How To Write A Donation Receipt

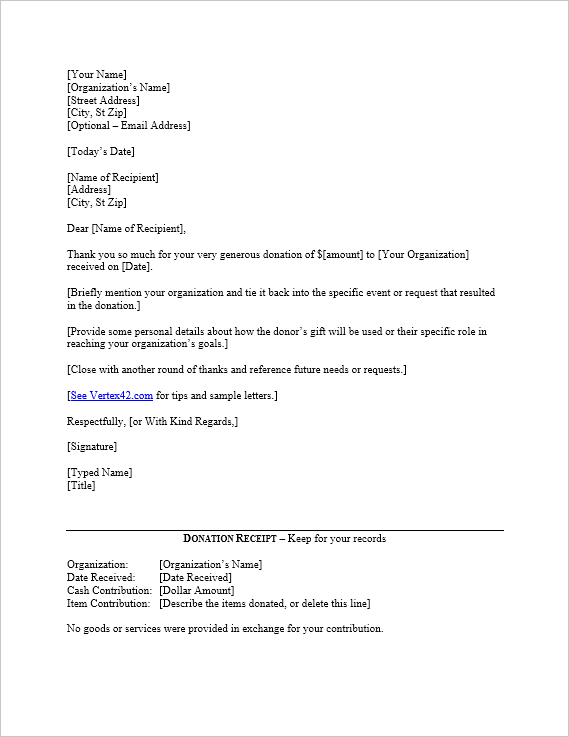

Select this template to you help you get started with a personalized thank you letter for a donation received.

How to write a donation receipt. The letter should specify the date amount and other details if any in the letter. The letter should specify further notifications in this regard to the donor. Tips to write a donation receipt letter. You can also use it to help with sponsorship thank you letters.

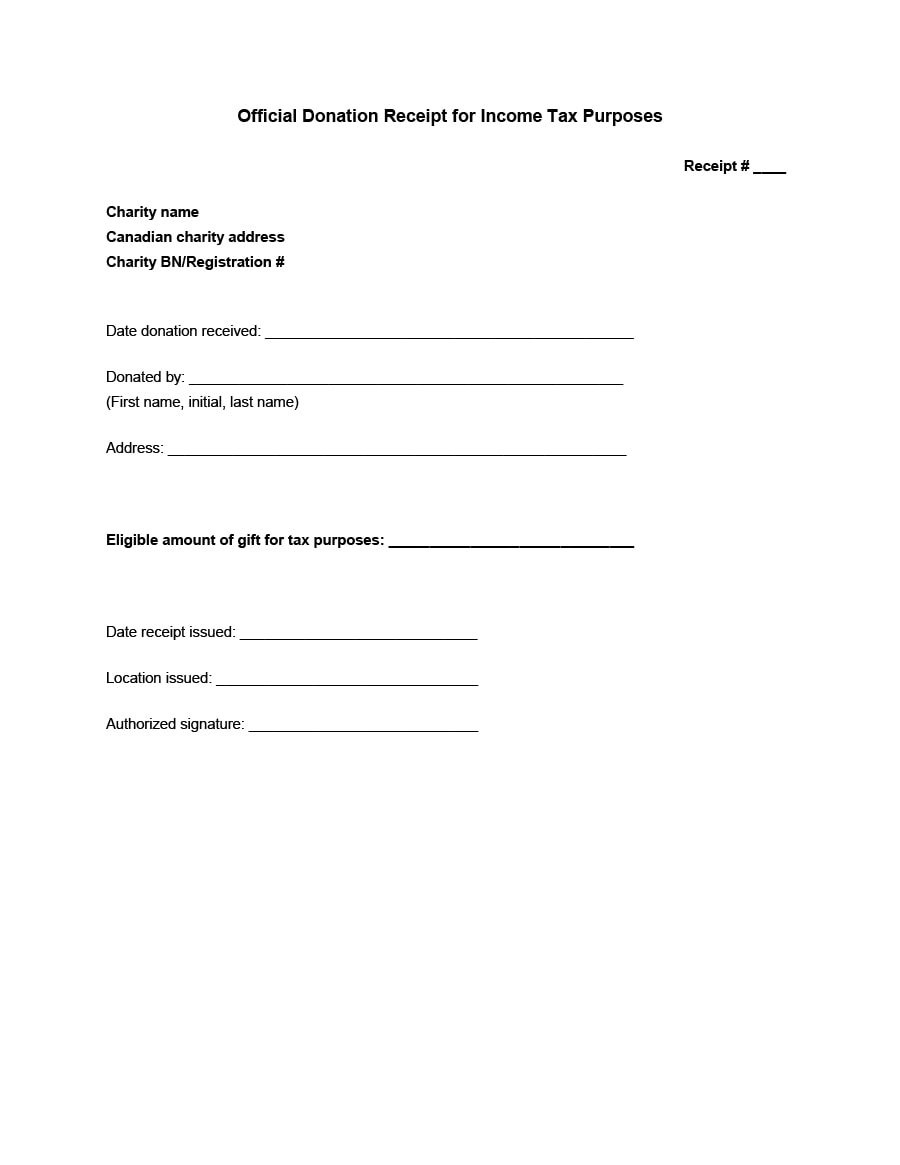

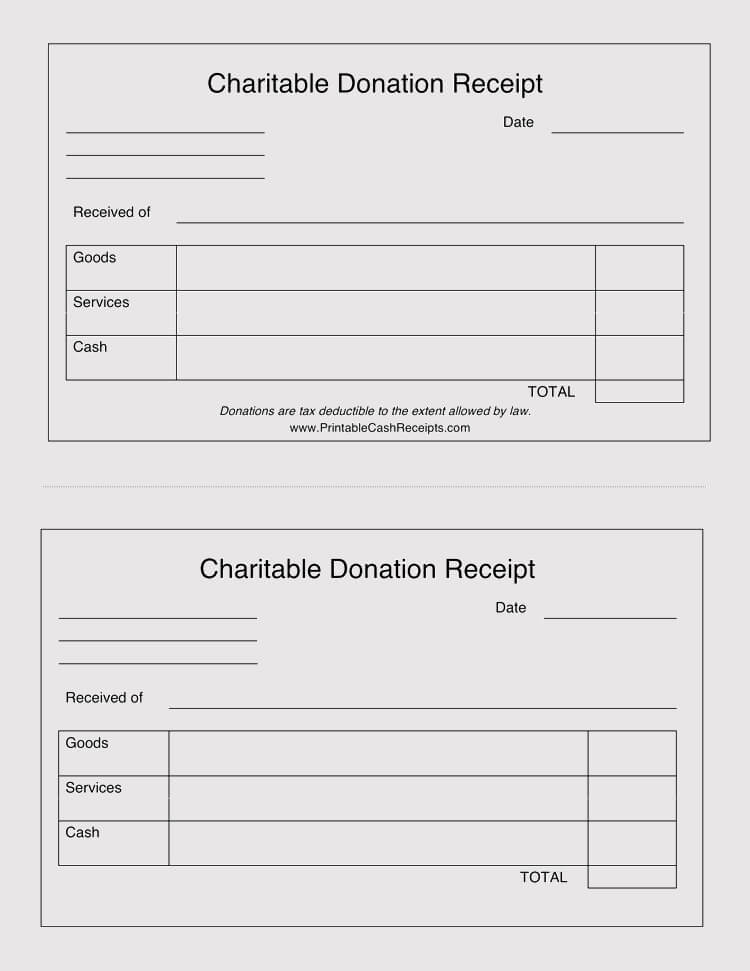

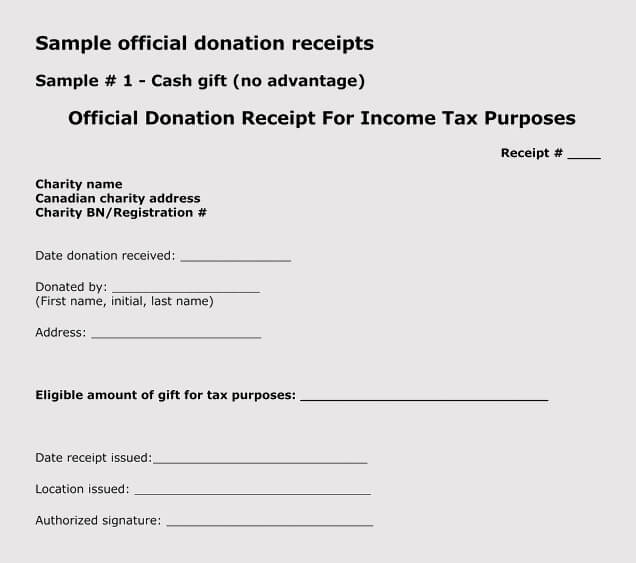

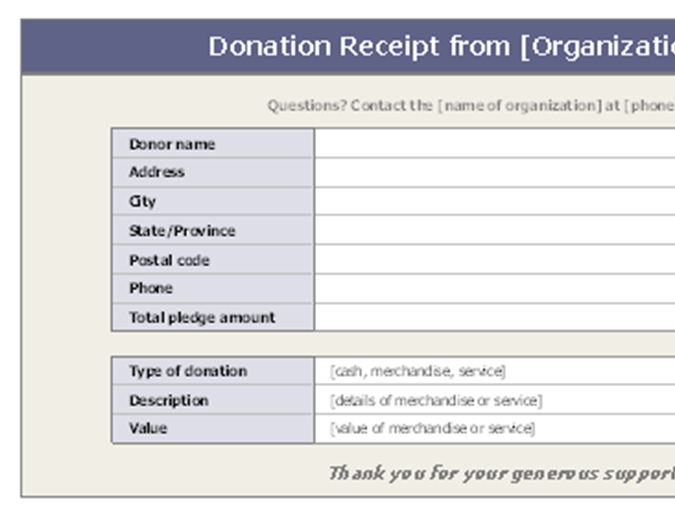

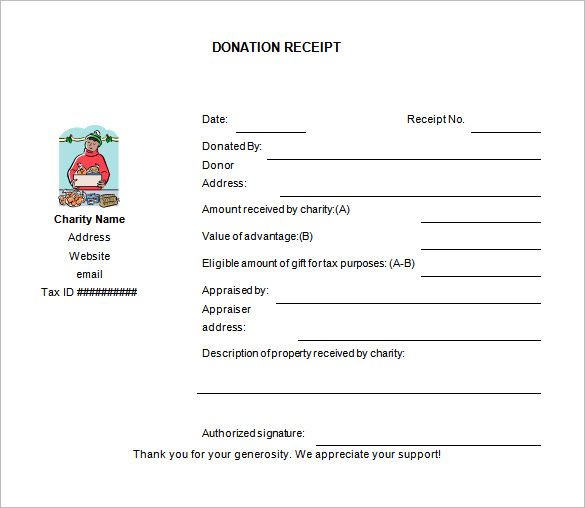

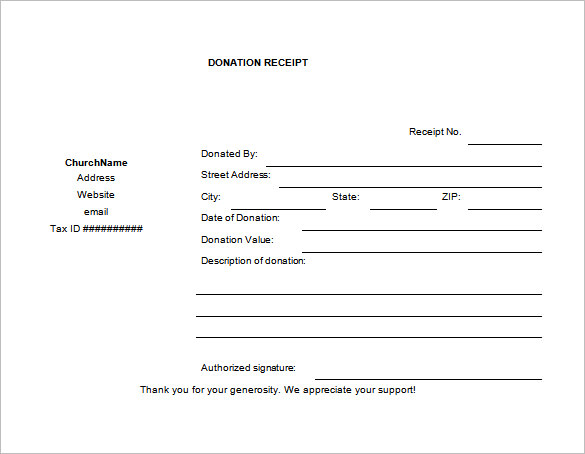

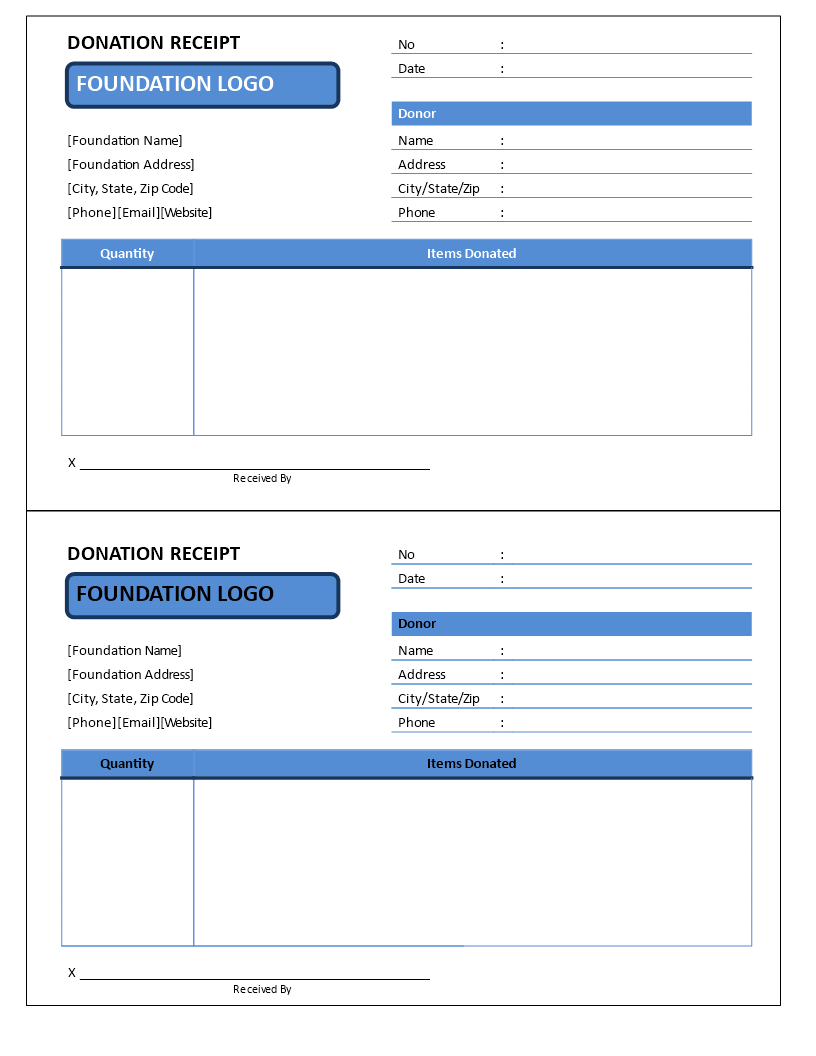

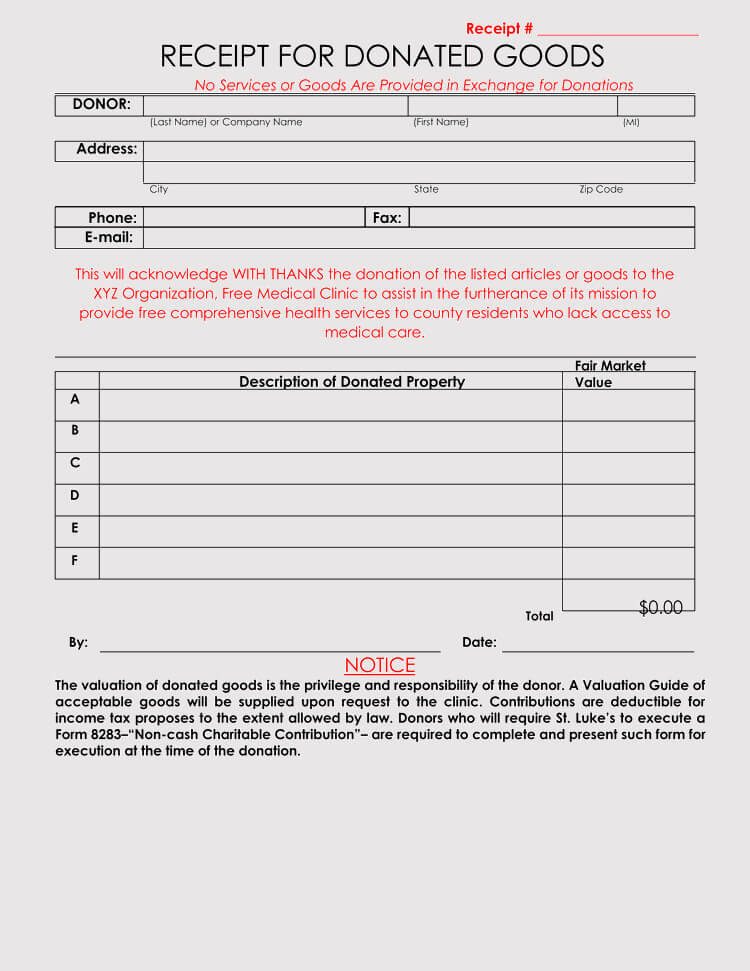

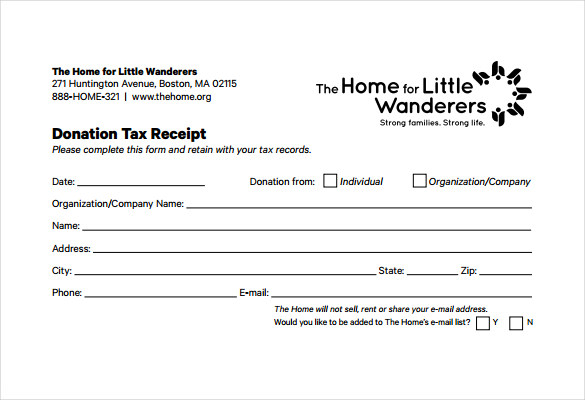

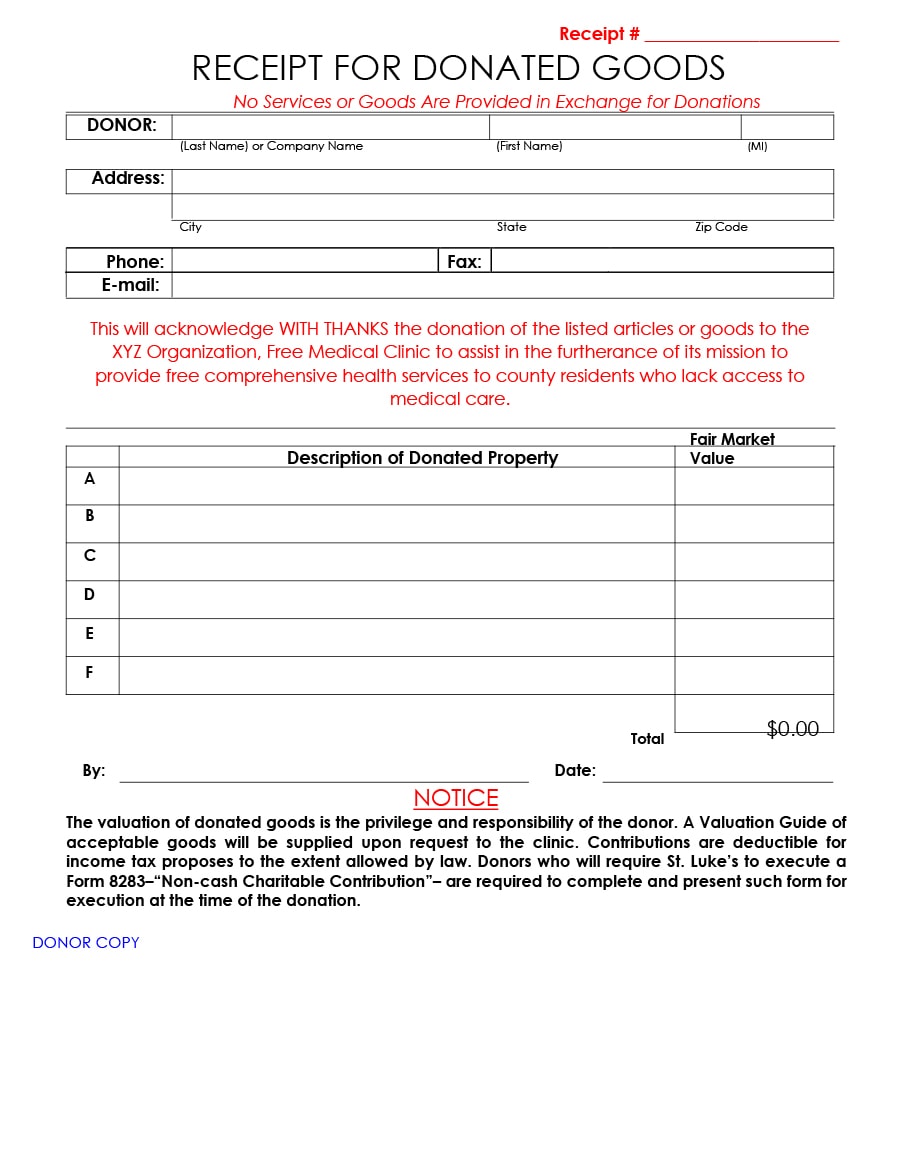

Criteria for a tax deductible donation. Place the cursor on the left side of the page and type the date that the donation was made. How to create a donation receipt creating a receipt pick a form. Declare whether the donor received goods in return for the donation.

Add information about the donation. The tone of the letter should be polite. One factor to keep in mind when looking to donate your goods is that in order to receive a tax receipt your donation must meet a few basic criteria. Include your name and your status.

Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction. You should make a note of thanks in the letter. Include the month the day and the year. Use bold letters so that it may be seen clearly.

Best practices for creating a 501c3 tax compliant donation receipt. The next important thing to place is a space. The donor received a t shirt valued at 12 in exchange for the donation. Your donation must be money or physical property given to a qualified organization.

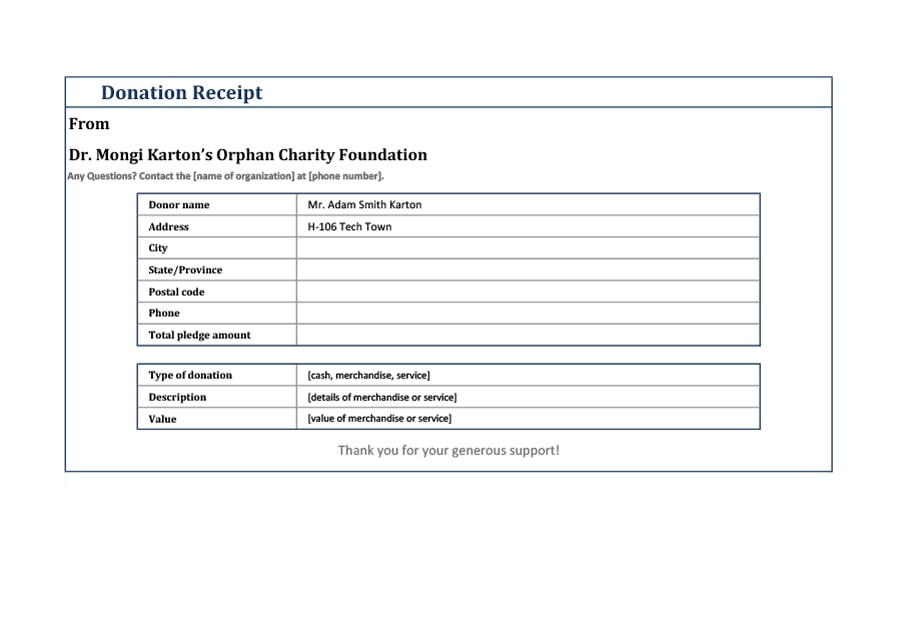

First things first incorporate your organizations name and category. Include the donors name. Use the optional donation receipt section if you have not already provided the donor with an official receipt or written acknowledgement. We acknowledge with thanks the receipt of 1000 which you have so generously contributed to caring for children.

Sometimes organizations like to add their logo or tagline to the heading of the letter as well. Center the words receipt for donation on the top of the page. This includes the date when the letter is being written as well as the address of the recipient of the letter. Heres a simple step by step guide on how to make a donation receipt template for your own use.

As previously stated a donation receipt can be in the form of a letter or an email. Caring for children is recognized as a nonprofit organization by the irs.