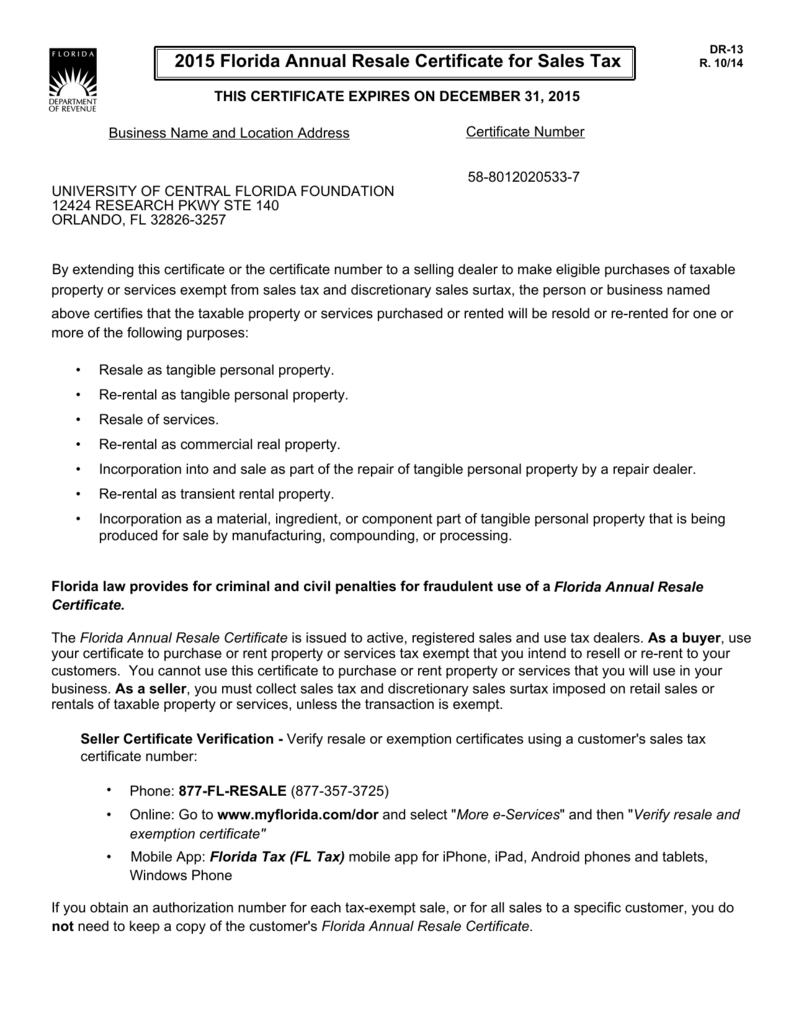

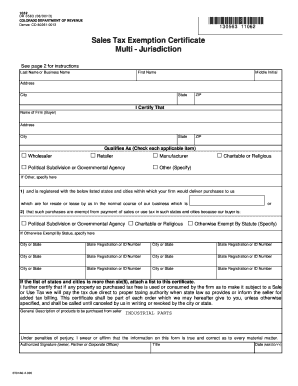

How to register for new york state sales tax tax bulletin st 360 tb st 360 printer friendly version pdf issue date.

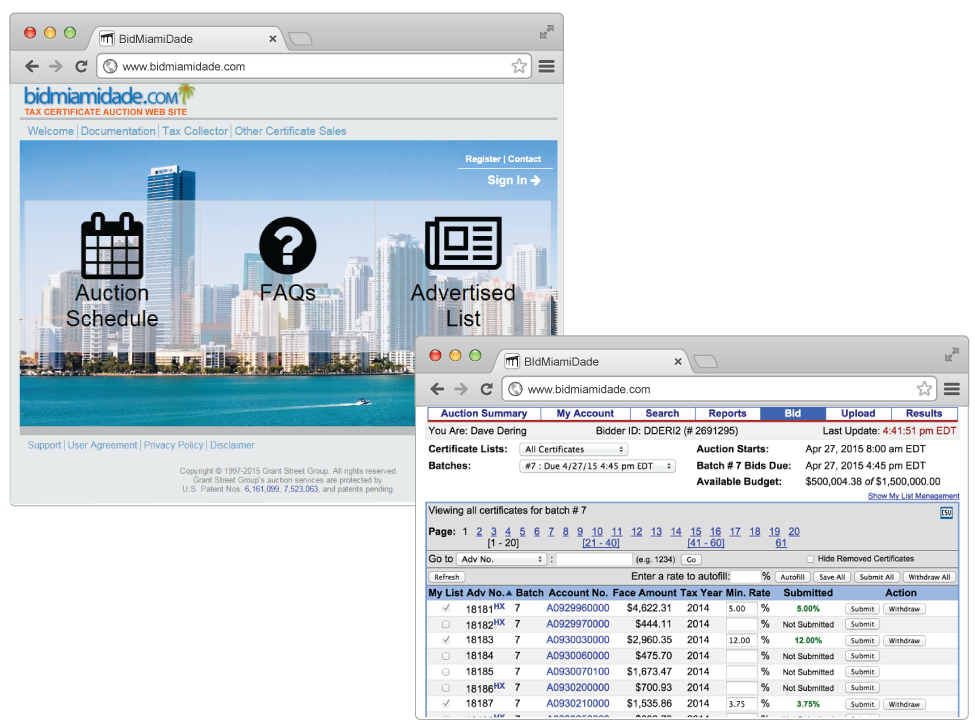

Tax certificate auction. A direct bid auction takes the lowest interest rate entered and awards the certificate at that rate. The duval county tax certificate sale uses a direct bid auction format. Breaking down tax lien certificate a tax lien certificate is a lien placed on your property for not paying your taxes. The online tax sale auction allows for speed and efficiency of the tax certificate sale and ensures the prompt and accurate collection of delinquent tax revenue needed to fund vital county services.

The sale is conducted online in a reverse auction style with participants bidding downward on interest rates starting at 18. If the taxes remain unpaid the delinquent property will be advertised once a week for 3 consecutive weeks prior to the tax certificate sale and the advertising fee will be added to the tax bill. If you are interested in participating in the online tax certificate sale visit our official tax certificate auction site. Tax certificate holders can obtain tax deed application cost estimates and apply for tax deeds online on deedexpress.

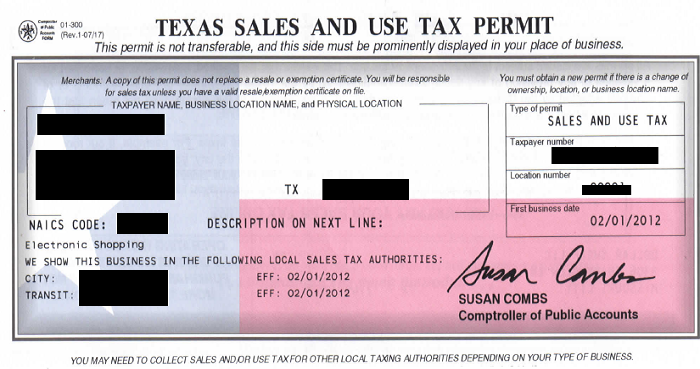

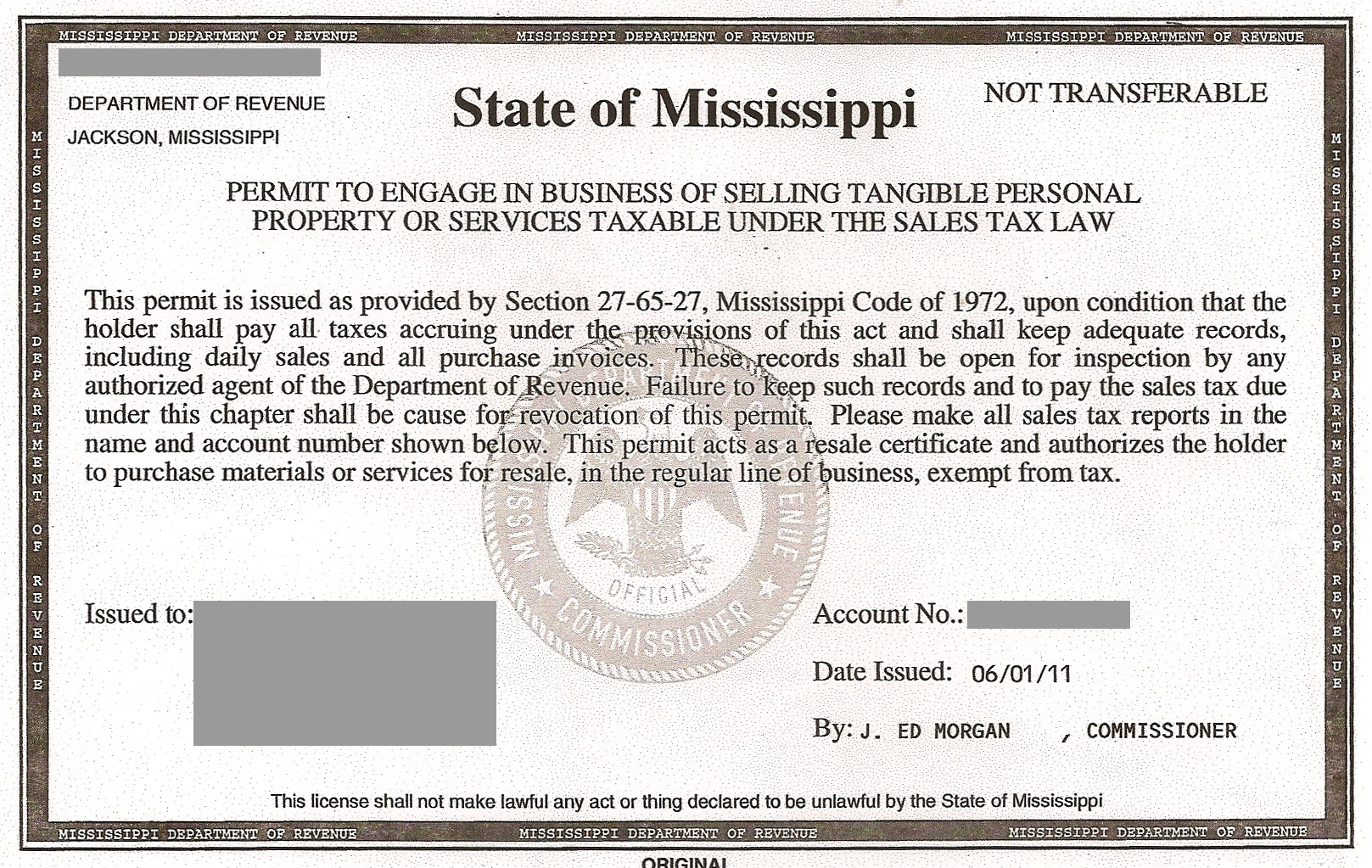

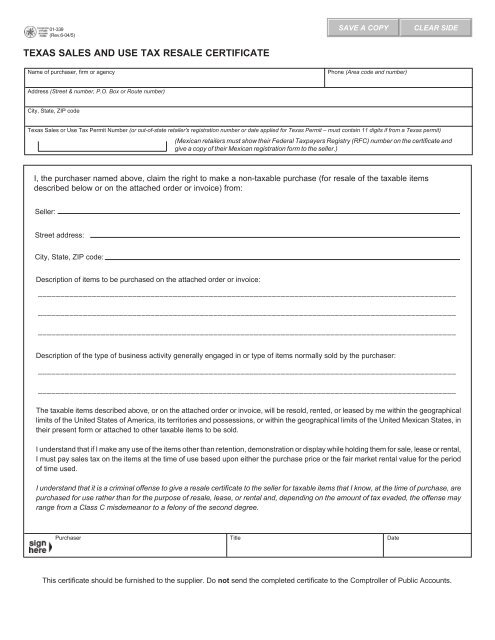

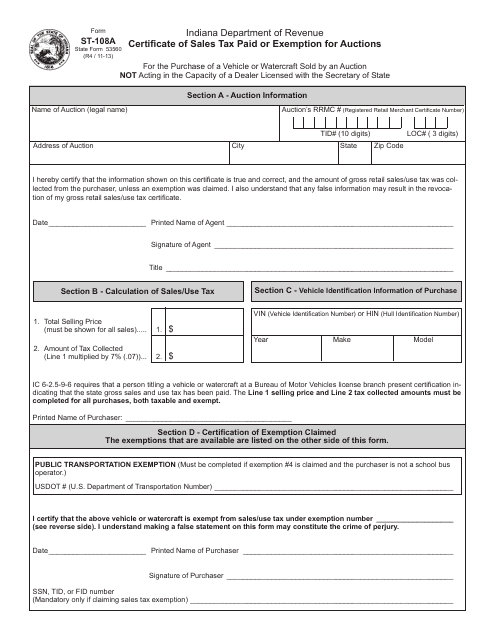

In duval county if bidder one and bidder two are both bidding on. Application to register for a sales tax certificate of authority this registration authorizes the collection of sales and use tax on certain property and rentals. The tax certificate sale allows investors to purchase certificates by paying the tax debt. The tax certificate holder is entitled to submit a tax deed application after two years since april 1 of the year the tax certificate was issued and before seven years from the date the tax certificate was issued.

If you will be making sales in new york state that are subject to sales tax you must register with the tax department and obtain a certificate of authority online at new york business express. The certificate is awarded to the lowest bidder who will pay the taxes interest and costs. If you will be making sales in new york state that are subject to sales tax you must register with the tax department and obtain a certificate of authority. Once youve done your research get a list of properties for sale from the county treasurer investigate potential properties and make a list of the ones you want.

Before buying a tax lien certificate decide where you want to invest in a tax lien then research the laws regarding liens in that specific county since they vary from area to area. A 3 mandatory interest charge is added to the amount due at that time. Tax lien certificates are generally sold to investors through an auction process. The auction is not proxy style in which a certificate is awarded at 025 less than the next lowest bid.

A registration authorizing the collection of sales and use tax on the sale of taxable tangible personal property rentals specific taxable services and purchases of.

/how-to-invest-tax-lien-certificates-4156474_v4-07a1533f0d804376a110dad6664ed2df.png)