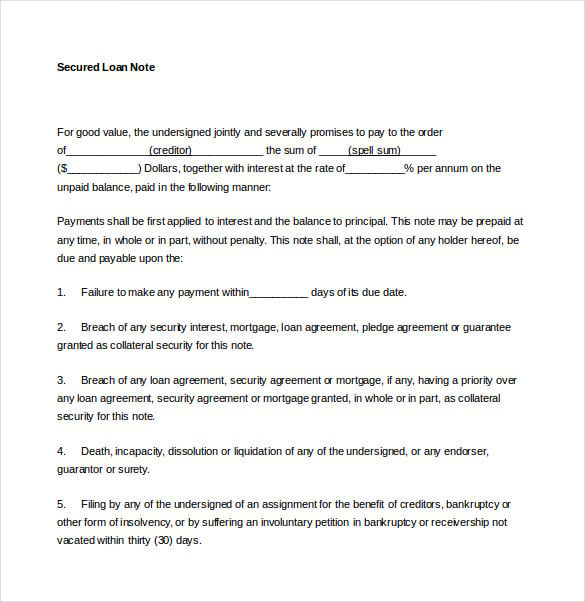

Certificate Secured Loan

Terms is based on maturity date of certificate.

Certificate secured loan. Two types of certificate loans exist. The funds are kept in the share for a specific period of time based on the terms of the loan. Certificate secured loans fixed interest rate equal to 250 above the certificate rate rounded to the nearest higher quarter percentage point certificate rates. Borrow against your certificate to avoid early withdrawal penalties and continue to earning interest on your investment all while paying low rates.

To apply for a certificate. Members can save even more by avoiding penalty for early withdraw of funds. Want to avoid an early withdrawal penalty. This greatly reduces the risk to the lender.

Installments and lines of credit. What is a certificate secured loan. The loan term may not exceed the maturity date of the certificate. Certificate secured loan if you have money tied up in a share certificate oe federals certificate secured loan can get you extra cash.

With a certificate loan the term of the loan must be equal to or shorter. This greatly reduces the risk to the lender. A certificate secured loan from cenla federal credit union is the perfect solution. Secure an affordable loan by borrowing against your america first certificate account.

America first offers low interest rates as low as 30 above your certificate dividend and flexible repayment terms that match your accounts maturity. A great loan for those who. A certificate secured loan is a personal loan that allows you to borrow against your savings account certificate with a credit union. You will provide the certificate as collateral and then you will be able to borrow a certain amount of money.

A cd loan allows you to use your nest egg to secure a low rate for a loan while your cd continues to earn money. Types of certificate loans. Want a fixed monthly payment. A certificate secured loan is one way to build or rebuild your credit profile by effectively taking a loan against your own money.

A certificate secured loan is a loan provided through a credit union that is secured by the amount available on deposit in the borrowers share account. Only certificates with a 6 month term or more may be pledged as.

/GettyImages-955530262-5bd87bb1c9e77c00518d6332.jpeg)