Sales Certificate Texas

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent.

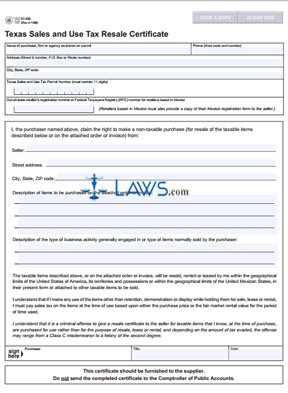

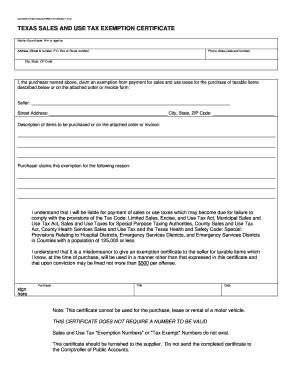

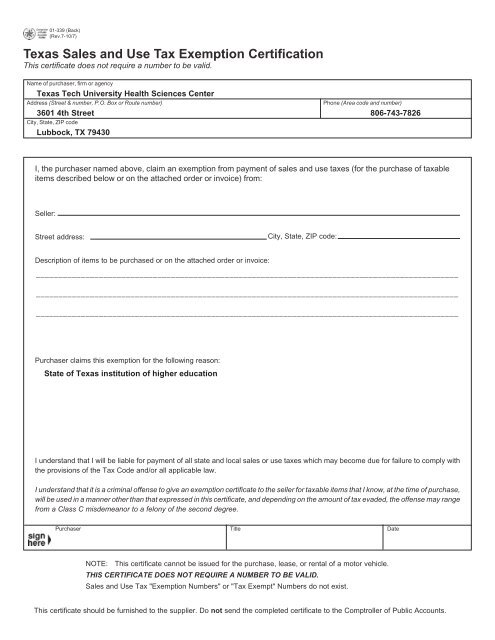

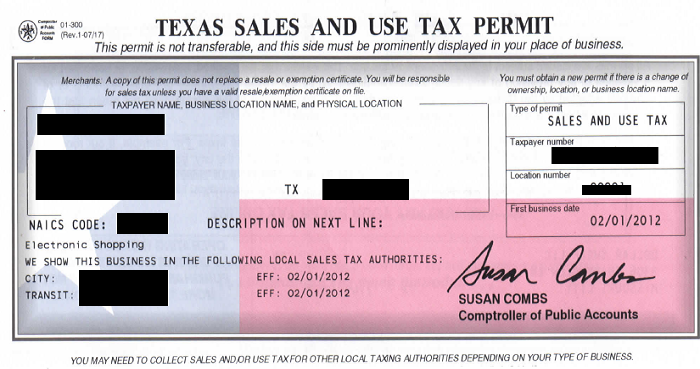

Sales certificate texas. Links to all help for sales tax registration. You cannot use this online application if you are a sole owner partner officer or director and do not have a social security number. This certificate does not require a number to be valid. Email the application to salesapplications at cpatexasgov or fax the application to 512 936 0010.

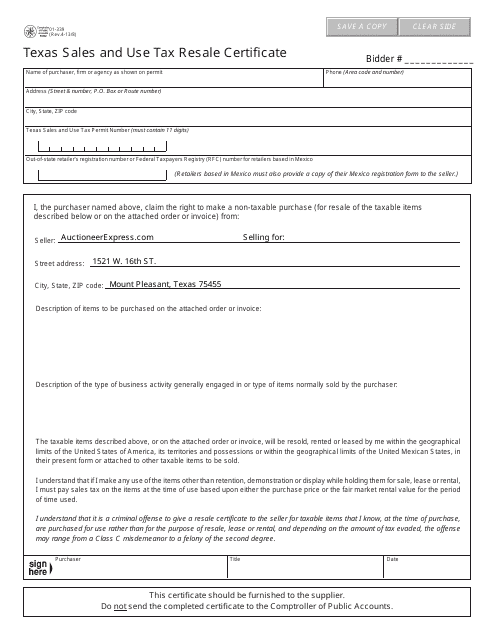

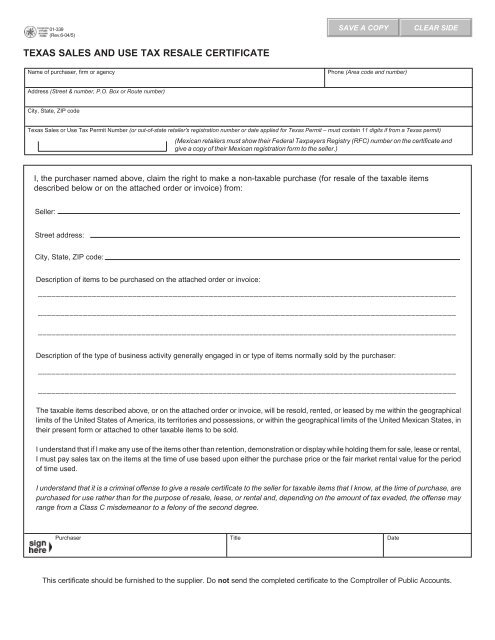

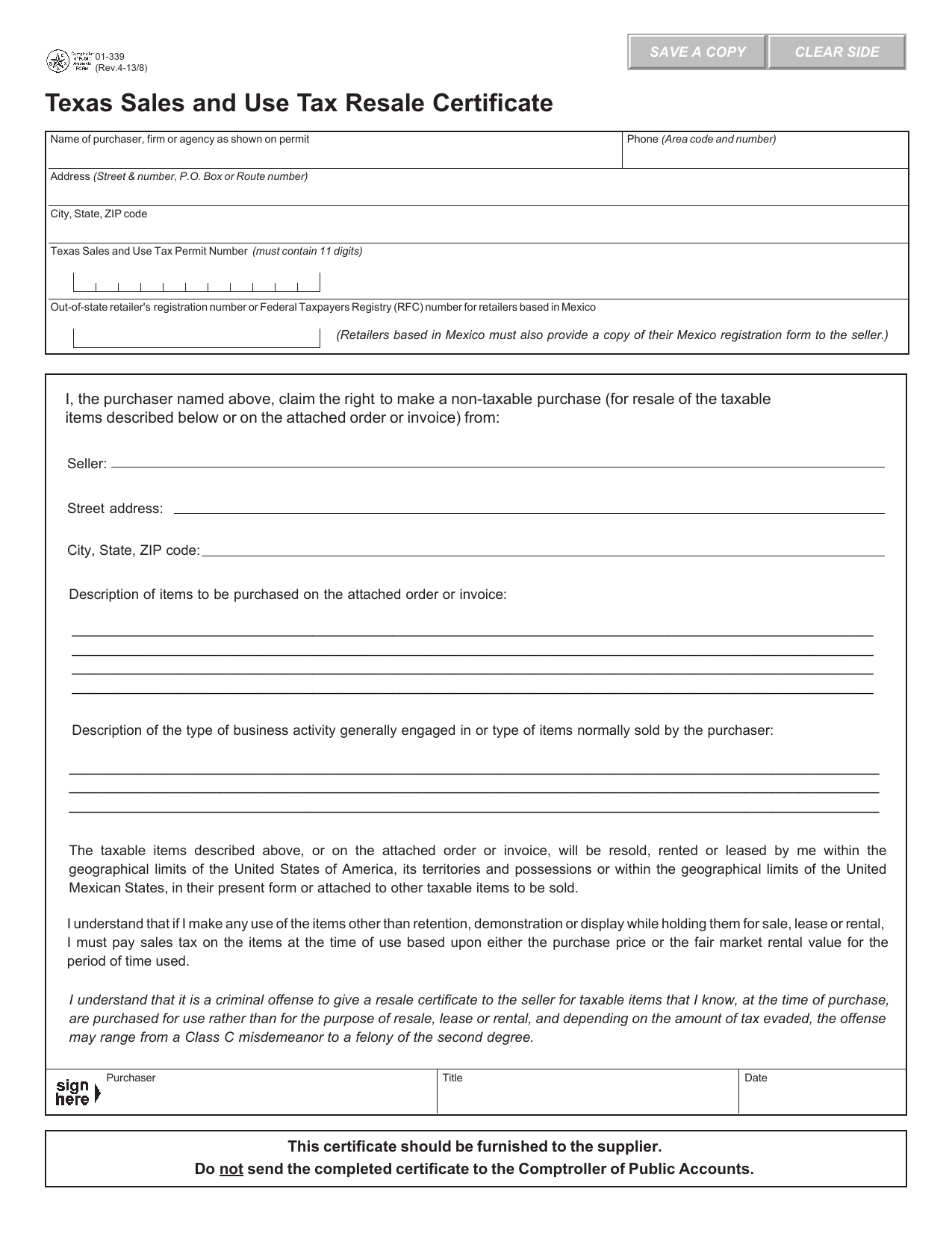

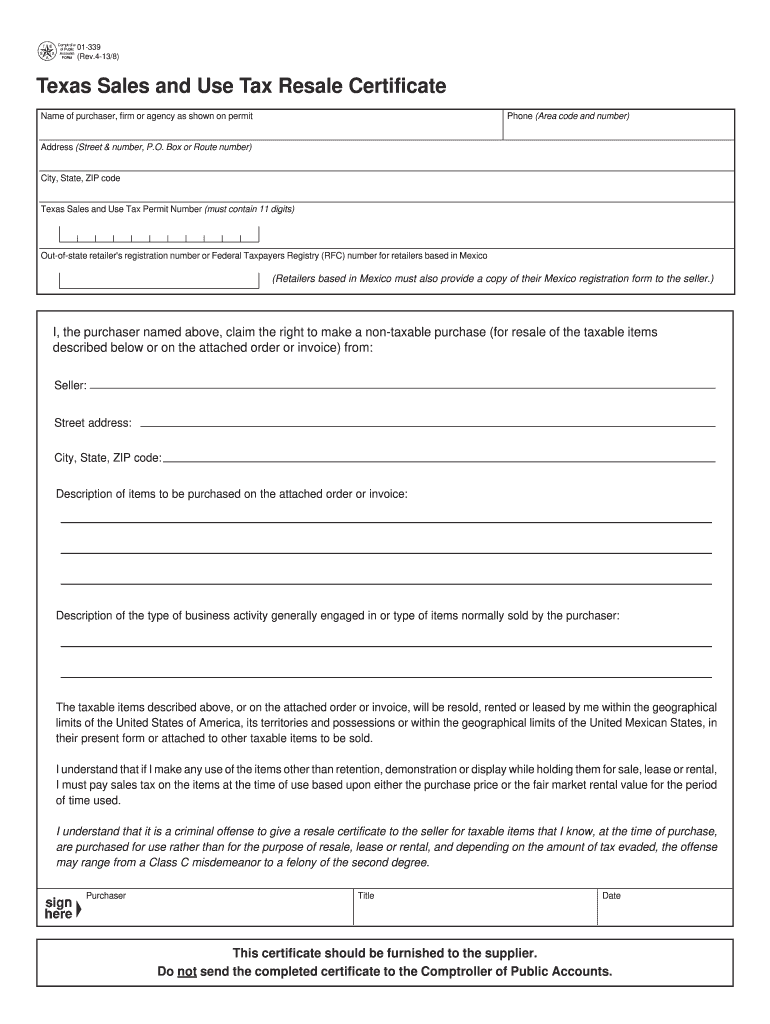

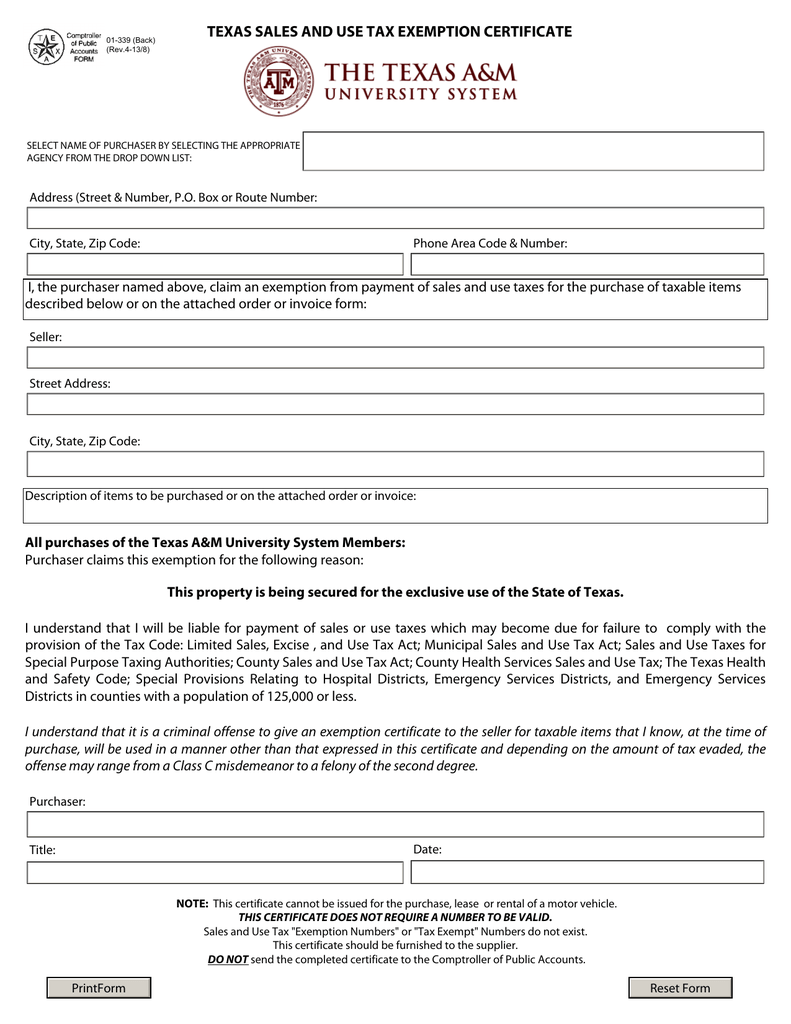

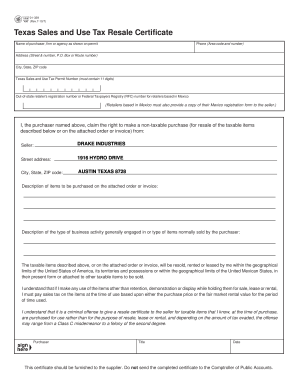

01 148 texas sales and use tax return credits and customs broker schedule pdf 01 922 instructions for completing texas sales and use tax return pdf 01 922s instrucciones para llenar la declaracon de impuestos sobre las ventas y uso pdf 01 118 texas sales and use tax prepayment report pdf. Texas sales and use tax exemption certification. I understand that it is a criminal offense to give a resale certificate to the seller for taxable items that i know at the time of purchase are. I must pay sales tax on the items at the time of use based upon either the purchase price or the fair market rental value for the period of time used.

Texas sales and use tax exemption certification. Box or route number phone area code and number city state zip code. Texas is a member of the streamlined sales and use tax agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. Name of purchaser firm or agency address street number po.

You will need to apply using form ap 201 texas application pdf. Name of purchaser firm or agency address street number po. Box or route number phone area code and number city state zip code. I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase.

Sales and use tax texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. You can apply for a sales tax permit using our texas online sales tax registration application system or print an application from the texas sales and use tax forms webpage and mail it to the comptroller.