Shareholder Note Payable Template

Use our attorney drafted shareholder agreement form to set out and explain the structure and nature of shareholder relationships to the corporation and to one another.

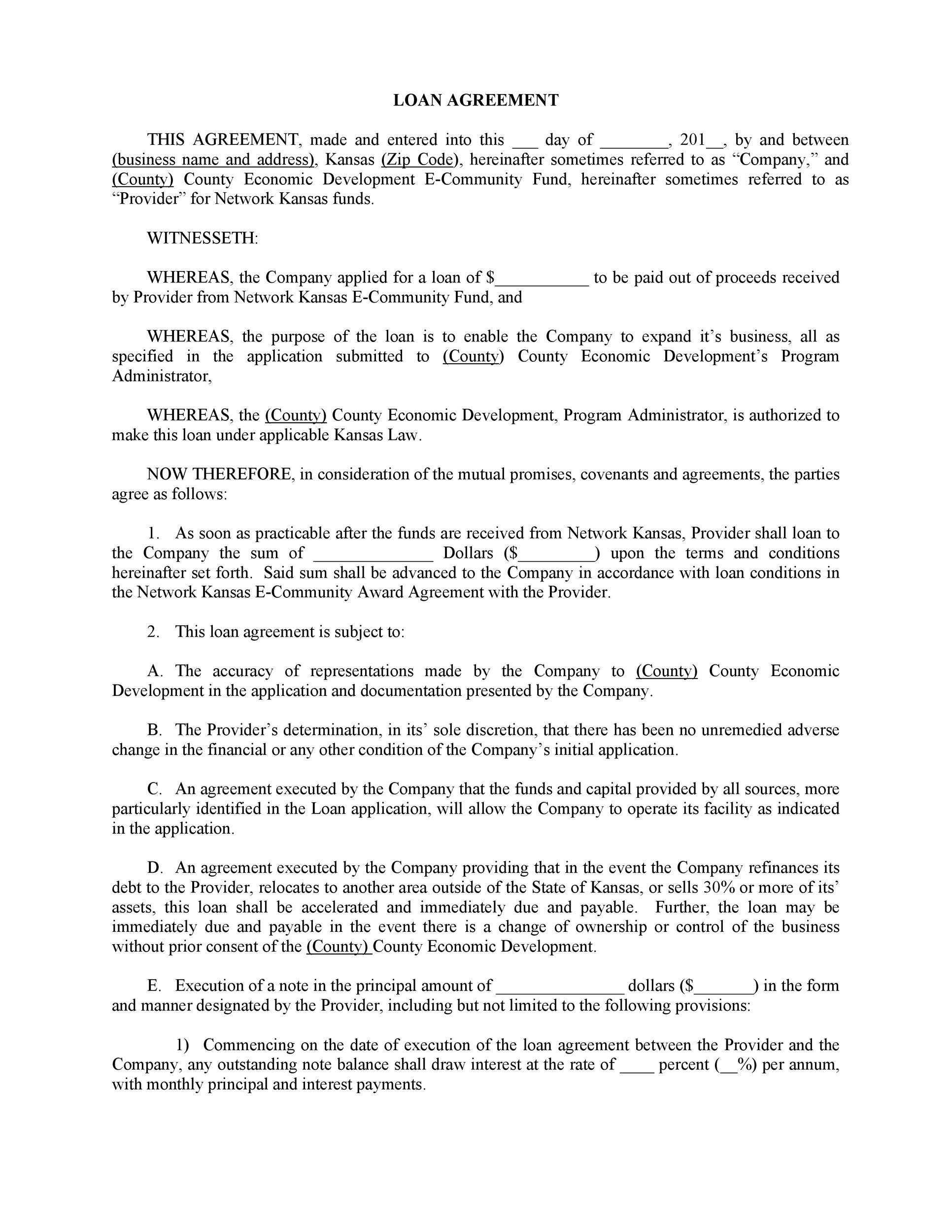

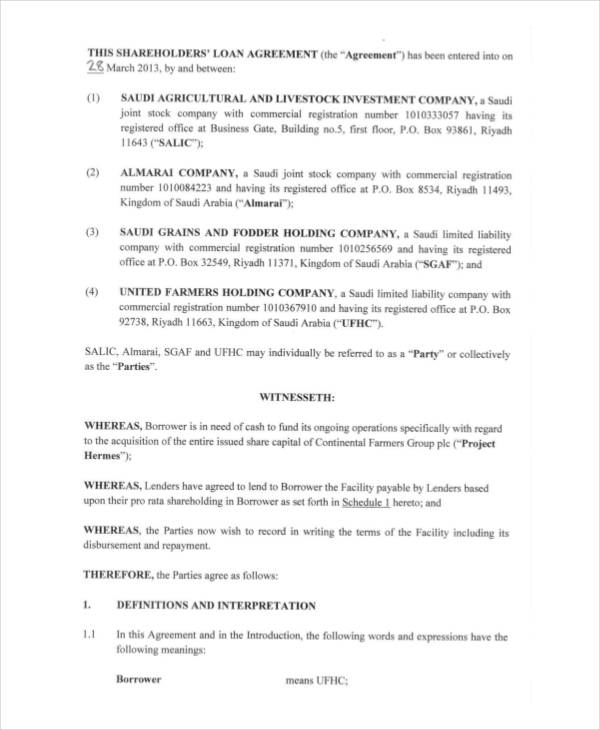

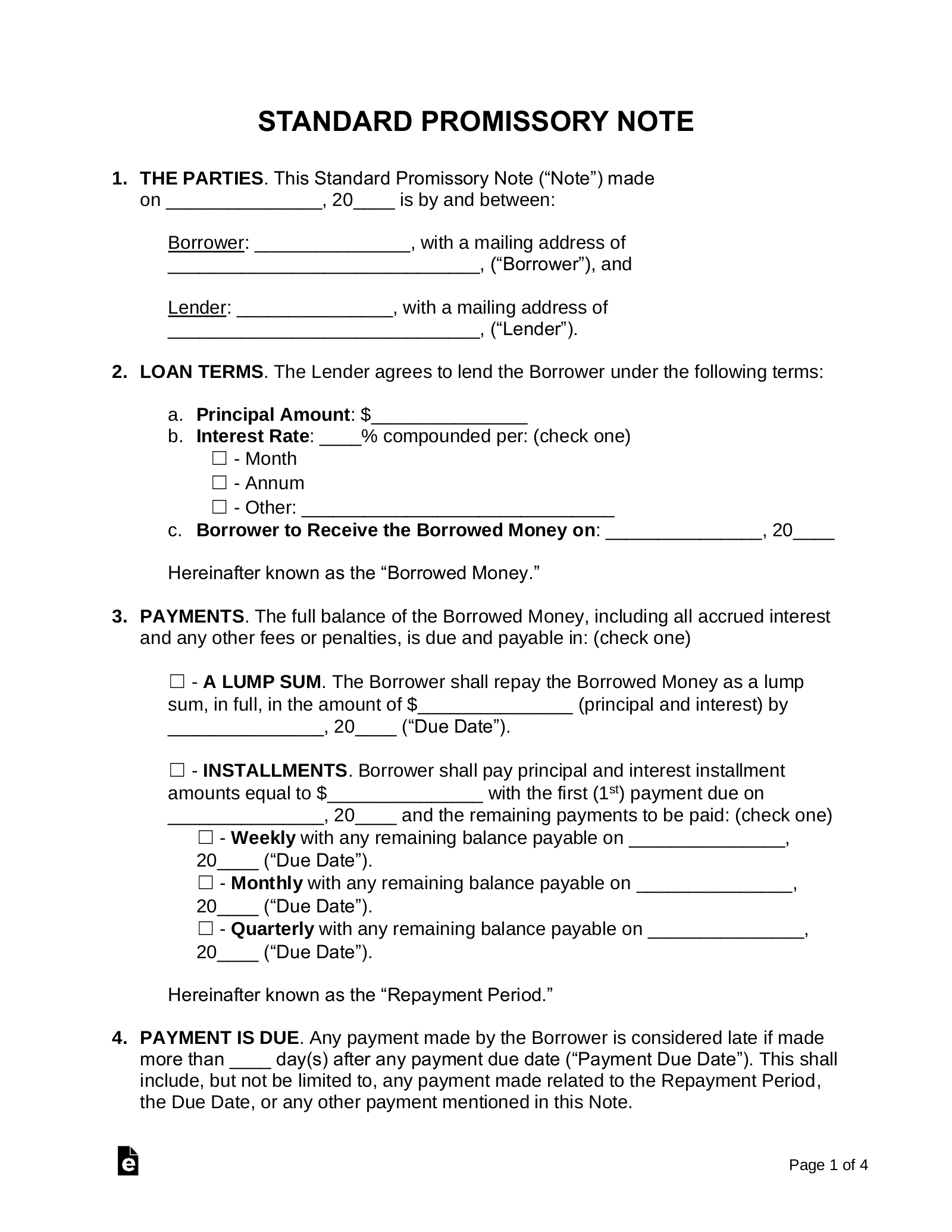

Shareholder note payable template. The promissory note or shareholder note described above appears to have been developed with a goal of maintaining flexibility for the company issuing it. Whether there is a note outlining the repayment schedule and collateral for the loan and whether the borrower made repayments. Updated june 5 2019 written by susan chai esq. Loans to employee shareholders by charles j.

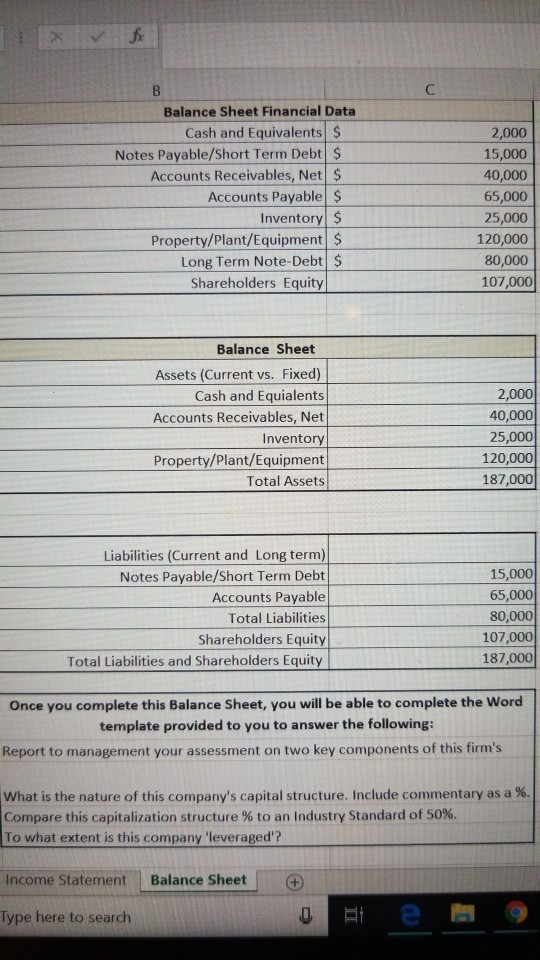

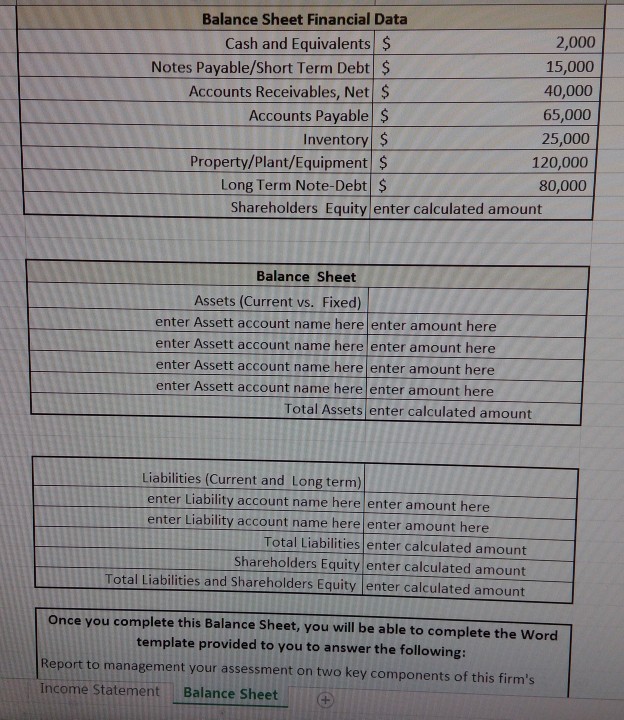

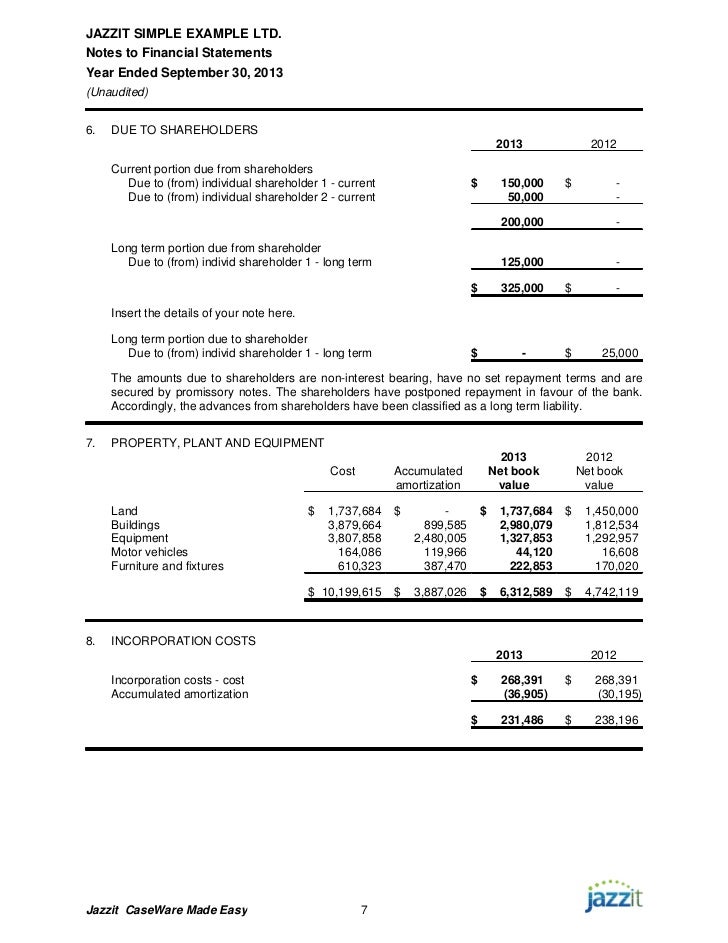

A note payable acts as a detailed receipt of the loan agreement. Shareholder loans should appear in the liability section of the balance sheet. A shareholder loan agreement records the transfer of funds between a corporation and a shareholder for borrowing lending or salary purposes. A note payable is the principal amount due on a written promise to pay a stated amount at some point in time.

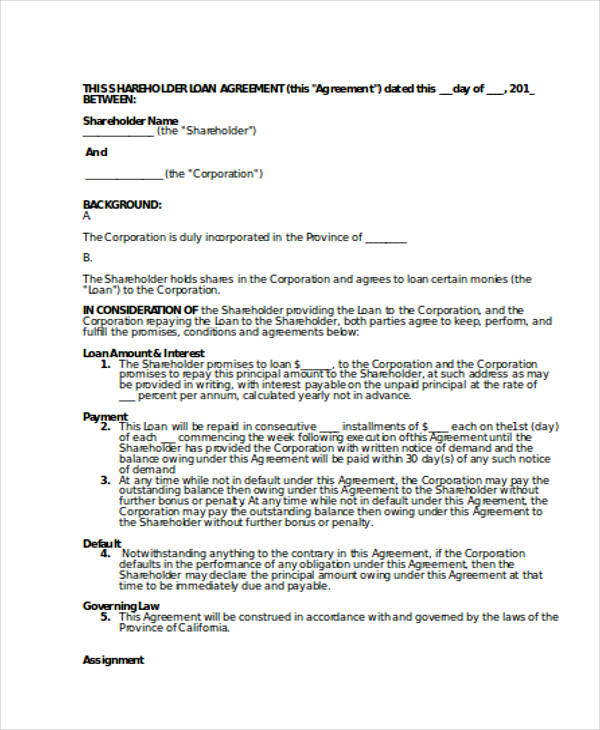

Create your shareholder loan contract today with our user friendly questionnaire. For notes with principal due within the ensuing 12 months you record a note payable on your companys balance sheet as a short term liability. Nariman teymourian ceo and president of the board of directors of capsian corporation owned 60 of the software development companys stock. There are 2 types of promissory notes secured and unsecured.

The court stated that the shareholders did not have basis in the earlier note when they were merely its guarantors. The document holds the borrower accountable for paying back the money plus interest if any. Potential sellers of stock ie individual shareholders who might one day sell stock pursuant to the buy sell agreement were apparently not present when the note terms were documented. Note payable and debt.

Sometimes loans can be complicated but having a record of the details compiled into a single document can help ensure that both parties see eye to eye on the agreement. Its essential that this loan be either positive or zero by the end of the year or the shareholder may be liable for tax on income equal to that amount. Available in all states. A promissory note or promise to pay is a note that details money borrowed from a lender and the repayment structure.

Print or download your customized form for free. A balance sheet shows assets liability and owners equity. Motivated by tax planning the shareholders gave the bank a personal note for the entire balance due and the bank canceled the note payable with the s corporation.