Gas Receipts For Tax Deductions

The internal revenue service allows you to claim unreimbursed business expenses as a deduction if you itemize your deductions.

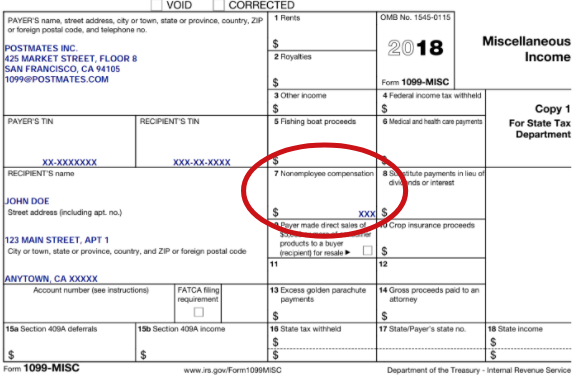

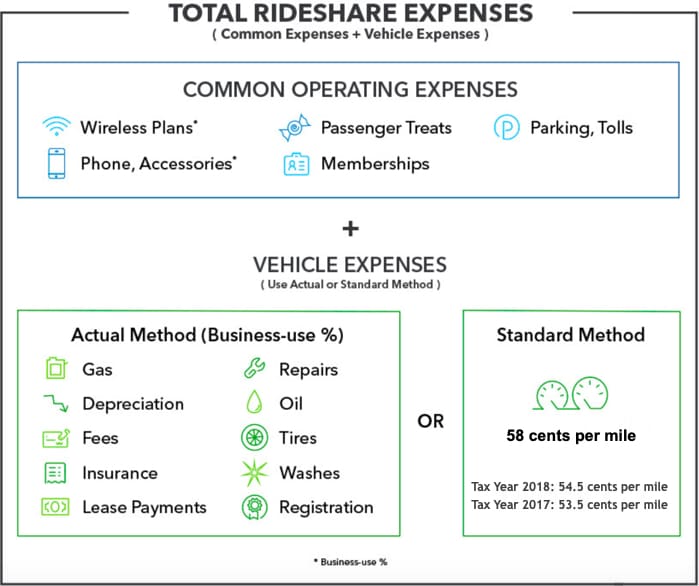

Gas receipts for tax deductions. Generally you cant make tax claims without receipts. I have gas receipts. 1 actual expenses this is where you take the actual expenses gasinsurance repairsmaintenance interest and depreciation. Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products you can count on hr block to help you with the gas tax deduction and other matters unique to your own life situation.

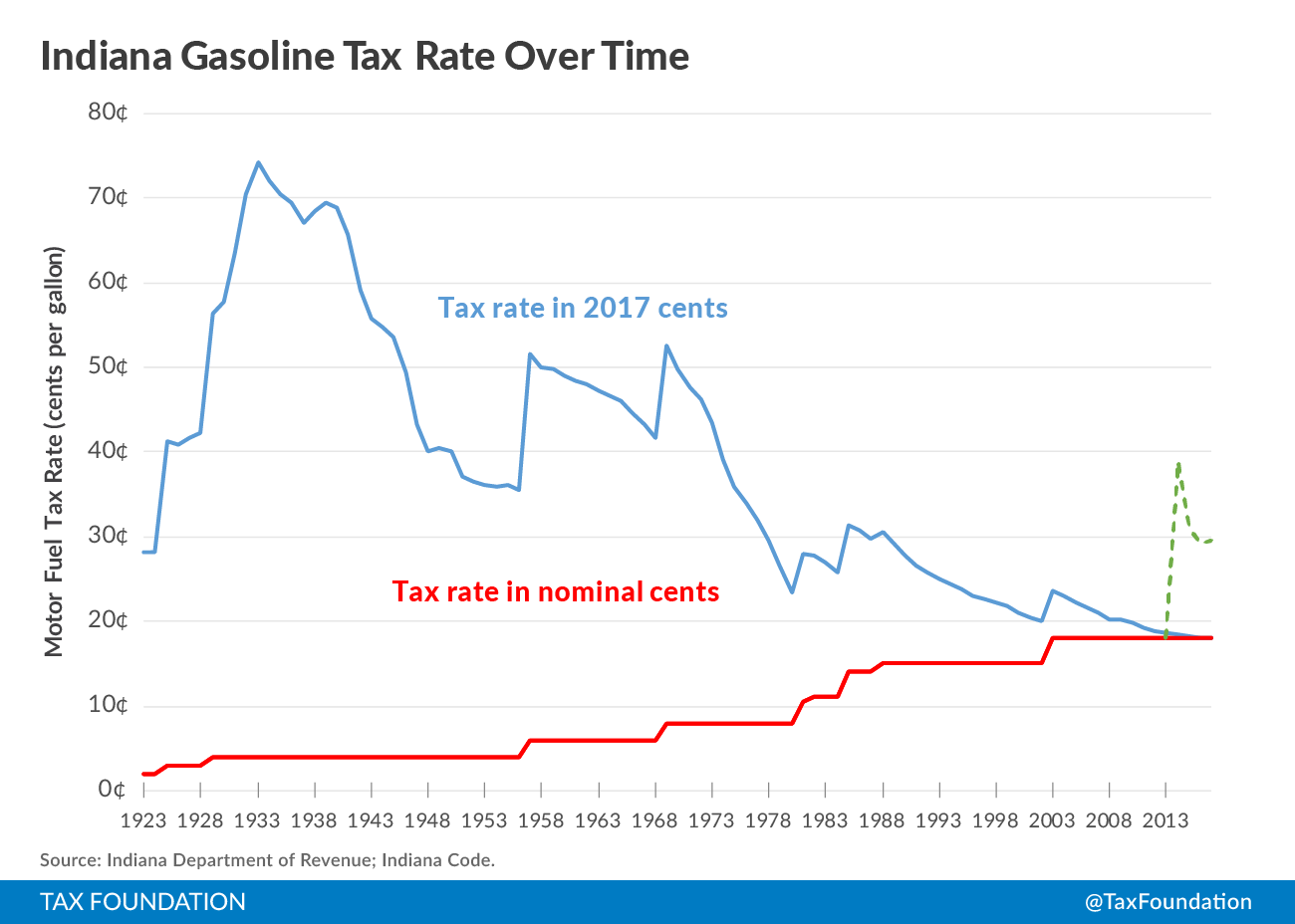

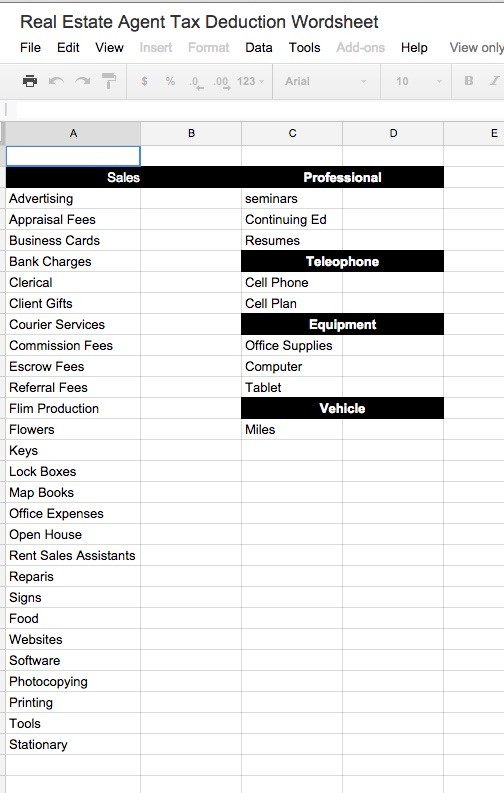

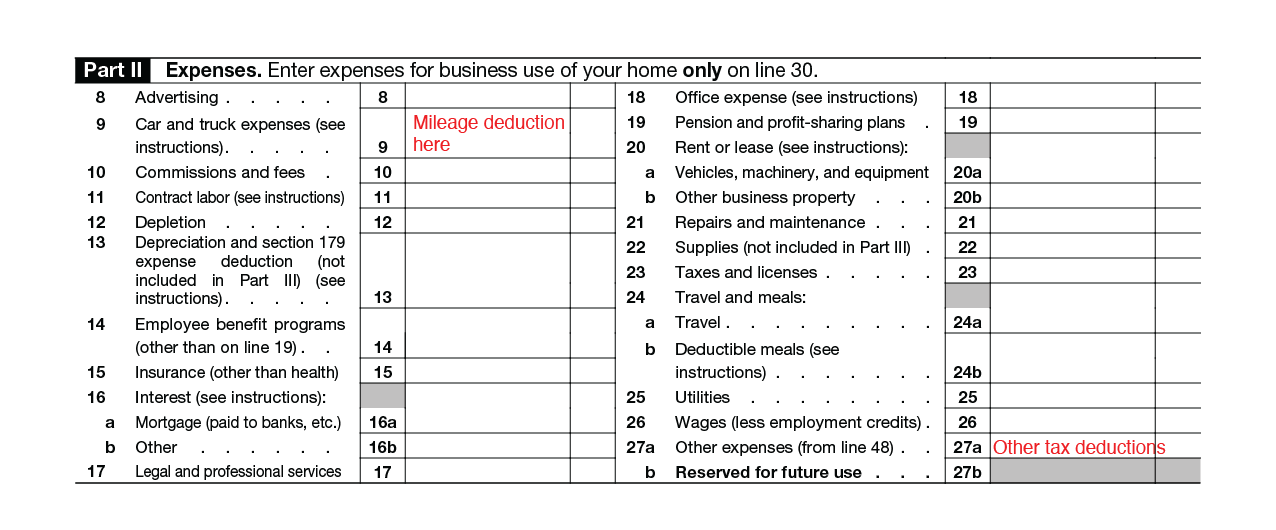

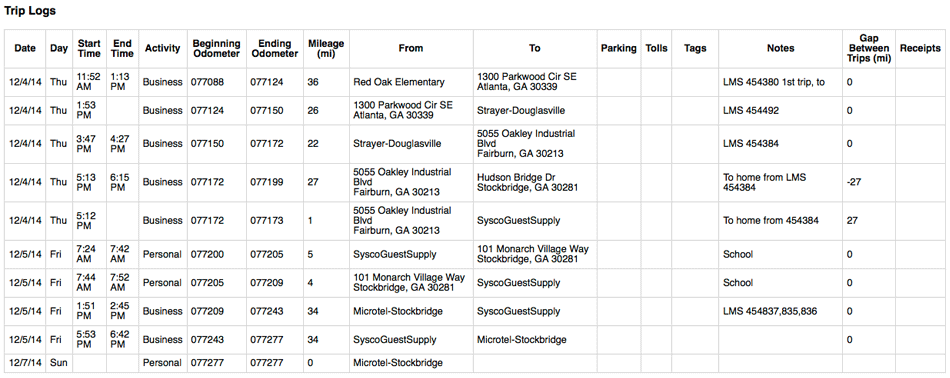

You dont get to write off gas tax as an itemized deduction by itself. Gas receipts for business expenses. Mileage or gas receipts for tax deductions although you are able to deduct certain driving related expenses on your taxes commuting is not one of them. All of your claimed business expenses on your income tax return need to be supported with original documents such as receiptswithout the evidence from receipts for your claimed business expenses the canada revenue agency cra may decide to reduce the number of expenses you have deducted.

Typically the deduction of sales tax only benefits a person with one or more large purchases for the tax yearsuch as a car boat rv or home additionthat led to a greater amount of sales tax paid than the amount of income tax withheld. The gas tax credit isnt the only tax change to impact south carolina this year. More help on the gas tax deduction. How can i input them.

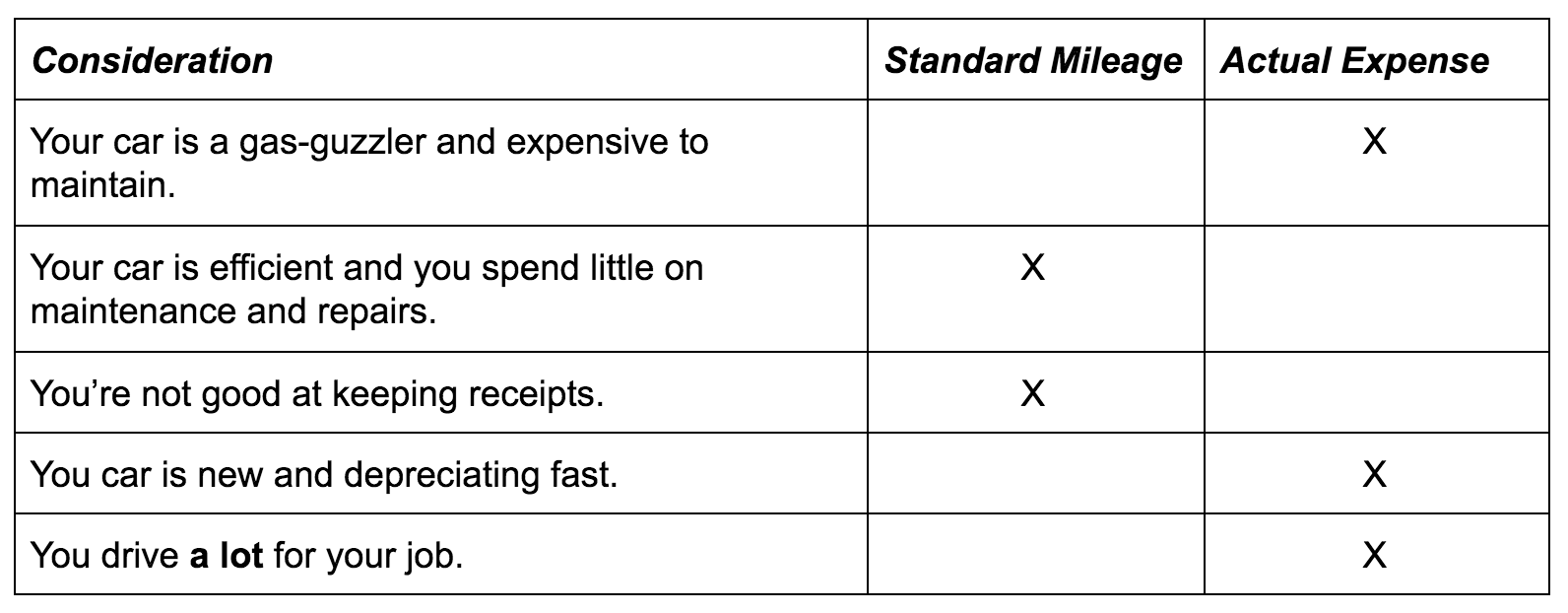

Any resident paying for a student to go to a south carolina college may claim a deduction for 50 of tuition up from 25 for a maximum deduction of 1500 a year. How can i use my gas receipts oil changes and mileage for deductions. There are two options the irs gives people when it comes to car and mileage deductions. The following also went into effect january 1.

Please see the steps below to enter your receipts. The irs typically requires that you keep documentation of all actual car expenses such as receipts for gas and oil purchases canceled checks or bank statements for lease and loan payments and essentially for any expense you include in your car expense deduction. Can gas tax be deducted on an itemized deduction. If you meet this description youll want to save all sales receipts.

Keeping receipts documentation.

/CommonTaxDeductionsScottOlsonStaffGettyImages-56a580365f9b58b7d0dd3010.jpg)