How To Log Receipts For Taxes

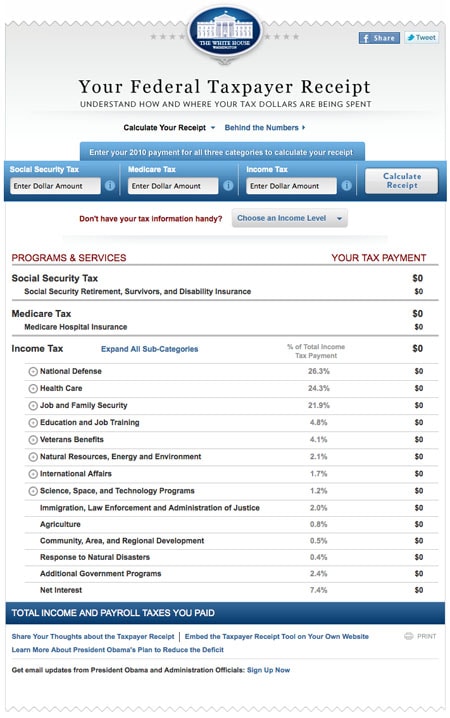

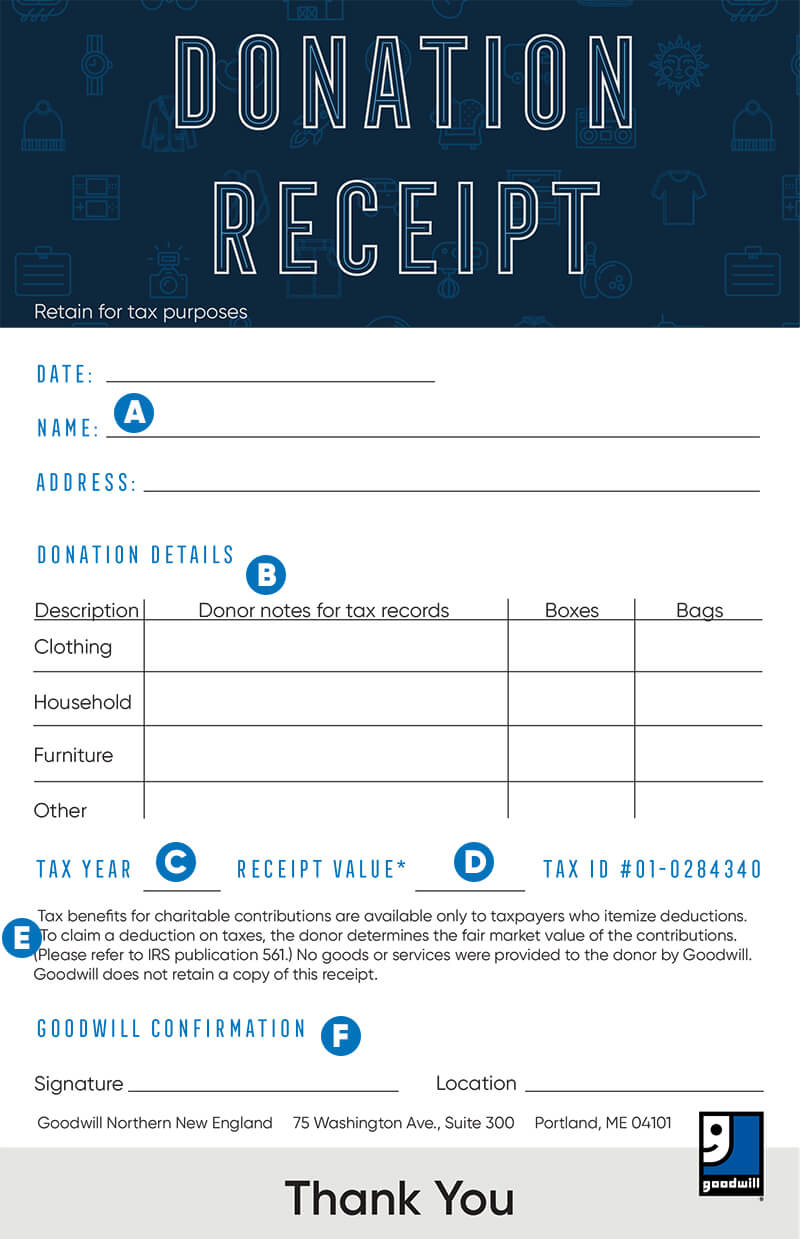

How to create a 501c3 compliant receipt using donorbox.

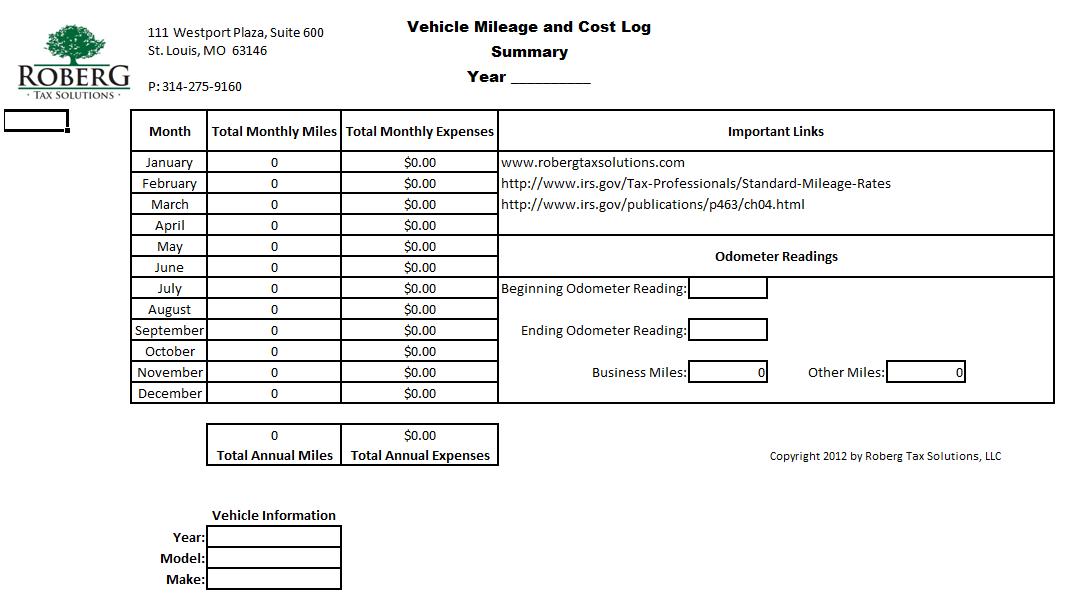

How to log receipts for taxes. Any receipt pay check or important documents are now captured on your phone. If you deducted the cost of bad debt or worthless securities keep records for seven years. Tap to select or add key information use your own custom drop down menus. Scan receipts and keep them at least six years.

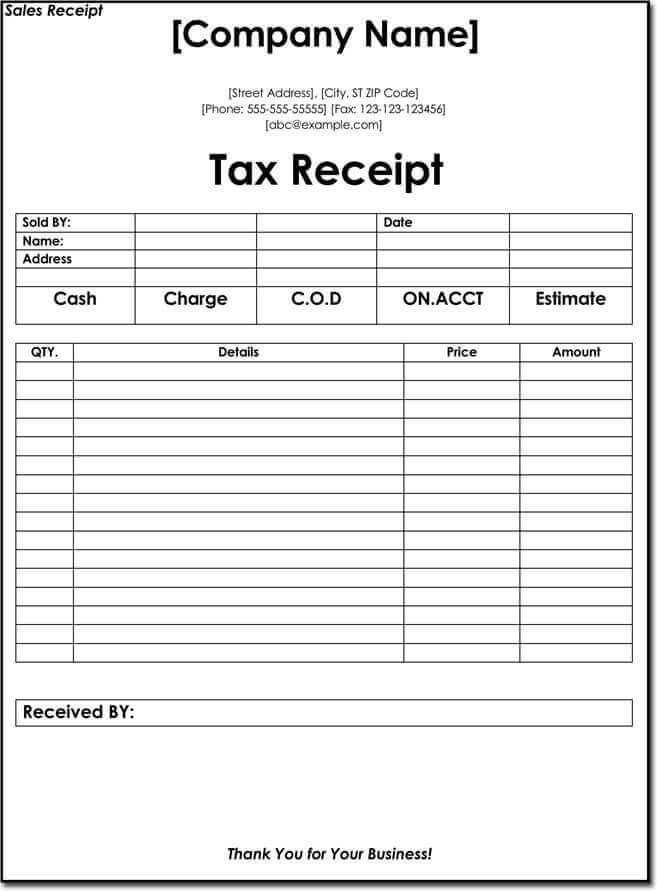

Organizations using donorbox our powerful and effective donation software can very easily generate 501c3 compliant tax receipts. Tap to capture a receipt. When you pay for anything work related keep your receipt and put it in your tax folder. Send your record to your email your cloud service.

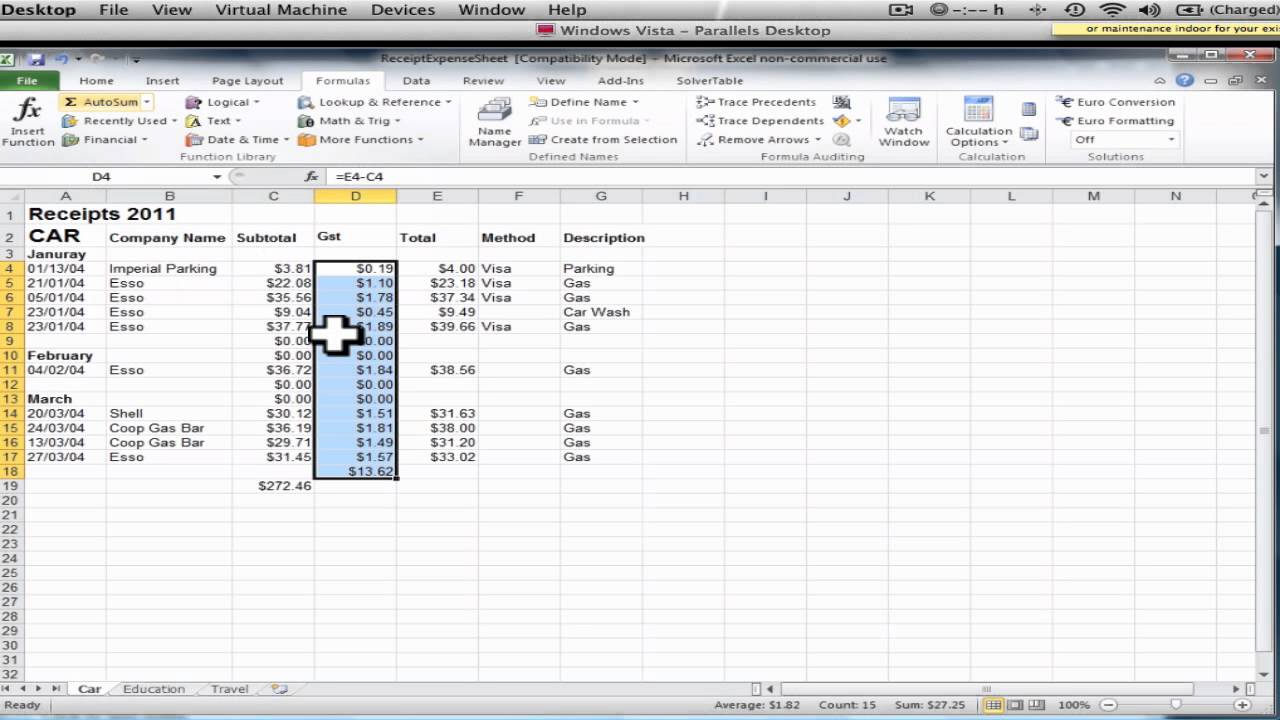

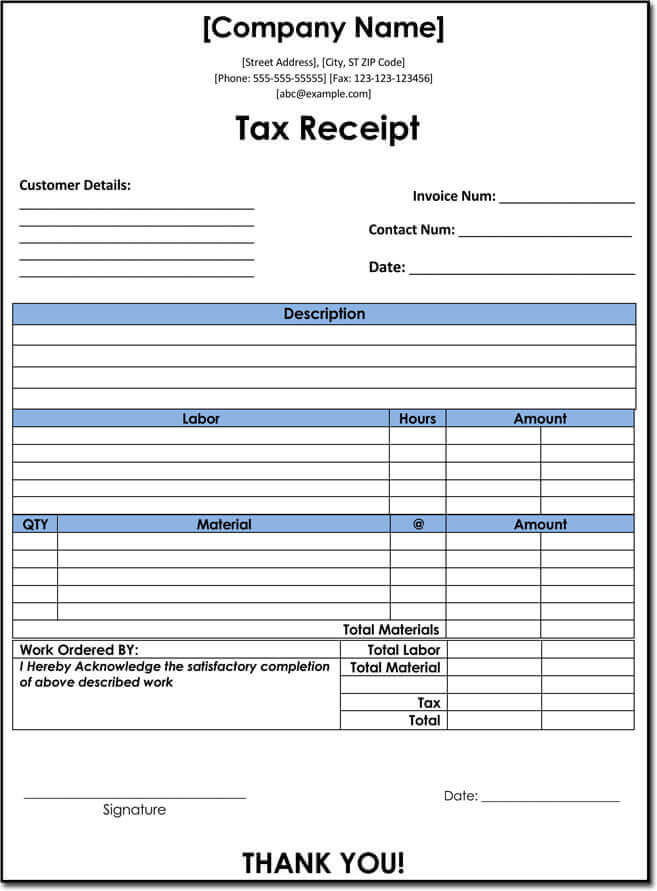

When where and what are generally found on a receipt which is why the irs loves when you keep them. Choose the accounting tab from the vertical menu. But nothing is worse than a huge bulging disorganized folder full of a years worth of receipts. Employment tax records must be kept for at least four years.

Determine the most appropriate category or subcategory for each receipt. This includes both receipts for every individual donation and consolidated receipts of the entire year of donations. Most supporting documents need to be kept for at least three years. Thats it youre done.

The irs allows taxpayers to scan receipts and store them electronically. As you sort through the receipts look at the date on each and remove any that are not for the current year. This is an iphone android and ipad app that also has a desktop feature. And be sure to keep a diary about how much time you spend working at home.

If you work from home even only occasionally keep your invoices for the telephone power water internet and office supplies. If youre looking to lower your taxable income and increase your potential for a tax refund a great place to start may be by looking at the purchases you already make and the bills you already pay each year. With its built in camera and gps simply 1. Yes the irs can come knocking for documentation and audit you up to six years back in some cases.

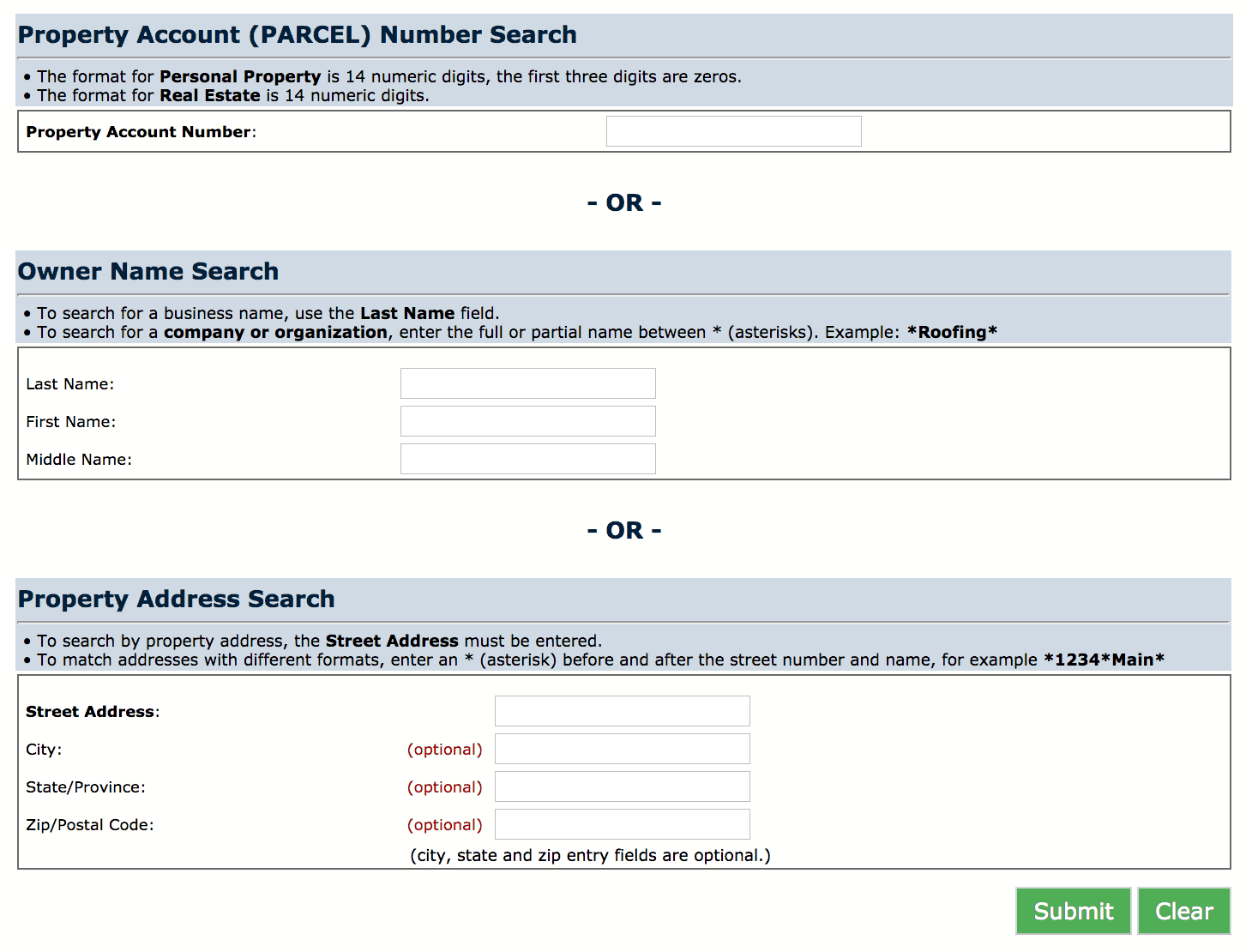

Compile a set of files for each tax year. If you omitted income from your return keep records for six years. Fill in the form and click save. Start at the top of your unsorted pile of receipts and handle each only once.

However hoping that the ink on your home depot receipt hasnt faded away is a whole other issue. Knowing which receipts to save and which to toss will help you maximize your tax refund while minimizing the amount of paperwork you have to save for tax time each year.