Tax Law Certificate

The certificate is open to both us.

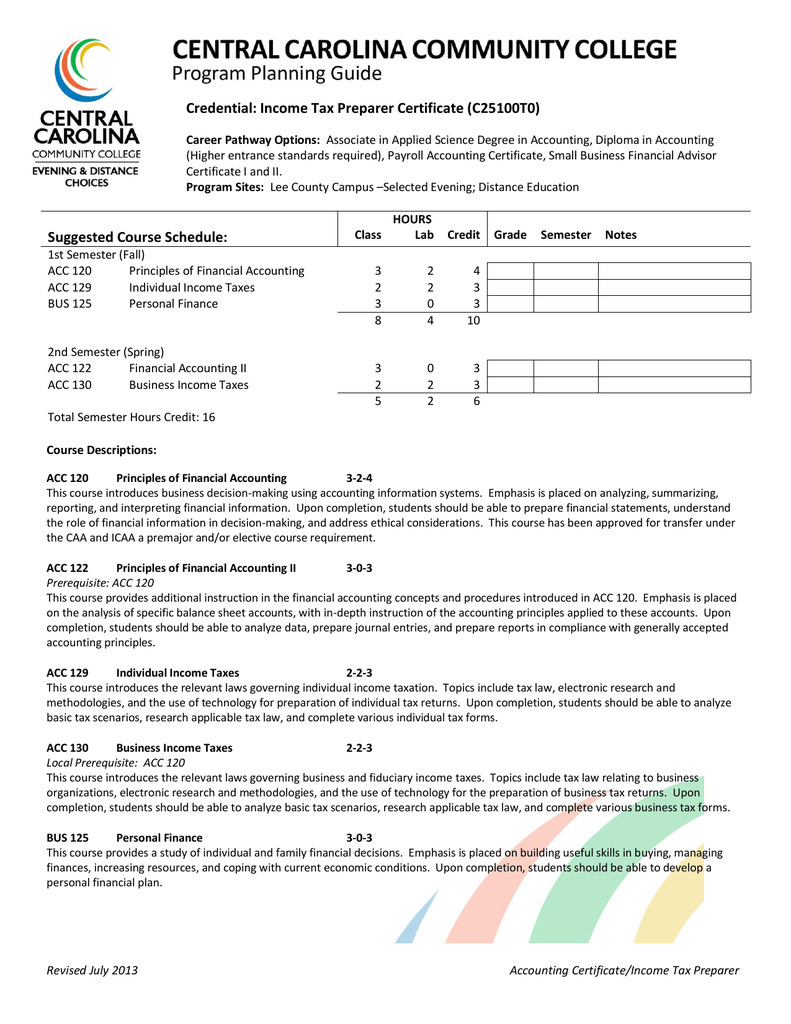

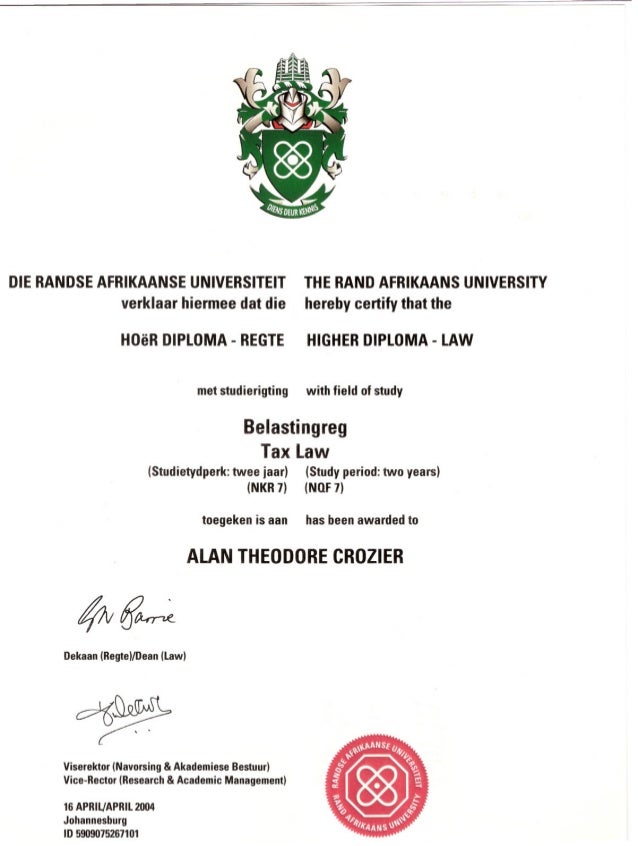

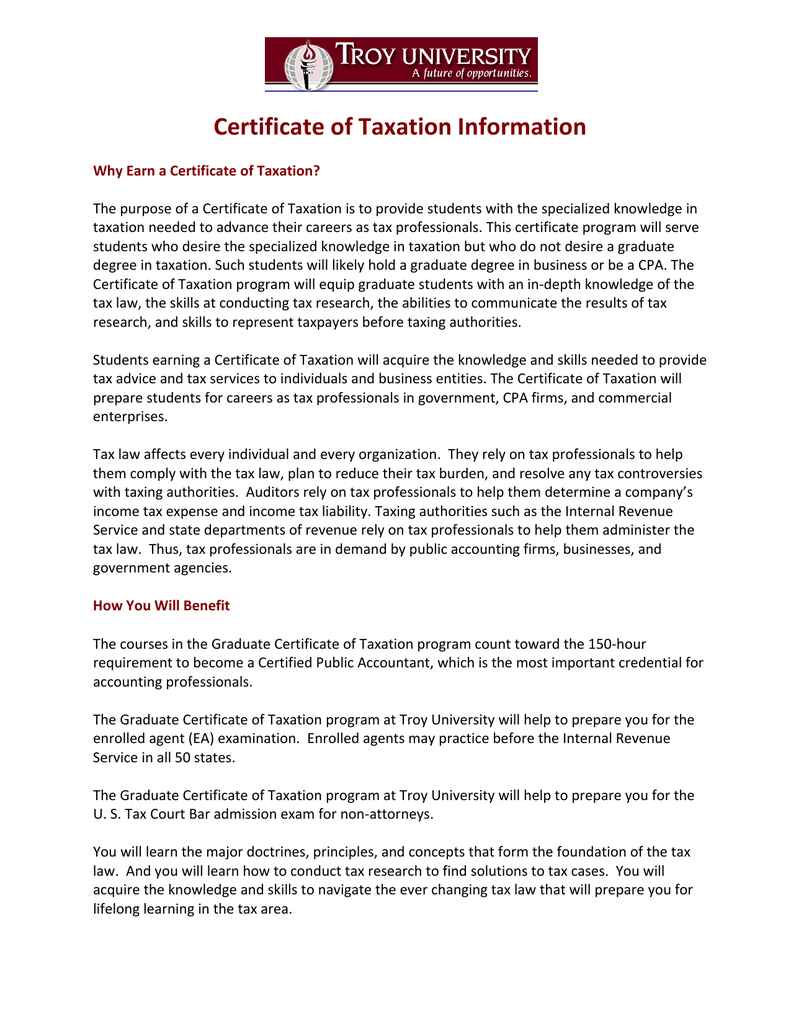

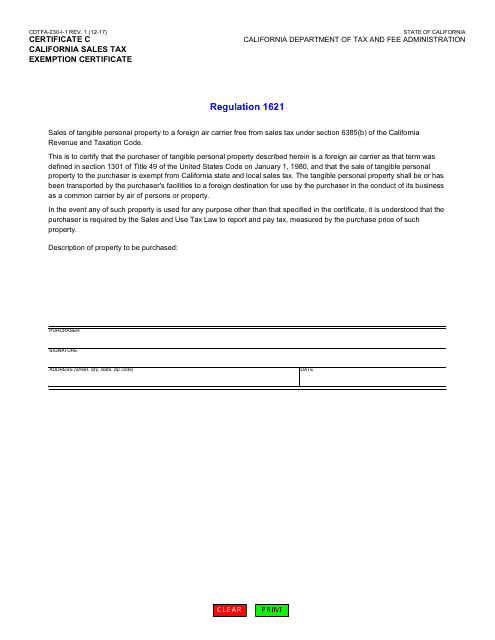

Tax law certificate. And foreign trained lawyers as well as non attorney tax professionals and can be completed together with the tax llm. Corporate taxation i ii taxation of mergers and acquisitions advanced corporate tax problems students may request to substitute another advanced corporate tax course. The tax law certificate program will offer students concentrated and advanced exposure to tax law policy and practice and will help students launch careers in tax law. And 3 complete an upper level research and writing requirement analyzing an issue related to tax law.

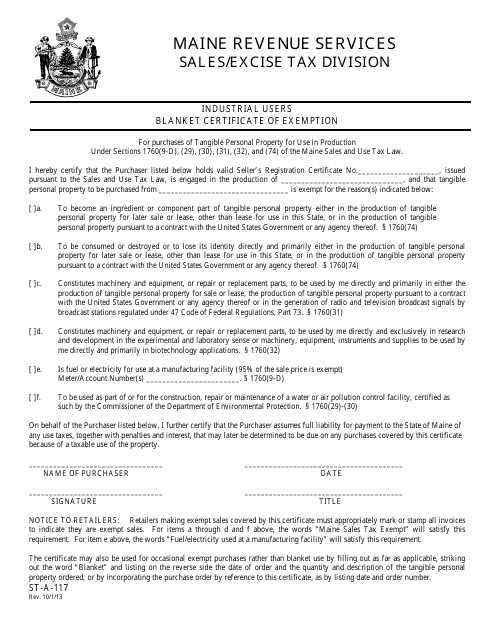

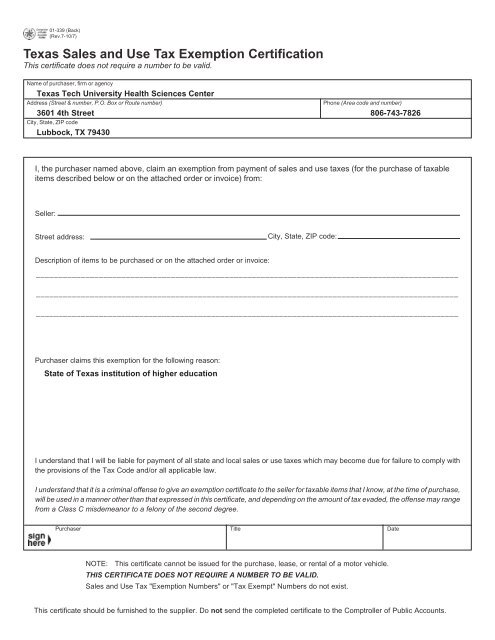

Corporate taxation the corporate taxation apc requires the following core courses. Tax law affects and influences nearly every aspect of our lives from sales tax income tax property tax charitable deductions tax credits and inheritance tax just to name a few areas. The tax law certificate is a response to the growing demand for attorneys with expertise in the tax field. To earn a tax law certificate a student must complete 1 earn at least 9 units of approved course work in the subject area.

The advanced professional certificate apc is a 12 credit specialized study program in corporate tax estate planning or international tax. Students in the certificate program for tax law participate in a supervised writing project externship or clinic in the area of tax law. Degree or on a stand alone basis. Tax law degree and certificate program overviews.

The certificate is awarded upon completion of at least 15 units of tax related courses and a substantial research paper on a tax related topic. 2 complete a practicum requirement related to tax law. The certificate in international taxation can also be completed entirely online. Oct 10 2019 the most widely available educational options in tax law include programs that award a certificate and a master of law llm in tax.

They may begin their tax studies in federal income taxation in their first year and continue the study of taxation in a variety of courses during the last four semesters of law school.