Mortgage Processing Checklist Templates

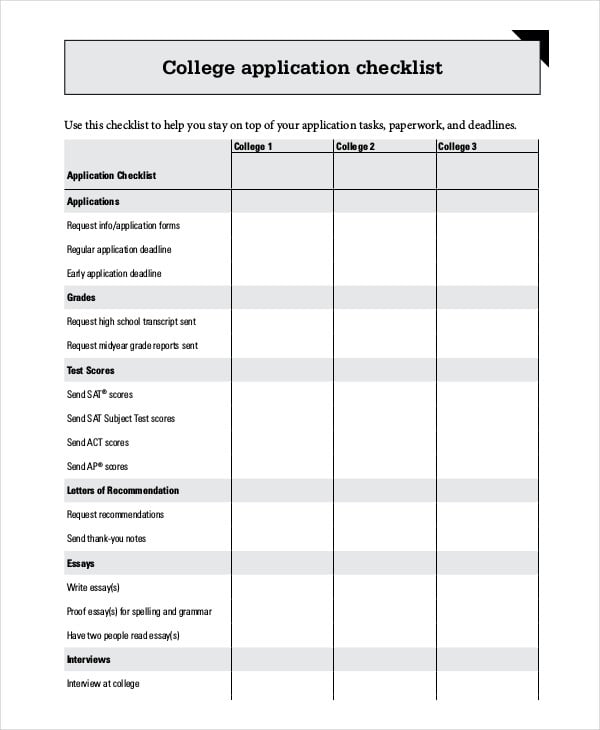

Mortgage processor checklist template it is recommended for financing major one off expenses including home renovations or repairs medical bills repayment of credit card debt or funding college tuition.

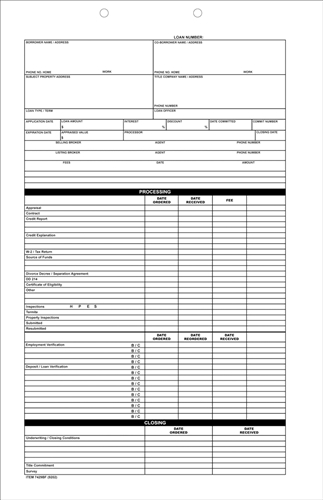

Mortgage processing checklist templates. The ultimate mortgage lead loan process checklist. Loan processing for afn. We serve the communities where we live and raise our families. Submit all client documentation to loan processor 22.

Welcome to american financial network afn. Afn is a direct lender with delegated authority to underwrite and close conventional fha usda va and alt qm products in house. Mortgage processing is the term for all the steps the loan professional takes to complete the. At blue water mortgage we want to be your mortgage company for life.

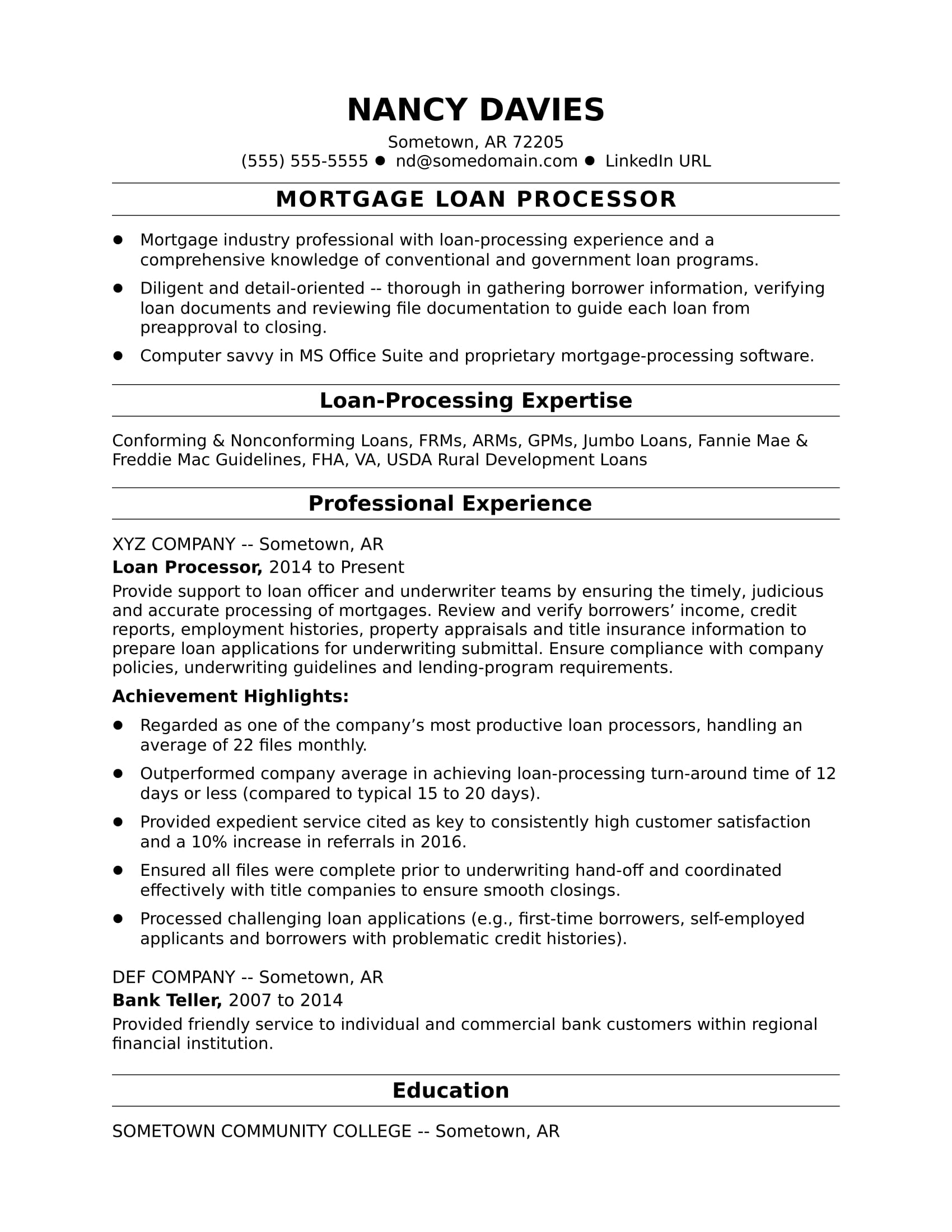

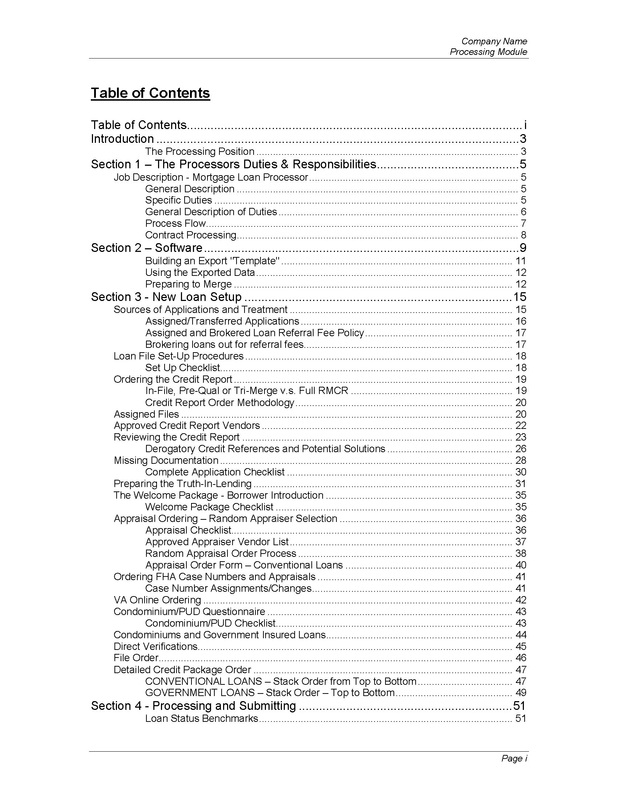

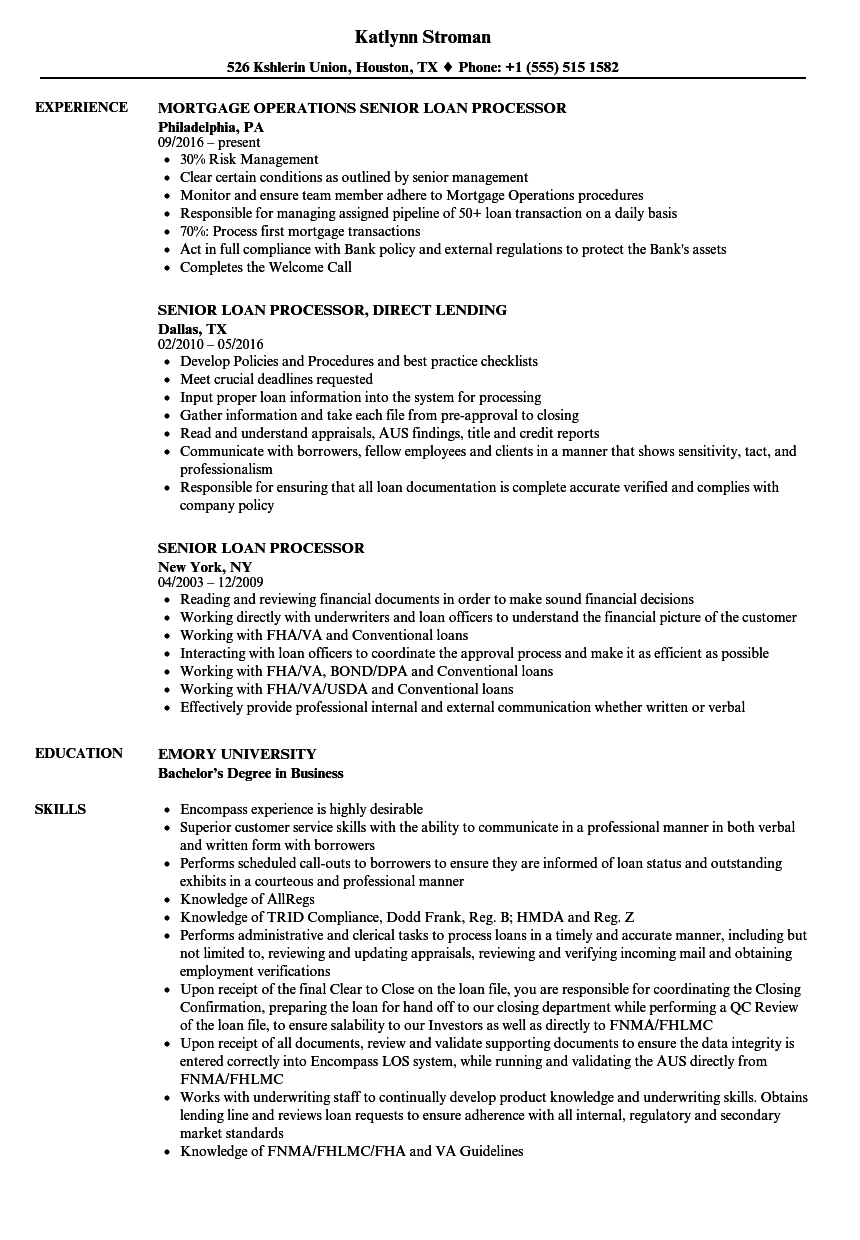

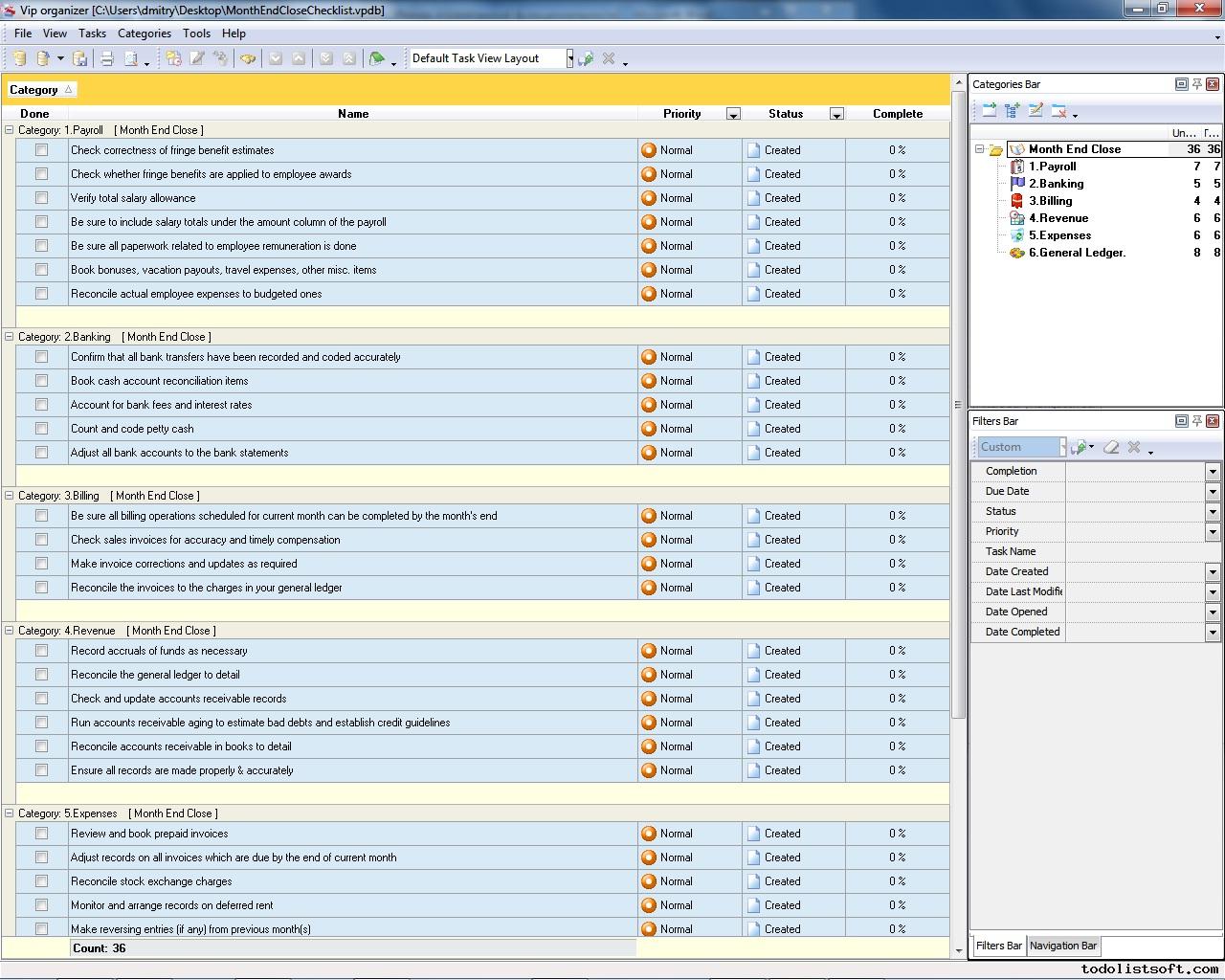

Click each task to expand a list of sub tasks. Loan processing step by step procedures we will outline all the major steps needed to be completed by a loan processor in order to ensure a successful loan package. The processor may be blamed or used as a scapegoat for errors in pricing that the loan officer should have been aware of. Youre our neighbors not just numbers.

Process however the loan officer may ask that the processor submit an interest rate lock in request. A duplicate of this checklist template will be added to your process street account. A mortgage file that has been submitted without being thoroughly reviewed and scrubbed by the loan officer is one of the major reasons for mortgage loan delays in closings. The main reason to take out a home equity loan is that it offers a cheaper way of borrowing cash than an unsecured personal loan.

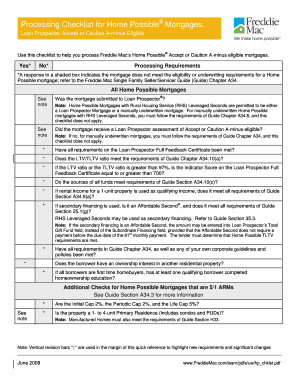

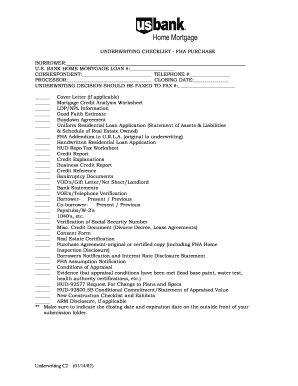

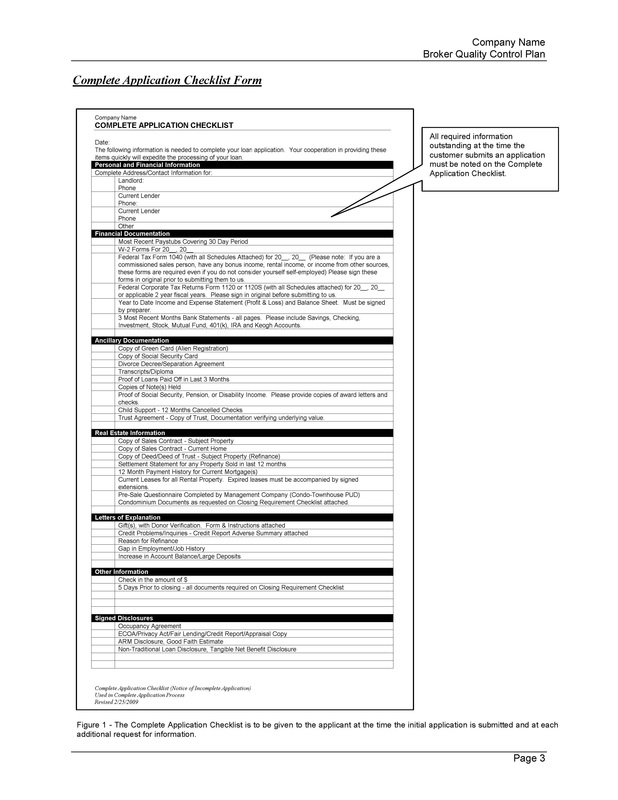

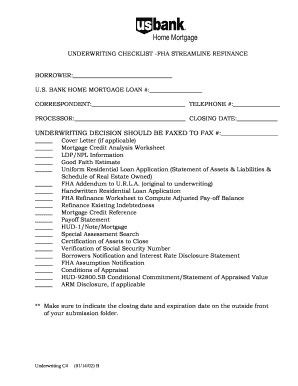

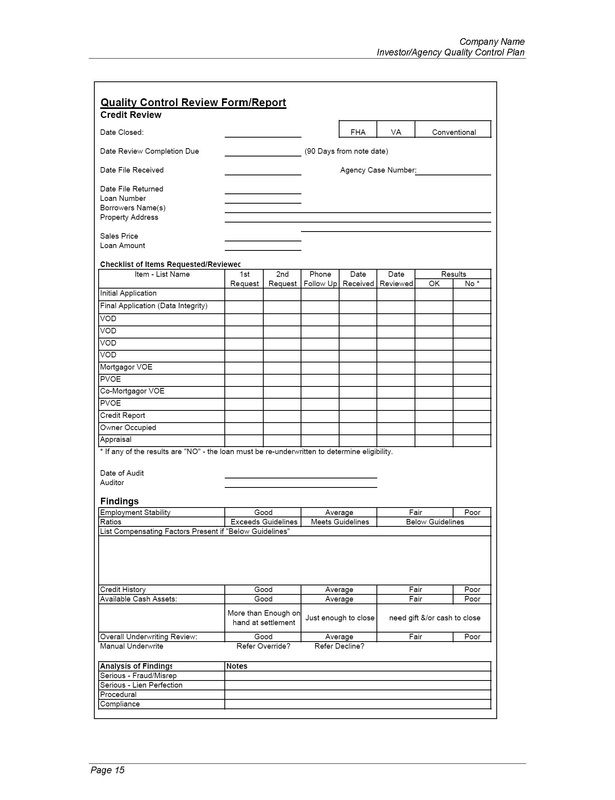

While there are variations to these steps depending on your employer local and state laws and others the following guide will still serve as a good checklist in any loan. The risk for the processor is that pricing mistakes can be extremely expensive. A mortgage processing checklist ensures that all the lenders requirements for the loan are met. Loan with the lowest interest rate and which does not contain negative amortization a prepayment penalty a interest only feature a balloon payment in the first 7 years a demand feature shared equityappreciation or for a reverse mortgage a loan without a prepayment penalty or shared.

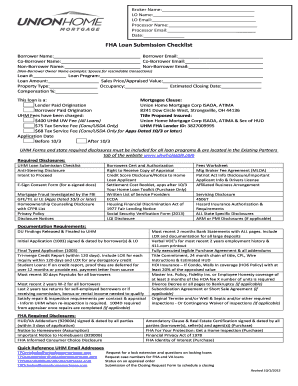

It is mandatory for all loan officers to make sure that all files are complete prior to submission to processing and follow this loan officer document checklist.