Third Party Risk Management Policy Template

This should include risk scoring and classification organize and consolidate your existing third party profiles.

Third party risk management policy template. Categorize vendors based on their risk profile and define an appropriate monitoring mechanism. Reporting and board accountability. Approve the banks risk based policies that govern the third party risk management process and identify critical activities. Key components of your third party risk management policy.

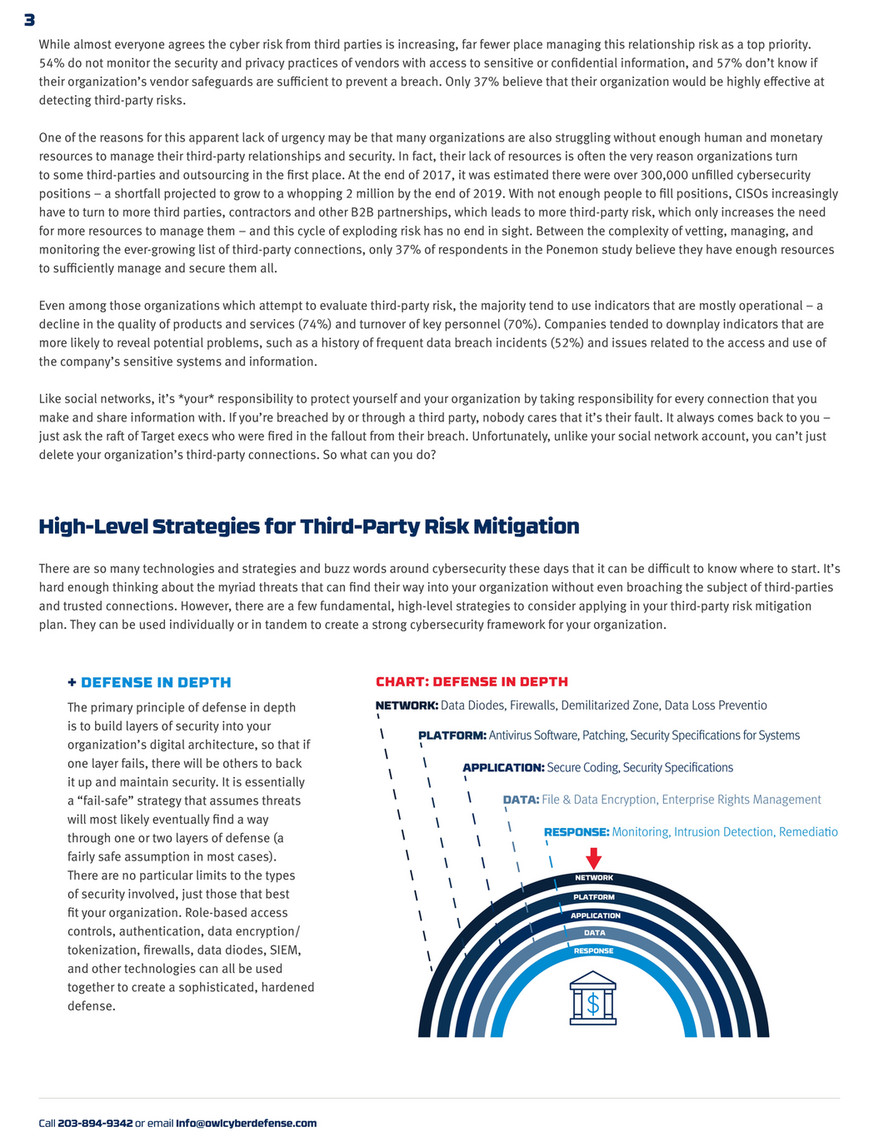

Third party risk management policy 1 19 2017docx 3 third party access control requirements. Review and approve management plans for using third parties that involve critical activities. Its also important to frame policies and implement controls to mitigate third party risks. Also leverage external sources for third party risk.

Review summary of due diligence results and managements recommendations to use third parties that involve critical activities. Assist firms in maturing their internal third party risk management programs by providing tools templates and guidance from across the membership. Setting up a vendor risk management policy. Creating an effective vendor or third party risk management framework to create an effective program for managing the risks posed by vendors or other third parties experts advise being thorough and applying the same criteria to all vendors adapted of course to the type of work the vendors are doing.

Relevance to other compliance policies 4. Risk assessment process and tolerance 5. Conduct a thorough assessment of the risks posed by third parties. Define third party risk management.

Due diligence process and exceptions 6. This third party risk management policy is designed to manage risks associated with third party vendors. Statement of policy 3. Overview of policy 2.

For example third party risk management is the process of controlling activities that could potentially lead to positive or negative results due to. Therefore view it vendor risk in the purview of the larger third party risk management program. Afn relies on to provide critical products or services on an ongoing basis in support of afns operations and services. Third party risk management like erm is a journey not a destination embed the process into the organizations decision making effective third party risk management is dependent on good data good data requires a good process for collecting and analyzing third party profile data 35 key takeaways.

Catalogue the third party vendors your organization uses. Review and define your procedures for monitoring third parties. Align all work to the occ risk management life cycle for third party risk to provide a complete structure for how firms should be viewing the issue.