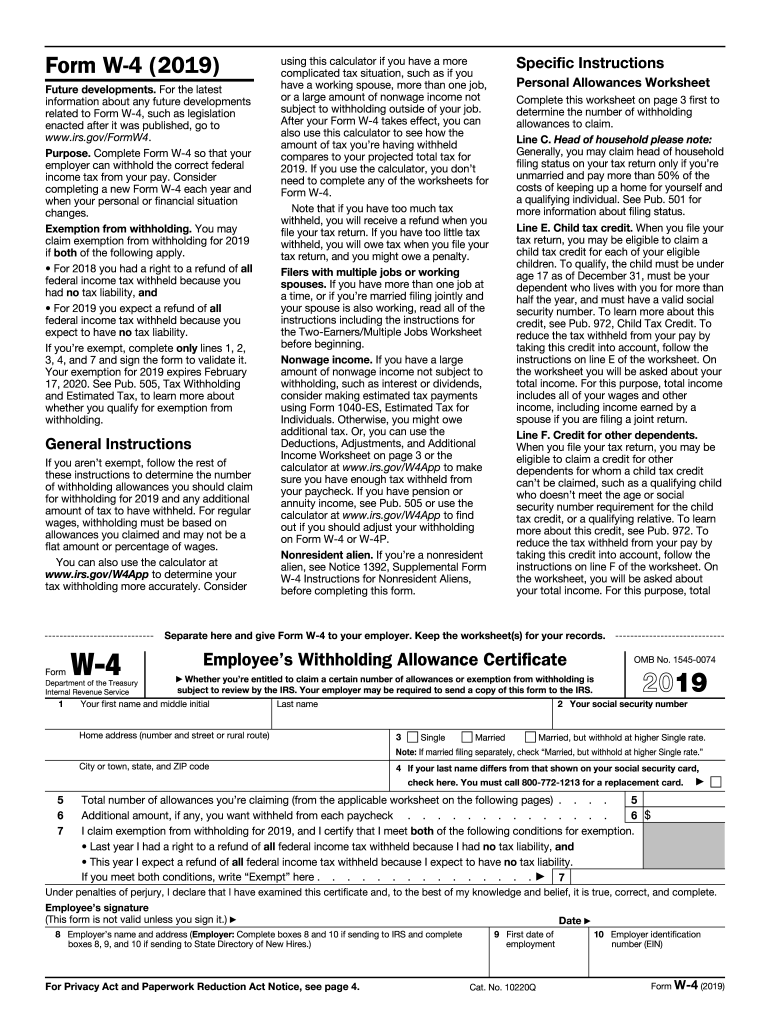

W4 2018 Printable

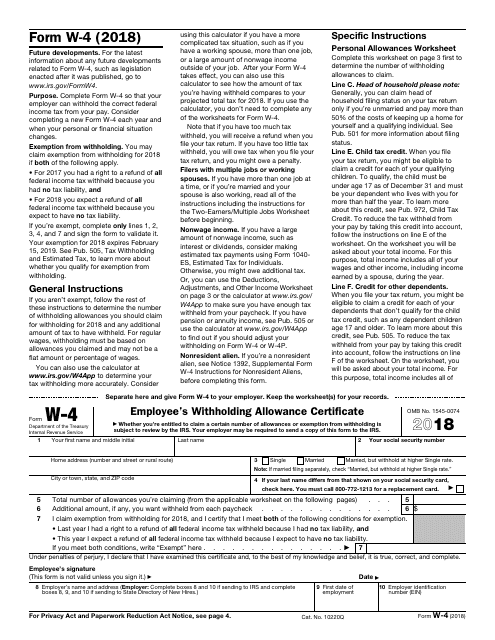

W 4 2018 form w 4 2018 page.

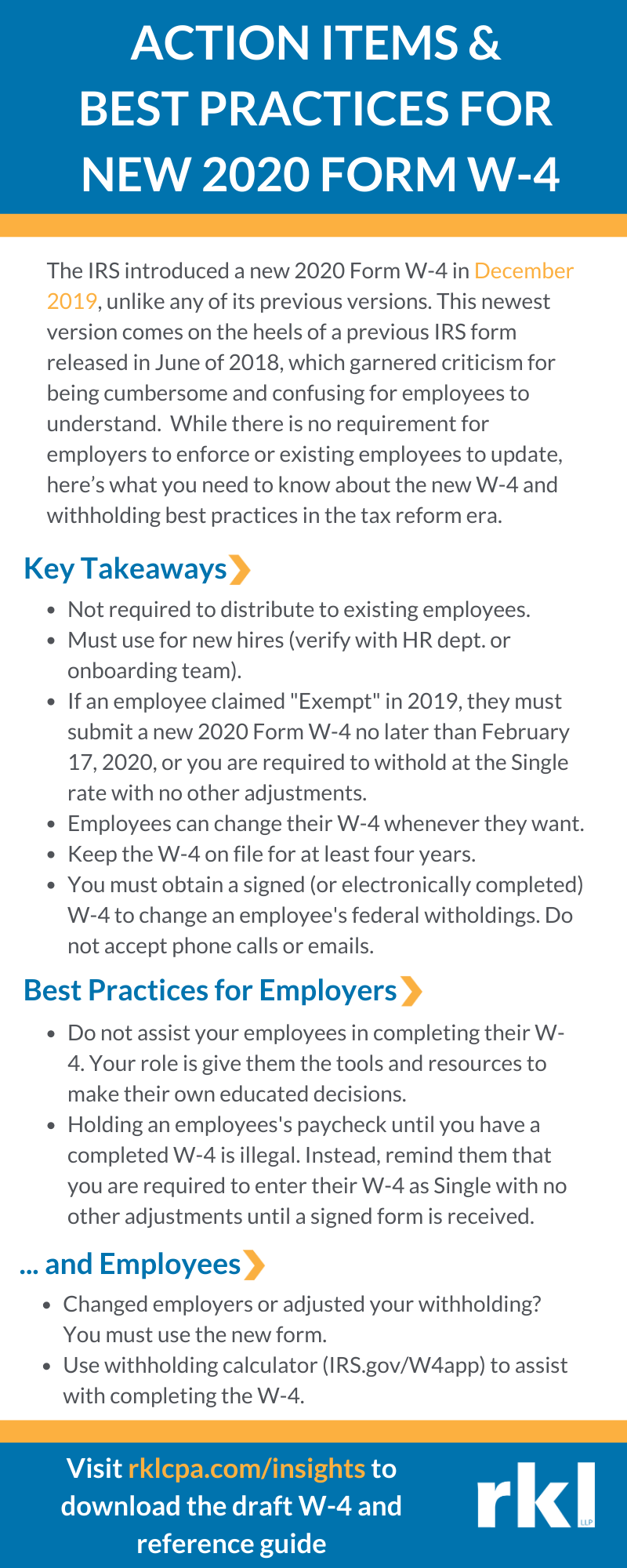

W4 2018 printable. Withholding certificate for pension or annuity payments 2019 02042019 form w 4p. You might be able to reduce the tax withheld from your paycheck if you expect to claim other tax credits such as the earned income tax. Employers who withhold income taxes social security tax or medicare tax from employees paychecks or who must pay the employers portion of social security or medicare tax. Download and print instantly.

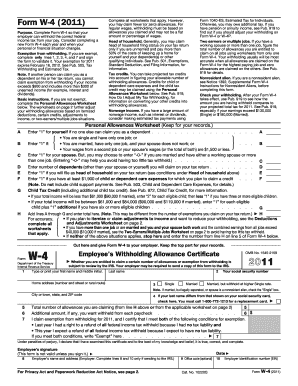

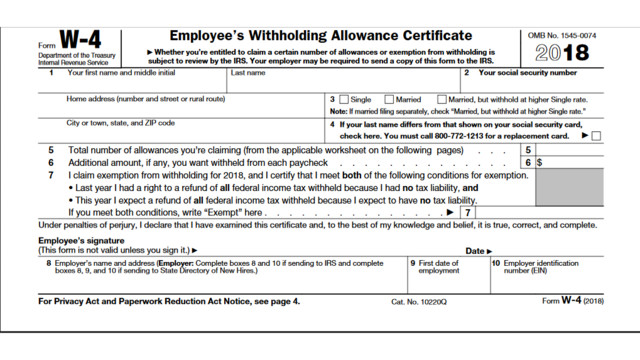

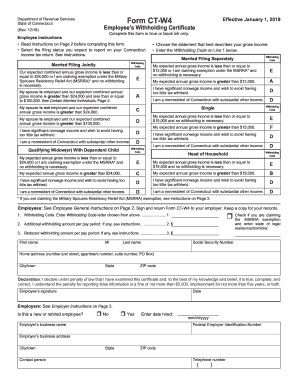

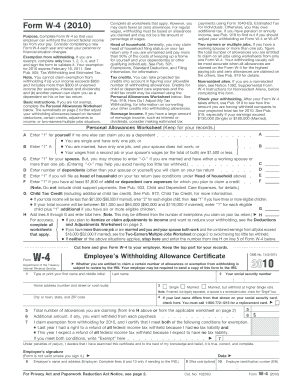

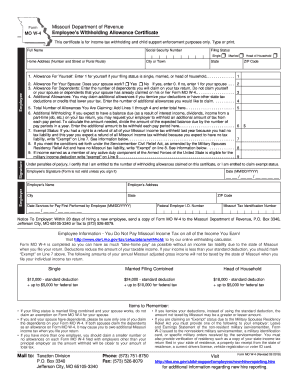

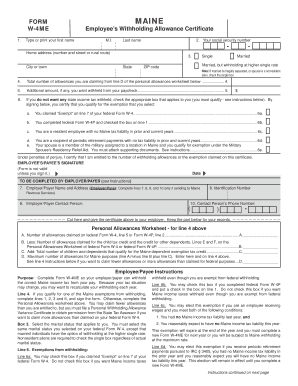

For any employee who does not complete form ct w4 you are required to withhold at the highest marginal rate of 699 without allowance for exemption. The form should be used for tax year 2018 and beyond as it reflects changes from the tax cuts and jobs act. Printable 2018 form w 4. Printable w 4 form 2018 2020.

If typing in a link above instead of clicking on it be sure to type the link into the address bar of your browser not in a search box. Note that these are friendly shortcut. Page is at irsgovpub17. Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file.

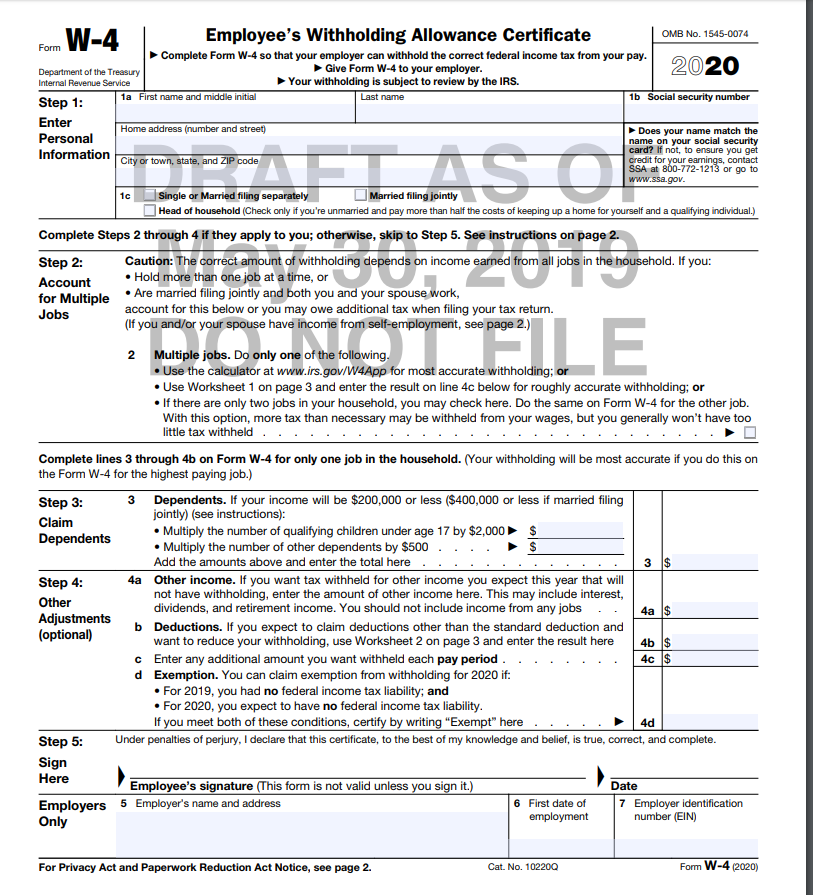

Fill out a digital sample in pdf put your signature and send the document via email or fax. Find printable w 4 form 2018 for correct federal income tax witholding. Withholding certificate for pension or annuity payments 2018 02052019 form w 4s. Form w 4 sp employees withholding certificate spanish version 2020 01022020 form w 4p.

See informational publication 20181 connecticut employers tax guidecircular ct for complete instructions. Try now to save time. Electronically complete a printable w 4 form. This document should be given to your employer once completed.

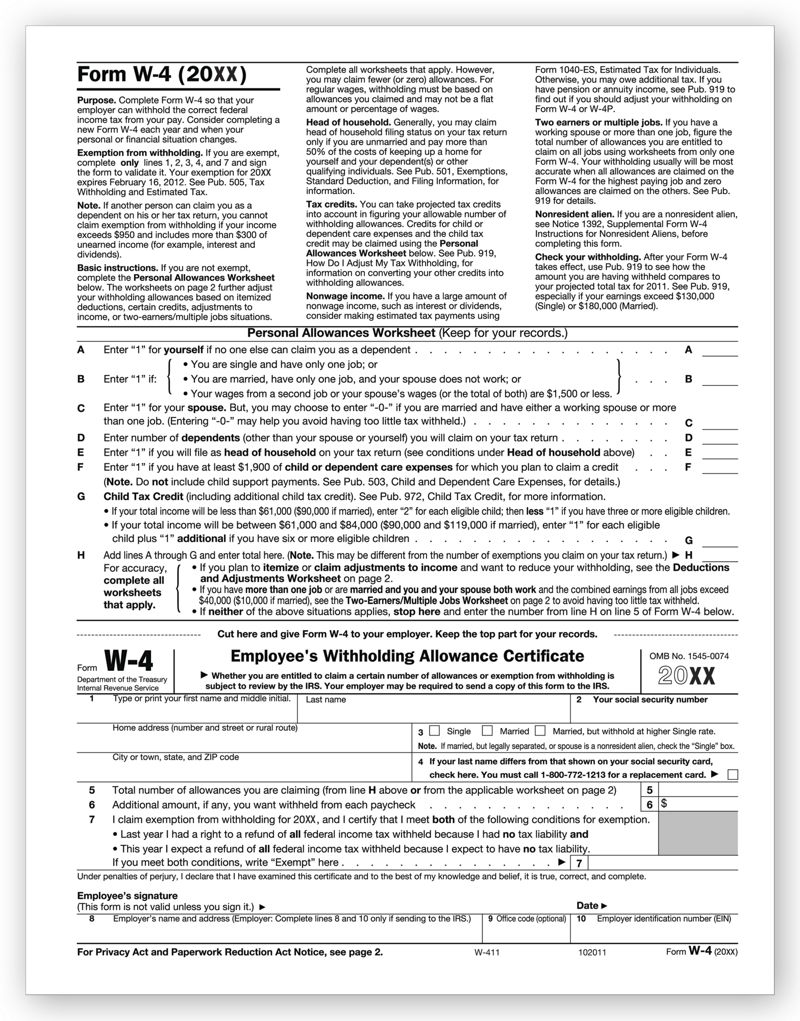

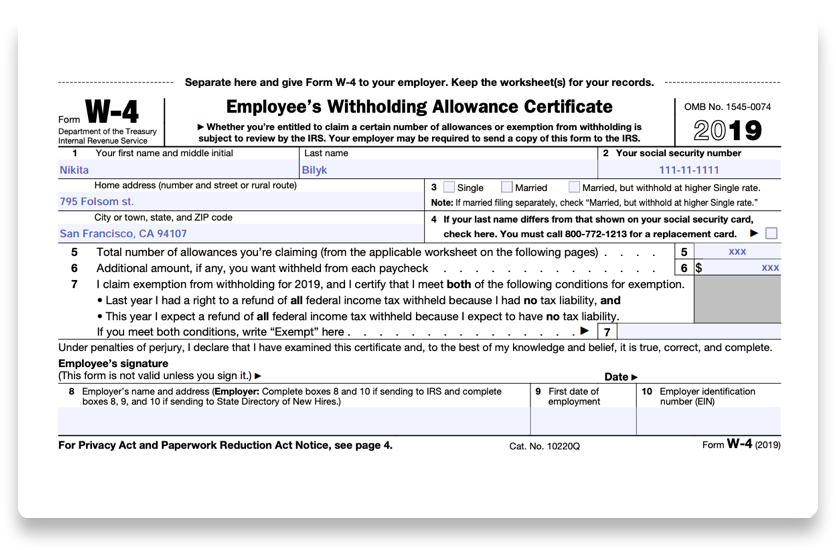

If you choose the option in step 2b on form w 4 complete this worksheet which calculates the total extra tax for all jobs on only one form w 4. The w 4 form is used by employed citizens to provide the irs with details regarding their taxes. You are required to keep form ct w4 in your files for each employee. Mobile and computer friendly.

The form w 4 page is at irsgovw4. It helps employers better understand how much taxes need to be paid for each worker. Printable version of the new w 4 form issued by the irs. Withholding will be most accurate if you complete the worksheet and enter the result on the form w 4 for the highest paying job.

2 your wages and other income including income earned by a spouse during the year.