Printable Illinois Tax Forms

Illinois has a flat state income tax of 495 which is administered by the illinois department of revenuetaxformfinder provides printable pdf copies of 76 current illinois income tax forms.

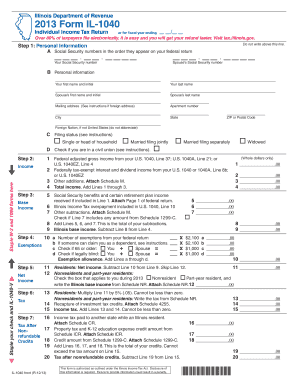

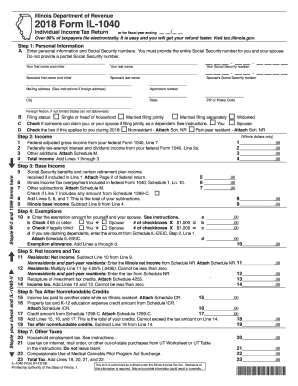

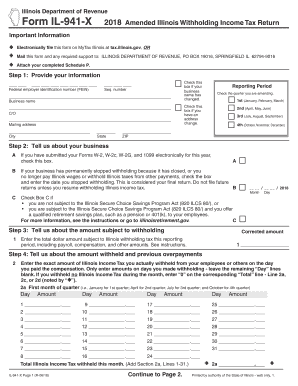

Printable illinois tax forms. The amount withheld from your pay depends in part on the number of allowances you claim on this form. The current tax year is 2019 with tax returns due in april 2020. Printable illinois state tax forms for the 2019 tax year will be based on income earned between january 1 2019 through december 31 2019. The current tax year is 2019 and most states will release updated tax forms between january and april of 2020.

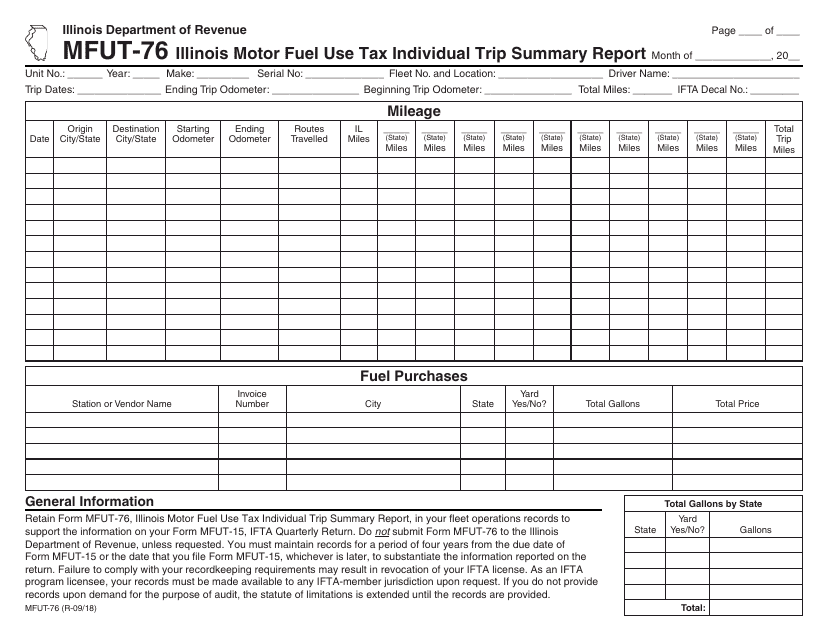

Mylocaltax for local government officials only. Most states will release updated tax forms between january and april. File your il 1040 make a payment look up your refund status and more. Instructions for form 941 pdf.

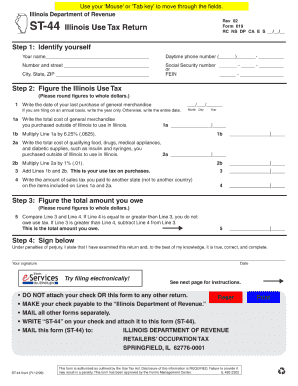

Additional information for tax professionals. State tax forms for 2019 and 2020. Individual income tax return. Illinois income tax from other non wage illinois income.

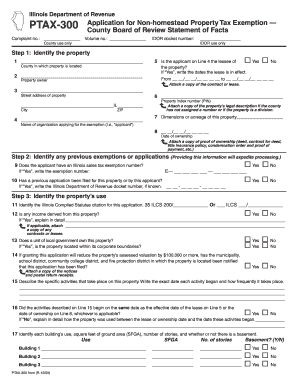

Employers quarterly federal tax return. Mydec real property transfer tax declarations. Amended individual income tax return. Who must complete form il w 4.

Additional information for tax professionals. Illinois income tax page. Employers who withhold income taxes social security tax or medicare tax from employees paychecks or who must pay the employers portion of social security or medicare tax. The state income tax rate is displayed on the illinois 1040 form and can also be found inside the illinois 1040 instructions booklet.

The illinois income tax rate for tax year 2019 is 495. Mylocaltax for local government officials only. If you are an employee you must complete this form so your employer can withhold the correct amount of illinois income tax from your pay. Form 941 pdf related.

Illinois has a state income tax of 495. Il 1040 es 2019 estimated income tax payments for individuals use this form for payments that are due on april 15 2019 june 17 2019 september 16 2019 and january 15 2020.