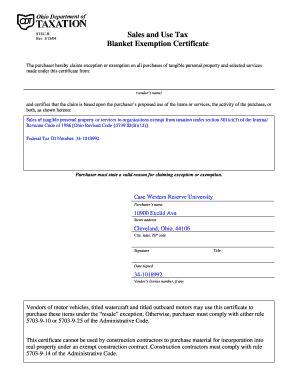

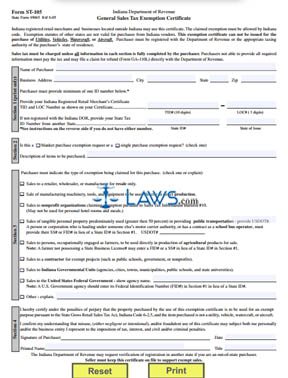

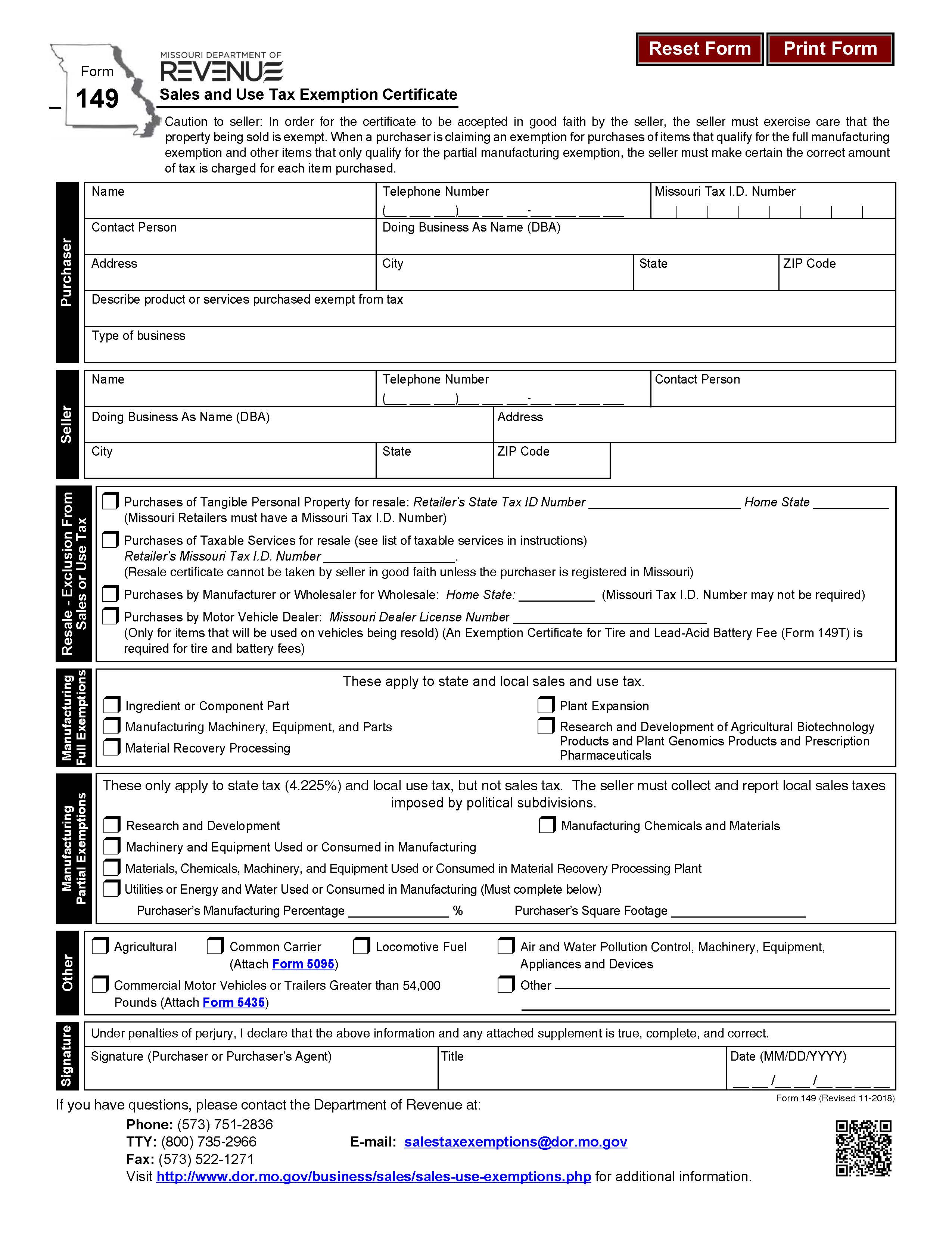

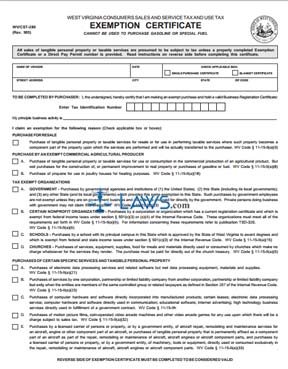

Exemption Certificate Form

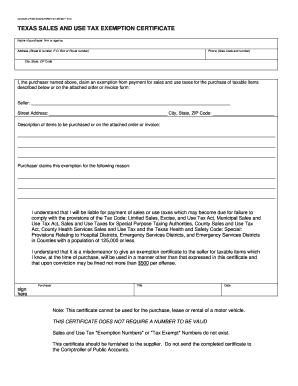

The purchaser fills out the certificate and gives it to the seller.

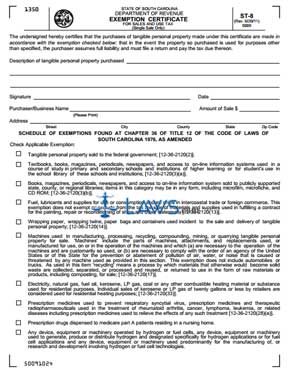

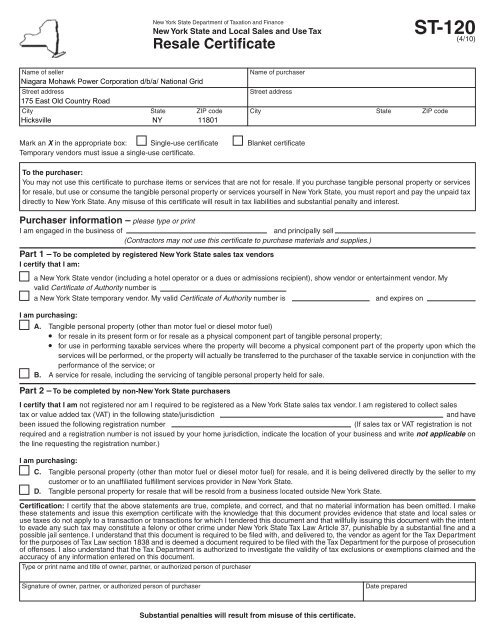

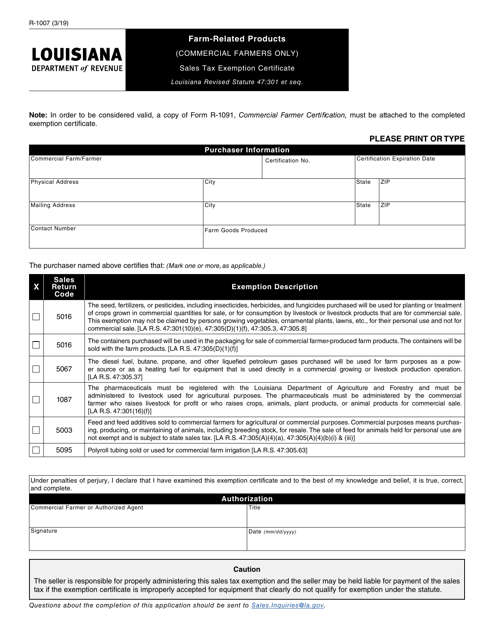

Exemption certificate form. This form may be used in conjunction with form rev 1715 exempt organization declaration of sales tax exemption when a. If this certificate is not completed you must charge sales tax. Mexican states in their present form or attached to other taxable items to be sold. Do not return this form to the pa department of revenue.

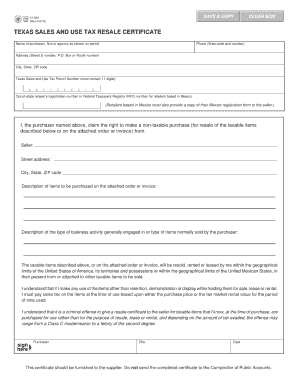

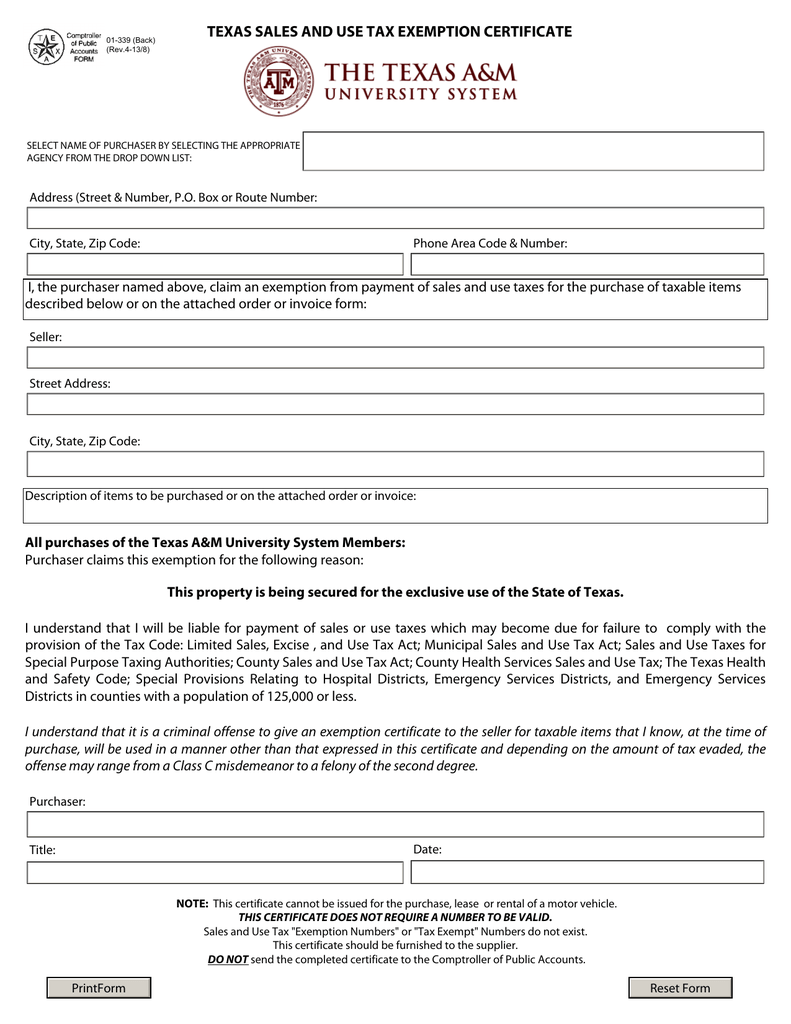

Form st3 certificate of exemption purchaser. I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that i know at the time of purchase will be used in a manner other than that expressed in this certificate and depending on the amount of tax evaded the offense may range from a class c misdemeanor to a felony of the second degree. Popular for tax pros. Certificates are available on the vermont of taxes website to entities eligible for exemptions or for exempt purchases.

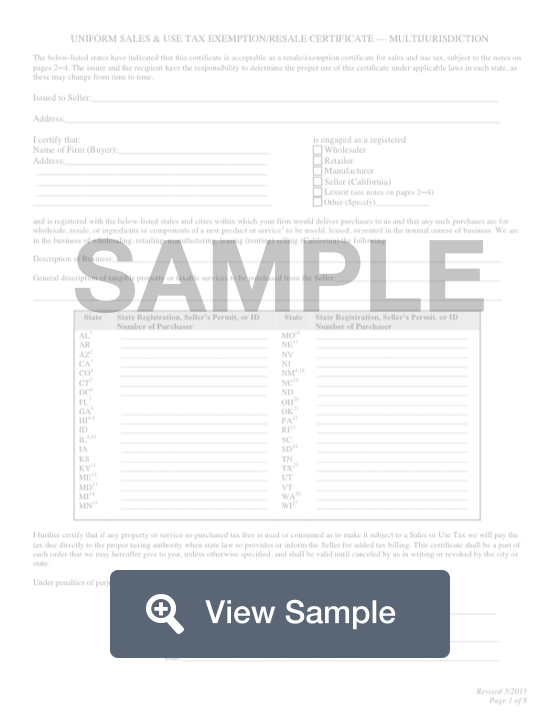

This is a blanket certificate unless one of the boxes below is checked. Machinery and equipment parts tools and supplies used or consumed in the production. Tax forms and instructions used by tax exempt organizations. New york state and local sales and use tax exempt use certificate please read the instructions on pages 3 and 4 for more information on each exemption and mark an x in the applicable boxes next to the exemptions you are claiming.

Exemption certificates for sales tax tax bulletin st 240 tb st 240 printer friendly version pdf issue date. The seller or lessor must retain this certificate for at least four years from the date of the exempt sale to which the certificate applies. 01 339 sales and use tax resale certificate exemption certification. This certificate remains in force as long as the.

Sales and use tax exemption for purchases made under the buy connecticut provision. Employers quarterly federal tax return. Keep this certificate as part of your records. Enter the appropriate number.

See this list in the nebraska sales tax exemptions chart. Most nonprofit organizations are not exempt from paying sales and use tax. Employers engaged in a trade or business who pay compensation. I understand that if i make any use of the items other than retention demonstration or display while holding them for sale lease or rental.

Contractors exempt purchase certificate for a renovation contract with a direct payment permit holder. Complete this certificate and give it to the seller. Sales and use tax exemption for purchases by qualifying governmental agencies.