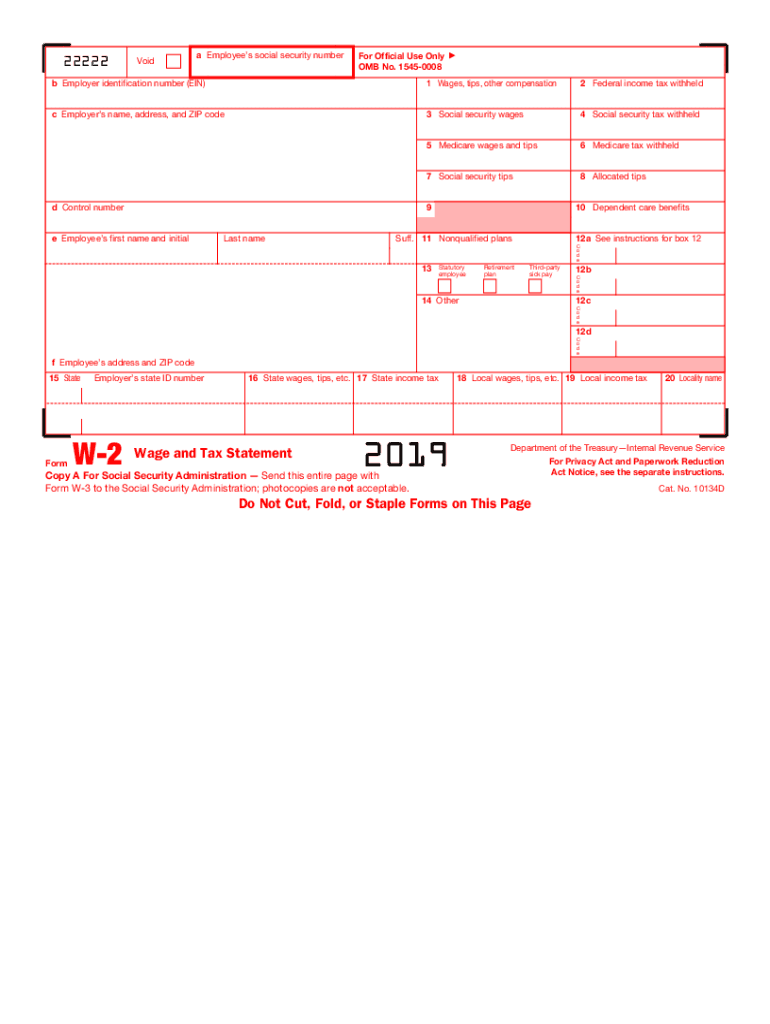

W2 Pdf Template

.png)

Form w 4 2020 employees withholding certificate department of the treasury internal revenue service complete form w 4 so that your employer can withhold the correct federal income tax from your pay.

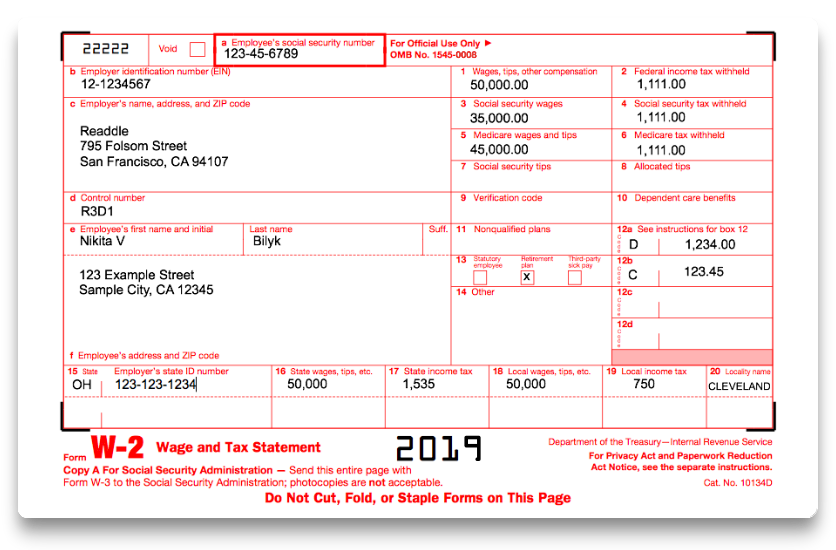

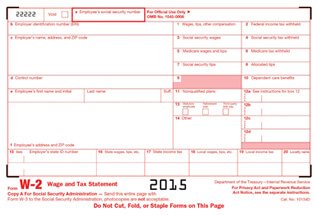

W2 pdf template. The form is issued annually by the internal revenue service irs. The w2 form is a template made for the employers report of a salary and insurance details to the internal revenue service. A w 2 form is used for filing taxes. Download the latest version of the fillable w 2 form through the link below.

It is a form that an employer must fill out and then provide to the employee during the tax filing season. A person can easily fill out a printable template online. Form w 2 officially the wage and tax statement is an internal revenue service irs tax form used in the united states to report wages paid to employees and the taxes withheld from them. W 2 form.

Irs form w 2 wage and tax statement is a document used to report the wages and tax withheld to the employee and the appropriate authorities. Medicare tax owed on the allocated tips shown on your forms w 2 that you must report as income and on other tips you did not report to your employer. A w 2 form is used for filing taxes. E filing print mail.

When e filing a document make sure all empty boxes are filled in. Let expressefile save you time and a stamp by transmitting and mailing copies of your w 2 form for just 299 per form. B employer identification number ein c employers name address and zip code d control number e employees first name and initial last name suff. It should be completed by every employer who gets more than six hundred dollars per year.

If you are required to file a tax return a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it. By filing form 4137 your social security tips will be credited to your social security record used to figure your benefits. To order official irs information returns such as forms w 2 and w 3 which include a scannable copy a for filing go to irs online ordering for information returns and employer returns page or visit.