Opportunity Zone Certification

A qualified opportunity fund is an investment vehicle organized as a corporation or a partnership for the purpose of investing in qualified opportunity zone property.

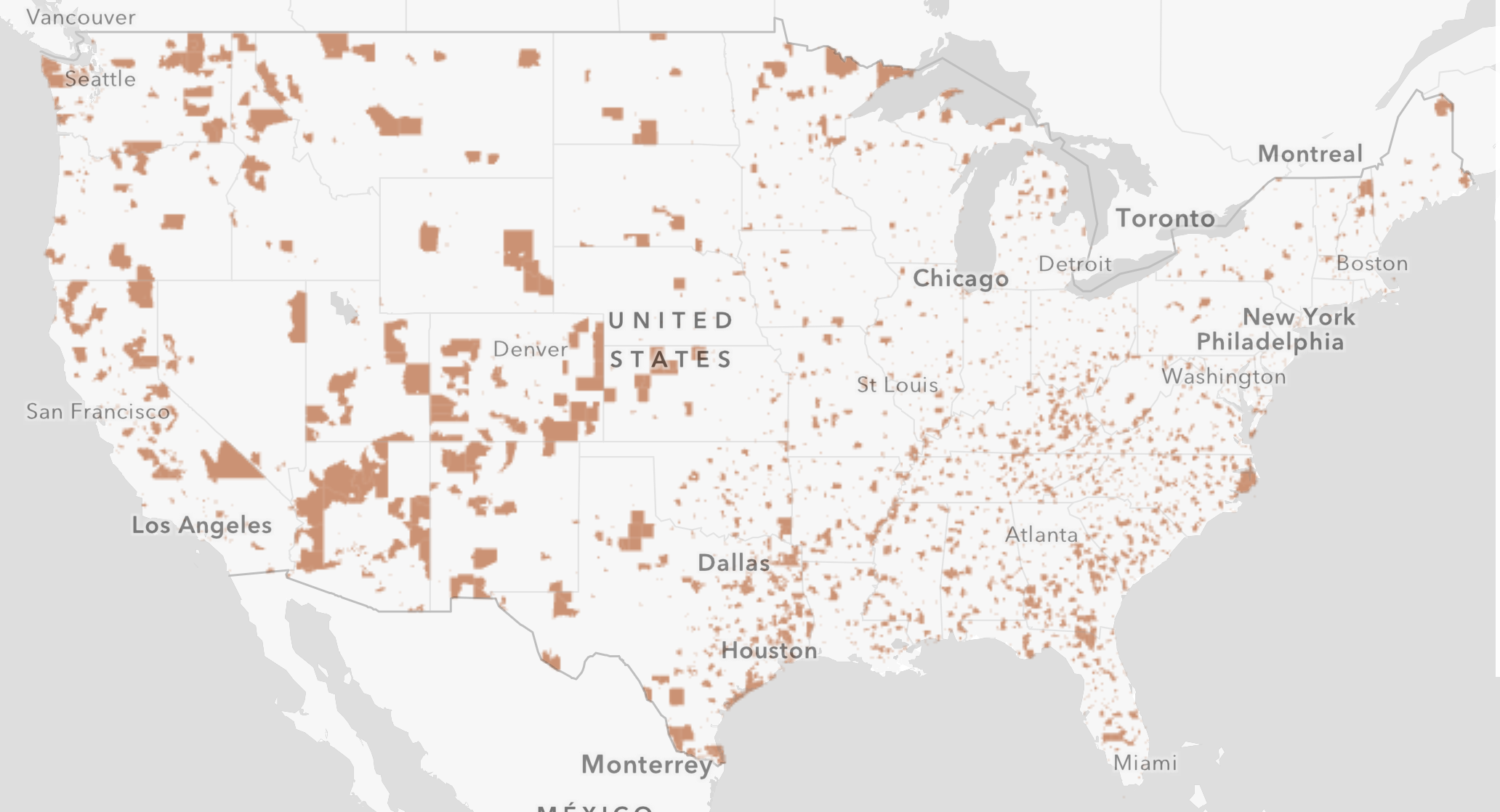

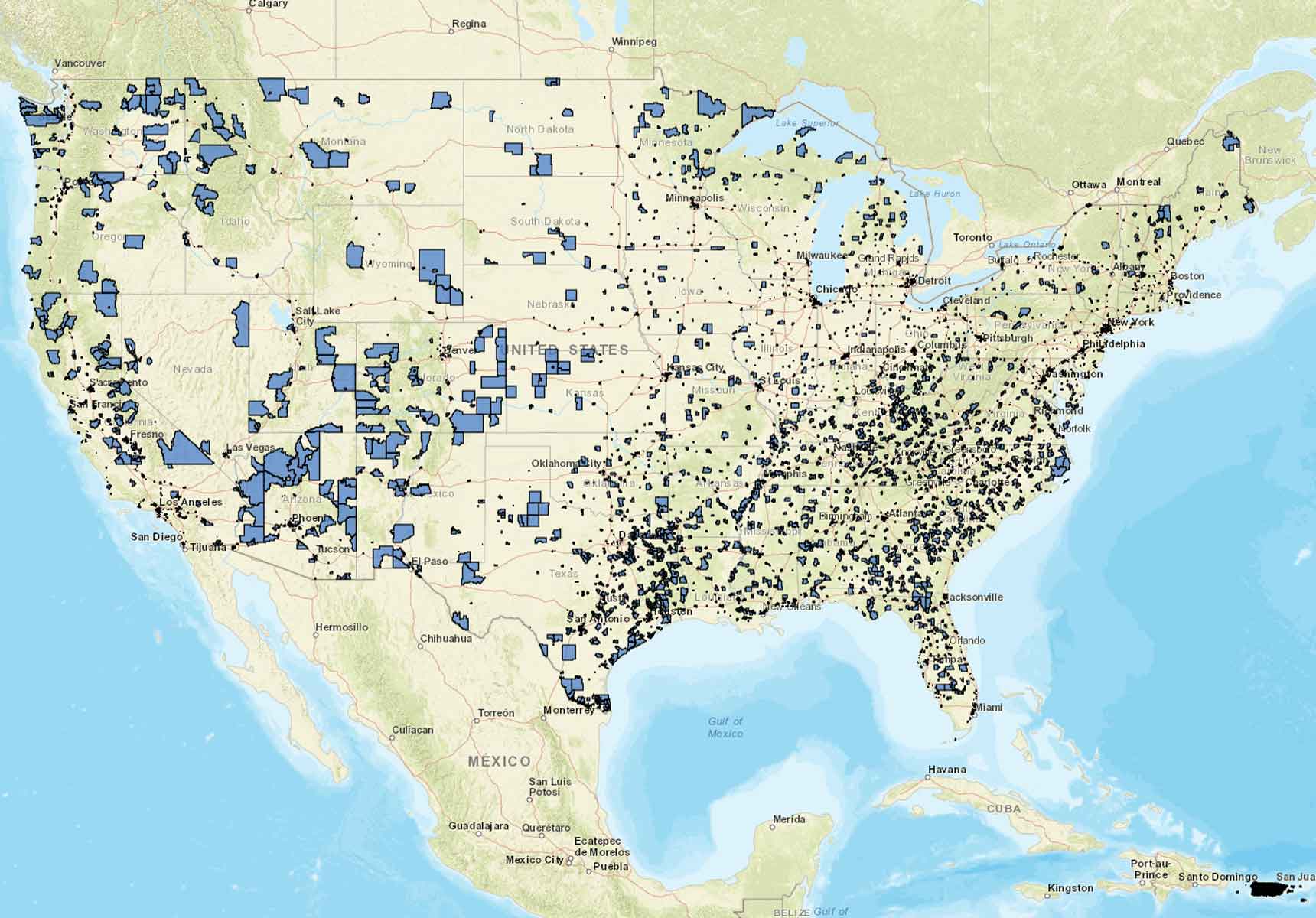

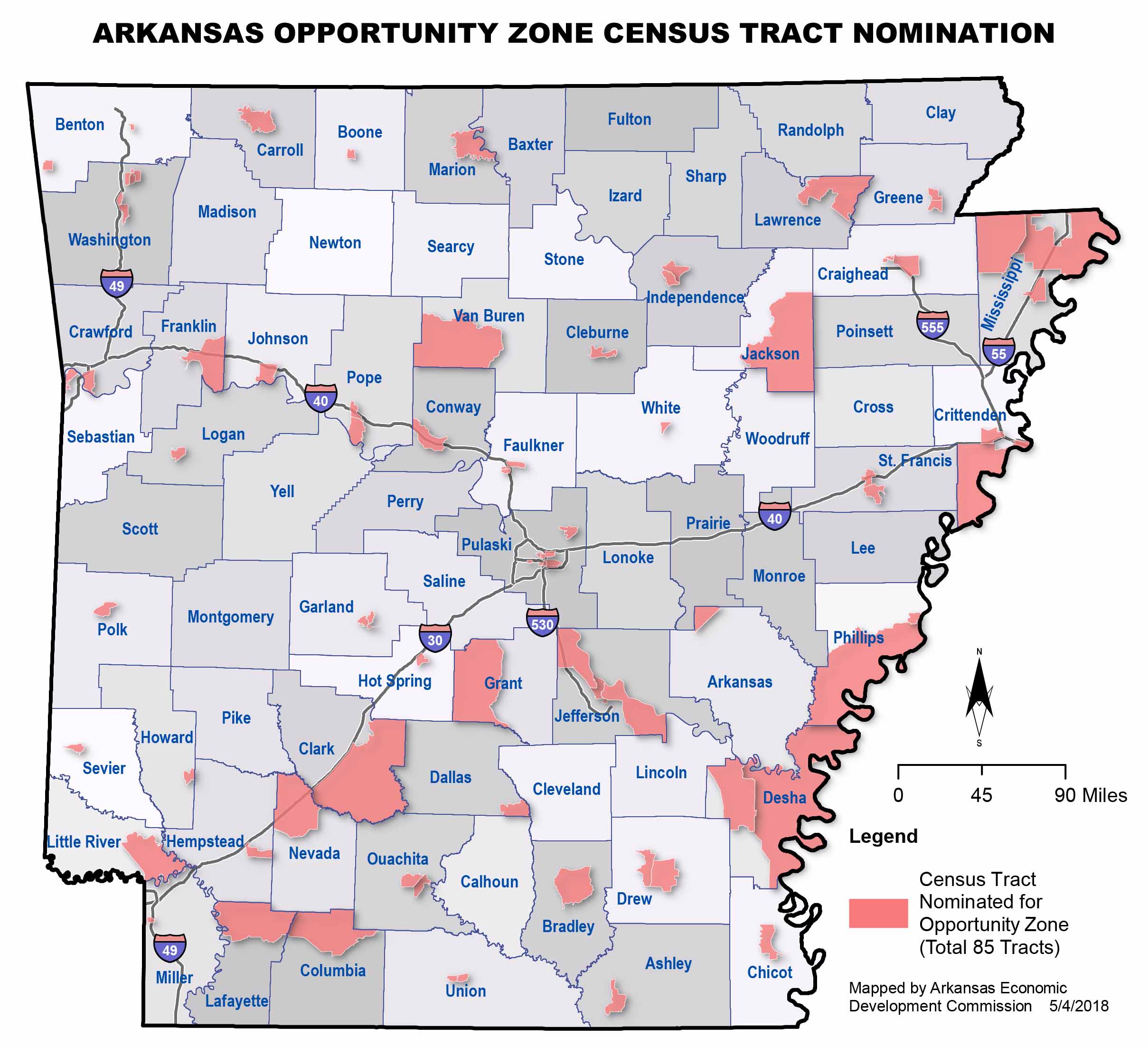

Opportunity zone certification. Resources for applicants in the ny prize program. Community economic development. The opportunity zones incentive is a new community investment tool established by congress in the tax cuts and jobs act of 2017 to encourage long term investments in low income urban and rural communities nationwide. Opportunity zone certification please note that the business should complete part one of this form and then forward to the local opportunity zone coordinator.

Dca will acknowledge the certification and provide copies back to the business the. Helping communities meet housing needs and connecting people with housing assistance. In new york state the future is already herefueled by thriving businesses at the cutting edge of innovation top talent a 150 billion investment in infrastructure low cost clean energy and more. Investor must invest in a qualified opportunity fund which holds at least 90 of its assets in qualified opportunity zone property.

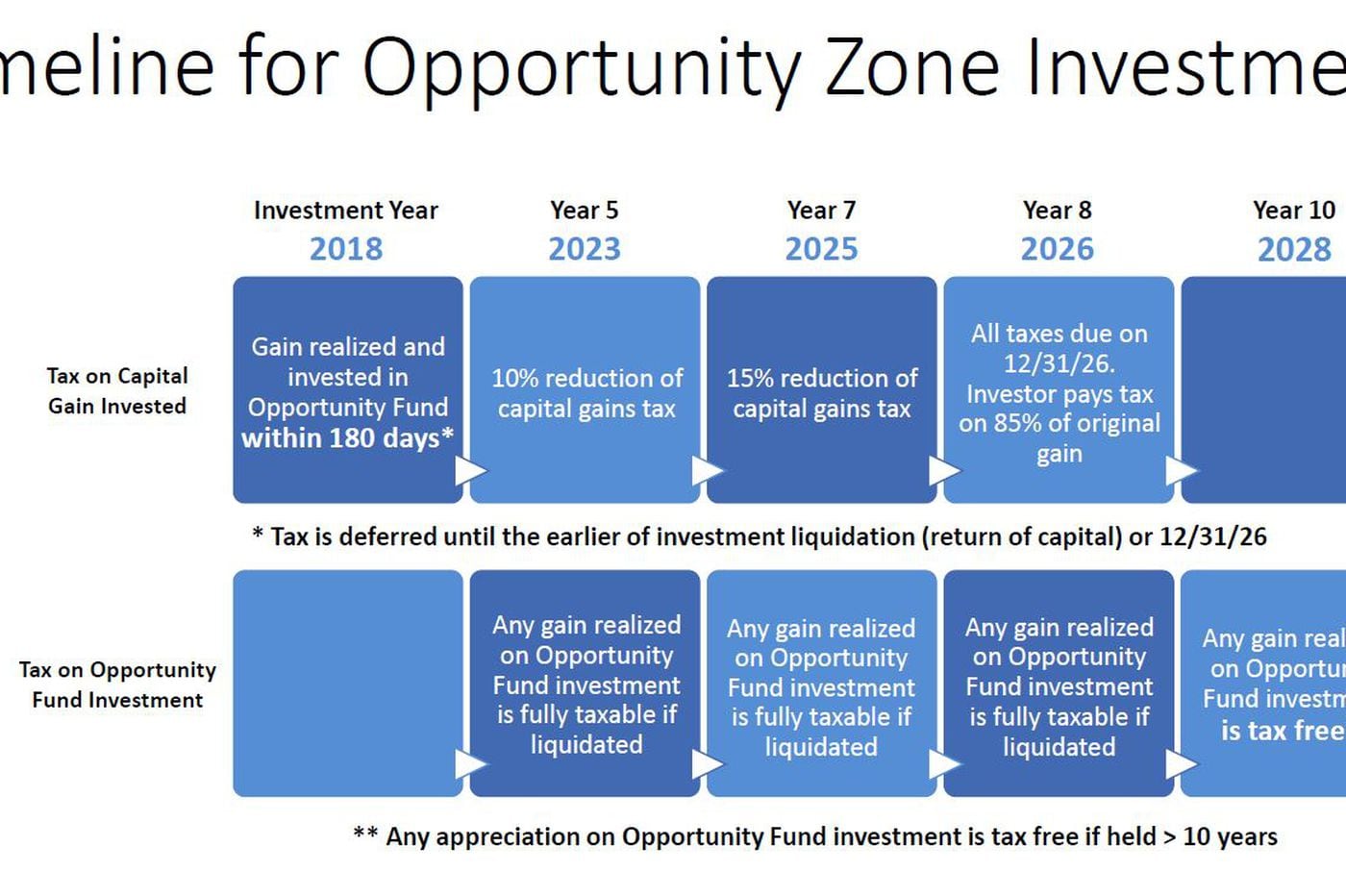

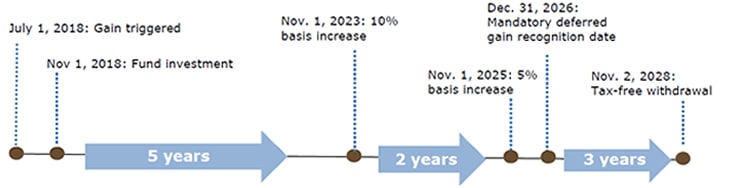

Opportunity zones are designed to spur economic development by providing tax benefits to investorsfirst investors can defer tax on any prior gains invested in a qualified opportunity fund qof until the earlier of the date on which the investment in a qof is sold or exchanged or december 31 2026. Financial assistance opportunities for communities. The oz coordinator will have the information certified in part two and forward it to dca. Irs allows self certification of qualified opportunity funds by the public finance department and tax group the irs released opportunity zone faqs on april 24 explaining that an eligible entity will be able to self certify to become a qualified opportunity fund qof by filing a form to be released this summer with its timely filed including.

Safe affordable housing. A qualified opportunity fund qof is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is located in an opportunity zone and utilizes the investors gains from a prior investment for funding the opportunity fund.