First Time Home Buyer Budget Worksheet

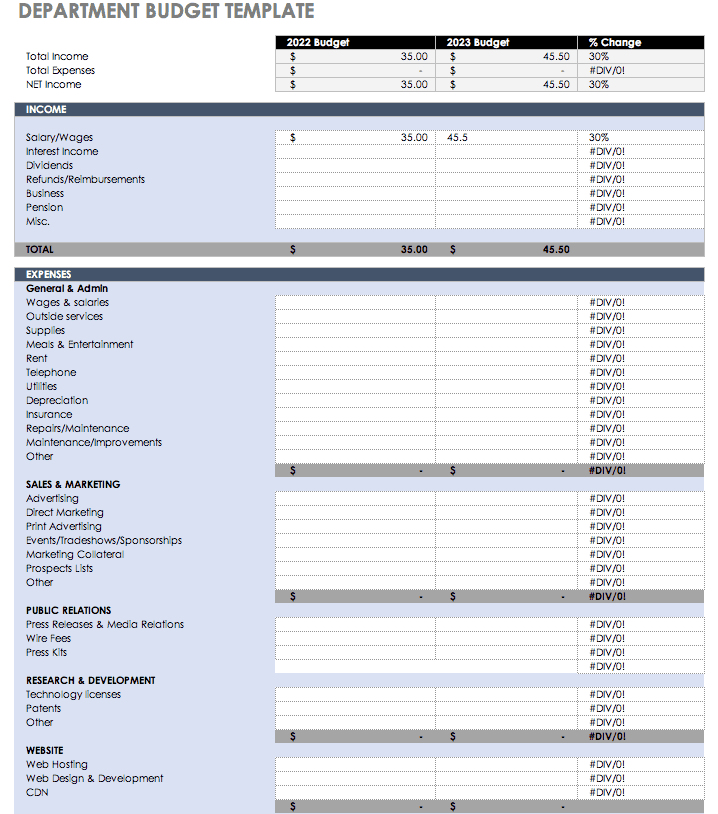

It includes detailed budget calculations home features checklists and comparison tools.

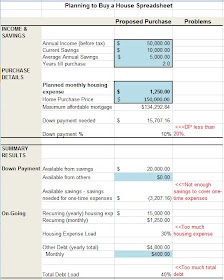

First time home buyer budget worksheet. Use this handy worksheet below to estimate what you may be able to afford. Homebuying step by step. The first question new homebuyers ask is can i afford to own a home. This worksheet helps you.

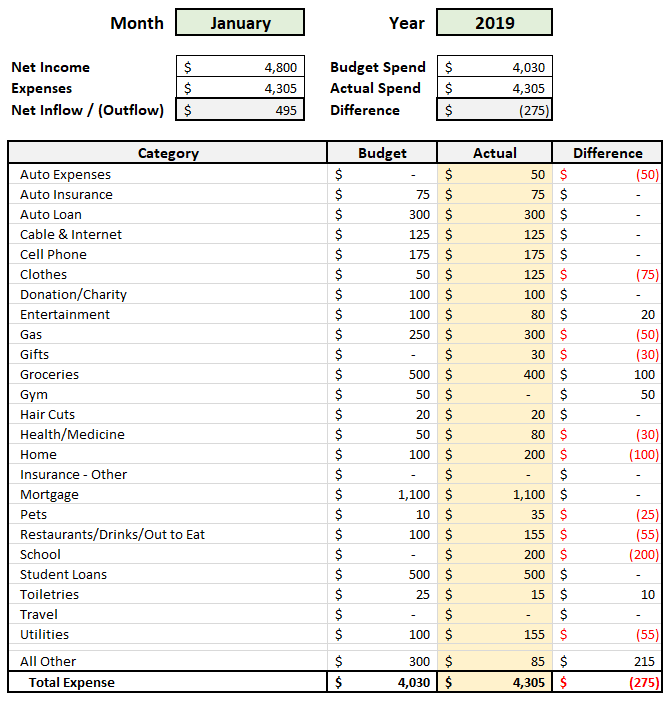

If your monthly budget results in a negative sum then you should take the time to consider your spending. Top tips for first time home buyers purchase like an experienced pro. Ah the first time home buyer budget. It takes a lot of careful planning and thought to buy a house not to mention a lot of money in some instances.

Calculate what youll need to cut back. If you cant make the numbers work month to month with your mortgage then theres no point in even thinking about buying a new home until youre financially ready. Building a budget to support a monthly mortgage payment c2020 vanderbilt mortgage and finance inc. This worksheet will only give you an idea of what you can afford.

Wondering if your budget will support a monthly mortgage payment. Account for all monthly expenses. These 18 tips will help you level the playing field. Your monthly budget worksheet.

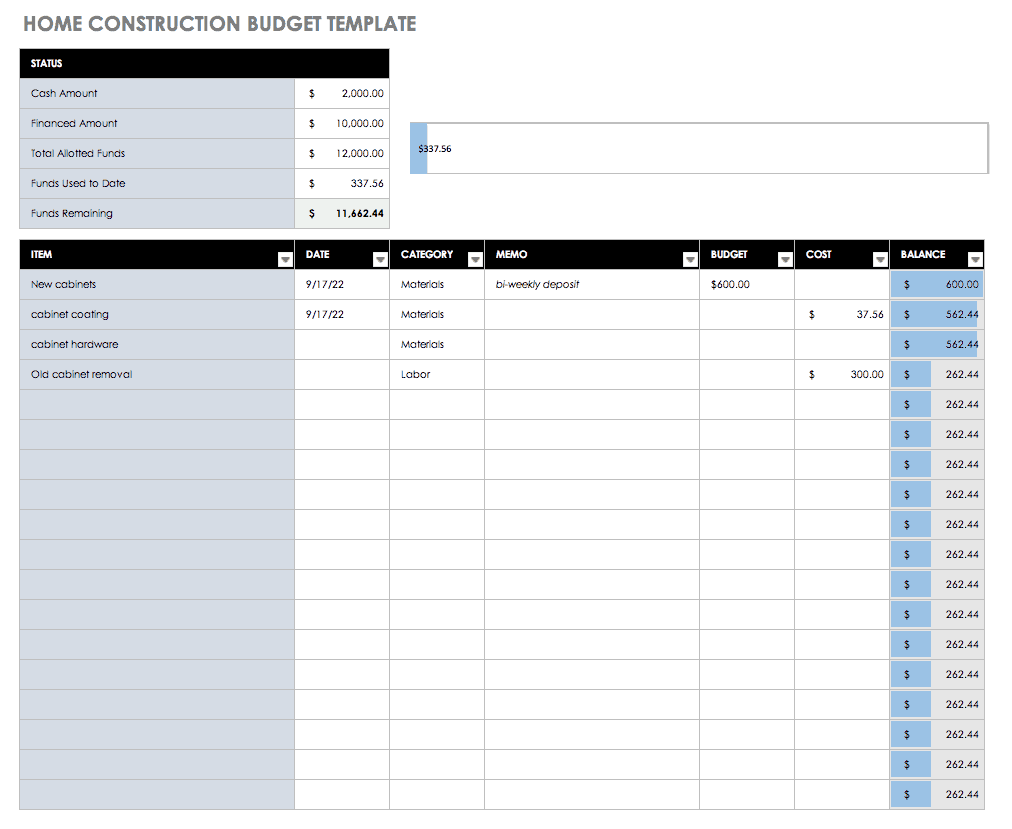

Reach your savings goal in a timely manner. Budget for buying a house. Click to download the monthly income worksheet 13. Click to download each worksheet below to 1 document your monthly income 2 track your expenses and 3 build a complete monthly budget.

Includes free buyers guide. Looking to buy a new home. Our monthly budget worksheet will help you determine just how much. To prepare you for your first big purchase brunswick crossing created a monthly budget worksheet specifically designed for buying a new home.

Figuring how much youre able to afford when buying a new home is incredibly important. How to build up a first time home buyer budget. At the end of the first section you will use the amount you determined in the second section and the amounts you determined in the first section to calculate your savings goals. This is the companion workbook to our homebuying guide.

You can use the budget worksheet to plan for your new home and also to help you save the money needed to get there. Develop a family budget instead of budgeting what youd like to spend use receipts to create a budget for what you actually spent over the last six months. Our budgeting resources can help you find out and stay in the green. One advantage of this approach is that it factors in unexpected expenses such as car repairs illnesses etc as well as predictable costs such as rent.

Is there anything you could cut back on. This workbook provides worksheets calculators and checklists for each step in the homebuying process. If not you may want to consider looking for a more budget friendly home.