What Business Receipts Do I Need To Keep

The eight small business record keeping rules always keep receipts bank statements invoices payroll records.

What business receipts do i need to keep. Taking a client out to lunch can be tax deductible but be careful you will need to do more than just keep the receipt. You should keep supporting documents that show the amounts and sources of your gross receipts. Usually the irs audits three years worth of records. In some cases the government may look further back into your records.

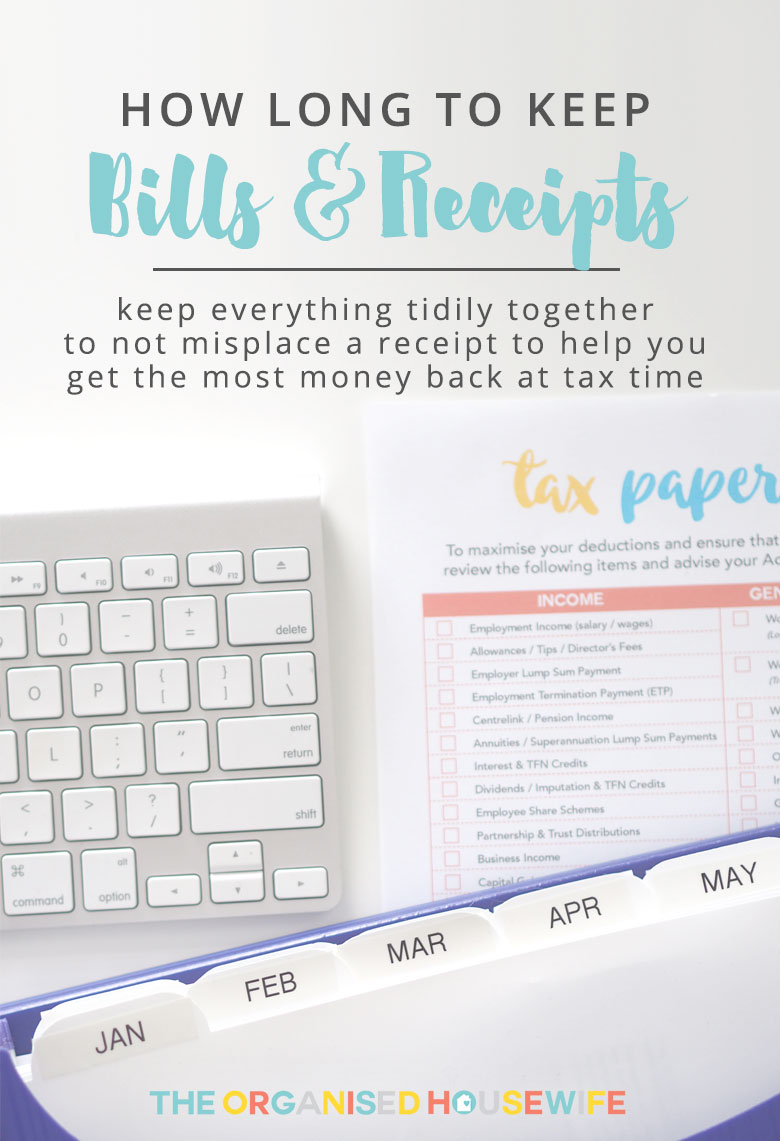

For instance organize them by year and type of income or expense. The following are some of the types of records you should keep. Gross receipts are the income you receive from your business. If youre a w2 worker the tax value of keeping many receipts is relatively low.

For instance if you operate a taco truck you dont have to keep receipts under 75 for pumping gas in the truck but you do need to keep receipts for the ground beef cheese taco shells pots pans skillets serving containers etc. Regardless of the price. Possession of the receipt will expedite any insurance claim. Once youve put on an outfit and taken off the tags.

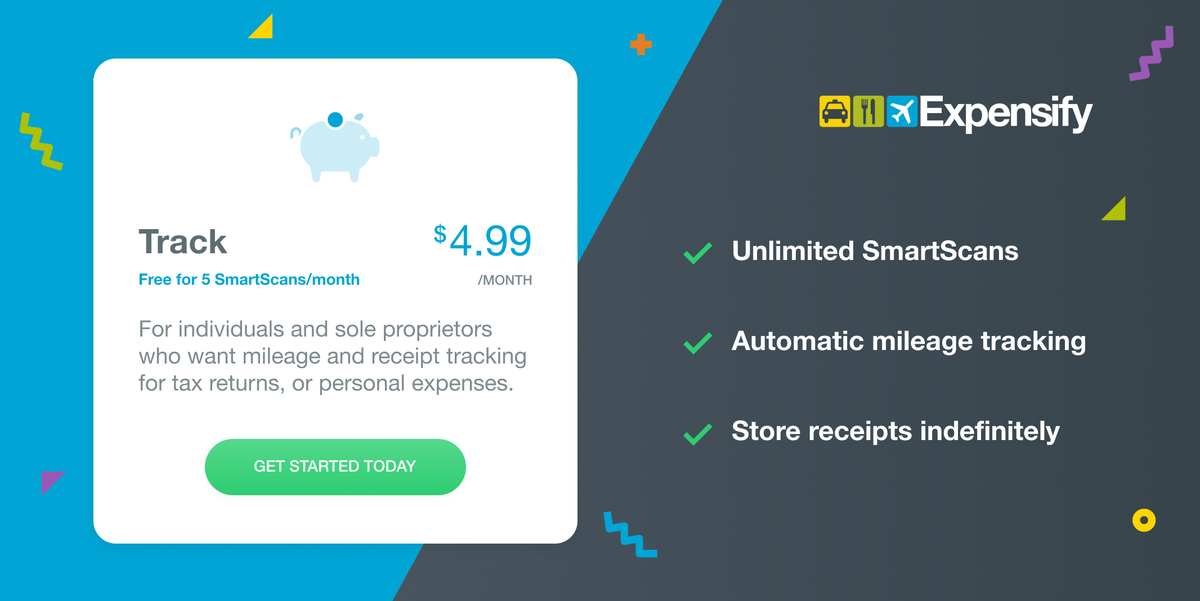

Most supporting documents need to be kept for at least three years. Keep receipts you get for major purchases such as jewelry antiques cars and collectibles. But if youre self employed youll want to keep almost all of them. After that you can get rid of it.

Keep your receipt or the invoice as well as you bank records showing that you paid for any continuing education classes. If you omitted income from your return keep records. Bank and credit card statements 1651 these are all the monthly. If you keep track of where you spend your cash as opposed to using a debit or credit card you may need to note any receipts for cash spending on your money management software.

Some documents you should keep forever. Generally you must keep your records that support an item of income deduction or credit shown on your tax return until the period of limitations for that tax return runs out. What records you really need to keep for your business receipts and bills received 252 the first type of financial paperwork. You will need the receipt to prove the items purchase value in case these items are lost stolen or damaged.

Employment tax records must be kept for at least four years. The types of receipts you should keep depend on what type of taxes youre going to file. Keep your business receipts for at least three years in case you need to show proof of purchases or sales. Atm receipts deposit records 1157 lets move on to deposit records and deposited checks.

You should keep them in an orderly fashion and in a safe place.