Printable Federal Tax Forms

You can find free fillable federal tax forms at the website of the irs or you can use online tax filing to supply the correct tax forms for you automatically.

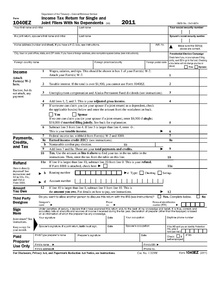

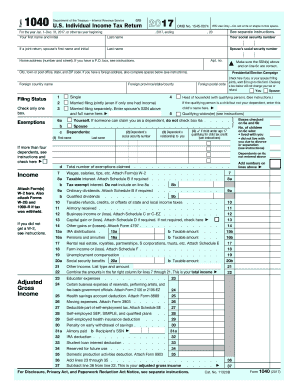

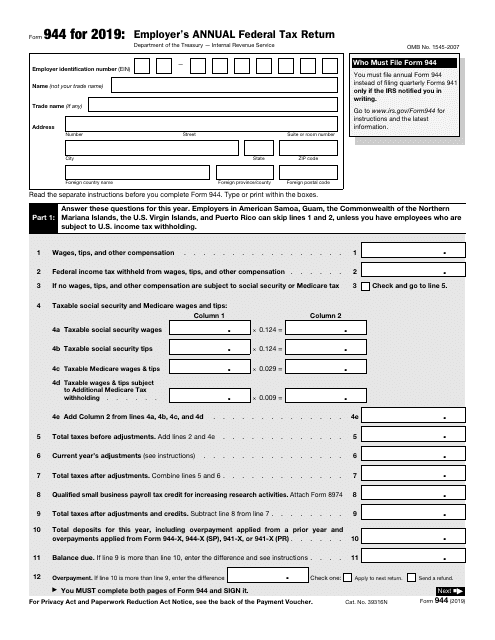

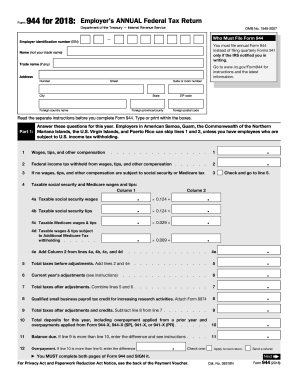

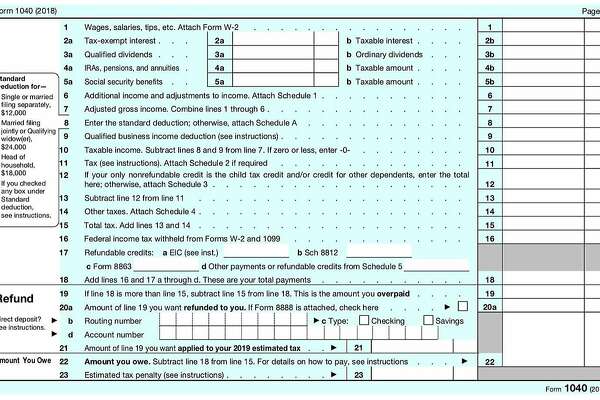

Printable federal tax forms. The current tax year is 2019 with tax returns due in april 2020. You can be assured you are preparing and filing the correct tax form by using online tax software. Get the right irs tax forms automatically. For tax year 2018 you will no longer use form 1040a or form 1040ez but instead will use the redesigned form 1040.

This form is for income earned in tax year 2018 with tax returns due in april 2019. Federal tax filing is free for everyone with no limitations and state filing is only 1499 1295. We will update this page with a new version of the form for 2020 as soon as it is made available by the federal government. Instructions for form 1040 us.

Individual income tax return 2018 01252019 form 1040 pr planilla para la declaracion de la contribucion federal sobre el trabajo por cuenta propia incluyendo el credito tributario adicional por hijos para residentes bona fide de puerto. Us individual income tax return. Forms and publications pdf instructions. Join the millions of taxpayers who have filed securely using freetaxusa.

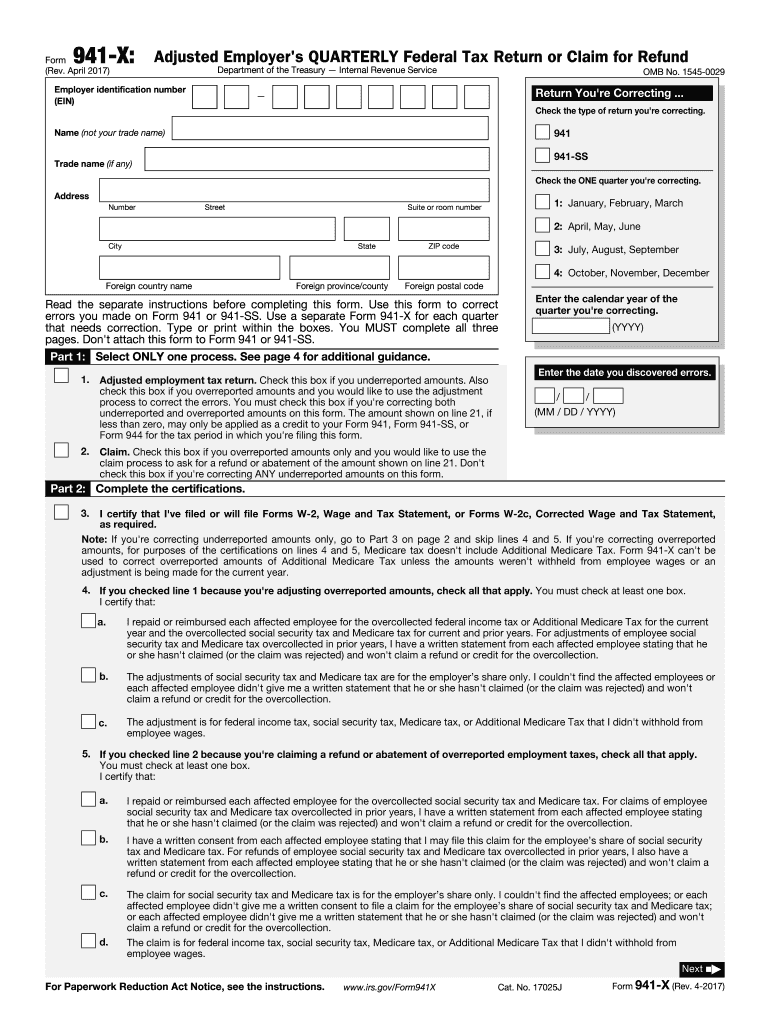

Printable 2019 federal income tax forms 1040 1040sr 1040ss 1040pr 1040nr 1040x instructions schedules and more. Many people will only need to file form 1040 and no schedules. Federal printable income tax forms 775 pdfs. The current tax year is 2018 and most states will release updated tax forms between january and april of 2019.

Join the millions of taxpayers who have filed securely using freetaxusa. Printable 2019 federal tax forms are listed below along with their most commonly filed supporting irs schedules worksheets 2019 tax tables and instructions for easy one page access.

/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)