Tax Expert Certification

An important difference in the types of practitioners is representation.

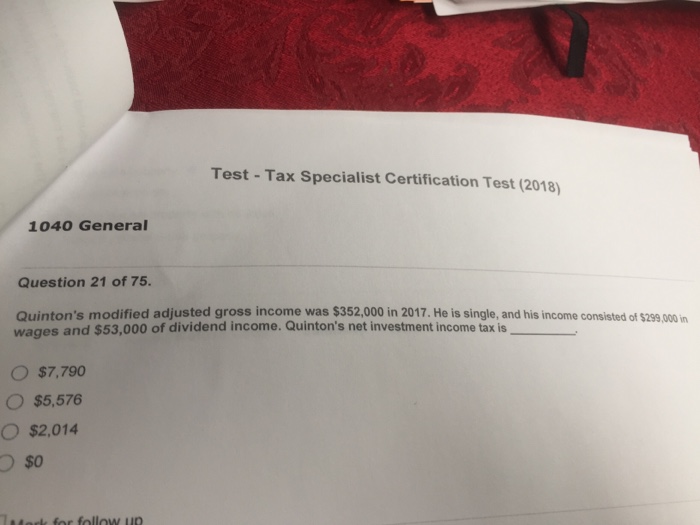

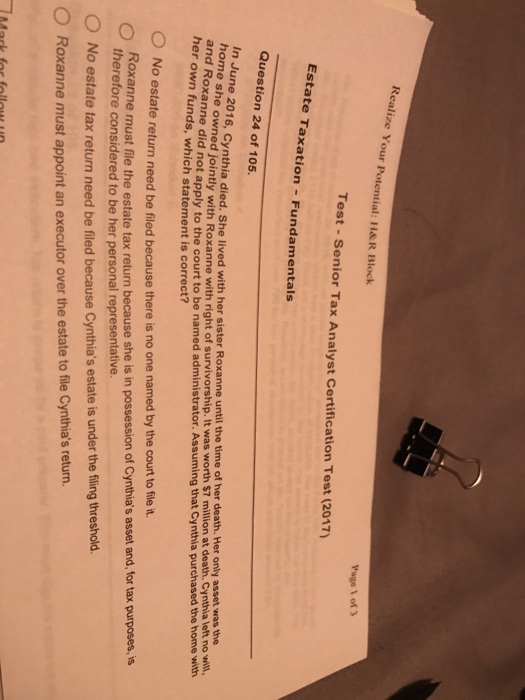

Tax expert certification. The chartered tax consultant ctc certificate program will enable you to prepare individual form 1040 and introduces small business tax preparation for form 1120 1120s and partnership form 1065 tax returns. Certificate in tax expert goods and service tax basic concept of gst law applicability and process of registration rates comparison time of supply place of supply valuation tax invoice input tax credit composition scheme gst returns payment of tax accounting for gst gst in tally gst vs previous indirect tax system. However tax professionals have differing levels of skills education and expertise. Both programs are excellent for tax preparers of any certification level.

Once certified tax return preparers often invest in cloud based software programs like intuit tax online or intuit proconnect lacerte tax that help provide their clients with better accuracy and quicker service. At any point whether its before during or after training there will always be support available for you. Optional training for volunteers looking to pass the advanced irs certification evening and daytime options. Tax certification and certificate program information.

Most tax experts complete the training within 40 hours and will have 2 4 weeks to do so. Learn about the different requirements for these programs as well as common courses and employment information. Become a tax preparer in just weeks with our 45 hour qualifying tax course. After youre certified as a tax preparer.

6 hour tax training certification. Any tax professional with an irs preparer tax identification number ptin is authorized to prepare federal tax returns.