Roth Ira Certificate

This particular savings vehicle combines certain features of an ira with a certificate of deposit.

Roth ira certificate. A traditional ira certificate gives you more of a tax benefit while you are saving for retirement whereas the roth ira is better for taxes during retirement. You can convert funds from a traditional ira into a roth ira. You cannot deduct contributions to a roth ira. The minimum balance to open an ira share certificate usually is larger than for a regular share account 1000 is a common minimum though the specific amount varies between individual credit unions.

On the downside cds tie up your fundscarrying heavy penalties for. When you open a capital one 360 ira cd youll have the option of selecting between a traditional ira or a roth ira. Roth ira rules essentially allow you to withdraw contributions and grow earnings tax free whereas traditional ira rules allow you to write contributions off to reduce your taxable income. On the plus side cds can be a safe and predictable source of income counterbalancing volatile stocks.

A roth ira is a retirement savings account that allows you to withdraw your money tax free. Iras are typically categorized as traditional or roth accounts but theres also a third option in the form of an ira cd. A certificate of deposit holding individual retirement account money has a pre set maturity date that might not coincide with your actual retirement. Esl offers two savings options for a roth ira certificates or money maker savings accounts.

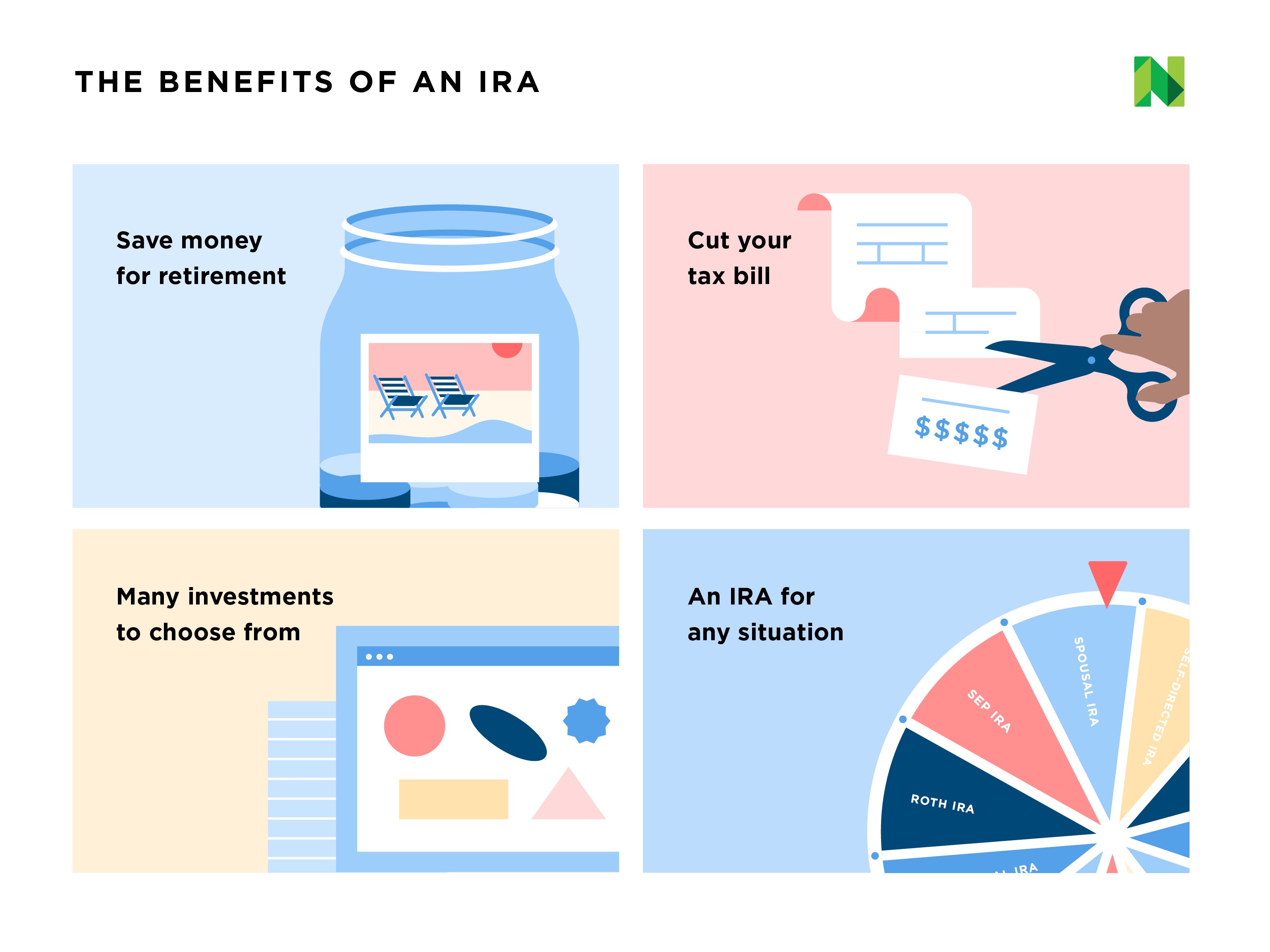

An individual retirement account ira is a tax advantaged way for just about anyone with earned income to save for retirement. What happens at the maturity date of my ira cd. The term for ira share certificates typically ranges between six months and five years similar to bank cds and longer terms pay higher interest. Key takeaways a roth ira cd is a certificate of deposit held inside a roth ira and some banks create cds expressly for.

Ira rates vary based on the underlying investments which in the case of an ira cd is a certificate of deposit. Learn why a roth ira may be a better choice than a traditional ira for some retirement savers. If you satisfy the requirements qualified distributions are tax free. A roth ira is an ira that except as explained below is subject to the rules that apply to a traditional ira.

:max_bytes(150000):strip_icc()/GettyImages-140671550-56a636e83df78cf7728bdbc1.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1095135878-3263c3364b0d40d291947931c1bc4833.jpg)